18+ Sample Small Estate Affidavit

-

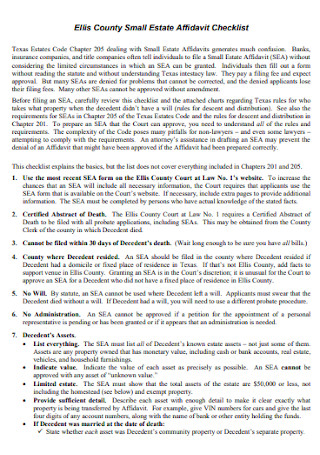

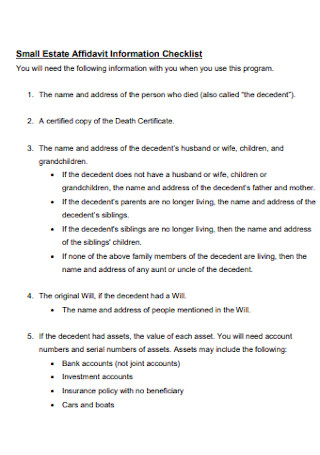

Small Estate Affidavit Checklist

download now -

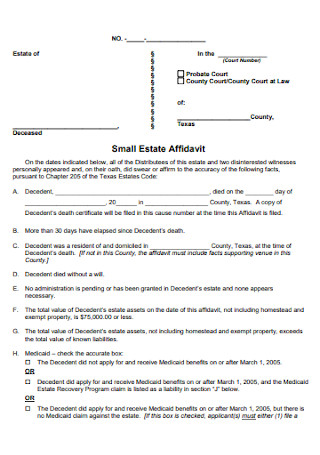

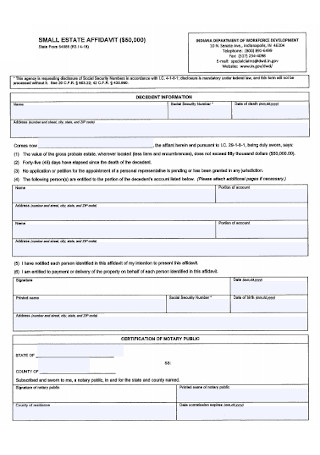

Sample Small Estate Affidavit

download now -

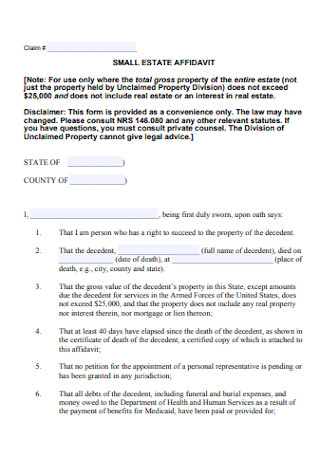

Basic Small Estate Affidavit

download now -

Small Estate Affidavit of Transfer

download now -

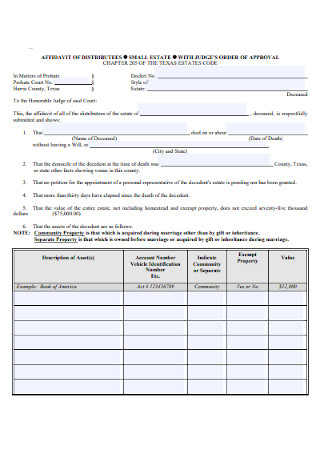

Small Estate Affidavit of Distributes

download now -

Small Estate Affidavit Format

download now -

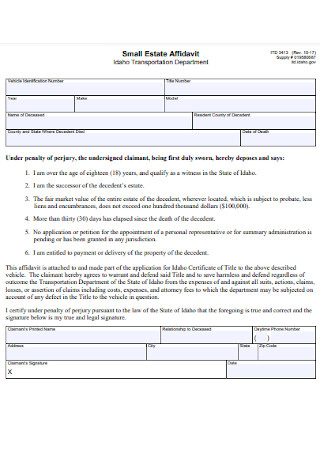

Small Transportation Estate Affidavit

download now -

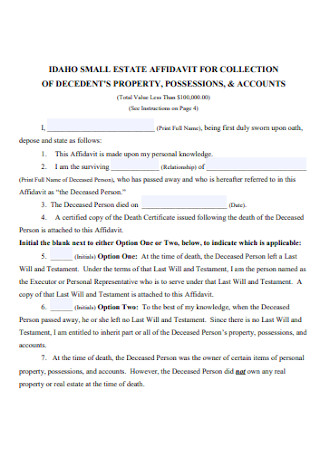

Small Estate Affidavit for Collection of Property

download now -

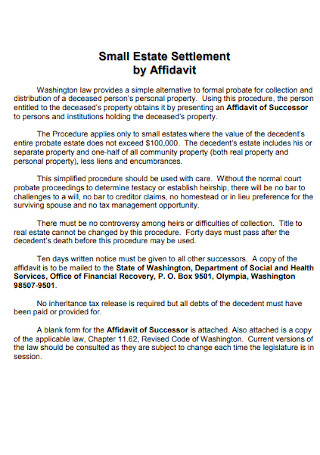

Small Estate Settlement by Affidavit

download now -

