24+ Sample Retirement Budgets

-

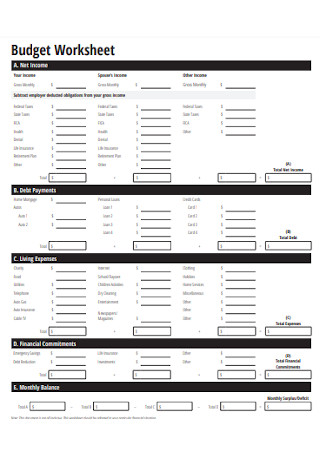

Retirement Planning Budget Sheet

download now -

Retirement Monthly Budget Worksheet

download now -

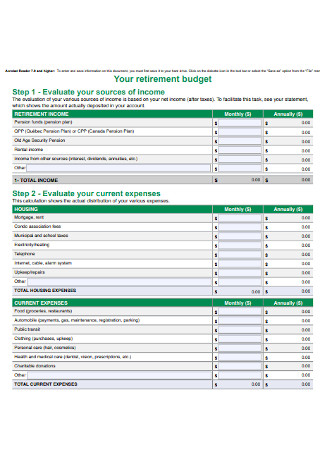

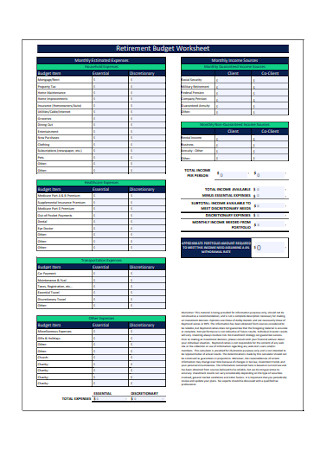

Retirement Budget Worksheet Template

download now -

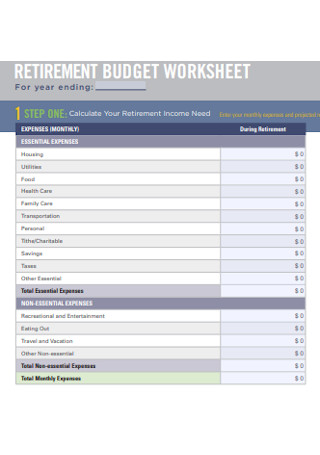

Retirement Income Budget Worksheet

download now -

Retirement Financial Plan Budget

download now -

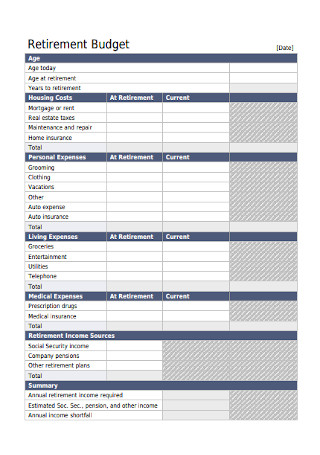

Sample Retirement Budget Template

download now -

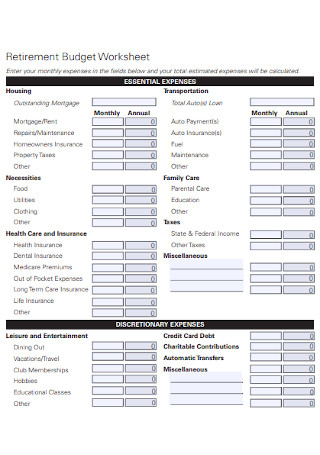

Retirement Expense budget Worksheet

download now -

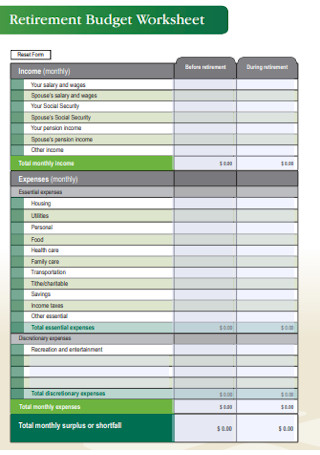

Retirement Budget Worksheet Example

download now -

Quick Retirement Budget Worksheet

download now -

Retirement Budget Worksheet Format

download now -

Retirement Expenses Budget Worksheet

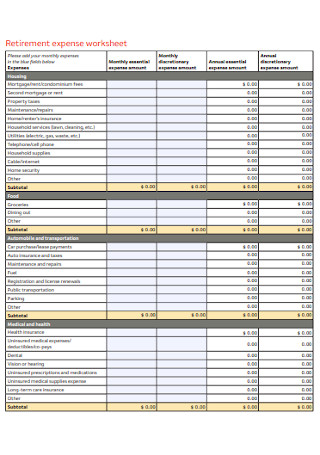

download now -

Your Retirement Expense Worksheet

download now -

Employee Retirement Budget Worksheet

download now -

Retirement Service Budget Worksheet

download now -

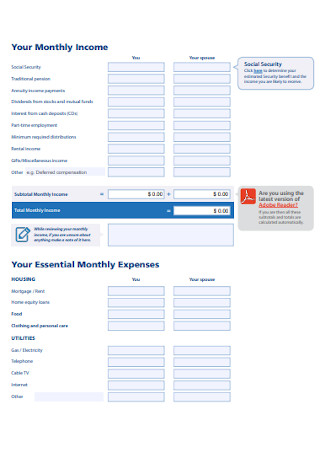

Retirement Monthly Budget Worksheet

download now -

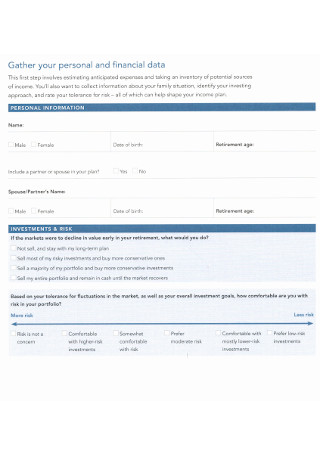

Retirement Income Planning Worksheet

download now -

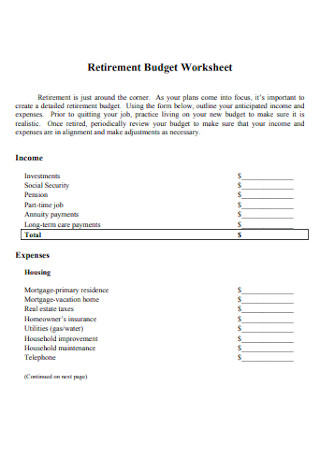

Basic Retirement Budget Worksheet

download now -

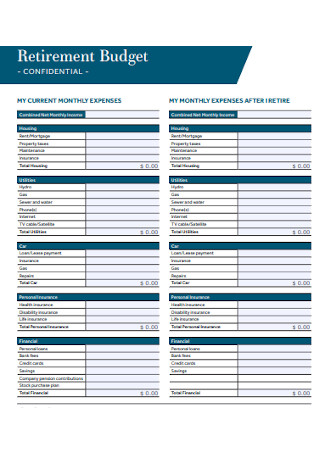

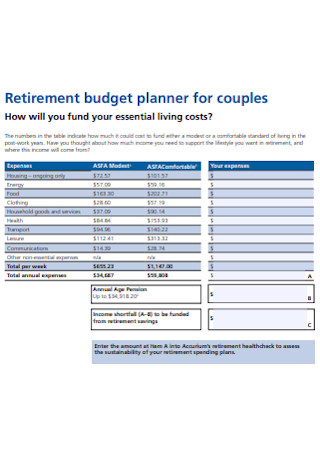

Retirement Budget Planner for Couples Worksheet

download now -

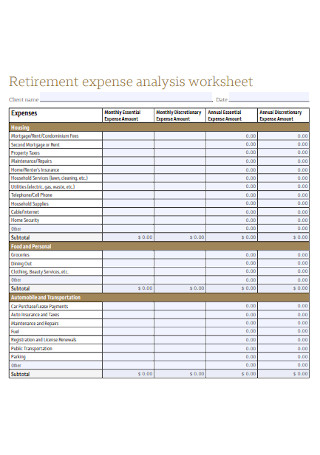

Retirement Expense Budget Analysis Worksheet

download now -

Retirement Budget Wealth Worksheet

download now -

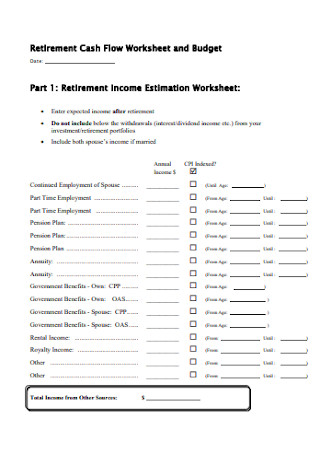

Retirement Income Budget Estimation Worksheet

download now -

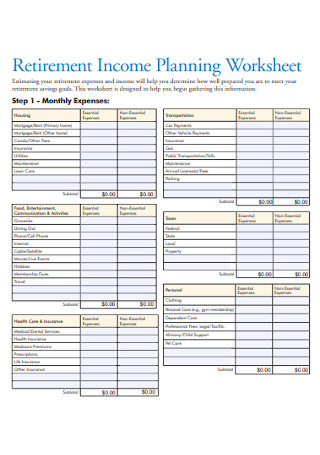

Retirement Income Budget Planning Worksheet

download now -

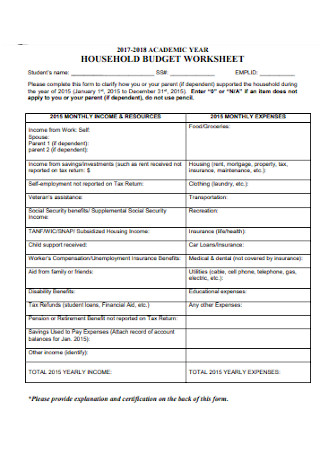

Household Retirement Budget Worksheet

download now -

Retirement Housing Budget Worksheet

download now -

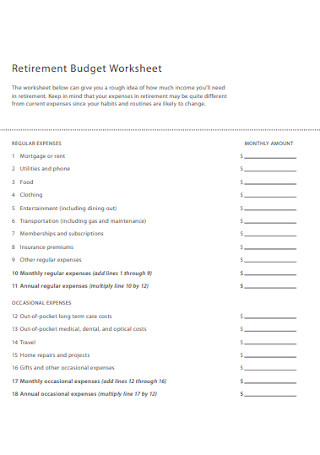

Standard Retirement Budget Worksheet

