50+ Sample Budget Sheets

-

Budget Working Sheet Template

download now -

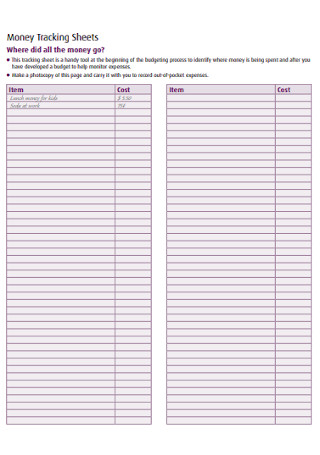

Budget Money Tracking Sheets

download now -

Budget Estimated Sheet Template

download now -

Personal Budget Sheet

download now -

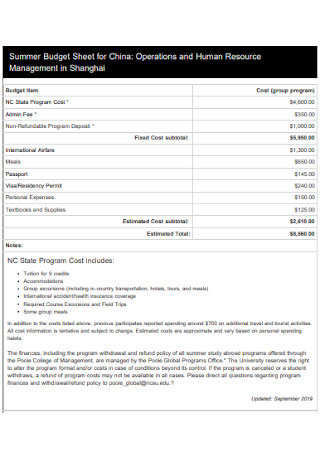

Summer Budget Sheet

download now -

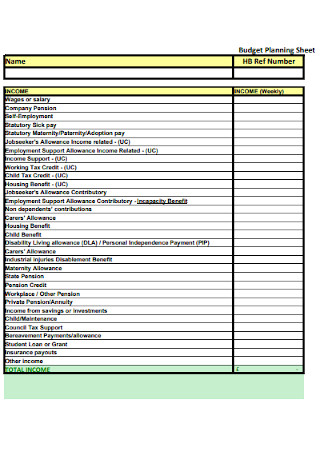

Budget Planning Sheet

download now -

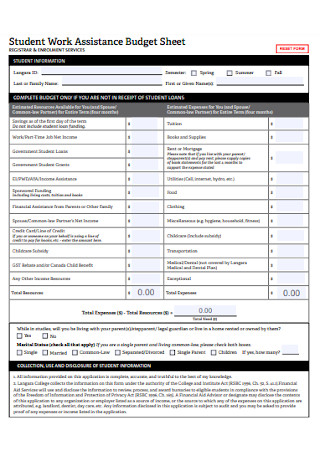

Work Assistance Budget Sheet

download now -

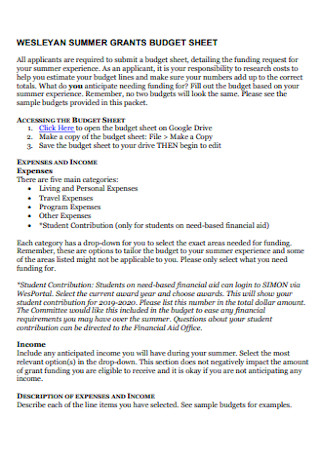

Suummer Grants Budget Sheet

download now -

Mini Grant Budget Sheet

download now -

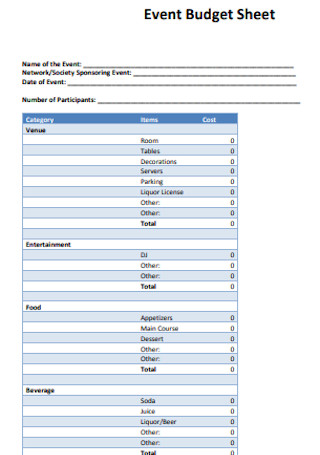

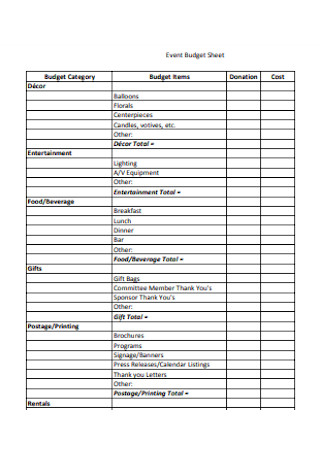

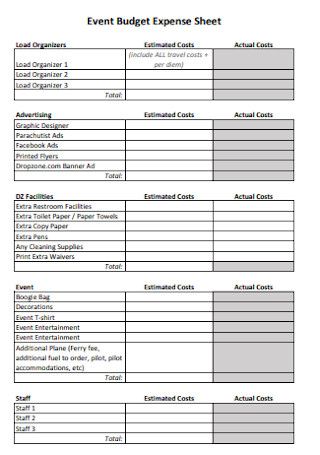

Event Budget Sheet Template

download now -

Budget Planning Worksheet

download now -

Sample Event Budget Sheet

download now -

Household Budget Sheet

download now -

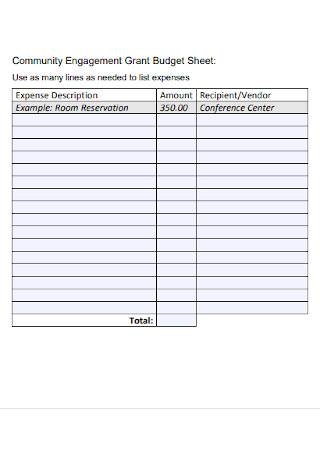

Community Engagement Grant Budget Sheet

download now -

Research Program Budget Sheet

download now -

International Student Budget Sheet

download now -

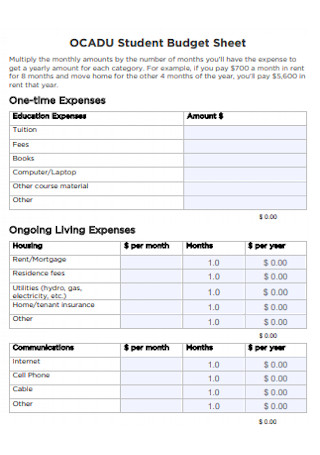

Student Budget Sheet Template

download now -

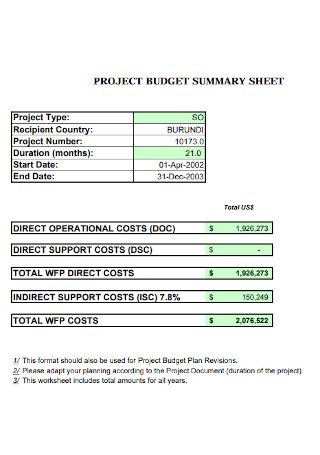

Project Budget Summary Sheet

download now -

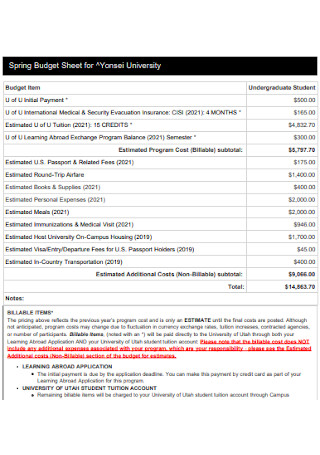

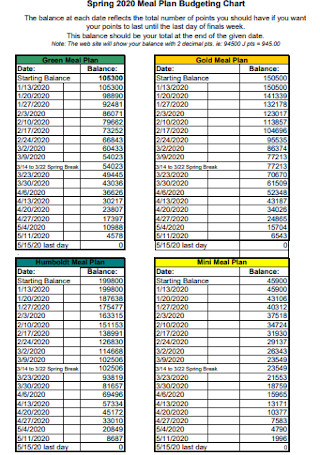

Spring Budget Sheet Template

download now -

Budget Sheet for Students

download now -

