39+ Sample College Budgets

-

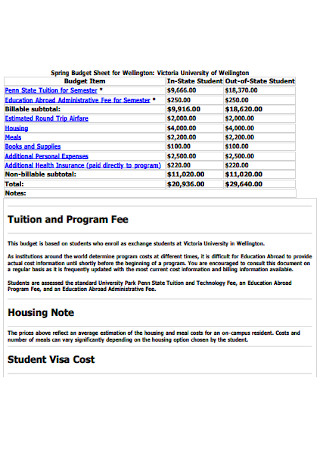

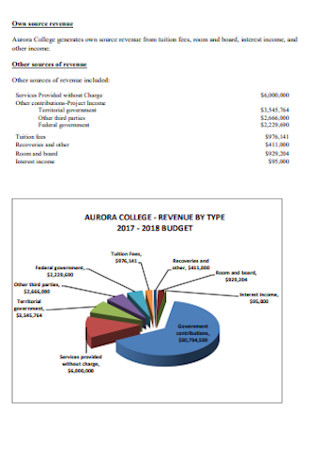

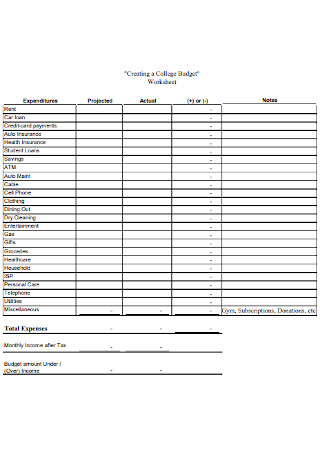

College Budget Sheet

download now -

College Student Budget Template

download now -

College Planning Budget

download now -

College Budget Director Template

download now -

College Expenses Budget Template

download now -

College Committee Budget Template

download now -

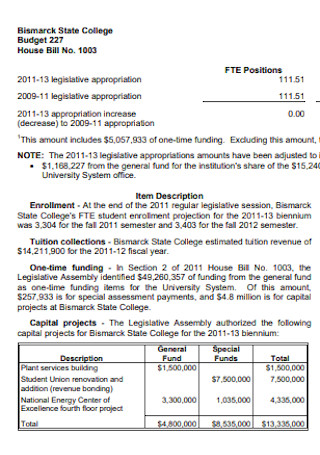

State College Budget

download now -

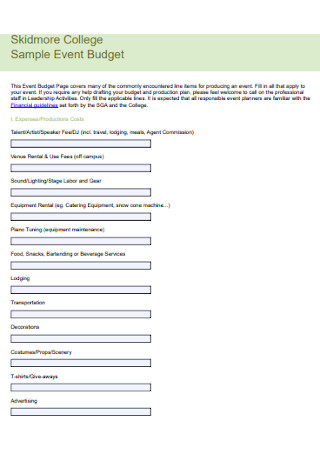

Sample College Event Budget

download now -

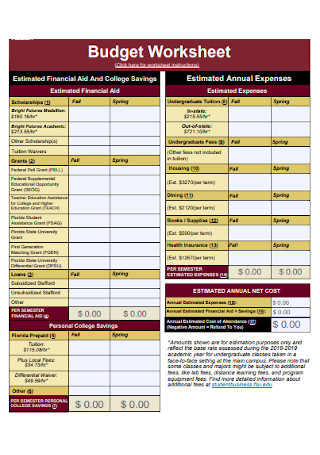

College Budget Worksheet

download now -

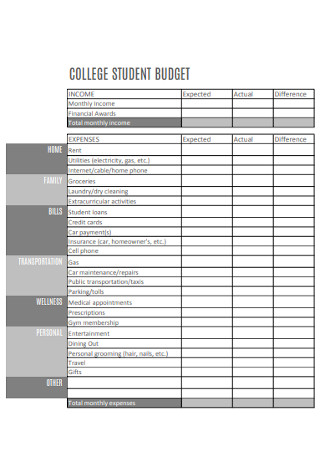

College Student Budget

download now -

College Operating Budget Template

download now -

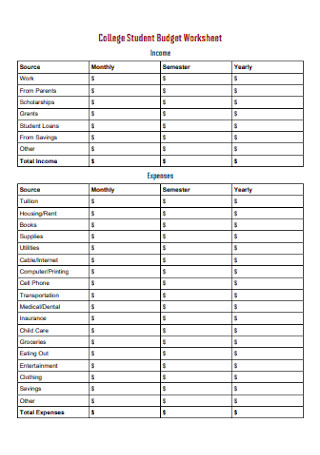

College Student Budget Worksheet

download now -

College Budget Coordinator Template

download now -

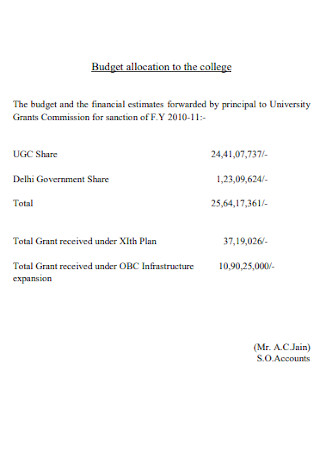

Budget Allocation to the College

download now -

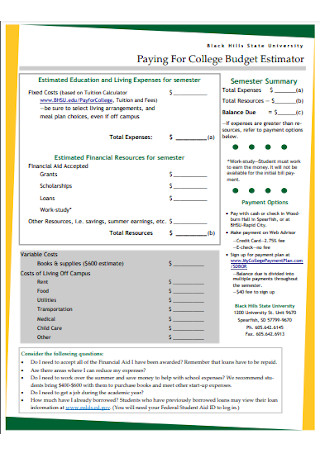

Paying For College Budget

download now -

College Capital Budget Template

download now -

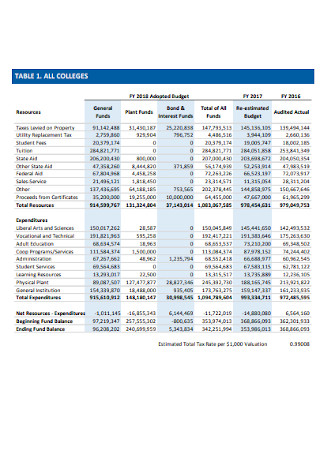

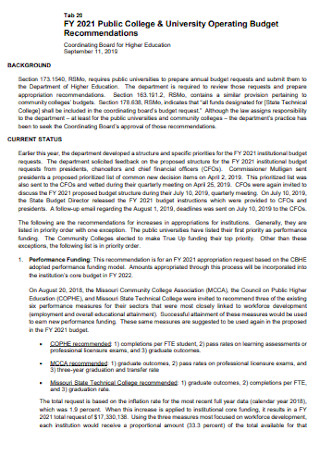

