21+ Sample Health Budgets

-

Health Research Service Budget

download now -

Personal Health Budget Template

download now -

Sample Personal Healthcare Budget Template

download now -

Month Health Budget Worksheet

download now -

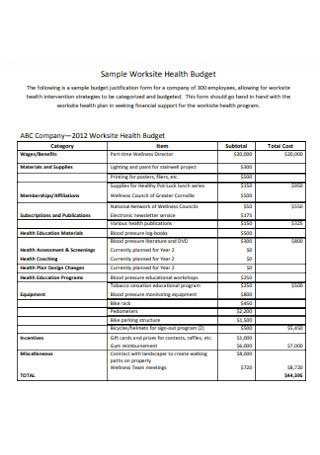

Health Worksite Budget Template

download now -

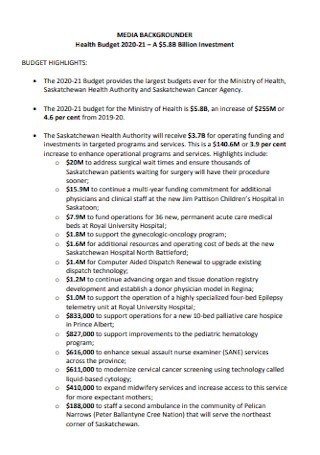

Health Investment Budget

download now -

Budget Analysis of Health Template

download now -

Health Budget Advocacy Template

download now -

Sample Personal Health Budget Template

download now -

National Health Expenditure Budget

download now -

Simple Health Budget Template

download now -

Public Health Budget Template

download now -

Health transparency Budget Template

download now -

Beef Health Budget Template

download now -

Budget Request for the Military Health

download now -

Family Health Planning Budget

download now -

Health Management Budget

download now -

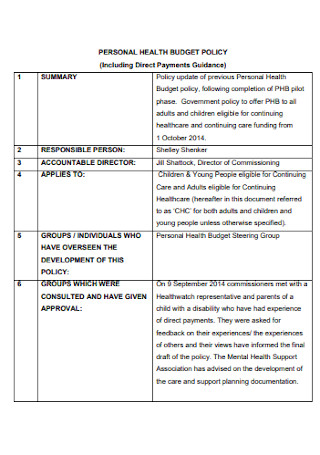

Health Budget Policy Template

download now -

Budget Materials for Health Template

download now -

Basic Personal Health Budget

download now -

Health Spending and Soft Budget

download now -

Standard Health Budget Template

download now

FREE Health Budget s to Download

21+ Sample Health Budgets

What Is a Health Budget?

Different Types of Health Budgets

Benefits of Effective Health Budgeting and Financial Management

How to Create a Health Budget

FAQs

What are the main causes of the increase in healthcare costs?

Why do healthcare costs keep increasing?

What are some examples of a health budget?

Why is a health budget essential?

How to develop a budget for a health program?

What Is a Health Budget?

A health budget is a clear and cohesive financial budget plan for the health care system that provides an estimation of income or revenue, allocation, and expenditures over a specific timeframe. It is considered and used by budget officials in the state government, business owners, managers, health care providers, professionals, families, and individuals when planning health care plans and health insurance programs. It is a comprehensive tool included in a healthcare operational plan to help healthcare businesses, organizations, and people to be informed on various budget planning processes in healthcare, the best way on spending funds, and the allocation of capital for different departments and projects.

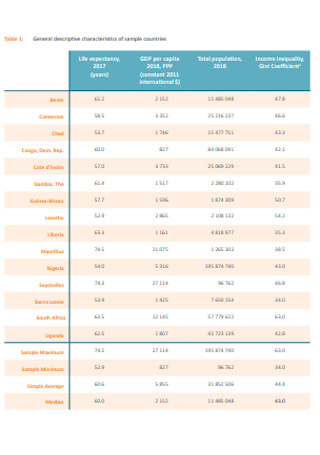

Based on a 2019 healthcare expenditure report published by the U.S. Centers for Medicare and Medicaid Services (CMS), the healthcare spending in 2019 can be broken down into 10 categories: hospital care (31%), physician services (20%), prescription drugs (10%), other personal healthcare costs (5%), nursing care facilities (5%), dental services (4%), home healthcare (3%), other medical professional services (3%), other non-durable medical products (2%), and durable medical equipment (2%). Thus, it is fundamental for government sectors, companies, departments, and other firms to construct an effective health budget for their healthcare business plan and other plans to evaluate and support their healthcare needs.