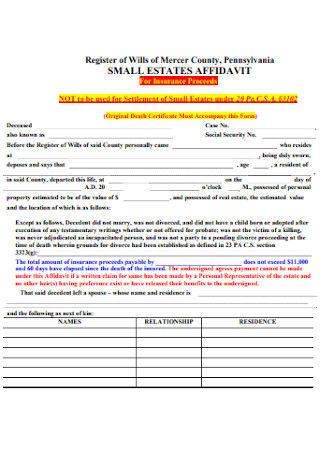

Small Estate Affidavit for Insurance

download now -

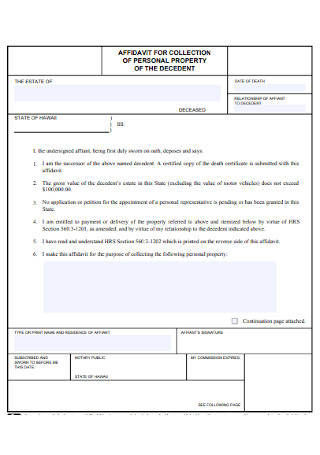

Personal Small Estate Affidavit

download now -

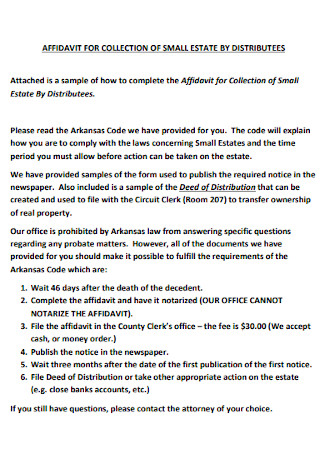

Affidavit for Collection of Small Estate

download now -

Small Estate Affidavit Information Checklist

download now -

Simple Small Estate Affidavit

download now -

Printable Small Estate Affidavit

download now -

Small Estate Affidavit for Collocation

download now -

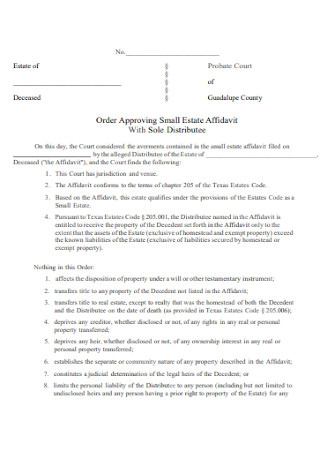

Small Estate Affidavit With Sole Distributees

download now -

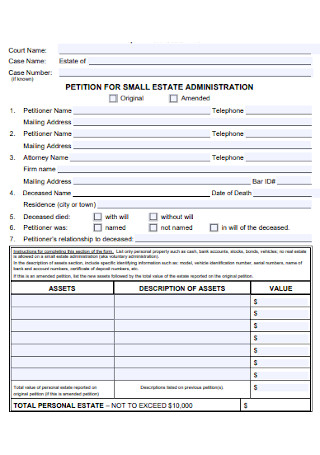

Petition of Small Estate Affidavit

download now -

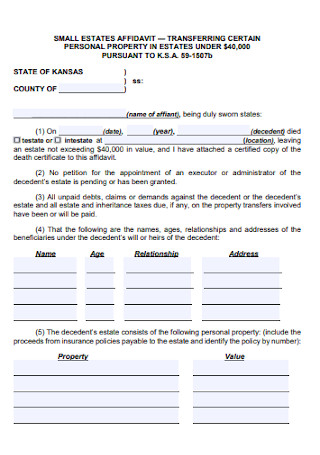

Formal Small Estate Affidavit

download now

FREE Small Estate Affidavit s to Download

18+ Sample Small Estate Affidavit

What Is a Small Estate Affidavit?

