50+ College Student Budget

-

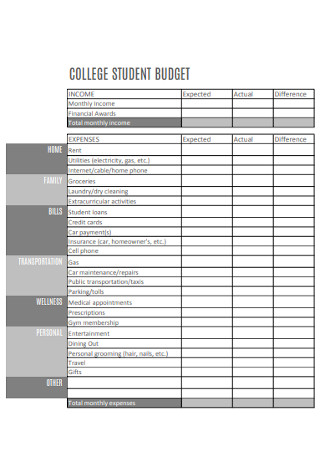

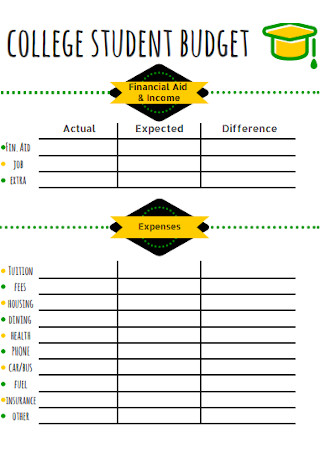

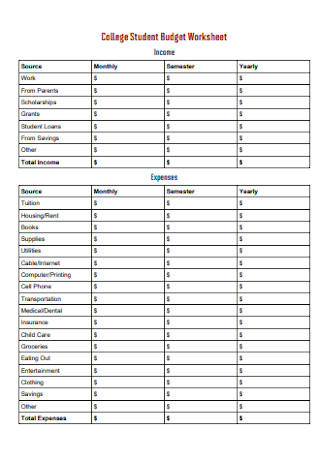

College Student Budget Worksheet

download now -

Sample College Student Budget

download now -

Simple College Student Budget

download now -

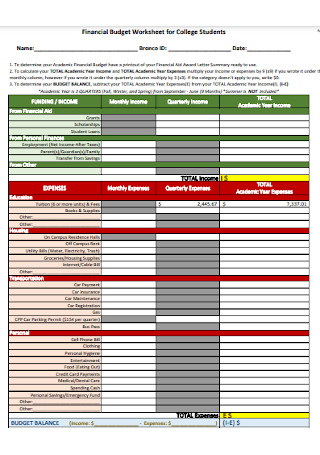

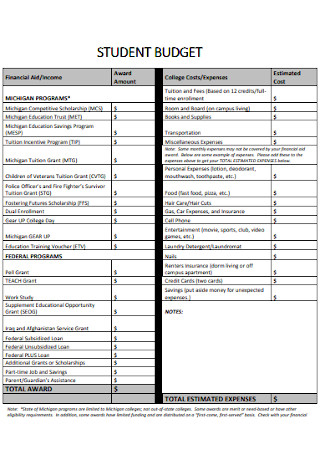

Financial Budget Worksheet for College Students

download now -

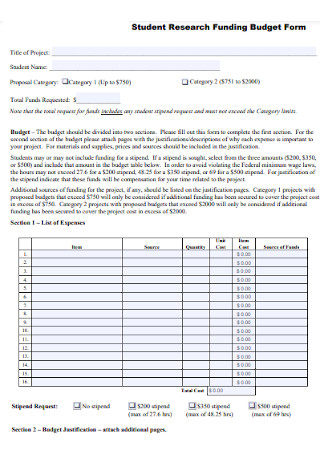

College Student Research Funding Budget

download now -

College Student Budget Format

download now -

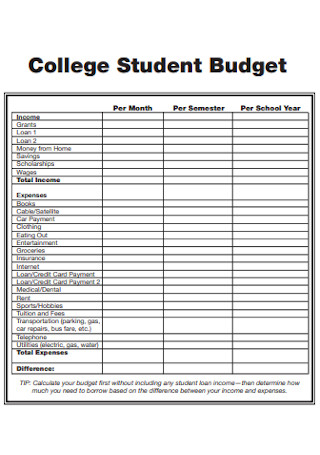

College Student Budget Sheet

download now -

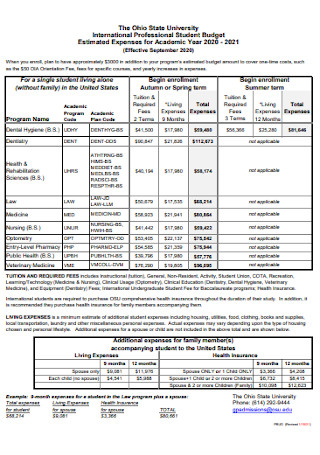

International C0llege Student Budget Template

download now -

Simple College Student Budget

download now -

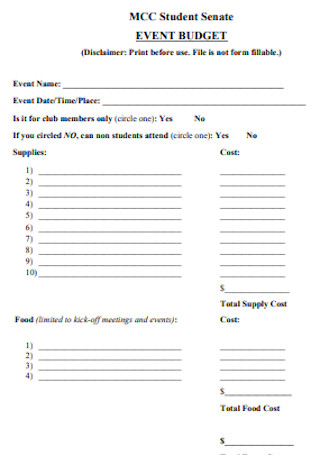

