12+ Sample Financial Feasibility Analysis

-

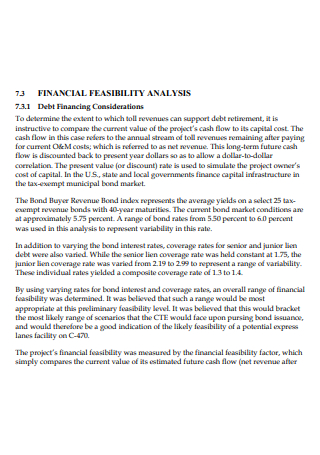

Financial Feasibility Analysis Template

download now -

Draft Financial Feasibility Analysis

download now -

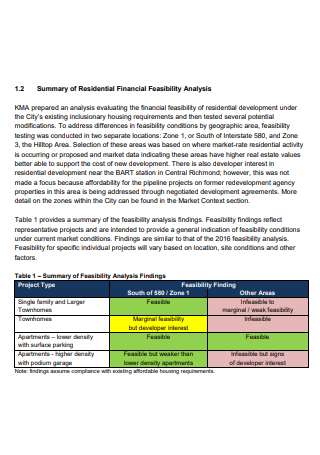

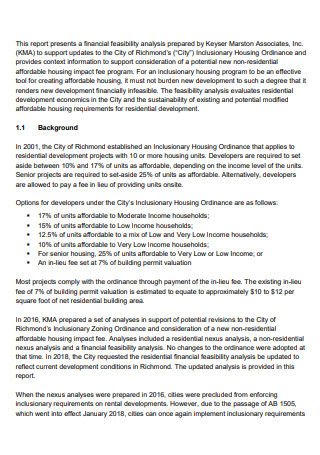

Residential Financial Feasibility Analysis

download now -

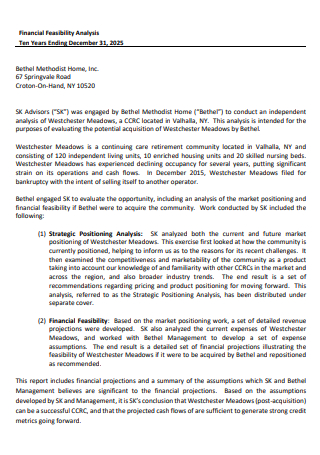

Basic Financial Feasibility Analysis

download now -

Financial Feasibility Credit Analysis

download now -

Financial Feasibility Analysis in PDF

download now -

Financial Feasibility Analysis Model

download now -

Printable Financial Feasibility Analysis

download now -

Financial Feasibility Analysis and Implementation Plan

download now -

Technical and Financial Feasibility Analysis

download now -

Financial Feasibility Analysis Example

download now -

Preliminary Financial Feasibility Analysis

download now -

Farming Business Financial Feasibility Analysis

download now

FREE Financial Feasibility Analysis s to Download

12+ Sample Financial Feasibility Analysis

What Is a Financial Feasibility Analysis?

Benefits of Finance

Elements of a Reliable Project Plan

How to Complete a Feasibility Study

FAQs

What is the purpose of financial analysis?

What is cash flow?

Does cash flow mean profit?

What Is a Financial Feasibility Analysis?

Analysis of financial feasibility evaluates the monetary aspects of a proposed plan or project. It analyses capital, expenses, revenues, return on investment, reimbursements, and disbursements to generate a more thorough report. Financial feasibility evaluations essentially inquire and answer the question, “Will the project or business have sufficient funds to finish the project’s development and generate sufficient profit?” This is the foundation of every firm; it must know whether it can support itself and whatever projects it undertakes. Finances are highly precious, and no one wants to waste money. Without financial feasibility study or any feasibility assessment, a firm would pursue any opportunity without determining whether or not it benefits the business. We want to avoid this, so we are investigating the potential negative repercussions of the project we intend to undertake. Specifically about finances. 82% of small companies fail due to cash flow issues. And while most small business owners think cash flow is the greatest threat to their companies, cash flow is a catch-all term—a symptom, if you will—for several underlying problems.

Benefits of Finance

A company’s financial department is frequently veiled in mystery. Many employees need help to describe the department, function, or impact on their work. But the truth is that everyone is affected by finances. Finance conveys an organization’s overall health, explains how an individual’s activities involve the company’s success, establishes parameters for future goals and initiatives, and establishes meaningful benchmarks for measuring departmental performance. Making an effort to enhance your financial skills can provide numerous benefits. Below are some essential advantages of obtaining a deeper understanding of finance, coupled with three specific suggestions for developing these skills.