Off Campus Living Budget Sheet

download now -

Spring Budget Sheet Format

download now -

Event Budget Sheet Template

download now -

Budget Fact Sheet

download now -

Fall Semester Budget Sheet

download now -

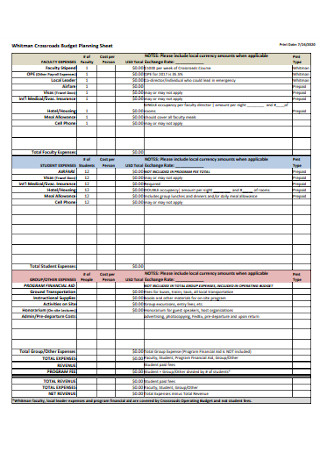

Crossroads Budget Planning Sheet

download now -

Monthly Income Budget Sheet

download now -

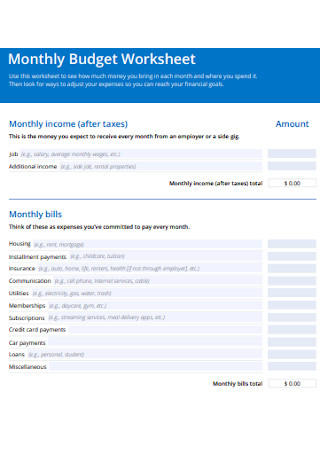

Monthly Budget Sheet Template

download now -

Budget Expense Sheet

download now -

Meal Plan Budgeting Sheet

download now -

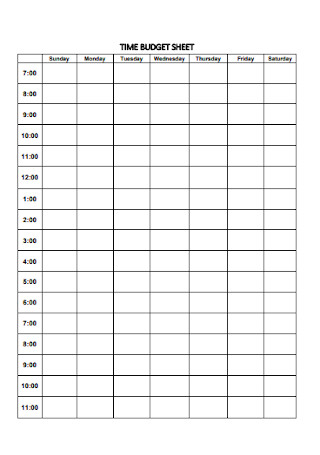

Sample Time Budget Sheet

download now -

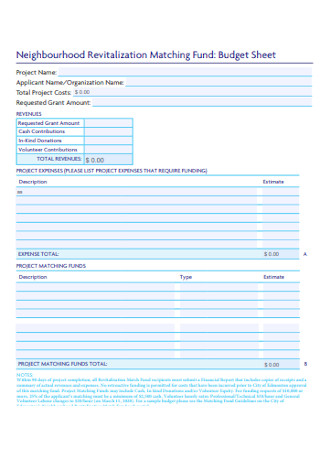

Fund Budget Sheet Template

download now -

Retirement Planning Budget Sheet

download now -

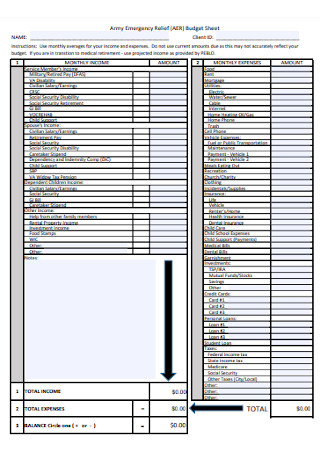

Emergency Relief Budget Sheet

download now -

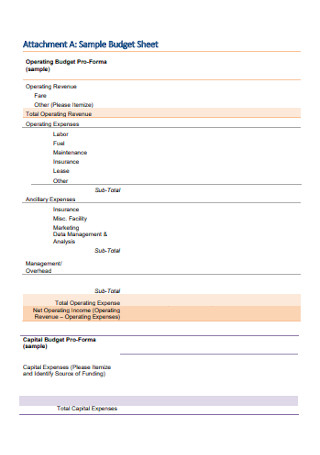

Sample Budget Sheet Template

download now -

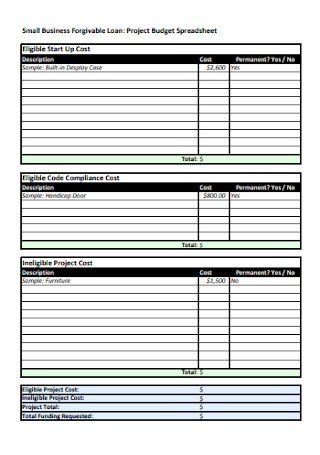

Project Budget Spreadsheet

download now -

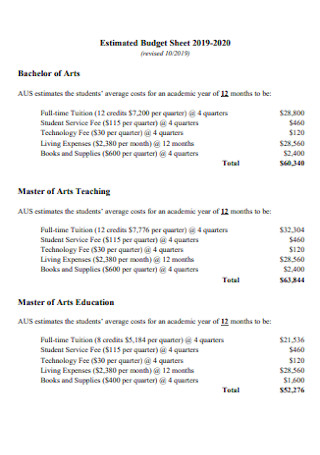

Estimated Budget Sheet Template

download now -

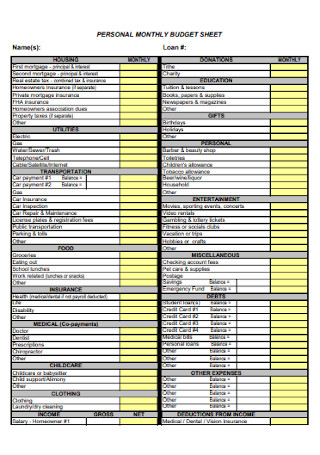

Personal Monthly Budget Sheet

download now -

Basic Monthly Budget Sheet

download now -

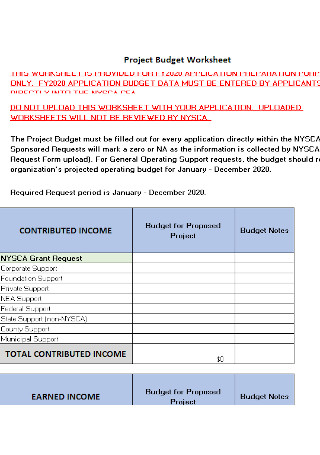

Project Budget Worksheet

download now -

Standard Budget Sheet Template

download now -

Simple Budget Worksheet

download now -

Budget Conference sSheet

download now -

Budget Request Fact Sheet

download now -

