27+ Sample Home Budgets

-

Personal Home Budget Template

download now -

Homeowner Monthly Budget

download now -

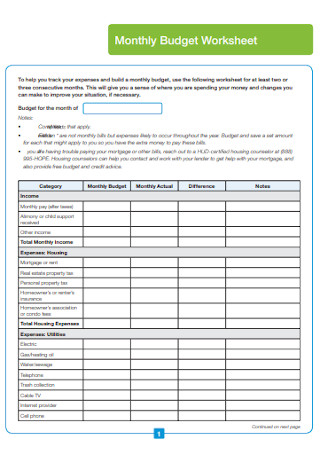

Monthly Home Budget Worksheet

download now -

Basics Home Budget Template

download now -

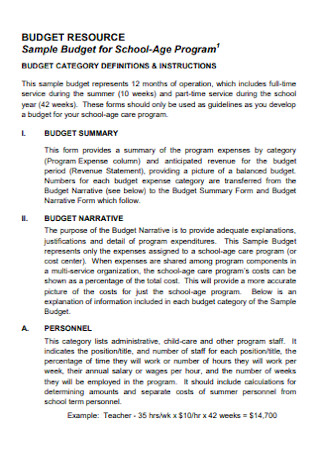

Home Budget for School Template

download now -

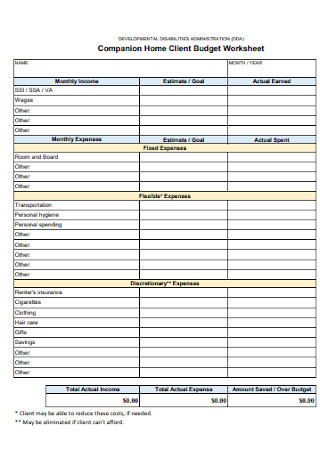

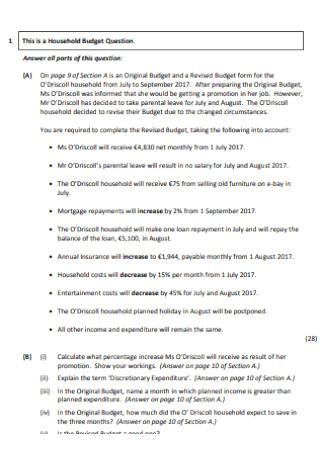

Home Client Budget Worksheet

download now -

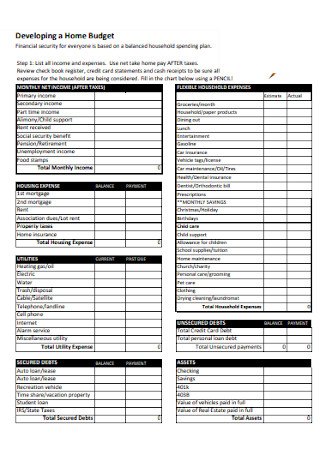

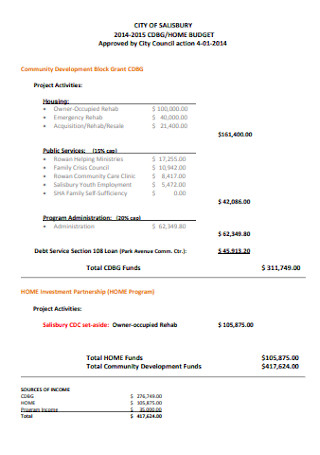

Sample Home Developing Budget

download now -

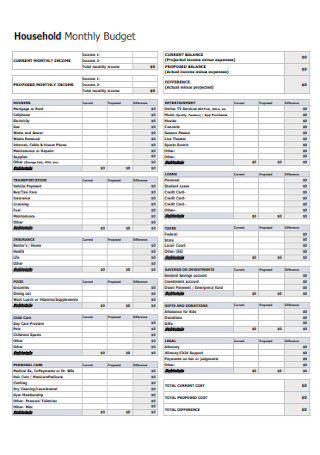

Household Monthly Budget Example

download now -

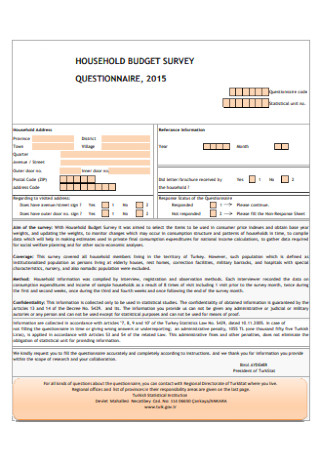

Household Survey Budget Template

download now -

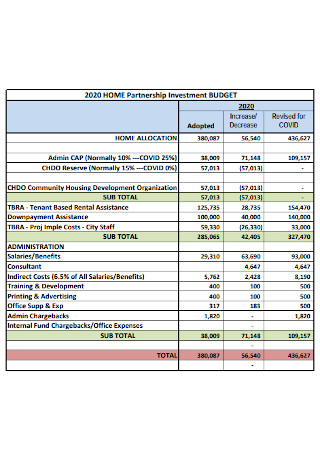

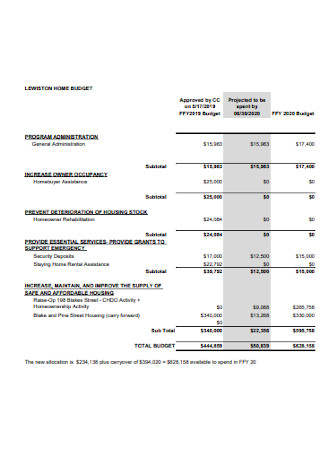

Home Partnership Investment Budget

download now -

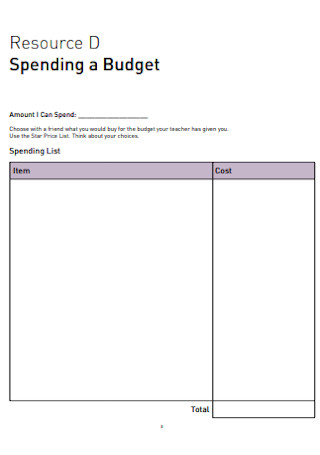

Home Spending Budget Template

download now -

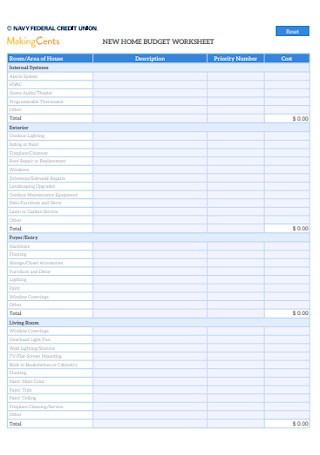

New Home Budget Worksheet

download now -

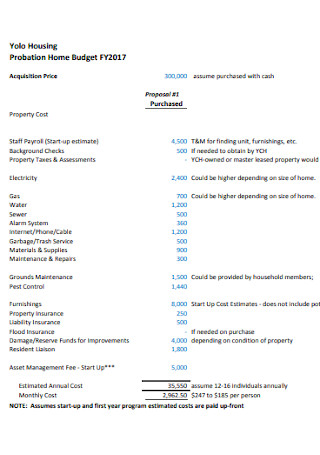

Probation Home Budget

download now -

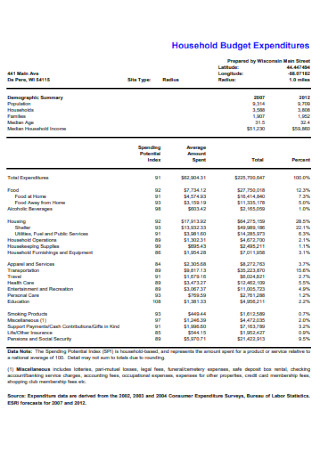

House Budget Expenditures Template

download now -

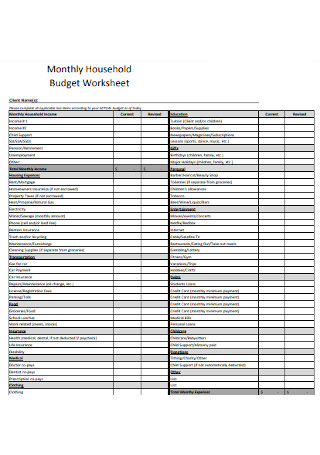

Monthly House Budget Template

download now -

Home Project Budget Template

download now -

Home Administration Budget

download now -

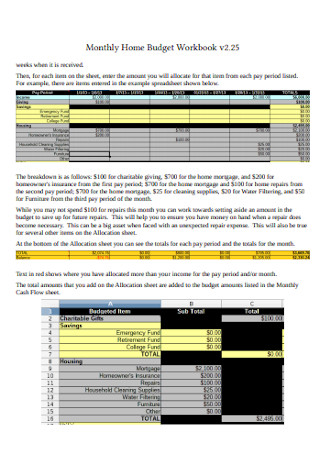

Home Budget Workbook Template

download now -

Formal Household Budget Template

download now -

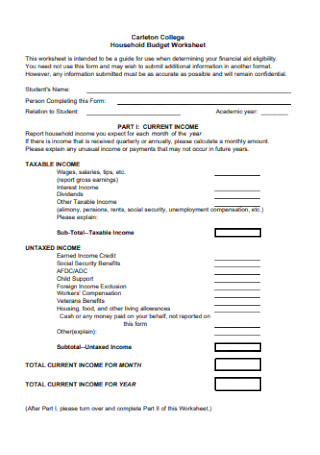

College Household Budget

download now -

Home Family Expenses Budget

download now -

Home Fund Budget Template

download now -

Household Work Budget Template

download now -

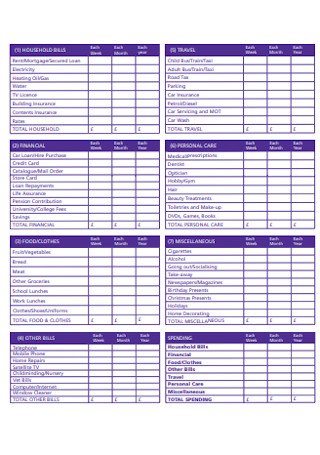

Printable Household Budget Template

download now -

House Budget Checklist Template

download now -

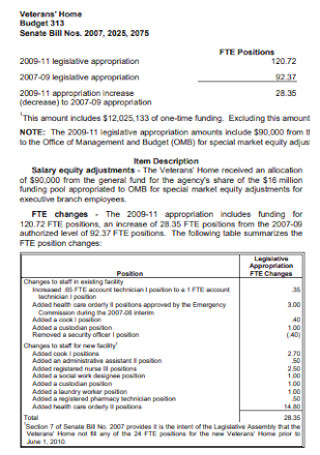

House-Passed Budget

download now -

Home Budget Planner Template

download now -

Homes Operating Budget Template

download now

What Is a Home Budget?

A home budget is a comprehensive budget that details all the financial aspects of a particular household. A home budget typically includes the basics such as a breakdown of both income and expenses.