College Student Event Budget Template

download now -

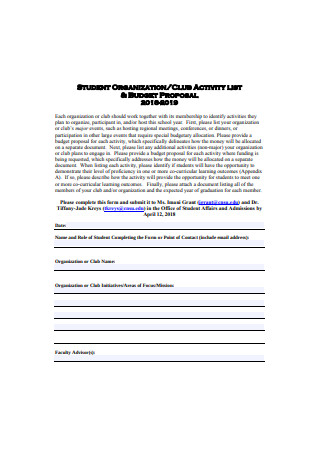

College Student Organization Budget

download now -

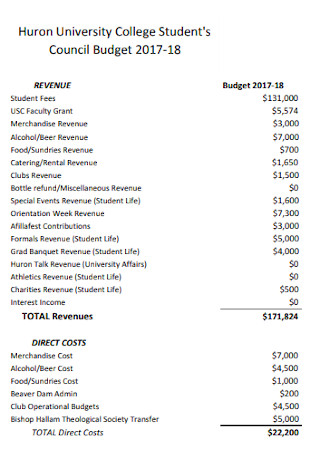

University College Student Budget

download now -

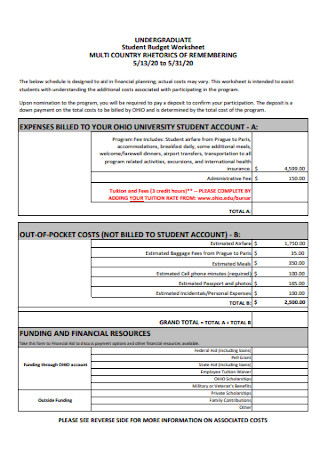

Undergraduate Student Budget Template

download now -

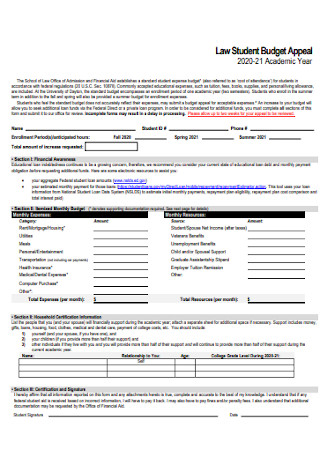

LawStudent Budget Template

download now -

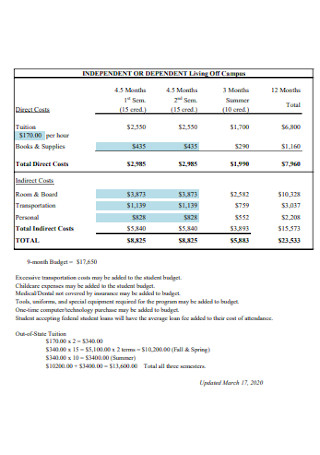

Basic Student Wage Budget

download now -

Campus Student Budget Template

download now -

College Student Committee Budget Template

download now -

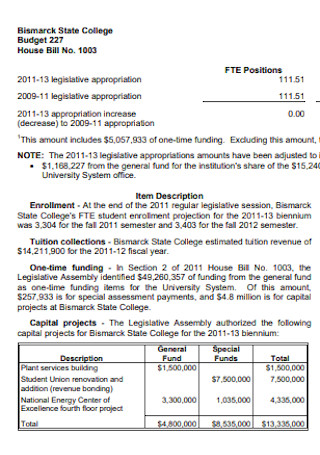

State College Student Budget

download now -

College Student Budget Worksheet Template

download now -

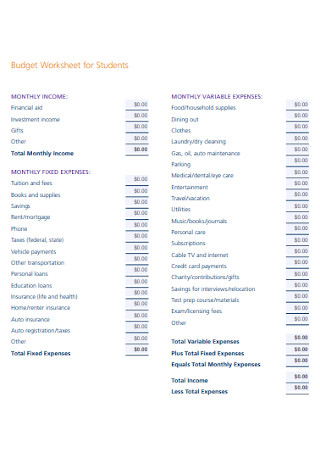

Budget Worksheet for Students

download now -

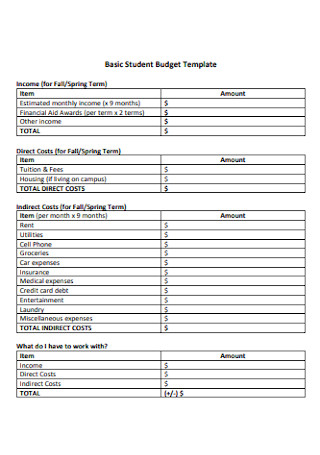