College And University Operating Budget

download now -

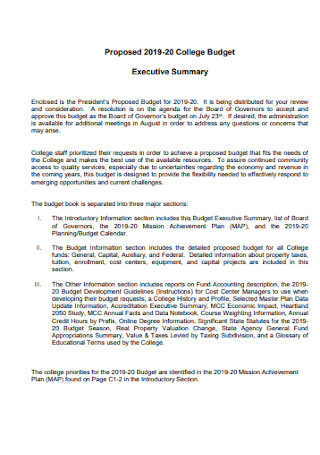

College Board Budget Template

download now -

College Annual Budget Template

download now -

College District Final Budget

download now -

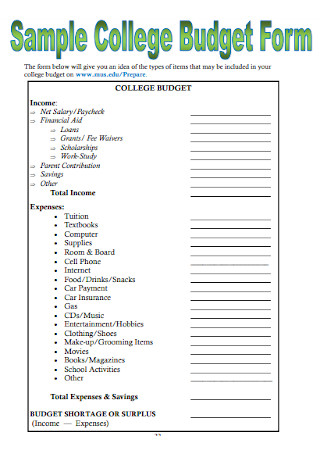

Sample College Budget Form

download now -

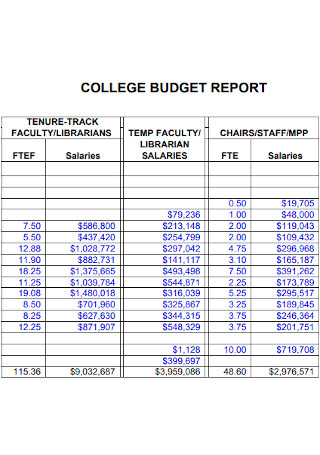

College Budget Report

download now -

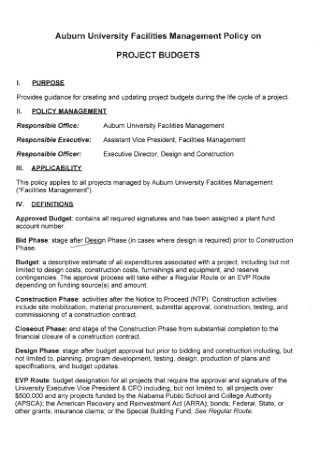

University Project Budget

download now -

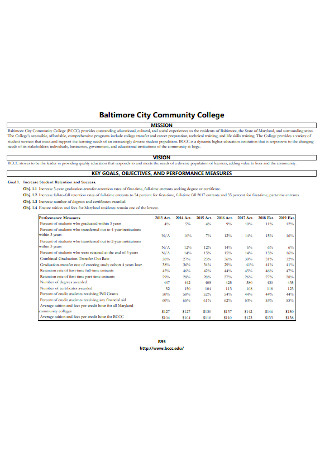

City Community College Budget

download now -

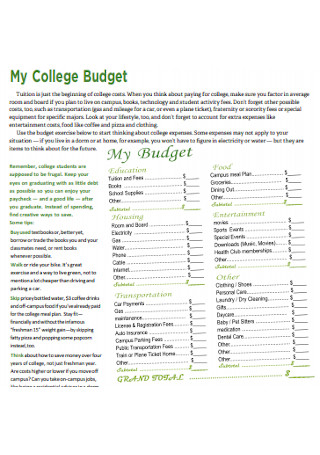

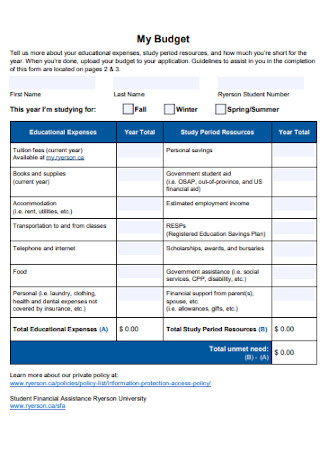

My College Budget Template

download now -

University Budget Plan Template

download now -

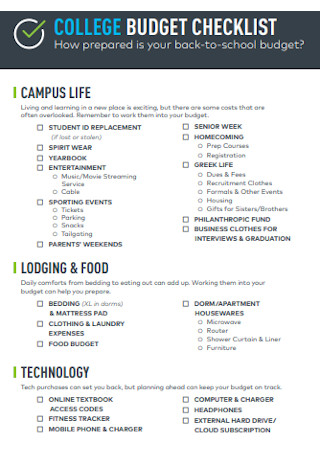

College Budget Checklist Template

download now -

College Budget Format

download now -

College University Budget Form

download now -

University College Budget Worksheet

download now -

College Certified Budget Report

download now -

Simple College Budget Template

download now -

College Budget Planner Template

download now -

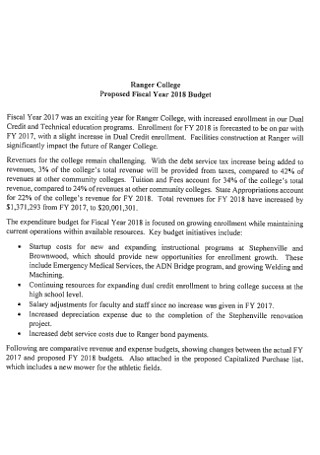

College Fiscal Year Budget Template

download now -

College University Operating Budget

download now -

College Budget Worksheet for Study

download now -

Sample College Budget Report

download now -

College Budget Plan Template

download now -

Standard College Budget Template

download now

FREE College Budget s to Download

39+ Sample College Budgets

What is a College Budget?

Examples of College Budgets

Tips on Budgeting in College

How to Create a College Budget

FAQs

What are the significant expenses for colleges and universities?

What is the best budget rule to maximize your money?

What are some examples of college budgets?

How should a student plan for a budget?

Why budgeting is essential for college students?

What is a College Budget?

A college budget is a clear and comprehensive spending plan or financial budget plan that allows students to manage their finances and have a perspective on how much they spend on their “needs” and “wants”. It is a fundamental money management tool to help students who are planning to attend college or the ones who are already enrolled to look ahead and assess their expenses carefully to avoid overspending, going into debt, or taking out additional loans. Preparing college budget plans is beneficial for students to become financially literate and to help them accomplish their goals and priorities.