Client Budget Sheet Template

download now -

Simple Budget Sheet Template

download now -

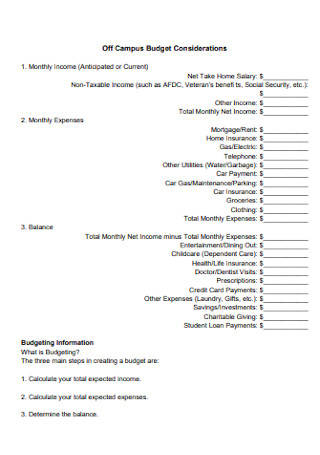

Off Campus Budget Considerations Sheet

download now -

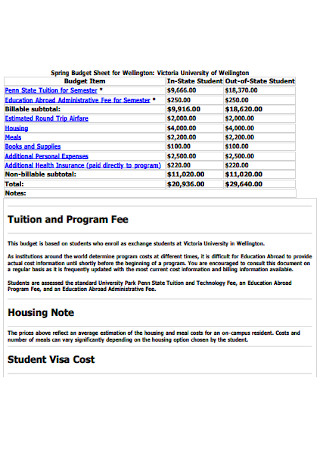

Spring College Budget Sheet

download now -

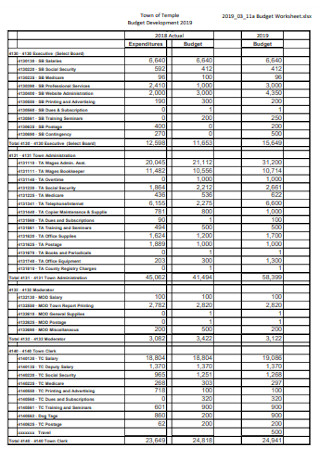

Budget Development Sheet

download now -

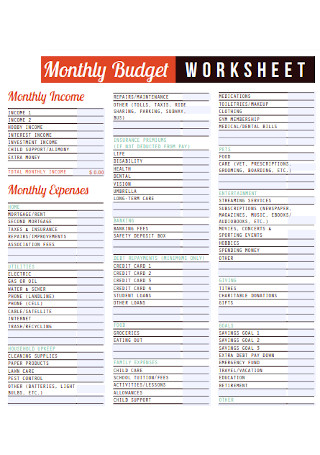

Monthly Budget Worksheet

download now

What Are Budget Sheets?

A budget sheet refers to your official financial worksheet in determining, calculating, recording, or monitoring your expenses over a certain period. Just like a budget plan, you can depend on the budget sheet to organize finances and not head down to constant debts, or worse, bankruptcy. Thanks to budget sheets, you now have comprehensive tools to manage money in the smartest way possible.

Based on a report, the Americans’ debt reached $14.3 trillion and a $438 billion credit card debt to boot in March 2020; hence, the personal savings rate went down.

What Are the Parts of a Budget Sheet?

A budget sheet may contain lots of numbers of different expenses, may those be related to a regular paycheck, household budget, college tuition, or any other business. However, there are common elements observed from every budget sheet too. And they usually consist of the following:

How Do You Make a Budget Sheet?

