13+ Sample Gift Affidavit

-

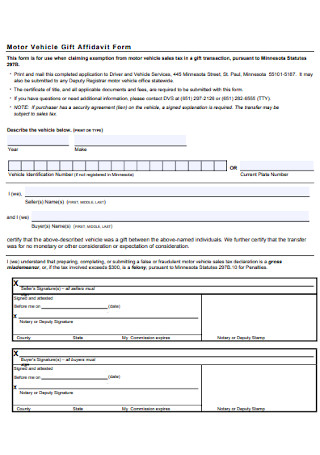

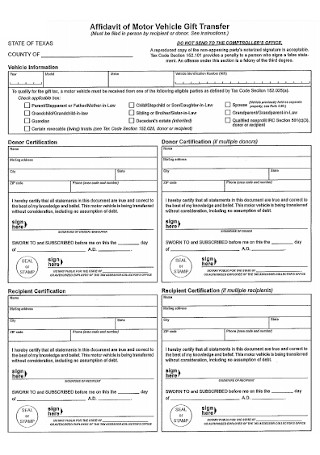

Motor Vehicle Gift Affidavit Form

download now -

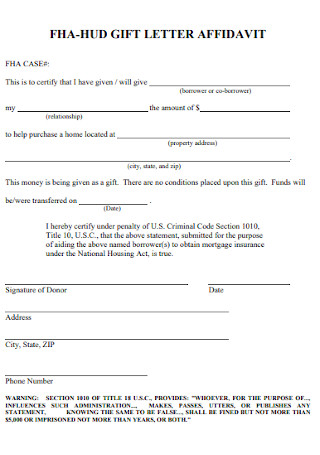

Gift Letter Affidavit

download now -

Gift of Shares Affidavit

download now -

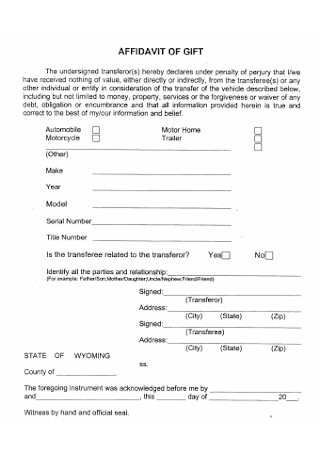

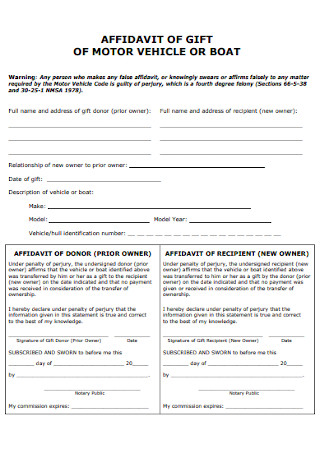

Affidavit of Gift of Motor Vehicle

download now -

Simple Affidavit of Gift

download now -

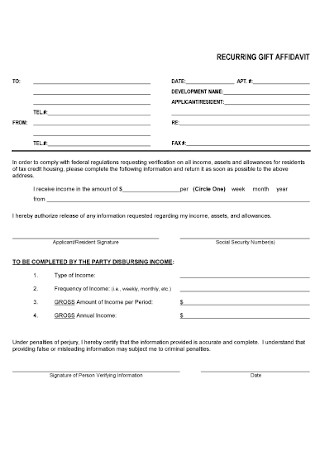

Recurring Gift Affidavit

download now -

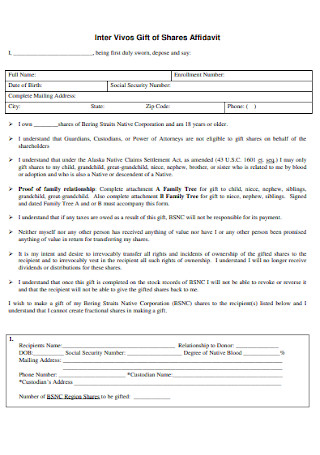

Inter Gift of Shares Affidavit

download now -

Affidavit for Gifting Corporate Stock

download now -

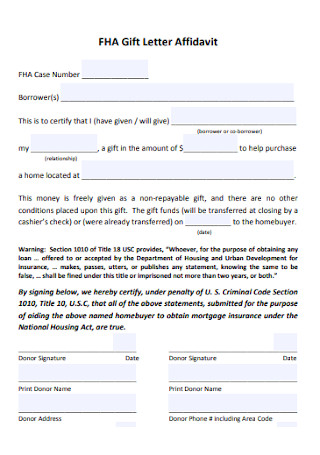

Sample Gift Letter Affidavit

download now -

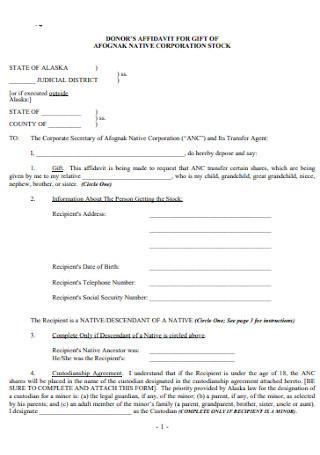

Donors Affidavit for Gift

download now -

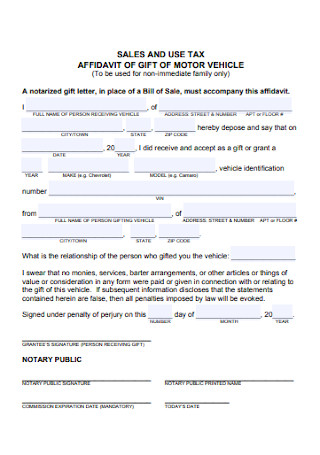

Affidavit Motor Vehicle of Gift

download now -

Gift of Affidavit for Boat

download now -

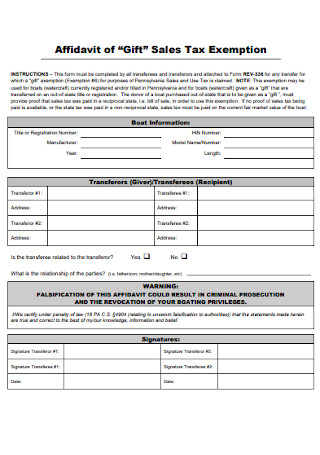

Affidavit of Gift for Sales Tax Exemption

download now -

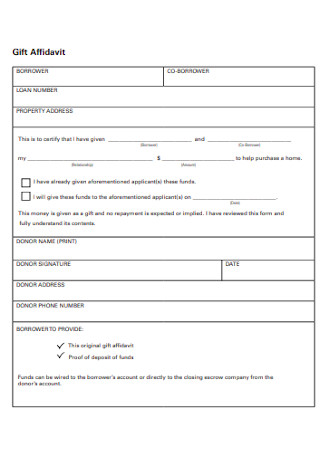

Standard Gift Affidavit

download now

FREE Gift Affidavit s to Download

13+ Sample Gift Affidavit

What Is a Gift Affidavit?

Common Terms That Are Used In a Gift Affidavit:

How To Create a Gift Affidavit

FAQs:

When is a gift affidavit needed?

What are the consequences of not filling a gift affidavit?

Is a lawyer needed in assisting me with the Gift?

Is it possible for the Donee or the recipient to refuse to accept the gift?

A gift affidavit is a simple document that can be used as proof if you gave someone a gift of great monetary value, you received a present from someone and you want a formal statement, a court asked that you swear under oath that the item was a gift. Are you planning to give someone a gift and are you in need of a gift affidavit? Then you came to the right website, learn more about Gift Affidavit! Just keep scrolling through this website.

What Is a Gift Affidavit?

A gift affidavit is a legal document that is used to prove that an item was given to someone as a gift. In a gift affidavit form, the person who is giving the gift which is known as the “donor” swears that an item is being gifted to the recipient which is also known as the “donee” and that no payment will be expected in return for the gift. In a legal sense, the term “gift” is used to refer to a definite and voluntary transfer from one person to another. This actually means that the ownership of the property