50+ SAMPLE University Budget

-

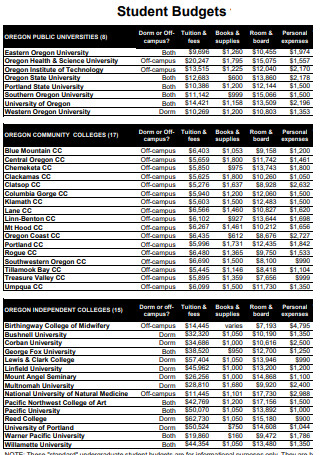

University Student Budget

download now -

Adopted University Budget Plan

download now -

Major University Budget Analysis

download now -

University Current Funds Budget Plan

download now -

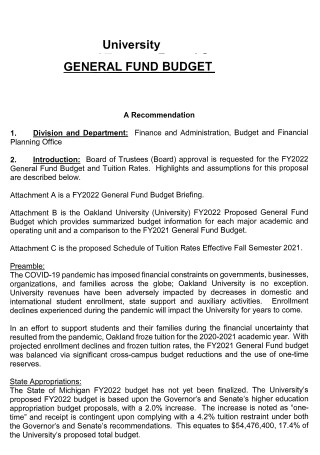

University General Funds Budget

download now -

University Biennial Budget

download now -

University Budget Overview

download now -

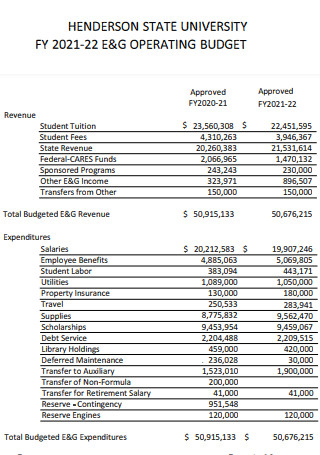

State University Operating Budget

download now -

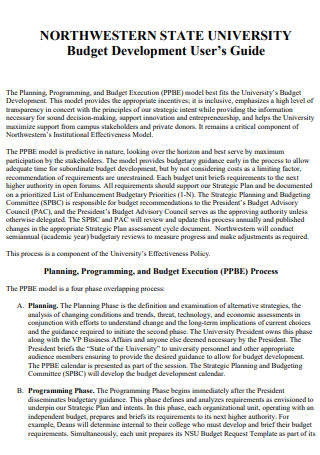

State University Budget Development

download now -

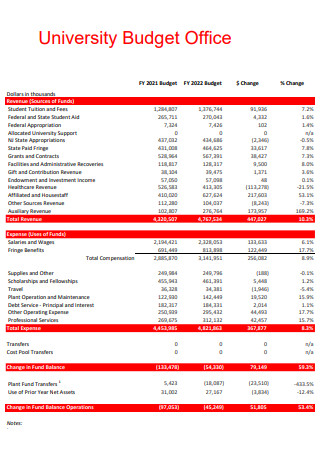

University Budget Office

download now -

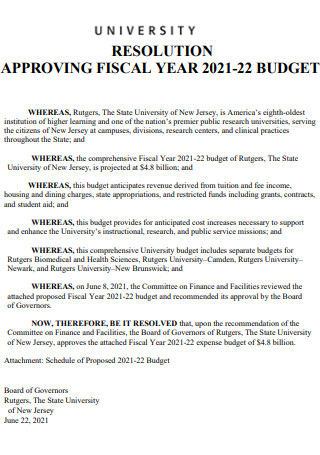

Approving University Budget

download now -

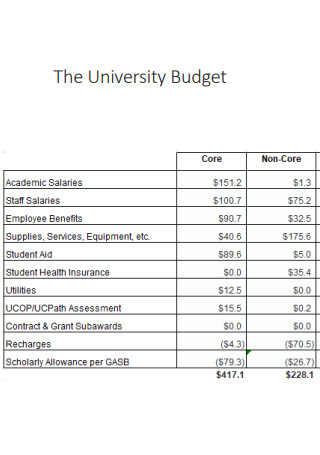

The University Budget

download now -

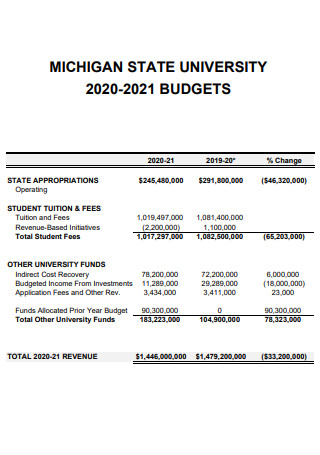

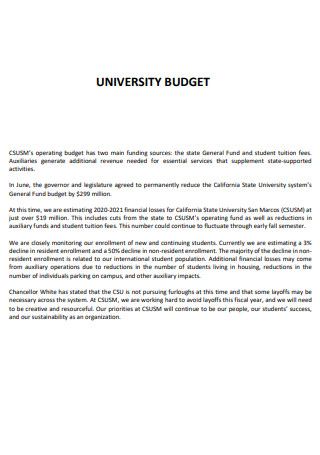

State University Budget

download now -

University Budget for Current Operations

download now -

University Budget Request

