24+ Sample Financial Power of Attorney

-

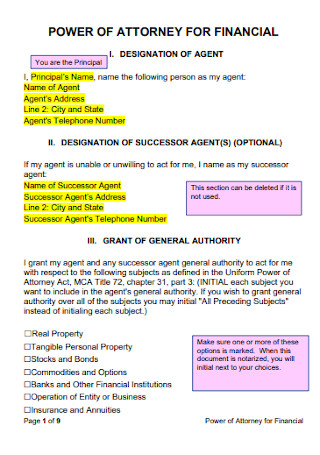

Financial Power of Attorney

download now -

Financial Power of Attorney Format

download now -

Office Financial Power of Attorney

download now -

Financial Durable Power of Attorney

download now -

Revoking Power of attorney for Finances

download now -

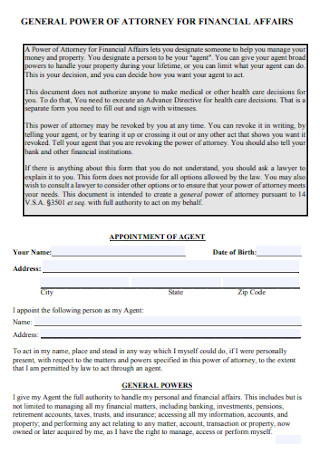

Power of Attorney for Financial Affairs

download now -

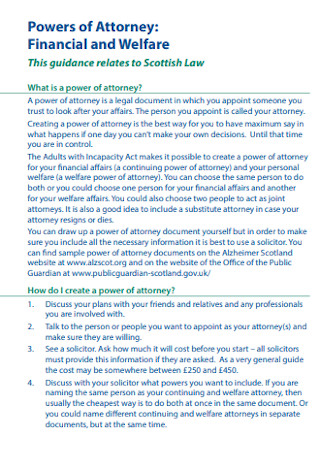

Financial and Welfare Powers of Attorney

download now -

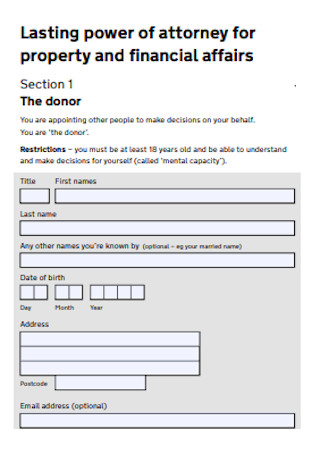

Property Financial Power of Attorney

download now -

Simple Power of Attorney for Financial

download now -

Powers of Attorney in Fund Financing Transactions

download now -

Law Office Financial Power of Attorney

download now -

Durable Financial Power of Attorney Form

download now -

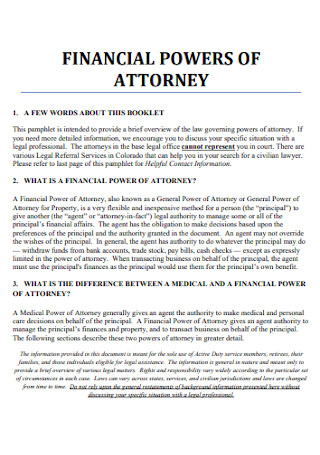

Financial Powers of Attorney Format

download now -

Power of Attorney Financial Matters

download now -

Formal Financial Powers of Attorney

download now -

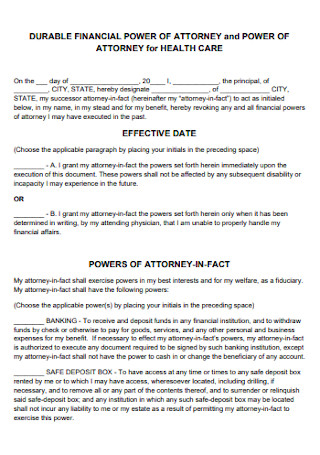

Health Care Financial Power of Attorney

download now -

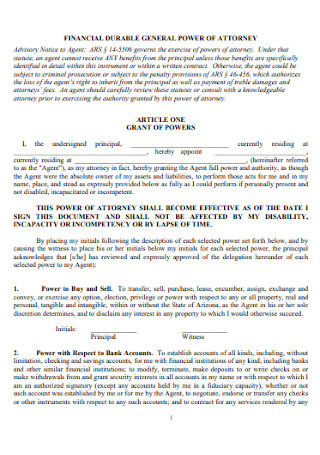

Financial Durable General Power of Attorney

download now -

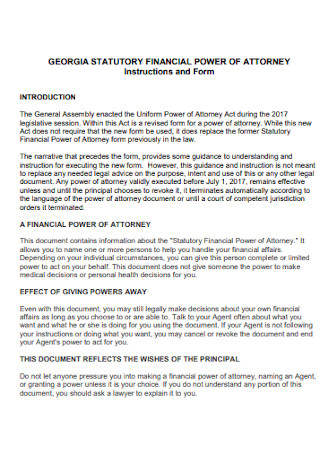

Statutory Financial Power of Attorney

download now -

Unlimited Power of Attorney For Financial Affairs

download now -

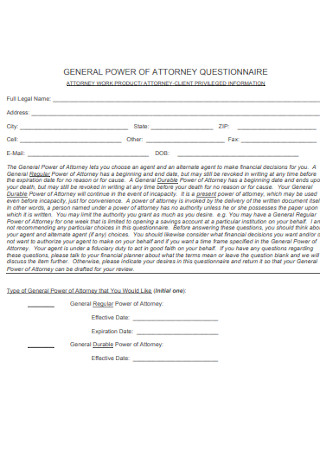

Financial Power of Attorney Questionnaire

download now -

Financial power of Attorney Packet Template

download now -

Financial Investments Power of Attorney

download now -

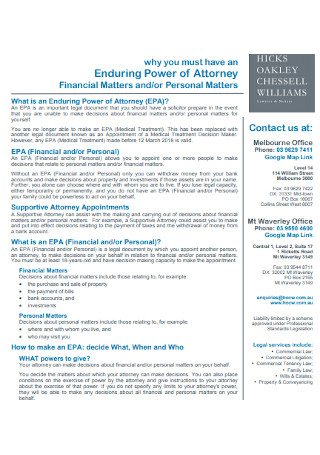

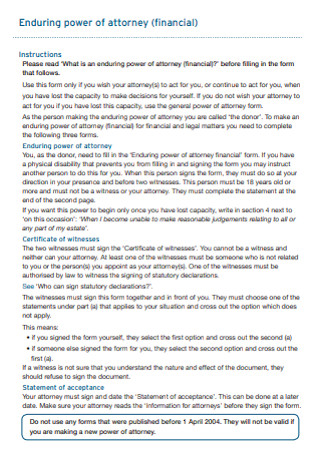

Financial Enduring Power of Attorney

download now -