People have different financial plans, goals, priorities, and expenses. Thus, a budget sheet isn’t a one-document-fits-all type of sheet. You have to personalize it. And with the sample budget sheets above, you can freely customize them afterward to meet your specific needs. And in creating the budget sheet properly, don’t forget to follow these steps:

Step 1: Review Your Financial Goals and Statements

Take a look back at your ongoing financial statements and assess your budget goals. Eventually, you’ll understand that your whole budget sheet is for school, a business project, or simply for personal use. Your financial statements are even your reference on what list of expenses must be written in the budget sheet.

Step 2: Complete the Parts of a Budget Sheet

Recall the important budget sheet parts down from the title to the date and time. You will need them to form a complete budget sheet for sure. That means you should have finalized your budget sheet’s purpose already, know what list of expenses to jot down, including the appropriate calculations, strategies, and schedules are.

Step 3: Arrange Your Details Carefully

While completing the budget sheet’s parts and adding as many details as you can, take a pause and check if all information was arranged well enough too. You have to be careful with the data inputted in the budget sheet or things might be hard to follow or worse, the records are inaccurate. You can always use graphic organizers and other strategies to organize the sheet anyway.

Step 4: Keep It User-Friendly

Last but not least, come up with a user-friendly budget sheet. Indeed, the listed sample budget sheets above promise you that. But how you customized the sheet might have lessened how easy to use the document is. In fact, you can always go for a simple budget sheet as long as the details are straightforward and easy to understand. More so, the document itself is convenient to use.

FAQs

What is the importance of a budget sheet?

A budget sheet is useful for reference and awareness purposes. There might be times you wonder why you only have a few savings left or if you doubt that your budget for retirement was really credited or not. Hence, refer to your budget sheet to monitor and manage all your different expenses.

What are the types of budgets?

There are four main types of budgets or budget methods that businesses are familiar with. These are the activity-based, incremental, value proposition, and zero-based budgets.

What is the 50-30-20 budget rule?

The 50-30-20 budget rule is a popular concept of budgeting where you are supposed to divide your income: 50% for needs, 30% for wants, and 20% for savings. And following that basic rule already lets you practice smart money management.

As natural beings, it is normal to have daily expenses, debts, and other financial-related concerns. But, don’t spend excessively. And that leads you back as to why monitoring and managing finances using a budget sheet is crucial. Budget sheets help you live life better financially rather than risking your future.