According to an online article published by Bankrate, the average American household earns close to $85,000 annually and spends an estimated $70,258 a year. Based on statistics, around $5,854 was spent on bills and other expenses. The largest expenses were housing and transportation.

Components of a Home Budget

One’s home budget would greatly depend on each individual’s household needs and circumstances. But there are a number of essential or general items that comprise a typical home budget. The following examples enumerate and describe some of these essential components of a basic home budget.

Tips for Creating a Home Budget

There are many different ways to craft a sound home budget. Of course, you need to establish a budget that works for you. In this case, one size may not fit all. There are, however, some universal and practical tips that you can keep in mind the next time you need to create a household budget.

How to Create a Home Budget

To create a sustainable home budget, you need to have a good grasp or understanding of your finances. And if it’s ease and convenience you are looking for, try using a sample template. The selection of sample home budgets above can help you get the work done faster! Simply choose one that matches your needs and follow the basic steps below.

Step 1: Objective

The first step is setting a financial objective. Similar to student budgets or personal budgets, a home budget is largely subjective. In order to have a more realistic and sustainable household budget, you need to set a clear goal or objective. Whether it is to save enough money for your children’s education or to grow your emergency fund, having an objective in mind can keep things in perspective. It can also help you refocus your commitment in case you exceed your budget. It can be quite challenging to stick to a budget; but if you know the purpose behind what you’re doing, it can help you stay focused and committed.

Step 2: Format

The next step is deciding on a format. There are many ways to present a budget. All you need is a format that works for you. It is important to find one that you are comfortable with and one that suits your immediate needs. If you are having trouble looking for a format, there are dozens of sample home budgets above that you can easily select and download. If you are looking to make a basic home budget, a simple table or chart should do. Using an Excel spreadsheet is one popular option too. The key is looking for a budget format that works for you.