download now -

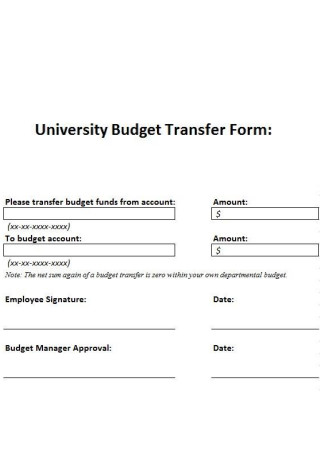

University Budget Transfer Form

download now -

Approval of University Budget

download now -

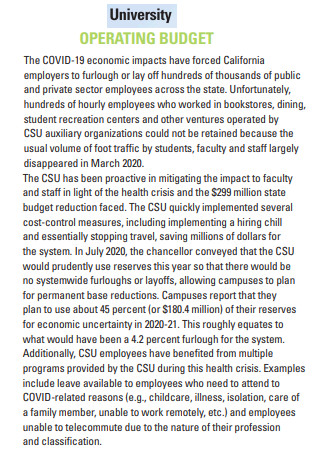

University Operating Budget

download now -

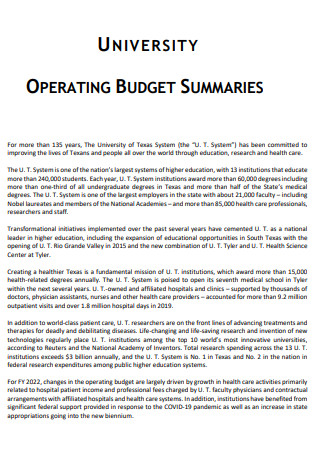

University Operating Budget Summaries

download now -

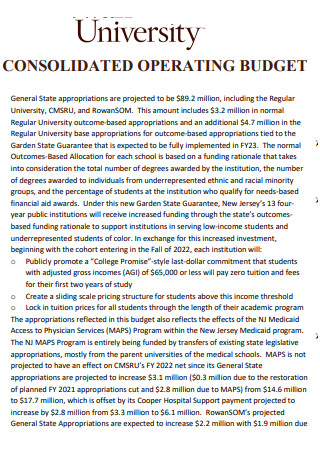

University Consolidated Operating Budget

download now -

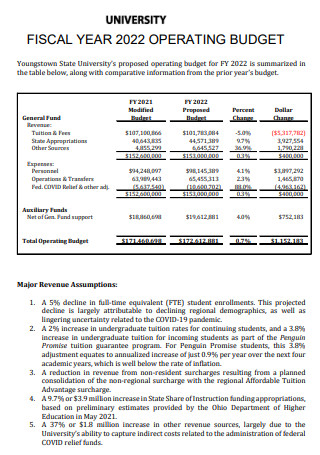

University Operating Budget Fiscal Year

download now -

University System Budget

download now -

University Budget Plan

download now -

University Budget

download now -

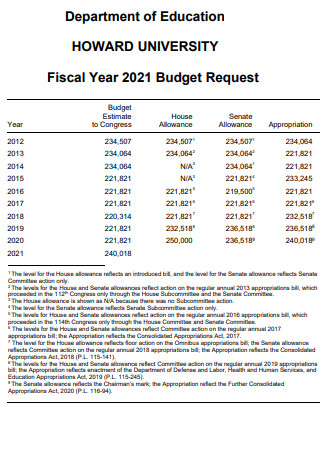

Department of Education University Budget

download now -

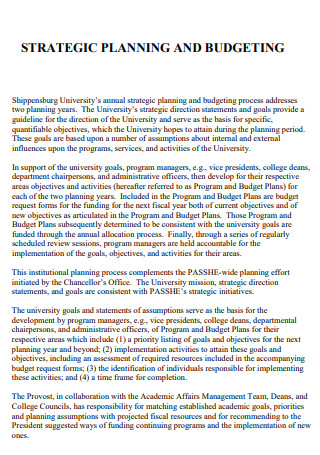

University Startegic Plan and Budget

download now -

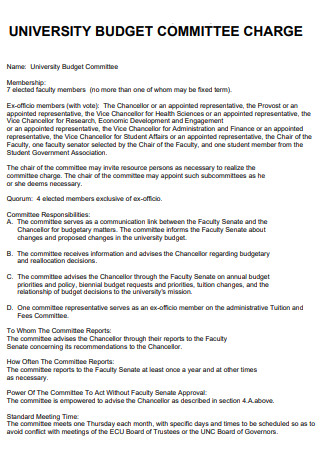

University Budget Commitee Charge

download now -

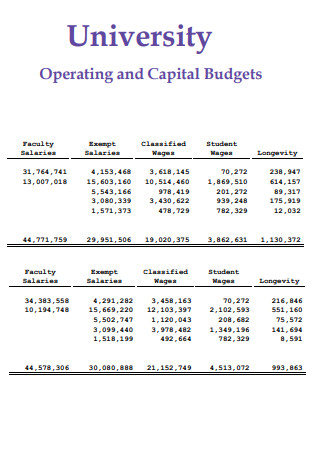

University Operating and Capital Budget

download now -

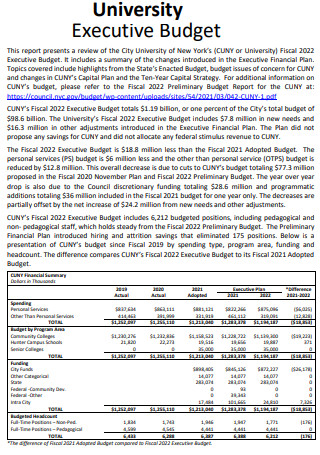