is transferred without any monterey payment or expecting something in return. It is most commonly used when giving someone an expensive item as a gift, such as a car and legal proof will be required to transfer the ownership of the item. There are various instances where such documents will be required, it ranges from disclosing politicians must file to paperwork on a loan where people are receiving a gift in order to help them with the down payment. Meanwhile, generic forms people can fill out to generate a gift affidavit that is available and it is possible to draft an entirely new statement with the help of an attorney in order to confirm that the statement is complete.

There are times that the person who will be giving the gift, which will be referred to as “donor” must fill out the gift affidavit, including the name and any other contact information of parties involved, date and the information of the gift. When people help each other with down payments on mortgages, this form of affidavit is most prevalent. In some cases, a person who will be receiving the gift must be the one who will fill out a gift affidavit testifying the nature of the gift and its circumstances. In other states, politicians are strictly prohibited from receiving gifts over a certain amount or value and are required to declare all gifts that were received, this is where a gift affidavit comes through. These types of documents may be filed on the public record, and allows people to take note or to view the gifts that were received by politicians, and to see who is sending presents to people like the legislators.

Just like any other affidavits, falsification of a gift affidavit can be grounds for legal penalties. If people misstate the value of the circumstances of a gift , it can be considered as a form of fraud, most especially in situations where the affidavit is being used as a supporting material for a loan. It is very important to ensure that the information of the affidavit is an accurate reflection of the situation as people understand it and all details that were provided are nothing but the truth. Innocent mistakes do happen, instances such as, if someone receives an antique that has not been properly valued, and is not aware that the value stated in the affidavit is not correct. Once that mistake is already recognized, it should be corrected as soon as possible. In addition to this affidavit, documentation such as canceled checks, proof of shipping etc should be provided. This certifies that a gift was transferred to the recipient.