Elements of a Reliable Project Plan

The absence of a project plan is a crucial project management stage that will jeopardize the project’s success before it even begins. A project plan can outline the essential resources and timeline and help you avoid obstacles that could derail your progress. To help you develop a perfect project plan, we’ve outlined the six stages you must take to ensure your project plan leads to project success, and we’ll show you how to create your project plan using our project scheduling template.

1. Identify and Meet with Relevant Parties

A stakeholder is somebody whose interests are influenced by the project’s outcomes. Included in this are your customers and end-users. Ensure you identify all project stakeholders and consider their interests while developing the project strategy. Meet with the project’s sponsors and key stakeholders to review their needs and expectations and to define the project’s baseline scope, budget, and schedule. Create a scope statement document to complete and document project scope specifics, ensure everyone is on the same page, and decrease the likelihood of costly miscommunication. In particular, cost management is crucial at this point in the process.

2. Set and Prioritize Goals

Once you have compiled a list of stakeholder requirements, prioritize them and establish project objectives. These should outline the desired project objectives, measurements, and benefits. Plan your project so that your dreams and the stakeholder demands they fulfill are clearly articulated and easily shared. If you are experiencing difficulty with prioritization, begin rating your goals based on urgency and significance, or consult these practical decision-making techniques.

3. Define Deliverables

Determine the deliverables and planning stages necessary to accomplish the project’s objectives. What are the precise deliverables required of you? Next, estimate the delivery dates for each project deliverable. Set firm milestones for critical deadlines and deliverables. Once work begins, you can monitor your progress to ensure the timely completion of assignments and satisfy stakeholders.

4. Create the Project Schedule

Examine each deliverable and outline the sequence of tasks that must be performed to complete it. Determine the time required, the resources required, and who will be liable for the performance of each activity. Next, identify any dependencies. Do specific jobs need to be completed before others can begin? Enter deliverables, dependencies, and milestones into your Gantt chart, or use one of the numerous online templates and apps. Ensure you also know how to prepare a project management report to provide a summary of the project’s status.

How to Complete a Feasibility Study

Before making a significant business decision, it is essential to determine whether the option is realistic and likely profitable. You can use feasibility studies to make better business decisions that increase the likelihood of action success. This article explains what a feasibility study is, when it should be utilized, and how to perform your own.

1. Perform Preliminary Investigation

Beginning a feasibility study with a preliminary analysis is optimal. In this step, you will consider the action’s feasibility and what it includes. A thorough feasibility analysis requires time and resources. A preliminary examination is conducted to assess whether a comprehensive feasibility study is worthwhile. If you believe the action you wish to take merits additional investigation, you can perform a comprehensive feasibility study.

2. Create a Study Outline

Then you can make a plan to describe each part of your feasibility study. The goal is to list essential elements of your survey so you can use it as a guide. Make an outline that answers each of these questions in detail. Then, explain how you will answer each question and what kind of answer you need to know if your plan can work.

3. Conduct Market Research

Analyzing your competition and the market is an effective method for determining the viability of your suggested action. If another organization has made a similar move, you can learn that your activity is viable and what steps will assist you in reaching your goal. Market research should assist you in providing more specific responses to the questions posed in the previous stage. By holding focus groups and distributing surveys, they discovered that buyers have a strong interest in their suggested new toy.

4. Conduct Organizational Research

If you find a market for your action plan, the next step is to see if your organization can do it. One important thing to look at is how the action will affect money. During this step, you should figure out how much you need to pay upfront, what long-term investments you need to make, and what other costs your business will have.

5. Analyze Your Results

After gathering all the information, you must examine the findings to determine whether your company can handle the activity or whether there is a market for it. Your conclusions will be trustworthy, accurate, and in the best interest of your project if you carefully analyze each section of the report and ensure that you fill it out correctly.

FAQs

What is the purpose of financial analysis?

The financial analysis seeks to determine whether an entity is sufficiently stable, solvent, liquid, or profitable to sustain a financial investment. It analyzes economic trends, establishes financial strategies, constructs a long-term plan for commercial activities, and finds investment projects or companies.

What is cash flow?

Cash flow refers to the net credit of money entering and leaving a business at a particular time. Continually, cash flows into and out of business.

Does cash flow mean profit?

No, the two measurements are drastically different. Cash flow is the cash that moves into and out of business during a specific period, whereas profit is the revenue remaining after deducting expenses.

That should get you writing. You understand its value and have the skills to write one without problems. Preparation is better than blindly jumping into a project. Don’t waste resources or bankrupt your business. If you need help again, especially with a business document, come back, and we’ll try to help.