50+ Sample Operating Budgets

-

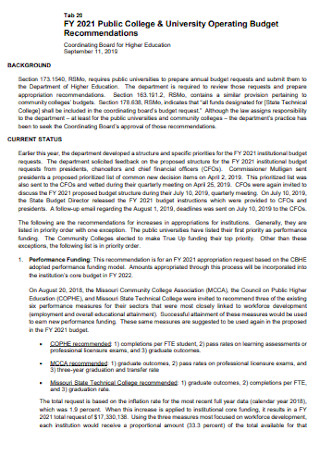

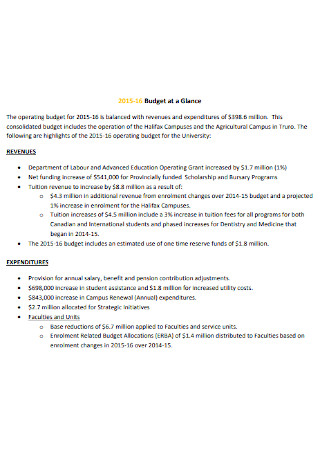

University Operating Budget

download now -

College Operating Budget Template

download now -

Operating Budget Plan Template

download now -

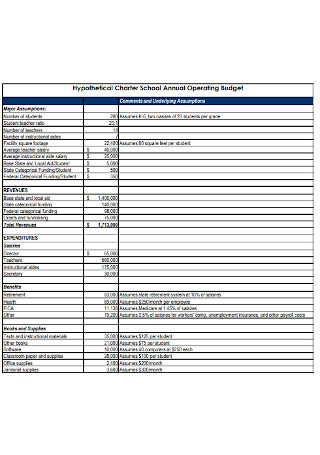

School Annual Operating Budget Template

download now -

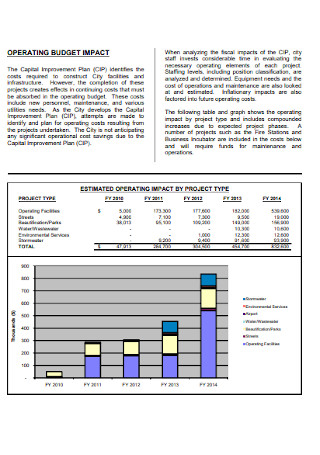

Operating Impact Budget Template

download now -

Operating Capital Budget

download now -

Development and Operating Budgets

download now -

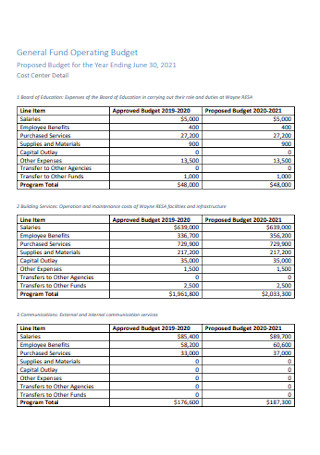

General Fund Operating Budget

download now -

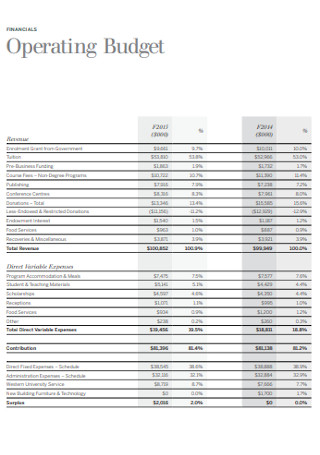

Operating Financial Budget

download now -

Campus Operating Budget Template

download now -

Budget for Current Operations Template

download now -

Sample Operating Budget Template

download now -

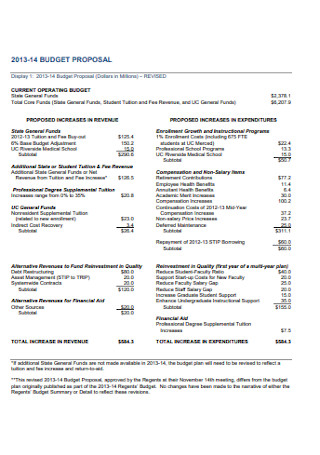

Operating Proposal Budget Template

download now -

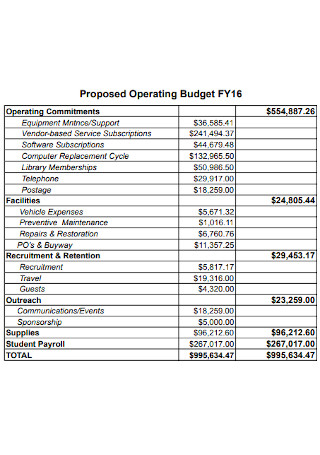

Sample Proposed Operating Budget

download now -

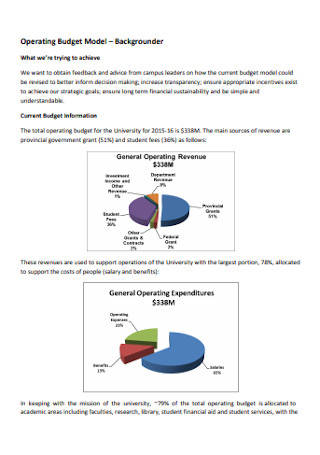

Operating Budget Model Template

download now -