Common Terms That Are Used In a Gift Affidavit:

This document can be completed by any person who gives another person a gift and wants to swear to it thus it can be requested by the affiant or the recipient. There are also some instances wherein, a court of law may request a gift affidavit as a proof that the “gift” was truly indeed given as a gift. If it is your first time to encounter a gift affidavit, it is very important to learn the common terms that are used in a gift affidavit and these may include the following:

How To Create a Gift Affidavit

Making a gift affidavit is a sample and can either be filled out using an existing template or to write up a one-page document. If you find yourself, where a form is not available, a simple one-page letter that will be identifying the giver, the recipient and the nature of the gift. Listed below are tips on how to create a gift affidavit:

1. Include the following details for the affiant

Just like other affidavits, the following details are very important and vital to every affidavit. This serves as the foundation for creating an affidavit. Always remember the following and include them when writing your gift affidavit:

- Full legal name of the affiant

- Date of birth of the affiant

- Address of the affiant

- Social security number of the affiant

- Full name and address of the recipient of the gift

- Details of the gift

- The date the gift was given

- Value of the gift

- Signature

It is also very important to provide a sworn statement to state that everything that is written in the affidavit is true and correct and must be sworn or affirmed by the law.

2. Identify the purpose the gift

When you are given a birthday gift, it’s highly unlikely that you will be needing a gift affidavit for it. However, if the gift is a car, a land property, an expensive painting or any other luxurious items, a gift affidavit will be deemed necessary. Gifts with such high monetary value may qualify for tax exemptions and even in situations wherein you would need to sort out the ownership of the property or the item.

3. Check all other elements as proof

In order for a transfer of ownership to be considered as a gift, the transaction must satisfy all elements of proof which are the following:

- Legal capacity of the donor to make a gift

- The purpose or the intention of giving the gift

- Delivery of the gift to the recipient

- The acceptance of the gift

All of the elements stated above must be met in order for the transfer to be considered as a gift, pending state laws.

4. Fill up the necessary informations that are needed

Once you have identified the other necessary details for the affidavit, it is now time to choose a ready-made template or make your own template for the gift affidavit. After having the template, you can now start filling up the necessary information that is needed and asked for of the affidavit. There may be some questions that are not applicable to you, you can write “none” or mark “o”. Fill out the form completely and double check all the information that you have stated to avoid problems and to avoid being considered as fraud by the court of law. Ensure that the information that you filled up in the affidavit is nothing but the truth only. Failure to comply with the truth and stating information that is untrue will result in perjury.

5. Sign and notarize the document

After drafting and double checking the affidavit, you can now bring it to the court office for notarization. Always remember that you do not sign on it if there are no other witnesses or if it is not in front of the person who is authorized to be considered as a witness. To be considered and be covered by state laws, the document needs to be signed by the affiant which is the donor and the recipient which is the donee, and it should be done in the presence of a notary public. Depending on what state you are living in, there are some states that accept remote notarization, so check with your state laws if that is something allowed in your area.

6. File in the court

After signing your gift affidavit and having it notarized, you can now go to the court and file it. Once it is notarized, it is now considered as a legal document.

FAQs:

When is a gift affidavit needed?

When a donor freely provides a valuable object to someone else, a gift affidavit is required. It’s most commonly used when giving someone a car or a large sum of money, usually a family member. It proves that a donor gave the item voluntarily and was not compelled to do so in any way. Affidavits of gifts also serve as confirmation that the present was not a loan and that the sender cannot demand its return, payment, or other compensation.

What are the consequences of not filling a gift affidavit?

The consequences of failing to complete a gift affidavit can vary depending on the sort of item donated. Unless a valid gift affidavit is provided, a person receiving an automobile as a gift will be compelled to pay taxes on it as if it were purchased. Gifts of up to $14,000 in cash or assets per person per year are tax-free under federal law. You may be needed to establish that the cash or assets were indeed gifts if you do not have a gift affidavit, or you may be asked to pay taxes on these items. In addition, the gift could be categorized as a loan or a sale.

Is a lawyer needed in assisting me with the Gift?

Giving or receiving a gift can be a formal undertaking, particularly if the asset being given is of high value and worth a substantial sum of money. An estate lawyer in your area can give you the support you require, particularly if there are any disagreements. If a lawsuit is necessary in certain circumstances, it may be necessary to hire a lawyer.

Is it possible for the Donee or the recipient to refuse to accept the gift?

The Donee must also be willing and voluntarily accept the gift without coercion for the Gift Affidavit to be binding. They must accept the present affirmatively; else, it will be revoked until it is accepted. If the Donee accepted it under duress or was substantially persuaded by the Donor, it will not be considered a gift.

Gift Affidavits are formal declarations that something was provided as a gift. If the gift has a high monetary value, the affidavit you filed can be used for both the Donor and the Donee for tax purposes, especially if it was given to eligible entities such as charities. Use a Gift Affidavit to prove that substantial presents or automobiles were given as gifts.