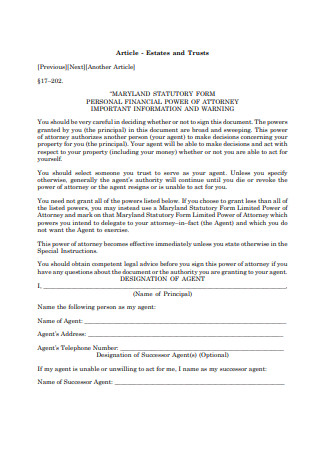

Personal Financial Power of Attorney

download now -

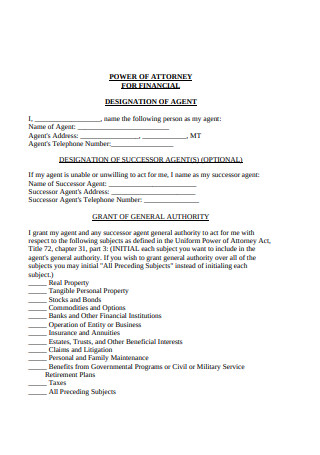

Simple Financial Power of Attorney

download now

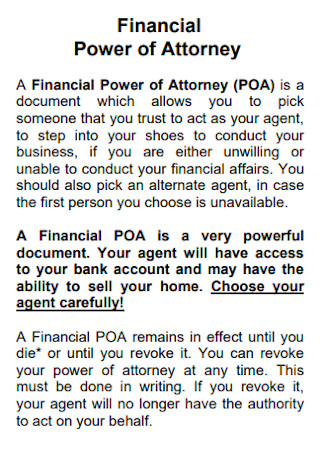

What Is a Financial Power of Attorney?

When you desire to give someone else the power to make financial choices for you, you’ll need an economic power of attorney. And it’s usually done in tandem with your will. This type of POA is designed to allow someone else to act as your legal representative for financial problems. Like other powers of attorney, the individual who forms a financial POA is known as the principal—in this case, you. No, being the principal does not imply that you will place students in detention. A principal in the context of a POA is simply the individual whose funds are being safeguarded. The agent or attorney-in-fact is the person you pick to handle your money when you cannot do it yourself. According to statistics, approximately 25 to 30% of households in the United States have estate planning documents in place. This means that some individuals do not have documents to address how they want their financial affairs handled if they cannot do so independently during their lifetime.

Benefits of Financial Power of Attorney

The principal voluntarily delegated authority to the agent through the use of powers of attorney. The principal has not relinquished their control to perform these same functions but has instead vested the agent with legal authority to perform various tasks on the principal’s behalf. In most states, powers of attorney are unilateral contracts – that is, they are signed solely by the head but accepted by the agent through the act of performance. After defining what a durable power of attorney is, here are the top 10 reasons to have one.

