31+ Sample Business Credit Applications

-

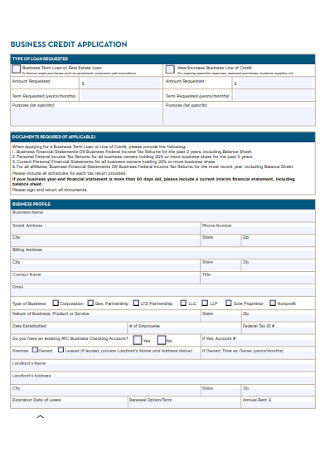

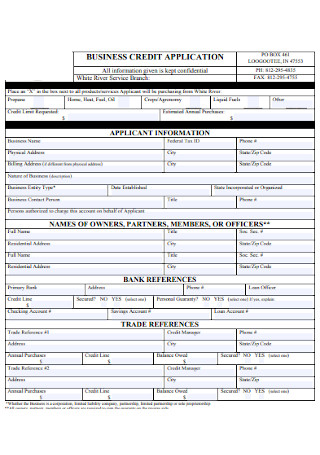

Company Business Credit Application

download now -

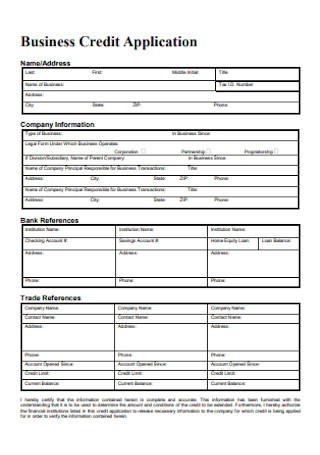

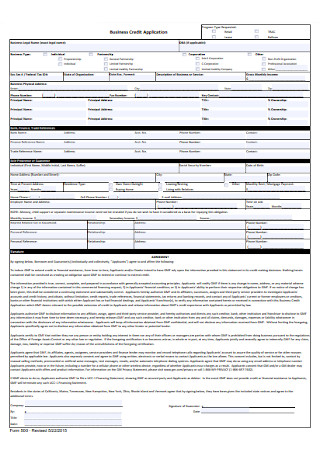

Business Credit Application Template

download now -

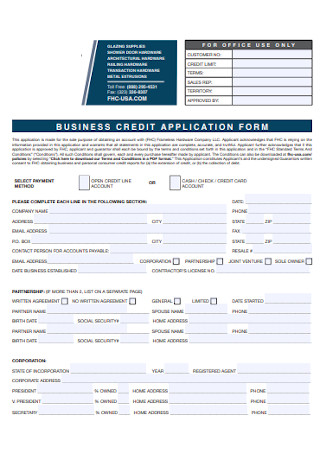

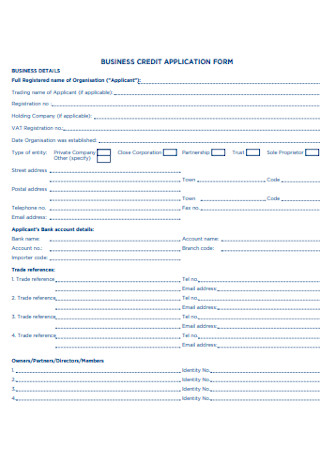

Business Credit Application Form

download now -

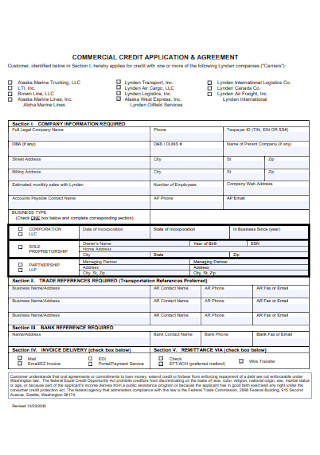

Commercial Business Credit Application

download now -

Business Information Credit Application

download now -

Business Financial Credit Application

download now -

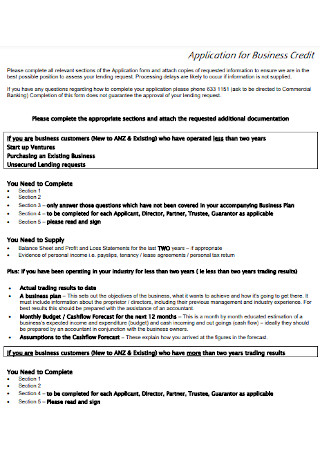

Application for Business Credit

download now -

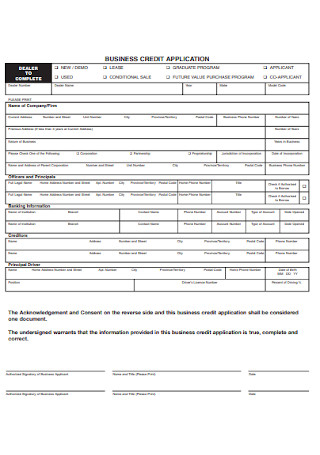

Business Dealer Credit Application

download now -

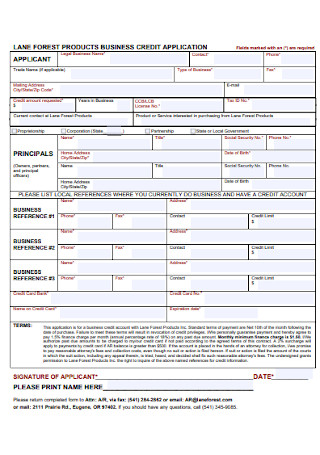

Forest Products Business Credit Application

download now -

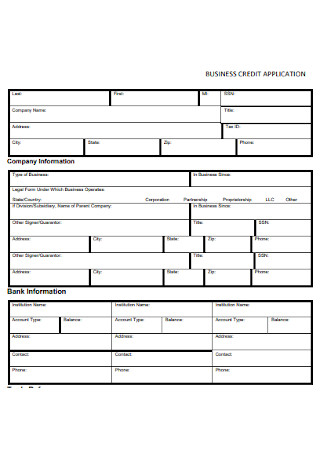

Business Bank Credit Application

download now -

