20+ SAMPLE Expense Budget

-

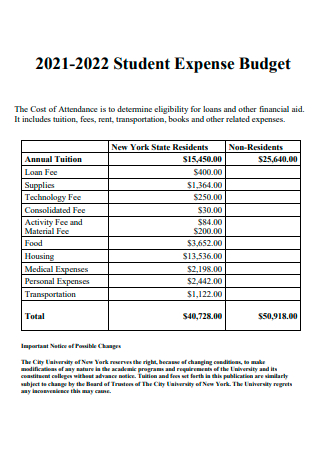

Student Expense Budget

download now -

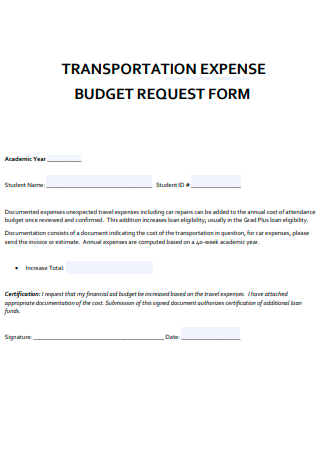

Transportation Expense Budget Request Form

download now -

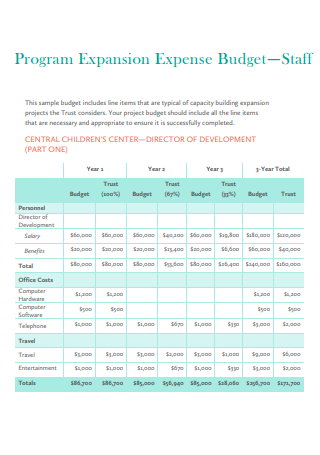

Program Expansion Expense Budget

download now -

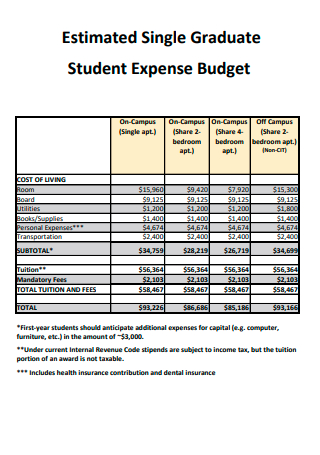

Estimated Single Graduate Student Expense Budget

download now -

Appeal For Alternate Student Expense Budget

download now -

Expense Budget Projection

download now -

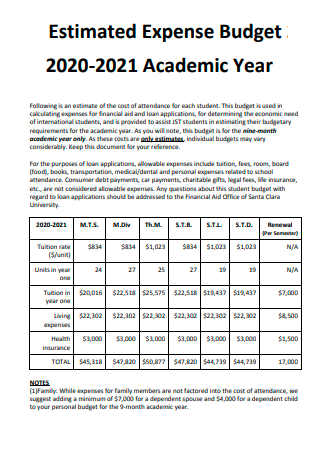

Estimated Expense Budget

download now -

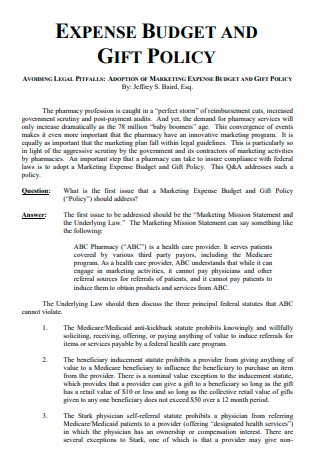

Expense Budget and Gift Policy

download now -

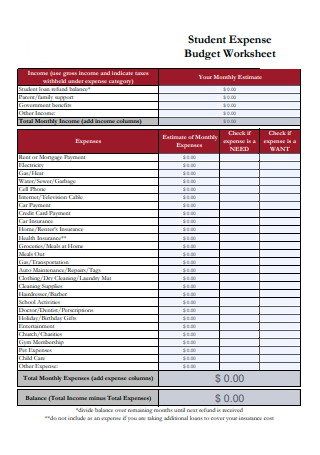

Student Expense Budget Worksheet

download now -

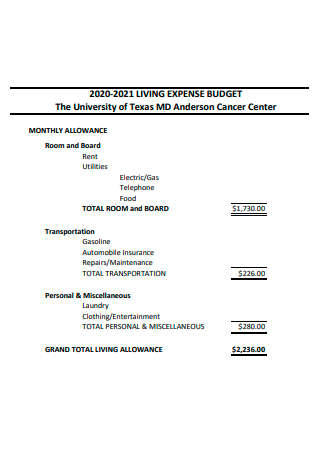

Living Expense Budget

download now -

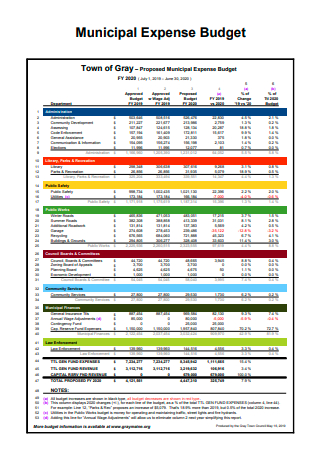

Municipal Expense Budget

download now -

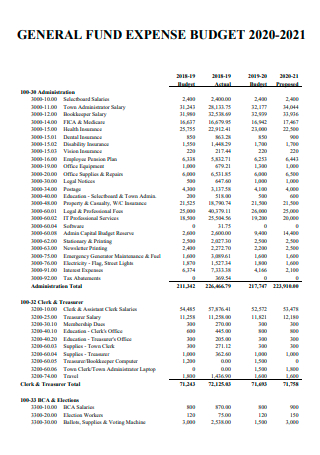

General Fund Expense Budget

download now -

Holiday Expense Budget Worksheet

download now -

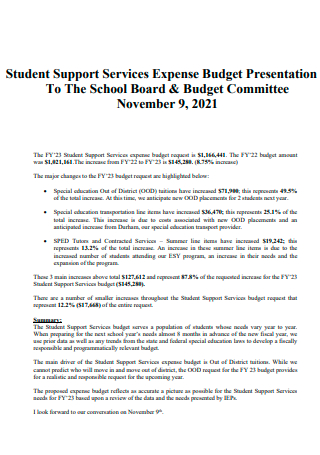

Student Support Services Expense Budget

download now -

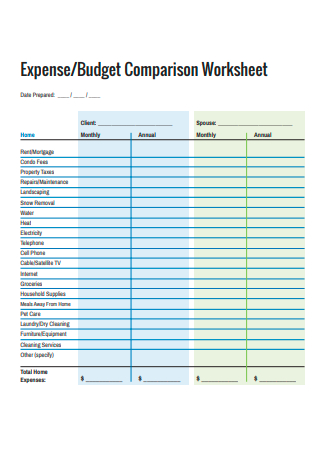

Expense Budget Comparison Worksheet

download now -

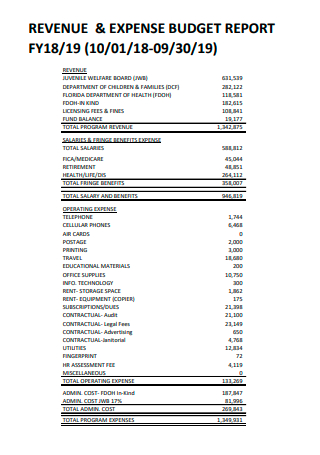

Revenue and Expense Budget Report

download now -

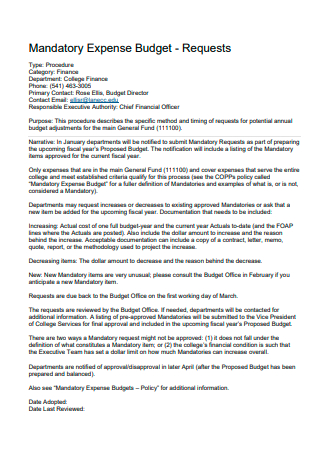

Mandatory Expense Budget

download now -

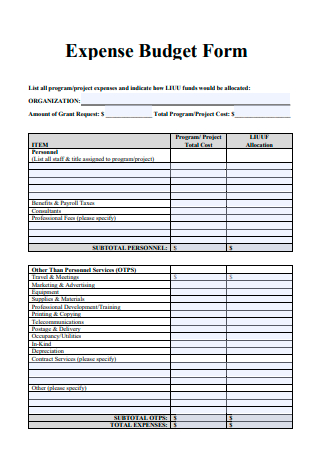

Expense Budget Form

download now -

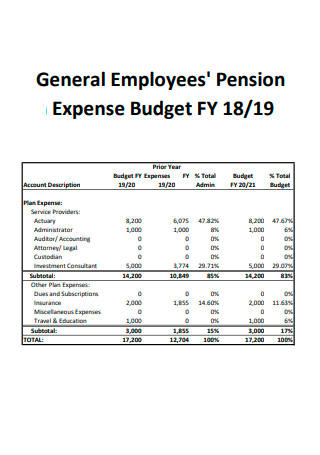

Employees’ Pension Expense Budget

download now -

Travel Expense Report For Budget Managers

download now -

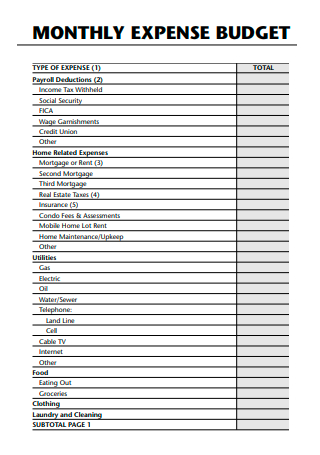

Monthly Expense Budget

download now

What Is a Budget?

A budget is a financial goal for a specific time frame, typically one year. In addition, it may incorporate anticipated sales volumes and revenues, resource quantities, costs and expenses, assets, liabilities, and cash flows. If you don’t have enough money to do everything you want, you can utilize this planning approach to prioritize your spending and allocate your funds to essential items. According to the statistics, more than eight in ten (86%) respondents check their monthly income and expenses.