Agency Operating Budget Template

download now -

Operating Budget Format

download now -

Annual Operating Budget Template

download now -

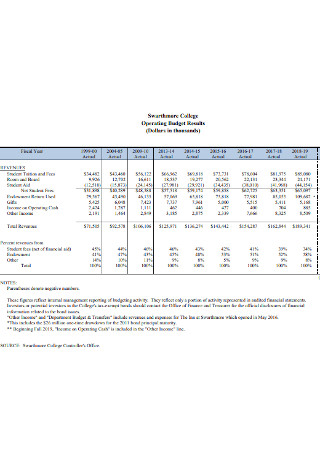

College Operating Budget Example

download now -

Simple Operating Budget Template

download now -

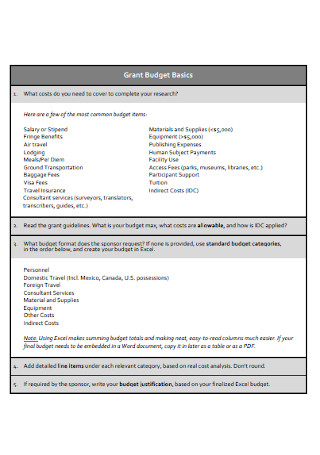

Basic Grant Budget Template

download now -

Operating Plan Budget Template

download now -

Municipal Electric Operating Budget

download now -

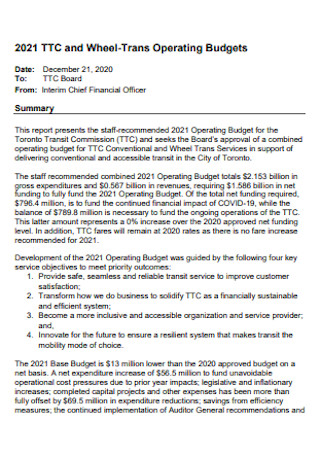

Trans Operating Budgets

download now -

Campus Operating Budget

download now -

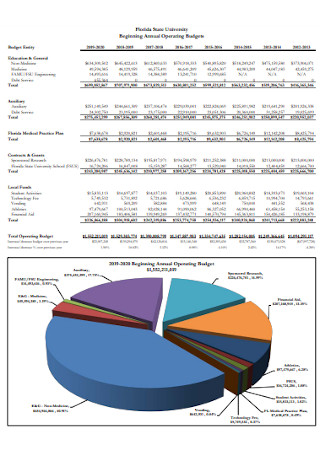

Beginning Annual Operating Budgets

download now -

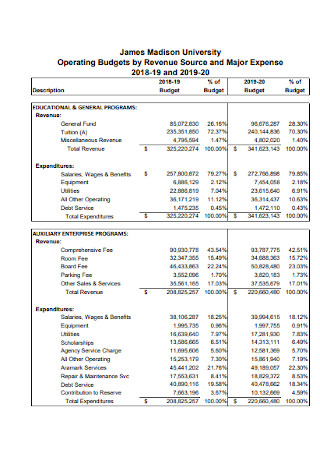

Operating Budgets for Revenue Template

download now -

Mini Grant Operating Budget Sheet

download now -

Annual Operating Budget Example

download now -

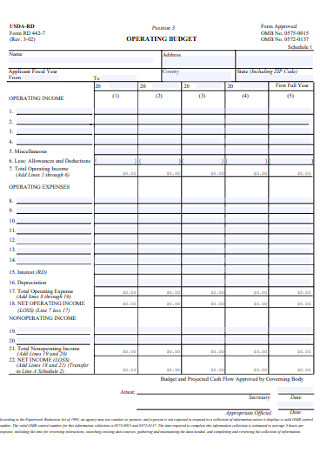

Operating Budget Form

download now -

Operating Proposal Budget Example

download now -

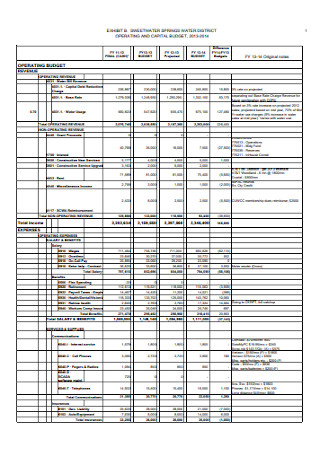

Operating and Capital Budget Template

download now -

General Operating Budget

download now -