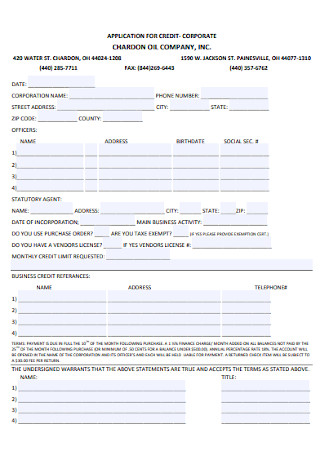

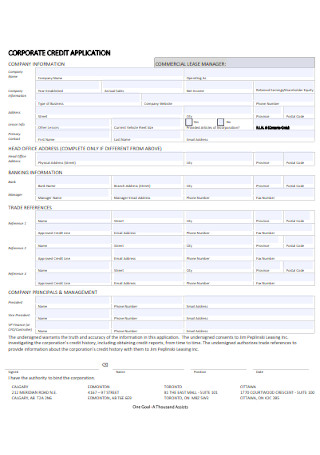

Corporate Business Credit Application

download now -

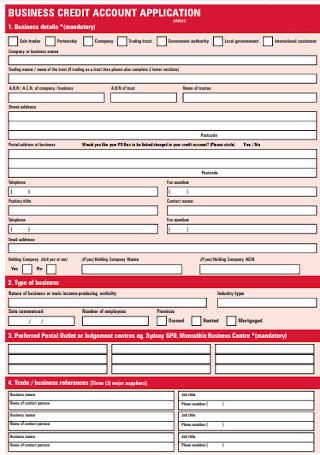

Business Credit Account Application

download now -

Business Credit Application Form

download now -

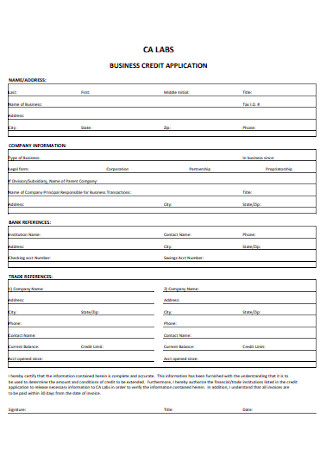

Lab Business Credit Application

download now -

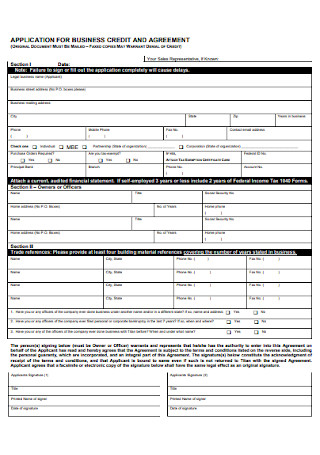

Business Credit Application and Agreement

download now -

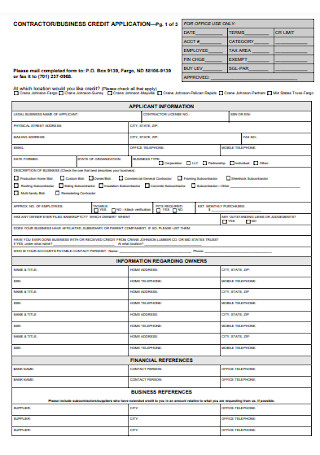

Contractor and Business Credit Application

download now -

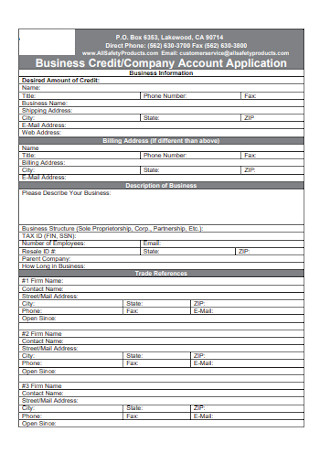

Business Credit and Company Account Application

download now -

Sample Business Credit Application Form

download now -

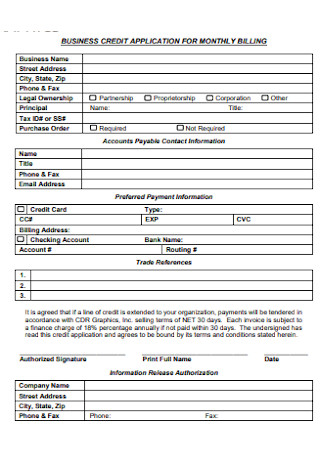

Business Credit Application for Monthly Billing

download now -

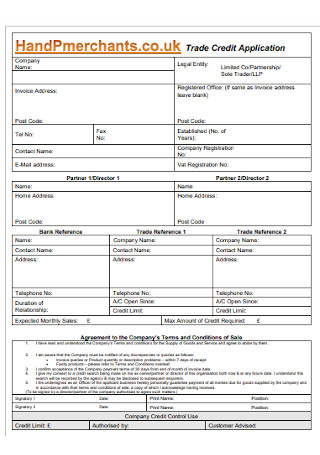

Trade Business Credit Application

download now -

Incorporated Business Credit Application

download now -

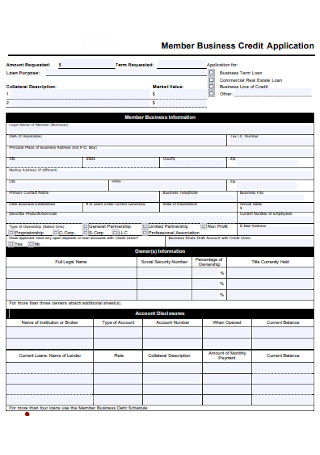

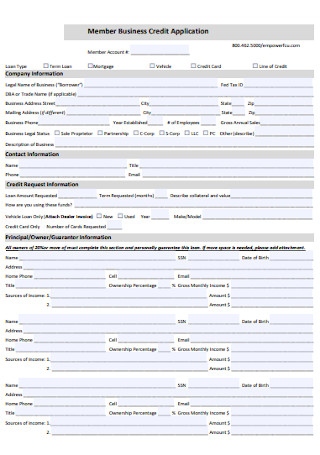