University Executive Budget

download now -

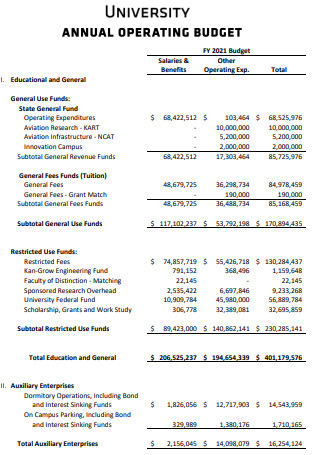

University Annual Operating Budget

download now -

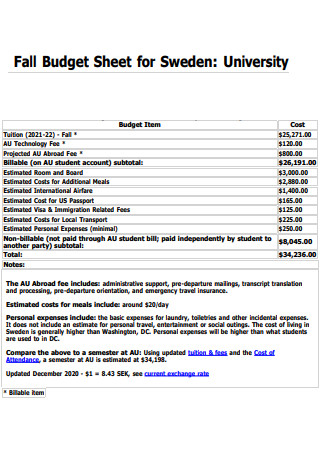

University Fall Budget Sheet

download now -

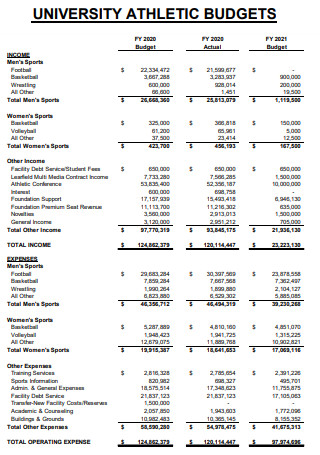

University Athletic Budget

download now -

University Budget Reduction Plan

download now -

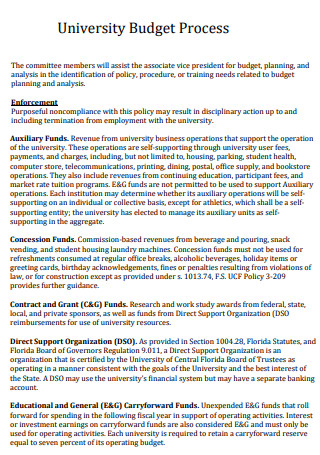

University Budget Process

download now -

University Annual Base Budget

download now -

University Funds Budget

download now -

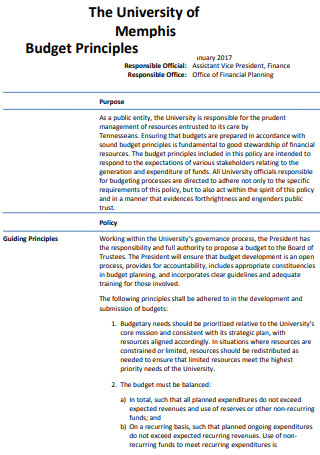

University Budget Principles

download now -

University Budget Reduction

download now -

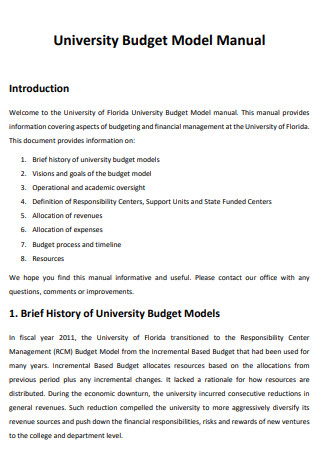

University Budget Model Manual

download now -

University Budget Build Process

download now -

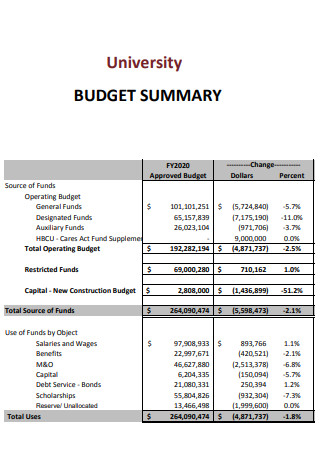

University Budget Summary

download now -

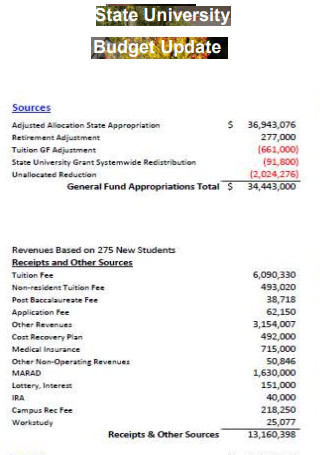

University Budget Update

download now -

University Budget Increase Policy

download now -

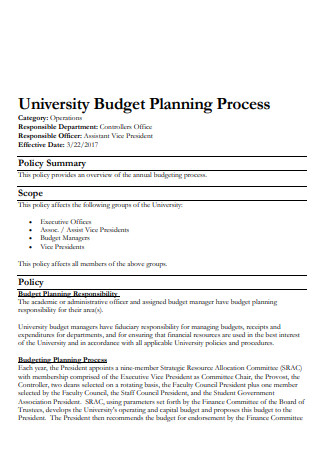

