50+ Sample Personal Budgets

-

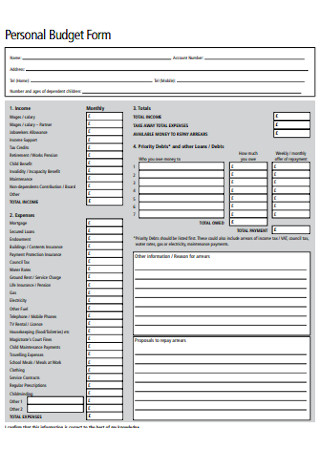

Personal Budget Declaration Form

download now -

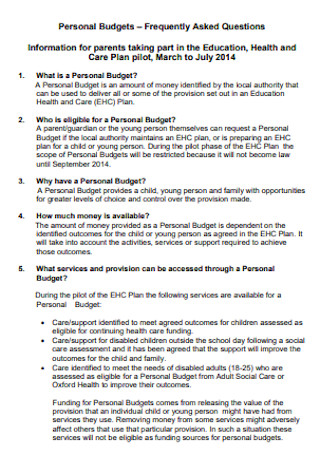

Personal Education Budgets

download now -

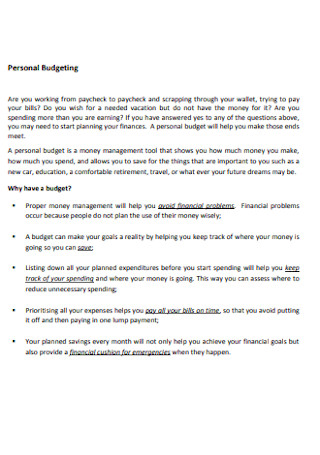

Personal Budgeting Format

download now -

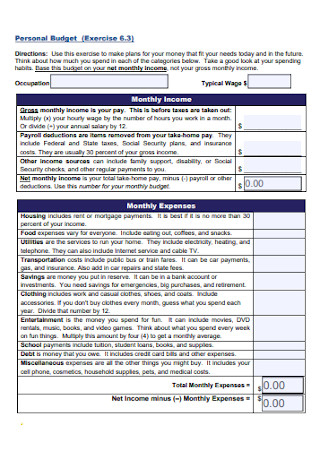

Monthly Personal Budget

download now -

Personal Budget Sheet

download now -

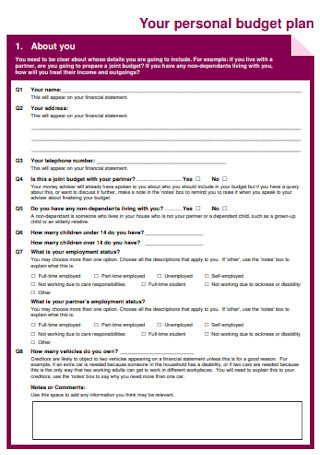

Personal Budget Plan Template

download now -

Personal Budget Form for Study

download now -

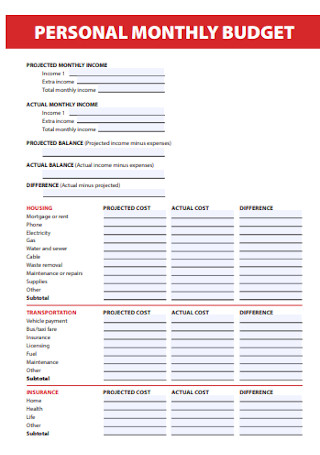

Personal Monthly Budget Template

download now -

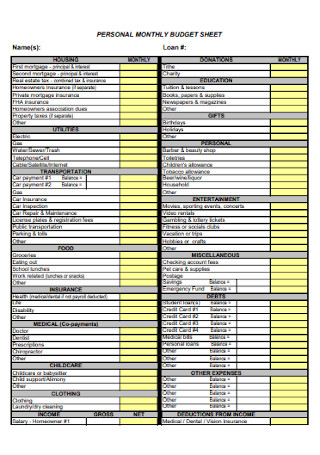

Monthly Budget Sheet

download now -

Personal Data Budget Template

download now -

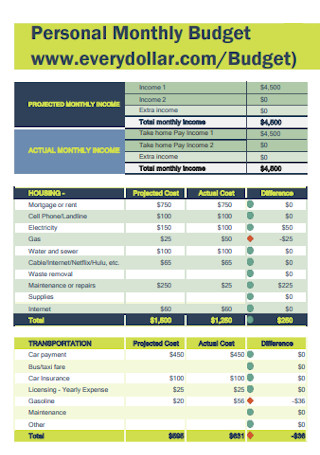

Personal Monthly Budget

download now -

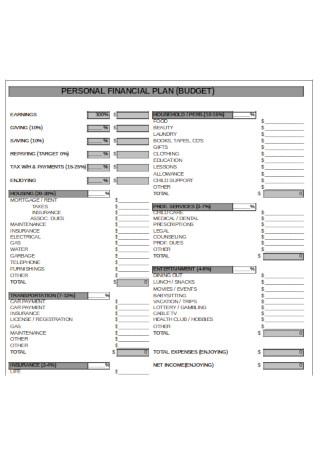

Personal Financial Bu8dget

download now -

Personal Monthly Budget Example

download now -

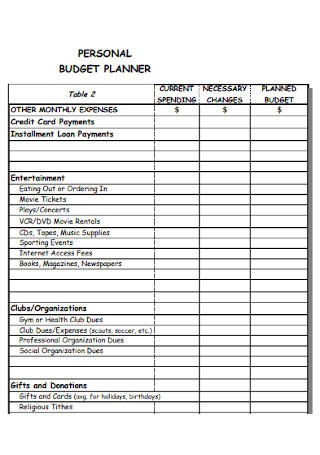

Personal Budget Planner Template

download now -

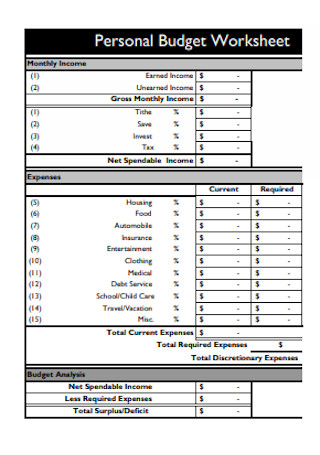

Personal Budget Worksheet

download now -

Personal Budget Survey Template

download now -

Basic Personal Budget Template

download now -

Formal Personal Budget Template

download now -

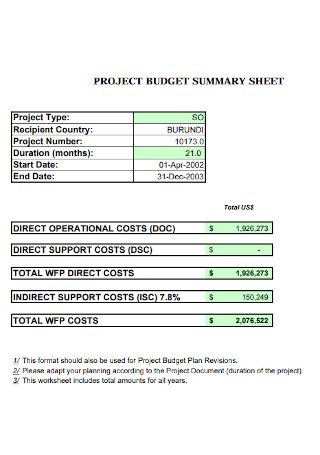

Personal Project Budget Sheet

download now -

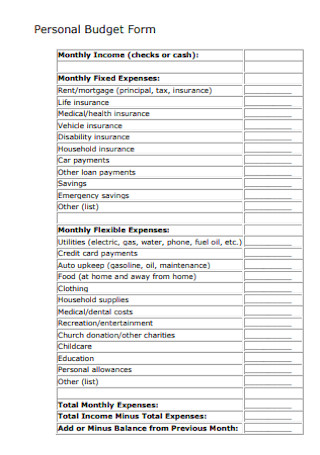

Personal Budget Form

download now -

Personal Budget Form Example

download now -

Simple Personal Budget Template

download now -

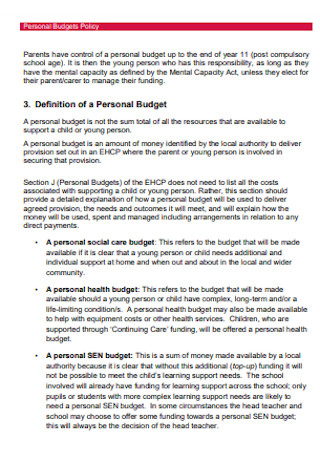

Personal Budgets Policy Template

download now -

Personal Budgets for Employment

download now -

Printable Personal Budget Template

download now -

Personal Program Budget

download now -