Benefits of Managing Your Budget

Budgeting is the most fundamental and successful method for managing one’s finances. However, most people avoid it because it requires more effort, like mowing the yard or repairing the roof. Budgeting also implies that you must sacrifice and refrain from enjoying things. Budgeting demonstrates how you use your funds and presents you with options for what to want based on your financial constraints. It will save you the trouble of excessive spending and debt. Budgeting does not prevent you from enjoying things; instead, it ensures you can enjoy something when you desire. Although budgeting requires more effort, it has numerous life-improving benefits:

Tips For Living Your Budget

If you consider your finances a house, then your budget is the structure’s foundation. A budget is a thorough strategy for spending, saving, and debt repayment if you are trying to pay off credit cards or loans. However, creating a budget and sticking to it are two different things. Constructing a budget plan stating your monthly revenue and anticipated expenses is relatively straightforward. The most challenging aspect is sticking to the planned day after day. Creating a realistic budget requires a thorough assessment of the facts, but it’s also crucial to consider your financial habits and long-term objectives. These strategies can help you get in tune with your budget to work in your favor.

1. Begin With Your Budgeting Attitude

Understanding what your budget entails and what you intend to achieve from it is the first step in sticking to it. Whether you perceive your budget favorably or unfavorably can affect your relationship with it. For instance, do you view your budget as something that gives you control over your spending or as something that restricts your spending? At its core, a budget is intended to be a tool for directing your monthly expenditure. But if you perceive it as limiting your ability to spend your money as you choose, you may be more inclined to fight against it. If you have ever attempted to diet instead of changing your food and activity habits, you may be familiar with this.