How to Establish a Financial Power of Attorney

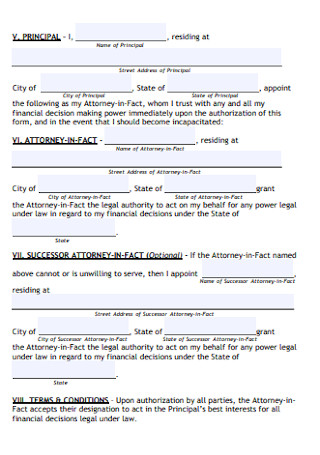

A financial POA is a legal document that appoints an individual — or, in some cases, an establishment such as a bank or trust company — to manage another person’s financial affairs. It can be used to make life easier for your parents or other loved ones, even if they continue to make decisions and handle some financial matters independently. Alternatively, it can be used to manage all of their financial affairs if they cannot do so themselves. First, it’s a good idea for you and the person in your care to become acquainted with the fundamentals of how a financial power of attorney works. A financial power of attorney can be used to alleviate the burden of managing financial affairs. The document may authorize the appointed individual — referred to as an “agent” or “attorney-in-fact” — to handle routine financial matters such as rent, insurance, and doctor’s bills, as well as significant financial transactions such as asset sales or management of a business, property, or investment contracts. With this, establishing a POA entails several steps. It may be reasonable to consult with a lawyer throughout this process. The following is a high-level overview of the steps you will take:

Step 1 Determine whether or not one is required.

In a few instances, a power of attorney is not required. A power of attorney may be unnecessary if all of a person’s assets and income are held jointly with their spouse, as with a joint bank account, deed, or brokerage account. Even if spouses have joint accounts and property titles or are beneficiaries of a living trust, a durable power of attorney is a good idea. This is because one spouse may have acquired assets or income that were not disclosed in the standard reports or in good faith or that were not disclosed in the standard reports or good faith. A strong power of attorney can appoint an agent — who may be the same person as the trustee of the living trust — to deal with these issues as they arise.

Step 2 Choose an agent.

In the POA, one adult will be designated as the decision-making agent. Individuals and families may require assistance in determining who is the best candidate for this role. An attorney, a religious leader, or a family counselor can all assist you in this process. Selecting an agent capable of carrying out the obligations while being willing to accept other people’s perspectives as needed is a good idea.

Step 3 Consider the standard forms.

You may discover that certain states, as well as your family’s bank or specific financial institutions, prefer to employ POAs. These can also be used as resources when you put together a POA for a loved one. Financial organizations may mandate that a specific format be utilized in some cases, so check with any bank statements or brokers that your elderly loved one uses before drafting the paperwork.

Step 4 Notarize the written POA and distribute copies to key individuals.

A POA must be drafted, witnessed, and notarized to be valid. With the possible exception of a POA connected to real estate, you do not need to submit it with a court or government office. Keep in mind that a verbal agreement, as well as a hastily prepared letter or note, is not considered a legal POA. Once you have a properly signed and witnessed POA, maintain a copy in a safe place and make sure that anyone attending for your loved one has a copy or is aware of who the agent is. Make sure the agent also has a copy.

Step 5 Review the POA regularly.

A financial POA must be prepared ahead of time. Because time is unpredictable, and a POA could remain in place for years or decades, you should all examine it regularly. Keep an eye on whether the person designated as the agent is still willing and capable of fulfilling that role, as circumstances and laws may change.

FAQs

What determines the validity of a power of attorney?

When individuals grant power of attorney, they must be mentally competent. The process of having witnesses sign the document helps ensure its authenticity and the competence of those involved. Additionally, their signatures must be notarized, which lends additional credibility. Further, if they retain the services of a lawyer to prepare or review the documents, the lawyer’s contact with them will bolster their competence at the time.

Is a POA agent compensated?

The person who administers a power of attorney determines whether or not the agent is to be compensated. If the job is straightforward and performed by a close family member, payment is rarely made, though he may choose to do so. If the job is likely to be complex and time-consuming, or if it will be handled by someone who is not close, the agent should be compensated hourly. In either case, the agent is entitled to self-reimbursement for reasonable expenses incurred. It is good to keep track of the hours spent on the job and any receipts required to justify reimbursement.

What are the dangers of signing a POA?

The agent has a lot of authority with a financial POA. While somebody will take this obligation seriously and act transparently, this power level may increase the possibility of elder financial exploitation. It’s a good idea to make decisions with a group of family and friends, be willing to present documentation of the decisions made, when they were made, and why they were made. However, you may have grounds for reporting elder abuse if you feel that an agent uses an older’s financial statement for reasons other than care for the aging adult or if funds are suddenly depleted without explanation.

Is it true that a power of attorney is legal in every state?

A power of attorney is valid in every state. When a power of attorney is signed, the agent’s abilities and acts are governed by the state’s laws in which they reside when the document is signed. If they often do financial activities in another state, a separate power of attorney prepared using the state’s particular legal form is not a terrible idea.

A financial power of attorney is an effective estate planning tool that can help you plan for the unexpected. If you are harmed in an accident and cannot communicate, your loved ones will be unable to access the finances essential to provide for your care if you do not have a power of attorney in place. Furthermore, unless you have taken the required measures to establish a medical power of attorney, your loved ones may be unable to communicate your preferences for your nursing care.