Personal Budgets for Special Educational

download now -

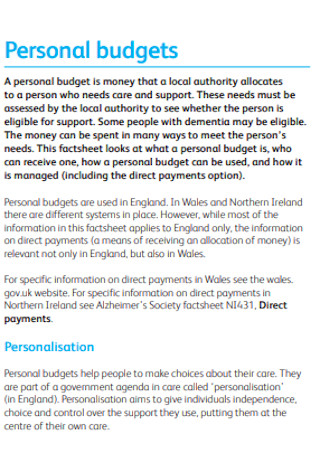

Personal Healthcare Budgets

download now -

Personal Budget Format

download now -

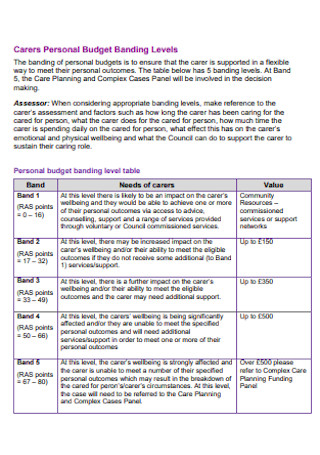

Personal Budget Banding Template

download now -

Personal Health Budget Template

download now -

Personal Payment Budget Template

download now -

Professional Personal Budgets

download now -

Personal Budget for Post

download now -

Simple Personal Budget Sheeet

download now -

Personal Budget for Special Educational

download now -

Weekly and Personal Budget Template

download now -

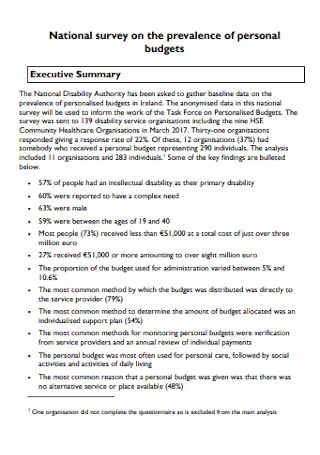

Personal Budgets Survey Template

download now -

Client Personal Budget Template

download now -

Personal Job Budget Template

download now -

Students Personal Budget Example

download now -

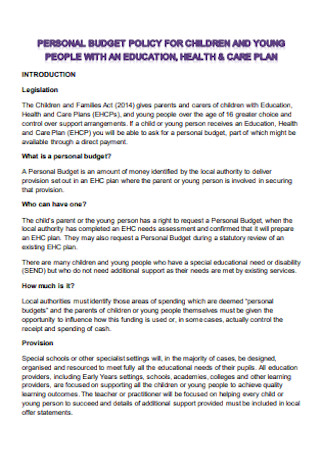

Personal Budget Policy for Children

download now -

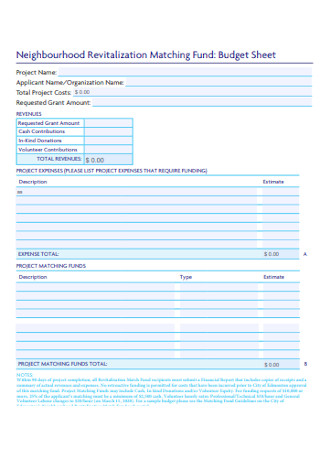

Personal Fund Budget Template

download now -

Personal Budgets for Children Template

download now -

Personal Home Budget Template

download now -

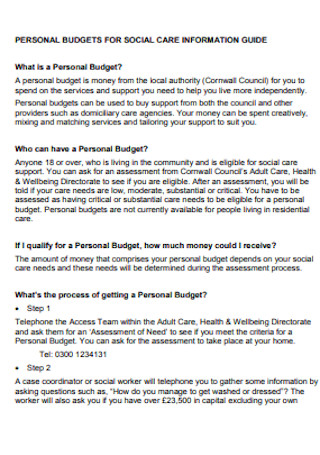

Social Care for Personal Budget

download now -

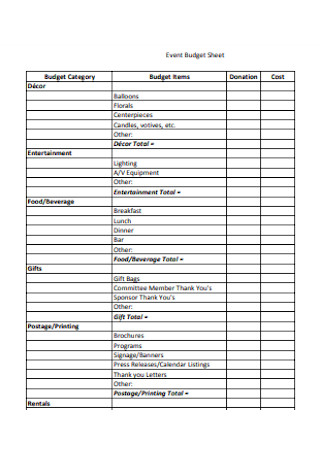

Personal Event Budget Template

download now -

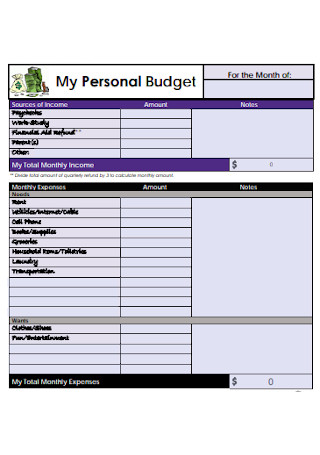

Monthly Personal Budget for Teens

download now -

Fall Semester Personal Budget Sheet

download now -

Sample Personal Budgets Example

download now

Personal Budgets: What Are They?

A personal budget is an effective tool used in planning for future expenses and tracking past spendings. It helps allocate money for specific expenses and these expenses are categorized so that you know how your money is spent or will be spent. Because it is a personal budget plan, you can modify this by adding the areas in which your income is channeled into.