2. Examine Your Financial Routines

No matter how much effort you spend each month creating a budget, it will fail if it conflicts with your spending and financial habits. If you haven’t recently examined your spending habits, you may be harming your budgeting efforts without recognizing them. Tracking your expenditures and maintaining a spending journal will help you detect the first two unhealthy money habits on our list. Writing makes an accidental purchase or expressing how you felt after a recent shopping frenzy may be unsettling. Still, correcting unhealthy spending habits that may be affecting your budget is essential.

3. Replace Old Financial Practices with New Ones

Once you’ve recognized the financial behaviors that prevent you from sticking to your budget, you can adopt new ones. As stated, keeping track of your expenses and keeping a spending journal are positive measures. There are more techniques to make budgeting more manageable and less stressful. Setting up an automatic bill payment, for instance, eliminates the risk of late fees and their associated fines. If you cannot automate your bill payments or choose not to due to sporadic income, you can schedule bill payment alerts to remind you when a payment is due. The more closely your budgeting matches your personal and spending patterns, the more likely you will avoid costly budgeting errors.

4. Choose the Right Budgeting Method

There are multiple ways to create a budget. If you’re having trouble sticking to the budget you’ve established for yourself, it may be because you’ve picked the incorrect way. The zero-based budget strategy entails assigning every dollar of monthly income to a single job. With this budget, there should be no waste or leftover funds; every dollar earned should go toward expenses, savings, or debt repayment. The cash envelope method can be used alone or with the zero-based budgeting strategy. With this form of budget, envelopes are created for each budget category.