download now

What Is a Retirement Budget?

A retirement budget is your official budget plan when you retire from work at a certain age. And in using a worksheet, you can calculate your estimated savings, divide your daily spending, settle every important payment, secure your family’s wealth, and so much more. Thanks to the retirement budget, you won’t have to suffer as a retiree unlike those whose budget won’t last long during post-retirement.

According to the Teachers Insurance and Annuity Association of America (TIAA), a retirement budget should estimate 70% for the essentials and 30% for nonessential spending.

Salient Sections of a Retirement Budget

A retirement budget consists of many sections and subsections. And they often differ from what plans you have in mind with your budget as a retiree someday. So what are they? Without further ado, find out the important sections of a standard retirement budget.

How to Set a Smart Retirement Budget

Now for the real deal, are you ready to create your retirement budget? It gets easier when you use the sample retirement budgets seen above. With a template, you can customize, print, and download your retirement budget anytime. But, you also have to consider other ways to get smart with your retirement. And you can do that by following these steps:

Step 1: Gather All Your Financial Statements

First, you need to take a trip back into reviewing all your financial statements. This applies to your bank and credit statement, tax returns, pay stubs, and so much more. That way, you can review how much the factors to calculate and plan in your retirement budget would be.

Step 2: Identify the Schedule or Period of Expenses

Every person has something to pay on a daily, weekly, biweekly, monthly, quarterly, or yearly basis. Thus, recognize all those recurring payments to know how to set the schedule for your retirement budget scheme. Also, determining those scheduled expenses won’t let you be blinded about what ongoing payments still happen in your post-retirement.

Step 3: Balance Your Expenses Carefully