Basic Student Budget Template

download now -

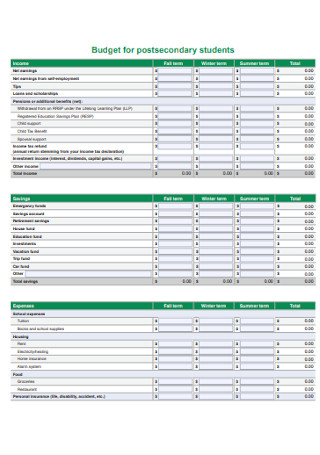

Budget for Postsecondary College Students

download now -

Simple College Student Budget Template

download now -

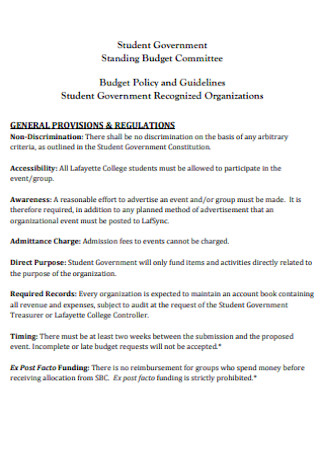

College Student Government Standing Budget

download now -

College Student Budget Form

download now -

College Student Budget Worksheet Example

download now -

University Student Budget Template

download now -

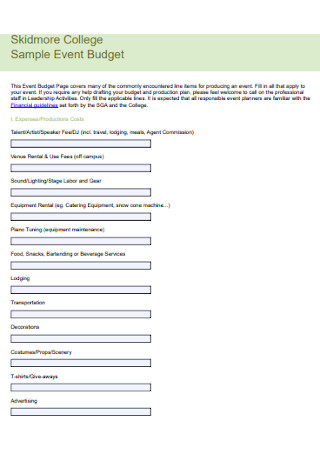

Sample College Student Event Budget

download now -

College Student Budget Worksheet

download now -

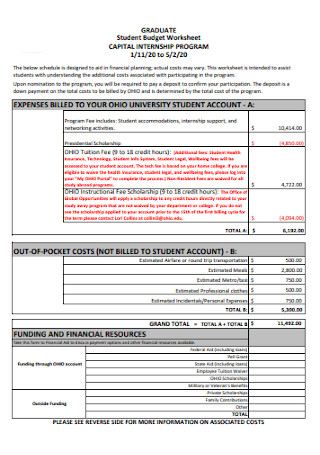

Graduate Student Budget Template

download now -

College Student Budgets Example

download now -

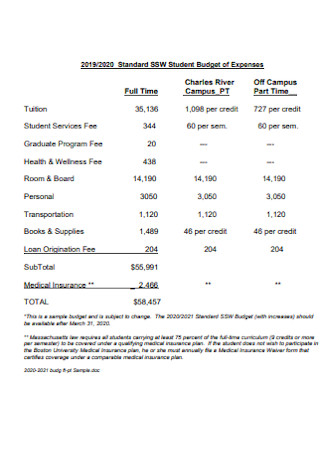

Student Budget of Expenses

download now -

College Student Financial Budget Template

download now -