Common Terms Used In Small Estate Affidavit

How To Create a Small Estate Affidavit?

FAQs:

Do I need to have my small estate affidavit notarized?

Do I need to hire a lawyer to help me with my small estate affidavits?

When can I not use a small estate affidavit?

Does it cost anything to file a small estate affidavit?

For small estates that are just valid less than a certain dollar amount, there is a simplified process that can be used to avoid formal probate proceedings, which can help the left loved ones save time and money from doing a formal probate proceedings. In order to claim the decedent’s assets, a relative, spouse, family member or the heir can complete a small estate affidavit and present it to whoever holds the asset, may it be the insurance company, bank or credit union. While there are some states that may require the affidavit to be filed in court first, there are also other states that don’t, so to be sure check with your state laws to get more information about this.

You can get a small estate affidavit from the probate courts and fill it out yourself or you can also look for a downloadable blank small estate affidavit that you can find here and just fill out the necessary information that is needed. Depending on what state you live in, a small estate affidavit can also be called as voluntary administration or affidavit in lieu of administration. From the word “small”, a small estate affidavit is limited only to estates that are also “small” ; this is worth less than a certain value. Each state has its own value limit, as well as the assets that count toward it. Personal property, as opposed to real property, such as a building or land, is frequently limited in estates. The small estate affidavit process usually does not allow these assets to be distributed to beneficiaries and heirs, although it depends on the state.

What Is a Small Estate Affidavit?

A small estate affidavit is a form of legal document that allows property and/or assets to be transferred from a will to certain individuals without having to go through the probate procedure. Because the probate process is often time-consuming and costly, this might be quite helpful to the beneficiaries of a deceased testator. Most of the time, small estate affidavit forms will usually require the individual completing it to list the interested parties, the information and amount value of the property that will be transferred, information about the deceased and other necessary details mandated by state law. You should also remember, that only allowed parties are permitted to file a small estate affidavits and there are the heirs, spouses, domestic partners, children, family members or depending on the state law,

You can only use a small estate affidavit with the following requirements:

- The decedent died without a will

- The decedent left less than $75,000 in property (this does not include the homestead and exempt property)

- The assets are worth more than the debts

- You can locate all of the heirs and all of the heirs are willing to sign the small estate affidavit

- No pending application for appointment of a personal representative has been appointed by a court

- No administration needed

Common Terms Used In Small Estate Affidavit

There are a handful of terms that you will encounter when making or doing research for your small estate affidavit. It is very important to know ahead of time what these terms mean before you start filling up your affidavit. Getting to know these terms will help you make your fill out easier and faster since you already know what these terms are for, aside from that, if you get to know what these terms are for, you can start digging out some information that is needed for those. Listed below are the common terms that are used in small estate affidavit:

How To Create a Small Estate Affidavit?

Receiving a property of a deceased family member is a difficult thing to go through most especially if the deceased failed to create their own will. This is why you should learn how to create your own small estate affidavit if you want to take possession of their assets that are rightfully yours. Creating one does not have to be that hard, you can look for templates that are blank and just fill out the necessary important information and you are good to go, but if you wish to create your own small estate affidavit then continue reading to know more about it:

1. Include the necessary documents

The documents that will be required may vary depending on which state you live in but most people can expect to provide the following documents:

- A copy of the death certificate

- The original will or copy of a will if there is one

- Documentation of the deceased’s assets (these may include the proof of ownership of the estate property, stock certificate or bank statement)

- Any form of identification of the affiant

When filling out your small estate affidavit it is also important to get ready for the following information:

- Affiant’s name

- Affiant’s address

- Deceased’s information, such as name, date of passing and former address (in case if you don’t have a copy of the death certificate)

- Confirmation of payment for all funeral and burial expenses

- List and details of any unpaid debts or claims

- Name and address of surviving spouse and children (if it is applicable)

- Any other information or documents that is required by the state

2. Identify who the affiant is and make a sworn statement

Like any other affidavits, it is very important that the affiant will make its own sworn statement, so if you are the one who will be claiming the assets and who will take responsibility for the deceased’s assets, then you should identify yourself in the affidavit that is why when filling out it is also important to have your contact information and your relationship to the decedent. You will also be required to write a statement of truth in order to attest to the veracity and truthfulness of the affidavit you are making. Failure to comply with this requirement may result in perjury.