Meanwhile, the US Bureau of Economic Analysis found out that the personal saving rate or the percentage of people’s income remaining each month after taxes and spending in the US has increased between 12.7% and 32.2% in March and April of 2020.

The Different Elements of a Personal Budget

Because of the pandemic, the US personal saving rate or the percentage of people’s disposable income remaining each month after taxes and spending has increased between 12.7% and 32.2% in March and April of 2020, according to the US Bureau of Economic Analysis. This means that many have tightened their budget because the economy slowed down and unemployment rose. If you are one of these people and want to save money for the future, you need to invest in making a good personal budget plan. Below are what you should include in your personal budget.

How to Create a Personal Budget

Creating a personal budget is not as difficult as you think. Start off with a draft and write down your past expenses. This way you can eliminate unnecessary spendings and prioritize the more important ones. To make your checklist pay off, read and follow these tips and tricks below:

Step 1: Select a Template

The best way to make a personal budget is with the help of a template. If you are having trouble finding the best template for you, start browsing our website and discover various ready-made stencils fitting for both business and personal needs. It is so easy to get. Just click the download button and you are good to continue personal budget-making.

Step 2: Edit Your Template

Having a suggested content is the benefit of working on a template. But it should not what your checklist is all about. If you want it to be personally-made, make sure to include all things necessary such as a list of expenses, allocation of each spending, date of spending, and so much more.