Professional College Student Budget

download now -

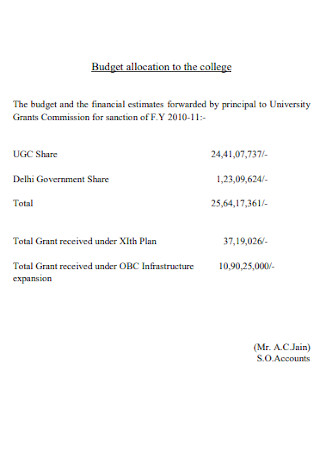

Budget Allocation to College Student

download now -

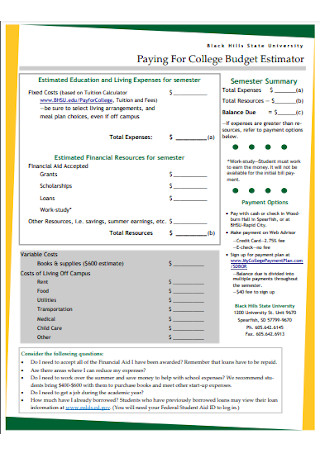

Paying For College Student Budget

download now -

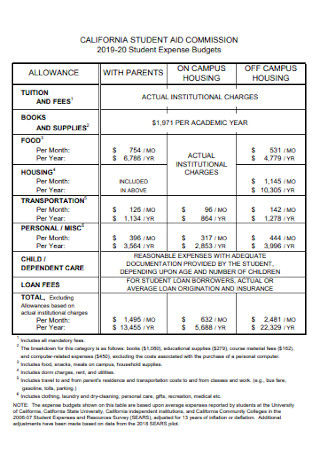

College Student Expense Budgets

download now -

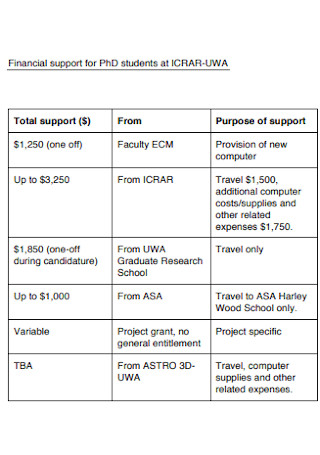

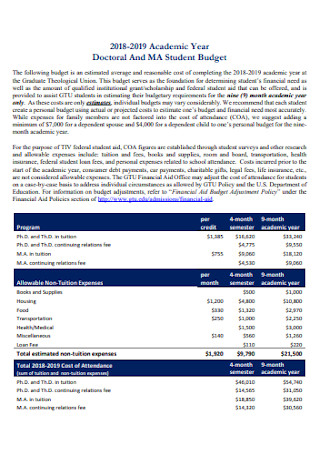

Academic Doctoral And Student Budget

download now -

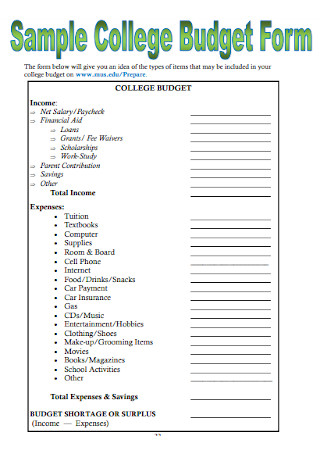

Sample College Student Budget Form

download now -

College Student Budget Report

download now -

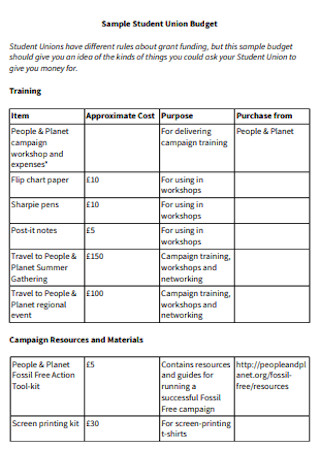

College Student Union Budget

download now -

Medical College Student Budget Appeal

download now -

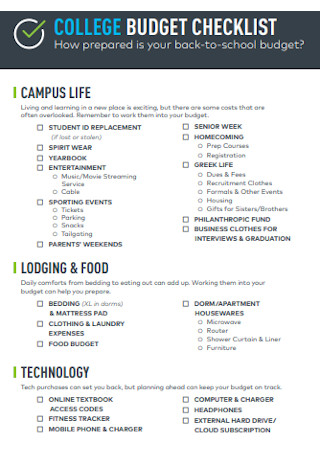

College Student Budget Checklist Template

download now -

College Student Finance Budget Exercise Template