Different Types of Health Budgets

There are several types of healthcare budgets and planning processes out there such as operational budgeting, capital budgeting, and rolling forecasting. Consider what type of health budget and budget planning methods you will use for your department, hospital, business, organization, or family.

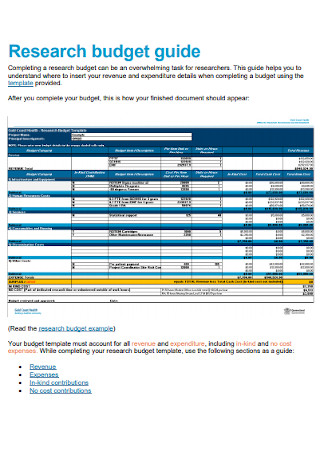

1. Health Research Service Budget

If you are a researcher who is working for the improvement of health care management and medical services in your area, a health research service budget is an important budgeting tool for the proper allocation and spending of your research and development team. You may use a ready-made research budget guide to help you understand where to add your revenue and expenditure details when you complete a health budget. Make things easy when you use a basic health budget template as you include all revenue and expenditure information, as well as in-kind and no-cost contributions.

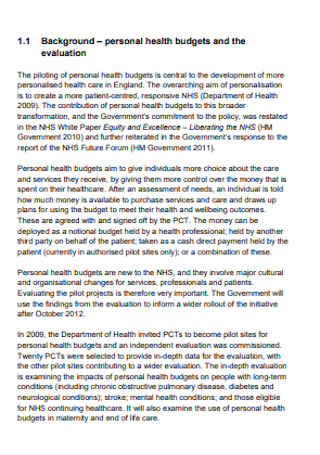

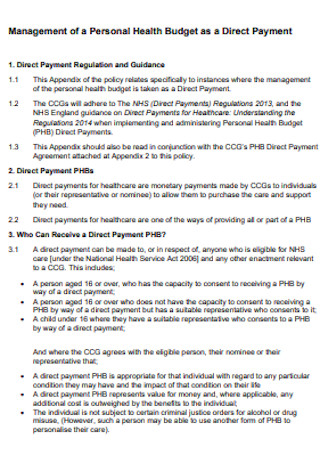

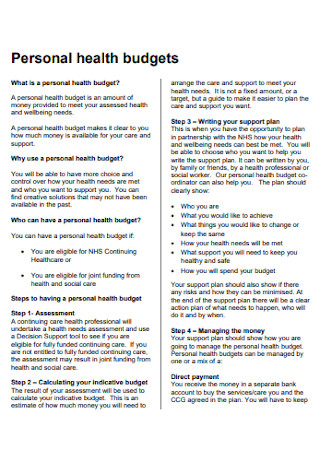

2. Personal Health Budget

Create a well-coordinated personal health budget to meet the assessed needs of a person and support them in education, health, social care, and others. It is used for children, young people, and adults who have continuing healthcare needs, and for people who still don’t have a health care strategic plan. This health budget specified the amount needed to fund a person’s healthcare and support needs. One method of managing this budget is using a health direct payment where the person or a family member obtains the cash to buy the agreed health care and support they need.

3. Monthly Health Budget Worksheet

A monthly health budget worksheet is a type of health budget for examining the financial health of a business or a professional every month. A financial manager and business professional need to complete an interactive budget worksheet while using certain money-managing apps and services or estimating the budget which includes income, spending, and savings. When setting budget percentages, many financial experts recommend following the rule of spending 50% of your after-tax pay on needs, 30% on wants, and 20% on savings and paying off debt.

4. Family Health Planning Budget

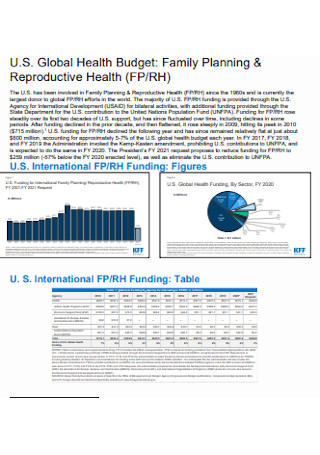

According to a report, the health planning budget request to fund international family planning and reproductive health in the United States costs around $640 million in 2022. As the largest donor to global family planning and reproductive health issues, the U.S. government sets the family health planning budget annually to assess and solve various concerns in international family planning and population issues. There are high-quality family planning services being provided to support the health and well-being of women and their families.