University Budget Planning Process

download now -

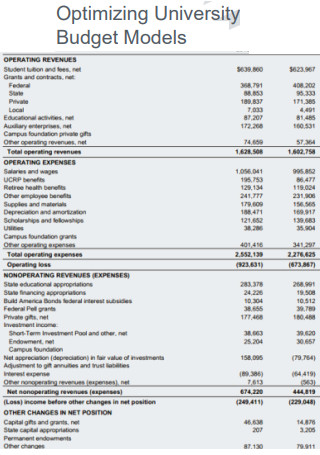

Optimizing University Budget Models

download now -

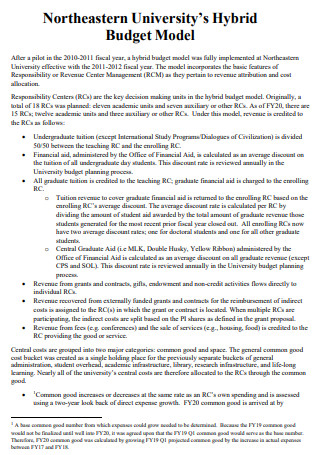

University Hybrid Budget Models

download now -

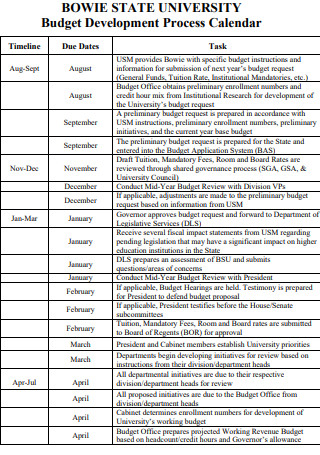

University Budget Development Process Calendar

download now -

University Primer for Understanding Budget

download now -

Sample University Budget

download now -

Simple University Budget

download now -

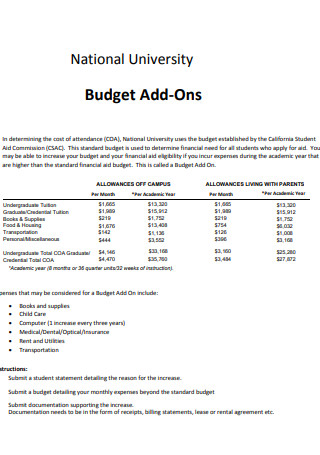

University Budget Add-Ons

download now

FREE University Budget s to Download

50+ SAMPLE University Budget

What Is a University Budget?

Expenses to Consider for a University Student Budget

Tips When Estimating Your University Budget

FAQS

What Factors Should Be Considered When Creating a University Budget?

Where Do University Funding Sources Come From?

What Factors Should Be Considered When Creating a University Budget?

Why Is Creating a University Budget Necessary?

What Is a University Budget?

A university budget is a description of all present and prospective expenditures that accounts for the total quantity of finances. It can assist a university student or the university itself in demonstrating how their funds are spent. Alternatively, demonstrate how the resources are to be spent. A university budget outlines the funds available and where it is invested. It could be for new buildings and programs at the university. Students’ university budgets are focused on their living and educational expenses. As a result, a university budget represents a picture of how money is expected to be spent in specified dates. Typically, it would be outlined inside an annual budget plan.

Expenses to Consider for a University Student Budget

Being a university student is not always easy. Especially if you are in the medium or lower socioeconomic bracket. There are much too many expenses and far too little hours in the day. University classes are also very hard. Some programs simply consume so much of your time that working a part-time job is not an option. So, let’s go over these expenses and decide where to pool our resources.