5. Utilize Tools That Make Budgeting Easier

As you try to get your budget and lifestyle to match up, think about what tools you can use to make the process easier. For example, you might want to use a budgeting app to track how much you spend and earn automatically. This saves you from having to do the math, so you can take your budget wherever you go. If you’ve had trouble saving money, you can use automatic saving and investing apps to put money aside regularly. Apps that help you pay off your loans, credit cards, or other debts can help you stay on track. Some personal finance apps let you keep track of your budget, savings, debt, and investments in one place, making things even more accessible. Managing your monthly money can be less stressful using banking and personal finance apps. The more you can simplify how you think about making a budget, the more likely you will stick to the plan.

How To Create an Expense Budget

The majority of individuals require a method for tracking where their monthly funds are going. A budget for expenses can help you feel more in control of your finances and make saving money for your goals easier. The trick is to find a method of financial tracking that works for you. The instructions below will assist you in creating an expense budget.

1. Calculate your net income

Your net income is the foundation of a successful budget. Take-home pay is total income or compensation minus deductions for taxes and employer-provided programs such as health insurance and retirement plans. If you focus on your total compensation instead of your net income, you may overspend since you will believe you have more money available. Suppose you are a freelancer, gig worker, contractor, or self-employed individual. In that case, keeping precise records of your contracts and payments is essential to managing your irregular income.

2. Track your expenditures

After determining how much money is coming in, the next step is to decide where it is going. Tracking and classifying your expenses will help you understand where you can save the most money and where you spend the most money. Start with a list of your fixed costs. This includes rent or mortgage, utilities, and car payments. Next, identify your variable expenses, such as groceries, gas, and entertainment, which may vary monthly. This is an area where you may find savings possibilities. Credit card and bank statements are valid starting points because they frequently itemize and categorize monthly expenses. Record your daily expenditures with whatever is available, be it a pen and paper, an app on your smartphone, a budgeting spreadsheet, or a template.

3. Set achievable goals

Make a list of your short- and long-term financial goals before you begin filtering through the material you’ve gathered. Short-term objectives should be accomplished within one to three years, including establishing an emergency fund or paying off credit card debt. Long-term objectives, such as saving for retirement or a child’s education, may require decades. Remember that your goals do not need to be etched in stone, but outlining them can drive you to stay within your budget. For instance, it may be simpler to reduce expenses if you are saving for a vacation.

4. Make a plan

Everything comes together here: your actual spending vs. your desired spending. Use your accumulated variable and fixed expenses to estimate your spending over the next few months. Then, compare this figure to your net income and your priorities. Consider establishing defined, attainable spending limitations for each expense category. You may decide to further categorize your expenditures into necessities and luxuries. For example, gasoline would be considered necessary if you drive daily to work. A monthly music subscription, though, may be viewed as a desire. This distinction becomes significant when searching for ways to focus funds toward financial objectives.

5. Adjust your expenses to stay inside your budget

Now that you’ve recorded your income and expenditures, you can make any required modifications to ensure that you don’t overspend and have sufficient funds for your goals. Consider your “wants” as the first place to make cuts. Can you skip movie night and watch a film at home instead? If you have already modified your spending on wants, examine your monthly payment expenses. On closer examination, a “need” may be “difficult to part with.” Consider modifying your fixed expenditure if the figures still do not add up. Could you save more, for instance, if you shopped for a cheaper auto or home insurance deal? Such selections include significant trade-offs, so examine your options well. Remember that even tiny saves can add up to a substantial amount of money. You may be amazed by how much additional money you may accumulate by making simple adjustments over time.

6. Review your budget regularly

Once your budget has been established, it is essential to examine it regularly and your expenditures to ensure that you remain on track. You may receive a raise, your expenses may alter, or you may achieve a goal and wish to plan for a new one. Regardless matter the cause, develop the practice of routinely reviewing your budget using the steps above.

FAQs

What does the spending budget include?

Most expenses include running costs, such as rent, utilities, advertising, and payroll. This is what I discuss in this post. Prices of goods sold, or what you spend on what you sell, are another sort of expenditure.

What are monthly expenses?

Create a monthly spending list. This comprises your fixed monthly living expenses, such as rent or mortgage, car payment, and utilities, as well as your variable monthly expenditures on haircuts, groceries, and clothing.

What is simple budget?

A simple budget allows you to track your expenditures without needing a degree in accounting. If you utilize a budget to govern your spending, you’ll know whether or not you can splurge on those trendy options or stock up on your favorite coffee beans when they go on sale without depleting funds allotted for expenses.

Budgeting requires more than just discipline. It is a tool to help you achieve your goals, do what you desire, and live the life you want. So keep it enjoyable. Reward yourself for sticking to your budget by the process. It will transform your perception of budgeting from a chore to an enjoyable hobby.