Member Business Credit Application

download now -

Business Credit Application Format

download now -

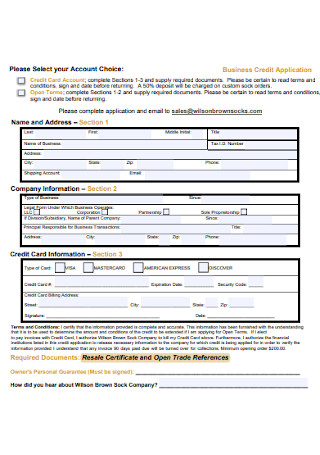

Sample Application for Business Credit Card

download now -

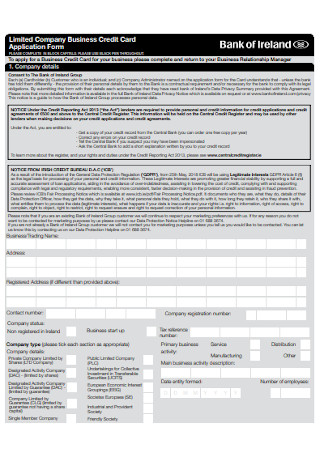

Company Business Credit Card Application Form

download now -

New Business Credit Application

download now -

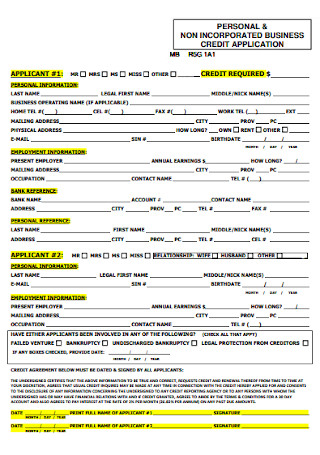

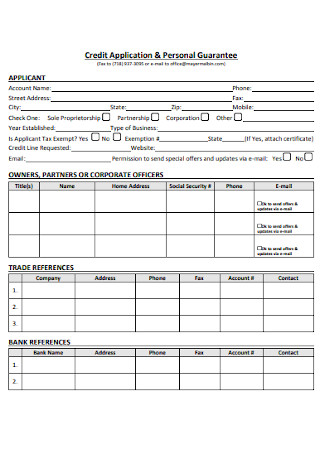

Personal Business Credit Application

download now -

Corporate Business Credit Application Template

download now -

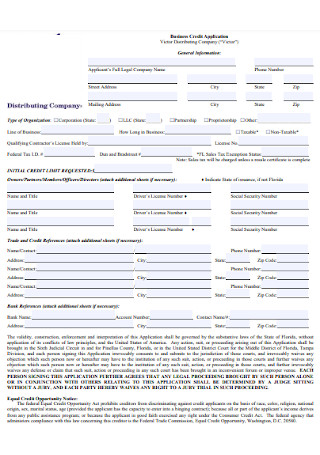

Distributing Company Business Credit Application

download now -

Customer Profile and Business Credit Application

download now -

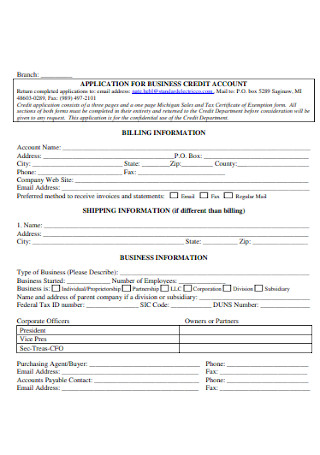

Application for Business Credit Account

download now -

Member Business Credit Application Template

download now

FREE Business Credit Application s to Download

31+ Sample Business Credit Applications

What Is a Business Credit Application?

The Five C’s of Credit

Components of a Business Credit Application

How To Create a Business Credit Application

FAQs

What is a credit application form?

How does the credit application process go?

How long are credit applications valid?

What Is a Business Credit Application?

A business credit application is a printed or written document by an individual or a company, either for seeking a credit line or asking for a credit extension from another business, firm, or financial, or lending institution. An organization that focuses on investing credit in startup businesses considers the document as a valuable report. It details the financial situation of a company, whether they are viable for applying for credit. A credit application allows a firm to investigate a client’s credit history, employment status, existing accounts, and ability to pay back what a firm lends for its business. There are regulations to follow when filing for business credit applications, and there are laws such as Truth In Lending Act that administer consumer protection and transparency.