Usually, college students have different types of income and expenses such as total income, monthly income, fixed expenses, variable expenses, and emergency funds. Total income includes any money they have from their families or received from financial aid such as grants and loans and monthly income pertains to recurring funds that they earn each month from their jobs or obtain from other funding sources. Fixed expenses come from their monthly expenses with similar prices, while variable expenses come from their necessities or wants with varying costs. From tuition fees, apartment renting, or campus boarding costs to personal expenditures, college students consider their school and activity fees, transportation costs, books and supplies, and many others in their budget.

Examples of College Budgets

Consider your income or personal money, expenses, savings, debt payments, and assets while preparing different kinds of budgets including college budgets. Here are some common examples of college budgets used by students, educators, academic directors, college executives, school board committees, and college educational institution owners.

Tips on Budgeting in College

There are many useful ways that you can do to save money and spend it properly such as setting aside savings, creating an income source, using student discounts, and many others. Remember the tips below to help you budget and save money in college.

How to Create a College Budget

Are you having a hard time making a clear and well-defined budget for college? Take note of the simple steps you need to do so that you can create a sensible college budget.

Step 1: Create a List of Your Income and Expenses

Document how much you earn or the money you have coming in (Ex. financial contributions from family members for your college expenses, financial aid from scholarships, grants, and student loans, and/or a part-time job or federal work-study job) and how much you are spending each week, month, semester, or year. Calculate your net income or the amount of money you earn or receive less taxes and list down your monthly expenses including dining, groceries, school supplies, ren or room and board, travel, household goods, phone, internet and monthly streaming subscriptions, transportation, loan payments, insurance, utilities, and miscellaneous while using income and expense worksheets.

Step 2: Categorize Your Expenses

Review your expenses and income over the past month and organize your expenses using a financial review checklist in a typical month and the average cost of each item. Categorize them as fixed expenses or variable expenses and tag everything as either a “need” or a “want”. Fixed expenses are bills you need to pay, while variable expenses are expenses with varying fees that often include wants.

Step 3: Analyze and Adjust If Necessary

Observe your net income and compare it with your monthly expenses. Analyze if you have sufficient money coming in each month to cover all your spending. If you notice that you are overspending beyond your financial limitation, you need to make some proper adjustments. Try to reduce the amount you spend on variable expenses and adjust some fixed expenses with fluctuating costs due to inflation while using food and grocery discount code coupons.

Step 4: Review and Finalize Your College Budget

After calculating, analyzing, and adjusting all the numbers, review your expenses once again to check what items you can cut from your list. Use a sample college budget template to finalize your budget for the month, semester, or year.

FAQs

The significant expenses for colleges and universities are tuition fees, room and board, books and supplies, equipment, personal expenses, transportation costs, and school and activity fees.

The 50/30/20 budget is the highly-recommended budget rule by many financial experts to fully maximize your money. In this rule, you will spend 50% or half of your income on your necessities, 30% on your wants, and allot 20% to your savings and debt repayment if necessary.

Some examples of college budgets are college budget sheets, college student budgets, college planning budgets, college director budgets, college expenses budgets, college committee budgets, state college budgets, college event program budgets, college budget worksheets, college operating budgets, college board budget, college annual budget, and college budget planners.

Some ways to help you plan for a budget sensibly are making sure that you pay the right amount of income tax and not overpaying it on any jobs you do, contemplating before spending if you really need the item, afford it, use it, and check if it is worthy to buy, saving money on your regular spends, avoiding cash machines that charge you with fees for checking your account and withdrawals, planning your meals for the week ahead, and preparing your cash money for the week ahead. Also, get a part-time job to boost your income, and grab the best student deals to save money.

Budgeting is essential for college students because it allows them to set goals and make important logical decisions as they consider their short-, medium-, and long-term goals and monitor their progress toward reaching them.

What are the significant expenses for colleges and universities?

What is the best budget rule to maximize your money?

What are some examples of college budgets?

How should a student plan for a budget?

Why budgeting is essential for college students?

Preparing a cohesive and reasonable college budget is like building a comprehensive spending plan for college as you need to take into account your daily, weekly, monthly, and annual expenses and work hard on how to use your finances efficiently, ensuring that you save and spend your money wisely. Follow the aforementioned tips in this article on budgeting for college and the steps in creating a simple college budget. We have sample budget templates that you can easily use for your budgeting such as annual budget templates and school budget templates.