Focus on the word balance. Maybe you focused too much on entertaining your retirement life while forgetting about your health and other important expenses. Remember that TIAA suggests estimating only 30% for the nonessentials and ensure 70% for essential spending. Don’t make it to a point where you lack the important ones or you may still suffer in surviving.

Step 4: Calculate the Fixed and the Flexible Costs

Take your calculator and start comparing the fixed and the flexible costs. This lets you find the total of your fixed expenses and the total of the non-fixed expenses. After that, divide the fixed expenses into the total expenses. You will eventually reach your retirement income’s percentage. And here’s a tip: You can add some fun to your retirement by lowering the fixed expenses. Therefore, more flexible costs are available for you to enjoy.

FAQs

What is the importance of a retirement budget?

A retirement budget is important to have a clear picture of your expenses during retirement. And thanks to the retirement budget worksheet, you will be financially secured with old age. It is too late to start saving when you are already retiring. Hence, it is better to seek professional advice and craft your retirement budget scheme ahead for a modest future.

How much should you spend during retirement?

Each month, most people spend less after retiring. And it is a common rule to expect your expenses to be around 70–80%. Hence, those who usually spent $1,000 per month before retiring may spend around $700 to $800 monthly in retirement.

What are the phases of retirement?

There are four different phases of retirement. And they consist of the following:

- Pre-retirement (ages 50–62)

- Early retirement (62–70)

- Middle retirement (70–80)

- Late retirement (80 and up)

Retirement could last very long. But not being financially prepared would certainly bring your enjoyment down. Budgeting involves changing income and expense levels, inflation, different periods, and others. Hence, you should prepare your retirement budget as early as possible for peace of mind during your final golden years in life.