Step 3: Income and Expenses

Once you have established a clear format and your home budget objective, you can proceed to the finer details of your budget. This section should be dedicated to the breakdown of both your household income and individual expenses. In order to know what kind of budget you should be following, you must have a firm grasp of how much incoming and outgoing money you have. These two factors are key when creating a budget. For instance, if your expenses exceed your income, then you know that you should make the necessary changes and adjustments to your spending habits.

Step 4: Categorization

Once you have identified all your household expenses, make sure to classify each one. There are different ways to categorize your expenses. The most common one is by assigning each item as either essential or non-essential. Examples of essential household expenses include rent, mortgage, utilities, tuition and food. Non-essentials might be items spent on entertainment or recreation. It is important to know which items to prioritize so you can better manage your finances and avoid spending unnecessarily or irresponsibly.

FAQs

What is the 50 20 30 budget rule?

The 50/30/20 rule is basically splitting your income into three main categories. The rule is 50% of your income should go towards needs or essentials such as rent, gas, etc. Whereas, 30% of it can be allocated towards your wants, including personal shopping. Lastly, 20% of your monthly income should be allocated to your savings or used to repay any debt.

What is a good home budget?

A good home budget is realistic, fair and sustainable. The budget shouldn’t promote an excessive lifestyle or living beyond one’s means. It should also see to it that expenses do not exceed one’s income.

What are the types of home budgets?

According to YourArticleLibrary, there are three types of family budgets. These are deficit budget, surplus budget, and balanced budget.

Ideally, a good home budget should be balanced and able to accommodate the needs of all household members. Are you ready to get your finances in order? Browse the wide selection of sample templates above to get started on your own household budget now!