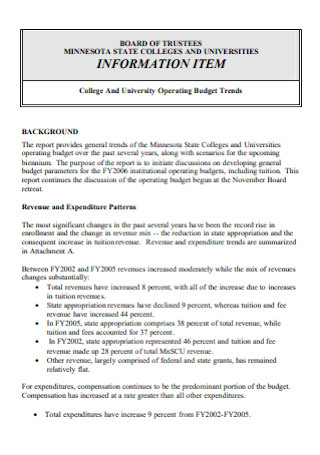

College And University Operating Budget

download now -

Template

download now -

Operating Yearly Budget Template

download now -

Operating Budget Transfer Template

download now -

Operating Budget Report Template

download now -

Financial Operating Budget Template

download now -

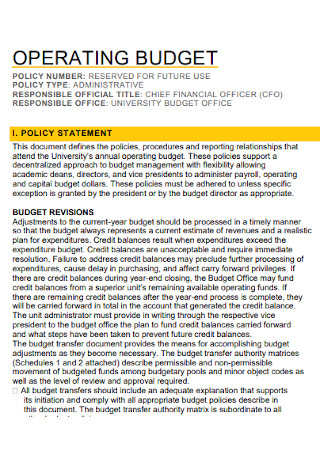

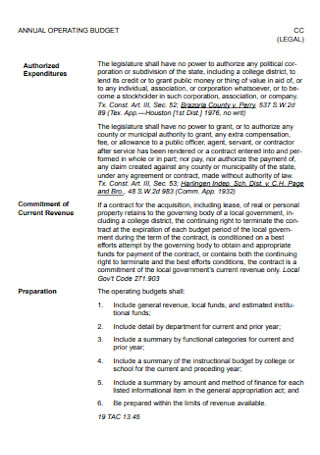

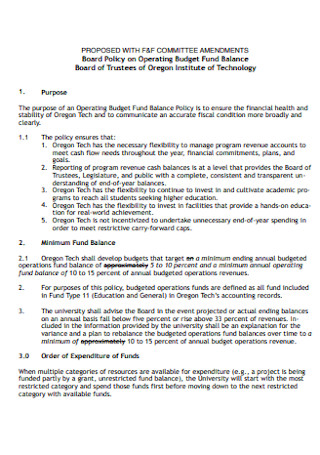

Board Policy on Operating Budget

download now -

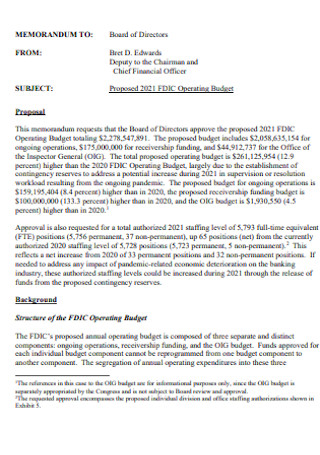

Proposed Operating Budget Template

download now -

Carryover of Unused Operating Budgets

download now -

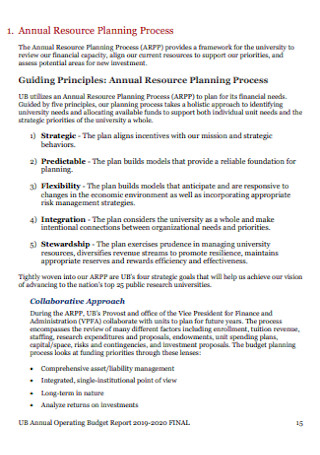

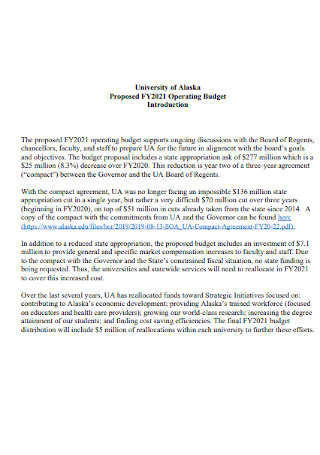

University Annual Operating Budget

download now -

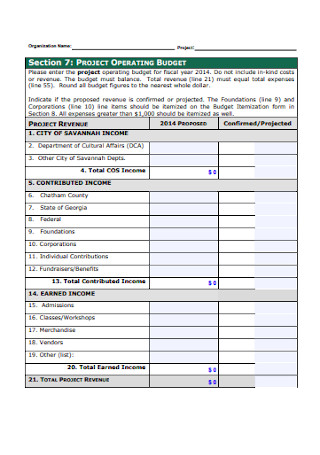

Sample Project Operating Budget Template

download now -

Business Operating Budget Example

download now -

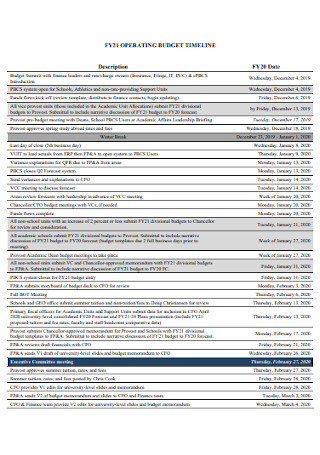

Operating Budget Timeline Template

download now -

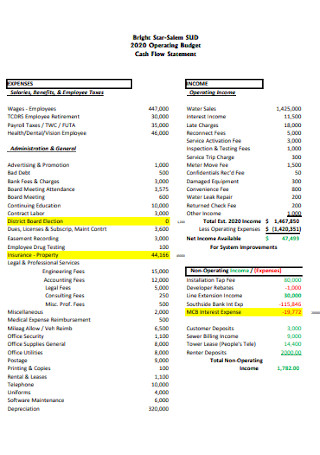

Operating Budget Statement Template

download now -

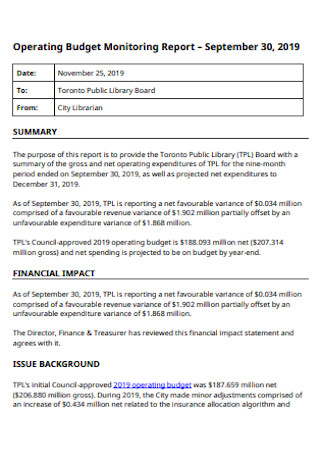