download now -

Student Monthly Budget Template

download now -

Simple College Student Budget Template

download now -

Post-Secondary Student Budget

download now -

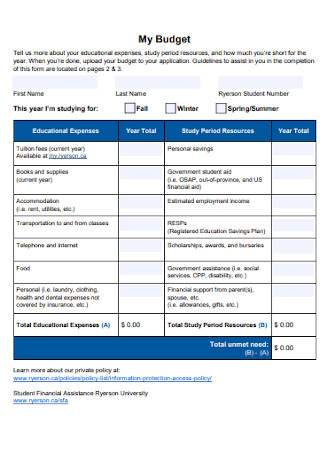

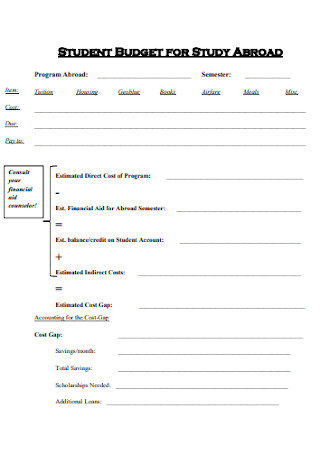

College Student Budget for Study

download now -

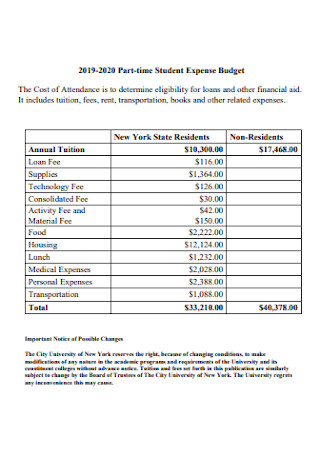

Part-time College Student Expense Budget

download now -

Academic College Student Budget

download now

FREE College Student Budget s to Download

50+ College Student Budget

What Is a College Student Budget?

Possible Expenses for a Typical College Student

Possible Formats for a College Student Budget

How to Create a College Student Budget

FAQs

How much should a college student have in savings?

How can college student afford groceries?

How to budget as a college student?

What Is a College Student Budget?