3. Verify the decedent’s and assets’ information.

Apart from your basic information, your affidavit must include all of the information required to complete a small estate affidavit. Your document should include the following factual statement:

- Confirmation of the date and location of the decedent’s death. The formal death certificate of the decedent can be used to verify this information.

- Indicate whether or whether the decedent’s outstanding funeral expenses must be paid or have already been paid. If the expenses have been paid in whole, a description of the expenses as well as the amount owed should be included.

- Information on any other claims against the estate, such as debts and obligations, that will be settled with the estate’s assets. Any leftover property will be distributed to the decedent’s rightful heirs and beneficiaries.

- A summary of the decedent’s personal property that will be distributed, assuming any exist. It should provide a detailed description as well as the estate’s entire valuation. Vehicles and common things such as jewelry, clothing, and art are examples of personal assets.

4. Sign the affidavit in the presence of a notary or any who is authorized

Check if you need two other persons to witness the affidavit and your signature once you’ve completed the small estate affidavit in its entirety. These witnesses must accompany you to the notary public’s office to notarize the paperwork. Before signing your affidavit, always ensure that everything that you have written is nothing but the truth. Double check as much as you can because once the court finds out that there are mistakes or lies within the affidavit, it may result to perjury.

5. File the affidavit with the court

What occurs next in the affidavit process is determined by your state’s procedures. In certain places, all you have to do is provide the completed affidavit and the death certificate to the person who has the assets, and they will release them. In other states, however, you must first obtain probate court approval, which may result in the issuance of a more formal set of paperwork that you will use to claim the decedent’s assets. If your county allows it, you can file the affidavit in person, by mail, or even online if your county allows it, but you’ll almost certainly have to pay a cost.

FAQs:

Do I need to have my small estate affidavit notarized?

The small estate affidavit must be notarized in many states to be legitimate. Even if it isn’t required in your state, you should do it anyway because the financial institutions holding the assets may want notarized verification that you are entitled to them.

Do I need to hire a lawyer to help me with my small estate affidavits?

When attempting to avoid the probate procedure, small estate affidavits are becoming increasingly popular legal documents to use. In reality, the use of these affidavits has spread so widely in many jurisdictions that the extent of what can be transferred is beginning to broaden. An expert estate planning attorney can assist you in writing and filing the affidavit, as well as walk you through the process. Your lawyer may also address any specific questions you might have concerning a small estate affidavit, as well as assist you in filing a claim if there are any issues with your affidavit (e.g., if a property owner refuses to transfer certain assets or property). In addition, if you need to attend a court hearing, your lawyer can represent you and remedy any errors that may have occurred in the case that your affidavit is disallowed.

When can I not use a small estate affidavit?

If ordinary probate proceedings have already begun, a small estate affidavit may not be employed. When the value of the estate exceeds the boundaries that identify a small estate, small estate affidavits are likewise ineffective.

Does it cost anything to file a small estate affidavit?

Yes. A fee is charged for submitting a Small Estate Affidavit. The fees differ from one county to the next. To find out what the fees are, contact the county clerk’s office or district clerk’s office in the county where the decedent lived at the time of death. If you have a low income, however, you may be eligible to have your court expenses waived. Fill out this form to request a fee waiver from the court: Statement of Financial Inability to Pay Court Costs or an Appeal Bond. This document informs the judge that you are unable to pay your court fees. Complete the form in blue or black ink and sign it. Don’t forget to fill in the blanks.

The filing and completion of the minor estate procedure is pretty simple. This gives you access to your departed loved one’s assets and property, allowing you to appropriately manage them. The estate will be transferred to your name after the process is completed, and you will have complete control over the estate.