Benefits of Effective Health Budgeting and Financial Management

Businesses, government agencies, and organizations need to formulate smart decisions on resource allocation for their budgets which include the health budget. They need to prioritize value-adding activities and minimize low-value activities in healthcare so that they can maximize the effectiveness and efficiency of healthcare services and medical products.

How to Create a Health Budget

It is integral for healthcare managers, business owners, professionals, and individuals to fully understand the uses and processes of health budgeting. When you prepare and execute health budgets, you need to increase your level of understanding of the basics of accounting, economics, and budgeting like using an accounting performance evaluation. Take note of the fundamental steps you need to do so that you can make a properly constructed health budget.

Step 1: Prepare the Statistical Budget

Each department of a health institution needs to measure how many procedures and services will be provided for the upcoming year. The nursing department estimates the number of patient days expected. So, you need to request their department budget estimates and be aware of the past performance of the healthcare facility by examining the organizational performance over the last five years. In this way, the management can make a plan for future operations.

Step 2: Set an Expense Budget

Determine the amount of money each department expects to pay out. These expenses include salaries, supplies, and other kinds of expenses. Coordinate with each department manager and provide them with a worksheet where they can record the salary information of their employees. Discuss possible price increases from the medical product suppliers and vendors. If expenses increase, the revenue budget should increase proportionately.

Step 3: Construct a Revenue Budget

Make a projection of patient service revenues, other operating revenues, and non-operating revenues. Decide what percentage of price increase will be necessary for your health budget. Consider other operating revenue projections and contributions and interest from investments.

Step 4: Compose an Operating Budget

List the expected income by source and anticipated expenses from salaries, supplies, and utilities for the upcoming fiscal year. Always pursue a larger revenue budget than an expense budget so that you can project a profit. The profit will be used to finance the capital budget.

Step 5: Develop a Capital Budget and a Cash Budget

Summarize the future plans for acquisitions of medical facilities and equipment and other collaboration projects with other institutions and organizations. So, determine how much your capital plan to exclusively devote to healthcare facility renovations and medical institution expansion projects. Delve through the operating performance and current financial status of the hospital to check whether future financing is needed. Then, review the cash flow on a monthly basis to prepare for your cash budget.

Step 6: Finalize the Health Budget

Make sure that you don’t spend too much time deciding how to obtain cash rather than how to make some real investments and manage what you have. Consider your financial statements such as your balance sheets and statements of revenues and expenses. Combine all of these budgets into your health budget.

FAQs

The main causes of the increase in healthcare costs are the aging population, the prevalence of chronic diseases, rising drug or medication prices, healthcare service costs, and administrative costs. The U.S. Census Bureau reported that 21% of the entire population will be age 65 or older by 2030 as older Americans will make up almost 25% of the population by 2060.

Healthcare costs keep on increasing because of government policy. There are various healthcare and medical programs that assist people without health insurance. In turn, healthcare providers have been able to raise the costs of healthcare services. Other than the government policy, some common factors affecting the increasing healthcare costs are disease prevalence or incidence, population growth, population aging, service price and intensity, and medical service utilization.

Some examples of a health budget are a health research service budget, a personal health budget, a monthly health budget worksheet, a health worksite budget, a health investment budget, a budget analysis of health, a health budget advocacy, a personal health budget, a national health expenditure budget, a public health budget, a family health planning budget, a health management budget, a health budget plan, and a health spending budget.

A health budget is essential for business firms, companies, institutions, organizations, professionals, families, and other individuals because most of the people who have efficient health budgets are becoming prepared financially when it comes to paying unexpected medical costs if they have a sudden accident or illness.

Sum up your routine health check-up costs as you count on the number of regular medical bills annually. Think about new healthcare costs if you are planning to start a family or if you will undergo a new health treatment. Create a plan for emergency health situations during the course of the year as you analyze your overall budget and set aside money for unexpected healthcare costs. Open a health savings account or flexible spending account. And, understand how your health care action plan works so that you can control your health care spending.

What are the main causes of the increase in healthcare costs?

Why do healthcare costs keep increasing?

What are some examples of a health budget?

Why is a health budget essential?

How to develop a budget for a health program?

According to a 2020 price report, the United States has consistently higher healthcare procedure costs than other developed countries. That’s why it is important that you are well-prepared for the future when sudden accidents or diseases occur like COVID-19. Whether you are preparing a health budget allocation for a government state hospital, a private medical institution, for your family, or for personal use, create a realistic and manageable health budget. We have sample health budget templates that you can easily use such as health expense budget templates, personal health budget templates, national health expenditure budget templates, public health budget templates, family health planning budget templates, health management budget templates, and health spending budget templates.