Step 3: Keep It Simple

Money is a contentious matter. To be more effective at budgeting, make sure your personal budget is simple and easy-to-read. You should easily understand it by just looking at the content once or twice. Additionally, add tables, charts, or bar graphs to neatly organized the list and this will make things in order.

Step 4: Do the Final Revision

Before using the personal budget, make sure to review it first. Although you can make adjustments along with using the document, revising it helps avoid errors, especially on the title, labels, and budget plan. After that, stick to the budget plan to achieve your financial goals.

FAQs

What are the different types of budget templates?

- Budget Worksheet Template

- Construction Budget Template

- Annual Budget Template

- Capital Budget Template

- Travel Budget Template

Why is budgeting important?

Budgeting is important because it helps you monitor your spending, sets your priorities, and paves a way towards achieving your financial goals.

When do you need a personal budget?

If you feel like you are spending more than you can afford, consider having a personal budget. However, a personal budget is not only useful when you feel like your money is running out. It is also helpful in saving money by allocating money for certain expenses, setting goals, and prioritizing important expenses.

Although budgeting is not always a comfortable topic to discuss, especially for people who are dealing with a mounting debt or unpaid bills, understanding your financial landscape is a valuable insight as you try to pursue financial freedom. For more budget templates, go to our website and get the chance to sign up for any of our subscription plans.