Tips When Estimating Your University Budget

It’s usually a good idea to make a budget as a student. More importantly if your funds are not specifically flowing in gold. Alternatively, you may not have a trust fund set up for your schooling. University programs, particularly those in science and engineering, are expensive. Or even those in the Fine Arts. Though education can now be acquired by most people, it has also become more expensive. As a result, the best thing a student can aspire for is a scholarship and careful planning of their university budget. And here are some pointers on how to go about it.

-

Tip 1. Identify Source of Income/Funds

Money through labor is not often the only source of income. It can come in the form of scholarships, loans, or even grants. Alternatively, you might apply for a credit line from a financial institution. Scholarships and grants are the safest and most preferable options. However, this necessitates excellent grades and exemplary high school records. It may also need competing with many people for that one position. However, it is always a good idea to check with your school to see if any grants are available. Grants and scholarships are frequently program-specific. Apply to as many as possible and sell yourself as much as possible. If there are no other options, a student loan or loans in general are a possibility. However, there is interest to be paid, which could result in a significant sum of money to owe.

-

Tip 2. Calculate Expected Expenses

We have detailed the expenses of a university student above for your convenience. But take it with a grain of salt. Given the fact that some of the factors in the list may not exactly be a useful reference for you. The two most significant factors to consider are living expenses and education expenses. That is, tuition, miscellaneous fees, and rent are given top priority. The first step is to determine the tuition fee. Second, check for a feasible lodging option. And evaluate whether both are doable and will still leave you with money. The next step is to hunt for used or rented textbooks to save money on brand new ones. One strategy to anticipate school fees is to ask an older year student what their curriculum looks like. Especially if you’re enrolled in the same program and subject as them. After that, account for food, transportation, and any additional costs.

-

Tip 3. Plan for Contingencies

Things will not always go as planned. There are just too many circumstances outside of your control that could cause your life to take an unexpected turn. Consider the case of an accident. Or a tuition increase that comes out of nowhere. Those are scenarios that could occur. As a result, having an existing contingency fund would be quite beneficial. It is a budget that will not be touched unless extraordinary circumstances require it. It’s also reassuring to know that there’s a backup plan if things go wrong. There’s a chance you’ll flunk a class and have to retake it. You may also have to pay for summer classes and unexpected school events. It is for unanticipated events. And it’s always a good idea to be prepared.

-

Tip 4. Add and Account Everything

After considering your potential expenses in addition to your current ones, determine whether it is financially feasible. If there are parts that can be saved, be picky about where your money goes. Make a university budget planner to help you keep track of your expenses. Alternatively, you can look at the sample university budget templates provided above.

FAQS

What Factors Should Be Considered When Creating a University Budget?

A university budget includes elements such as school, personal, and living expenditures. This comprises tuition, transportation, rent, and the purchase of personal items. A large amount is also required for the purchase of equipment and educational supplies.

Where Do University Funding Sources Come From?

According to investopedia.com, university funds can be obtained in a variety of methods. Tuition and other school fees generate the majority of the earnings. They can also raise money through fundraising, private donations, and federal grants. They can also obtain it through research grants and endowment financing.

What Factors Should Be Considered When Creating a University Budget?

A university budget includes elements such as school, personal, and living expenditures. This comprises tuition, transportation, rent, and the purchase of personal items. A large amount is also required for the purchase of equipment and educational supplies.

Why Is Creating a University Budget Necessary?

A university budget aids in the tracking of expenses and costs. It is incredibly beneficial for a student to be constantly mindful of their budget. Alternatively, their remaining resources. A budget can also help you plan for future expenses.

When it comes to education, money should be the last thing on a person’s mind. Regrettably, this is not always the case in most places around the world. So, the next best thing they could do? Prepare a campus budget by looking at university budget examples! A university budget calculate your every expected and current spendings! So, start tracking them now!