Operating Budget Monitoring Report

download now -

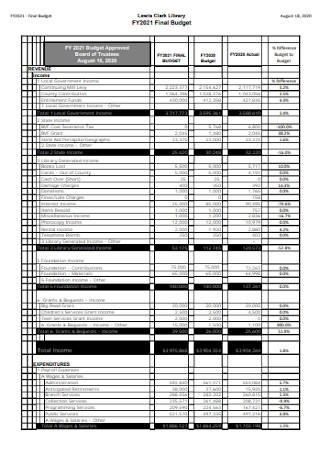

Library Operating Budget Template

download now -

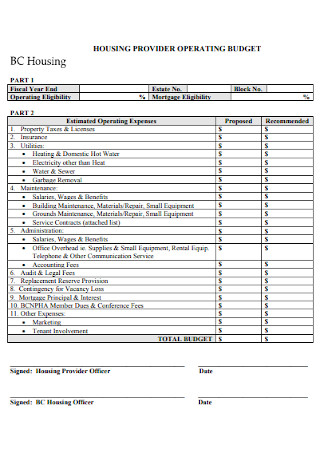

Housing Provider Operating Budget

download now

FREE Operating Budget s to Download

50+ Sample Operating Budgets

What is an Operating Budget?

Types of Budgets

Tips on Budgeting for Businesses

How to Create an Operating Budget

FAQs

What is the difference between an operating budget and a capital budget?

Why is an operating budget essential in business?

How to calculate an operating budget?

What is an Operating Budget?

An operating budget is composed of all the revenues and expenses of a small business firm, a company, an institution, or an organization over a specific period of time like a quarter or a year which is used to plan and manage its operations. Preparing an operating budget in advance is crucial for businesses and organizations to help them set a clear goal or plan that they want to accomplish. The basic components of an operating budget are revenue, variable costs, fixed costs, non-cash expenses, non-operating expenses, and capital costs.