A college student budget is a working list that a student uses to keep track of his or her finances in college. It details both the income and expenses, or in the ingoing and outgoing money flow.

According to the non-profit organization College Board, taking out a loan is one way to get a college education. You are obligated to repay the loan, with the corresponding interest rates. Interest rates vary and depend on the type of loan. There are three possible sources of student loans: the federal government, state agencies, and private organizations (e.g., banks, foundations).

Possible Expenses for a Typical College Student

Not everyone can obtain a college scholarship. And for those lucky enough to get financial aid, they have one less thing to worry about. However, keeping a scholarship may also be a different story. The following are typical expenses that most college students are faced with:

Possible Formats for a College Student Budget

In making a college student budget, it’s best to come up with a format before you start listing anything down. Try any one of these possible formats to get started! You are free to combine two or any of these types, depending on how detailed you want your student budget to be.

How to Create a College Student Budget

Designing a college student budget can be pretty straightforward. However, an attention to detail is necessary if you want to create a budget that suits you- one that you can actually rely on and use. With the information above, you can start building your budget by following the steps below.

Step 1: Decide on a Format

The first step is designing how you want your budget to look like. How do you want to present the information? There are a number of different ways and you are free to choose whatever works for you. A table format is a good and simple way to start. Using an Excel spreadsheet is also one of the most convenient ways. How simple or detailed the budget will appear depends entirely on your preference. You can make use of the possible formats explained above.

Step 2: Identify the Particulars

A basic budget should always indicate the expenses, income, the items and their amounts, and the total. It can also include savings or a personal fund. Some students set aside a certain amount to save up for a trip, to purchase an expensive gadget or item, or just to save for a rainy day. It’s equally important to identify your sources of income. If you are a full-time university student and have your parents to support your education, they are basically your main source of income. For those who don’t have that luxury, part-time jobs, student loans, or a side hustle can be listed under income. Then there are those lucky enough to get a full scholarship to college, or have a patron or donor paying for their education.

Step 3: Categorize the Items

The next step is to classify your expenses in an organized manner. You can get ideas from the tips above. Group your items according to your preference. Identify which items are your fixed and recurring expenses. You can also group your expenses into different categories: housing, academic-related, food, etc.

Step 4: Set Aside Savings

It is never wrong to set aside an amount for the future. And it’s never too early to learn the value of saving and frugality. Keeping and sticking to a budget helps you regulate your spending habits. Everyone, not just college students, needs to keep themselves in check, especially when it comes to spending on non-essential items.

FAQs

How much should a college student have in savings?

According to an article published on CNBC, Marguerita Cheng, CEO and co-founder of Blue Ocean Global Wealth, stresses the importance of saving, especially for college students. She urges them not to focus on the amount, but on the habit of saving. Just starting is the most important step. If $100 per month is unrealistic, then start with $25 every month.

How can college student afford groceries?

College students need supplies. But grocery shopping does not always need to be a spending spree. If you’re on a tight budget, preparing a grocery list ahead of time will help you avoid picking out any unnecessary items at the supermarket. Be on the look out for any sales, discounts, or coupons that can be used at the grocery. Another tip is learning how to cook. College students who have basic cooking skills don’t always have to spend on takeout or food deliveries. It’s more economical compared to always eating out.

How to budget as a college student?

The first step is identifying where your money is coming from and where it is going. Being aware of your spending habits and patterns is a crucial step if you want to craft a realistic budget that you can actually stick to. Categorize your items into income and expenses. You can further classify your expenses into several groups. Determine which of them are essential and non-essential. Indicate the amount for each fixed, recurring, and flexible expense.

Sticking to a budget in today’s world is becoming increasingly relevant and more challenging than ever. When everything we could ever want and need is available at the click of a mouse or a tap of a phone; and when advertising is in every nook and cranny, our impulses can sometimes get the better of us. College is the right time to develop budgeting skills- skills necessary to navigate a consumerist and materially-driven world. Download a college student budget sample today and get started!