Creating an operating budget is essential for businesses and organizations because it plays a significant role as a route map to businesses on how much they should spend on which portion of expenses by continuously monitoring the revenue and expenditures incurred by them and the resources to be used for the maximum benefit of those enterprises. Thus, business owners and financial analysts are able to go in-depth while observing the position of their businesses through comparison of actual budgets to obtain the results, tracking of the incurred expenses to prevent unnecessary wastages of funds and resources, and increasing the team’s efficiency by giving them fixed budgets.

Types of Budgets

There are three major types of operating budgets: revenue budgets, expenses budgets, and profit budgets. Revenue budgets forecast the anticipated revenues from the business or organization over a specific set period. Expenses budgets forecast the expenses which are to be incurred over the set period. While profit budgets came from the differences when revenue budgets and expense budgets are subtracted from one another. Aside from the operating budget, here are some types of budgets used by most business owners, managers, and financial analysts.

Tips on Budgeting for Businesses

Budgeting for your business or organization does not need to be confusing or stressful. Remember these practical budgeting tips while using income and expense statements and expense worksheets below to help you budget and save your funds for your short- and long-term goals.

How to Create an Operating Budget

Similar to a profit and loss projection report, an operating budget is a high-level summary report that outlines the projected revenue and the expenses associated with it for a period of time. Having an operating budget helps you to check whether your business or organization is spending to its plans accordingly. Take note of the simple steps you need to do so that you can create a comprehensive and reasonable operating budget.

Step 1: Collect Data and Analyze the Trend in Your Business

Gather the actual data of your business from your financial statements such as the balance sheet, income statement, cash flow statement, and statement of retained earnings for at least the past two years. Then, examine the trend of increase or decrease in revenue or expenses of your business or organization.

Step 2: Observe the Industry Trends

Take a closer look at the industry trends in which your business or organization operates. Track the influencers and publications in the industry where your business is. Take time to absorb the latest industry research and trends report. Use effective digital tools and analytics to help you assess and evaluate industry behavior. Listen to the concerns, requests, and suggestions of your customers. Analyze your competitors and their growth in the industry. Performing a trend analysis in the industry is beneficial to help you examine and predict the movements of a brand or an item based on current and historical data and understand the competitive dynamics of the industry.

Step 3: Calculate Your Revenue, Costs, and Other Expenses

Estimate your revenue on a year-over-year basis as you break down the revenue into its volume and price. Determine the variable costs which often include the cost of products sold, direct selling costs, sales commissions, payment processing fees, freight, marketing, direct labor, and many others. Include the fixed costs such as the fees for the rent, head office, insurance, telecommunication, management salaries/benefits, and utilities. Add non-cash expenses (depreciation and amortization) and non-operating expenses (interest, gains or losses, and taxes).

Step 4: Finalize Your Operating Budget

After calculating, analyzing, and reviewing all the costs, prepare your operating budget as you take an anticipated increase or decrease in figures from actual figures in the previous year and calculate the forecasted profits of your business. Use a sample operating budget template to outline your operating budget for the quarter, month, or year.

FAQs

An operating budget consists of personnel costs and annual facility costs. On the other hand, a capital budget is specific business funds not used for business operations and personnel management.

An operating budget is essential in business because it helps the manager to develop a comprehensive plan for the daily operations of the business.

When you calculate an operating budget, determine the monthly expenses and monthly production units as you closely look at every expenditure for the overall business. Divide the expenses by production to create the cost per unit measurement or the actual value of the products and services a company produced. Calculate the revenue to determine the gross income for a unit. Then, subtract the cost per unit from the revenue per unit to determine the profit margin of every unit.

What is the difference between an operating budget and a capital budget?

Why is an operating budget essential in business?

How to calculate an operating budget?

Based on a 2023 small business statistical report, there are around 33.2 million small businesses in the United States and 42% of small to mid-sized businesses have accelerated technology investments. Creating a clear and sensible operating budget is fundamental to help you in managing current expenses, evaluating actual past and current expenses to project future expenses, and building financial reserves. Follow the aforementioned tips in this article on budgeting for businesses in various industries and the steps in creating a reasonable operating budget. We have sample budget templates that you can easily use for your budgeting such as annual budget templates, health budget templates, and college budget templates.