According to an article on the United States Small Business Administration website, a study conducted by the National Small Business Association regarding Small Business Access to Capital Study, about 20 percent of loans by small businesses end up denied because of business credit. Roughly 1 out of 5 starting companies do not get the funding they need from financial institutions.

The Five C’s of Credit

When filing for credit applications, whether for personal or business use, acquiring credit knowledge is always advantageous. The five C’s of credit is a phrase that defines the five major factor that determines the creditworthiness of an individual or company. Lending institutions use these as a basis for quantifying and deciding if an applicant is eligible and determining interest rates and credit limits for current borrowers.

Components of a Business Credit Application

Well-constructed business credit applications make or break a company applying for credit. It is a vital part of any credit extension policy and serves various business functions. It helps with decision-making processes, records necessary information, and is a legal document in litigations. Below are the components of a business credit application.

How To Create a Business Credit Application

The business credit application serves as a vital opportunity to prove to lenders that your company has no issues in terms of debt repayment and holds appropriate credit risk for the institution. For your business credit application to stand out above the rest, here are some tips you can utilize.

Tip #1: Check Your Personal Credit or Scores

There is an advantage in knowing the standing of your personal credit or score before applying for a loan, credit, or investment. It is essential because it is one of the significant factors that lenders use to evaluate an individual’s creditworthiness. You can get a copy of your annual credit report for free through the website annualcreditreport.com. It is especially advisable to check your credit reports on an annual basis to see if there are any mistakes or errors and take the necessary steps to correct the information. Make sure to visit the three national credit bureaus, Equifax, Experian, and Transunion, to see if the information you have for all three is accurate.

Tip #2: Check the Business’ Credit Reports and Scores

In seeking credit reports and scores for a business, business owners can go directly to Dun & Bradstreet, Experian Business, and Equifax Small Business. You can use these business credit reports and scores to decide the approval of business, loans, and credit. It is critical to note that businesses without registrations to credit reporting agencies will only have personal credit reports in credit risk assessments. Obtain your D-U-N-S® number to set up your company profile with Dun & Bradstreet for lenders to view your company’s credit scores and reports.

Tip #3: Indicate Strong Trade References

Providing lenders with competent trade references instills confidence in the business’s ability to repay loans or credit. Some suppliers do not report payment histories to credit bureaus. However, these are the trade references the company must have to supply the information for a business credit application. Your company’s trade references are one of the most reliable factors to measure the stability of a company’s financial health and management capabilities. Provide your trade references’ details by indicating the company name, address, and contact information.

Tip #4: State the Company’s Financial Status

Cash flow cycles provide detail for revenue coming in and out of business. It serves as an essential factor in determining whether a company has the ability to repay loans and credit. Guarantee that all financial statements are in order before applying for business credit. Most lending and financial institutions ask for profit and loss statements (P&L), cash flow statements, existing bank accounts, and other assets and investments a company is currently tied to.

Tip #5: Provide a Document of Your Business Plan

When it comes to loaning or asking for a line of credit, businesses often need to provide lending institutions with documentation of their business plan. Banks often request a standard summary of the company, its products or services, market, management, teams, and financial statements.

FAQs

What is a credit application form?

A credit application form collects necessary information from individuals applying for credit to help firms, agencies, and lending institutions to assess credit suitability settlements. A credit application form acquires full business details, contact information, financial details, payment terms, and guarantees.

How does the credit application process go?

Credit review processes are essential to guarantee that individuals filing for credit can comply with repayment terms, with consideration to interest rates and other fees. Through a manual system process, it starts with the receipt of a sales order, issuance of credit application, review of the application, designation of credit levels, sales order approval, and filing for credit documentation.

How long are credit applications valid?

As a rule of thumb, an individual must wait six months to a year before applying for a new line of credit. It is within this period that a person’s credit scores can increase by keeping your credit balance low and paying fees and other dues on time. However, if your credit score is already in good standing, applying for new credit can go through smoothly.

In any business, keeping your company in good credit standing helps with applying for loans or even new credit lines for the company. Ensure that the company pays its dues on time and that repayment is not of concern. It is also advisable to monitor the company’s financial health and management capabilities in business credit applications. Keep up to date with financial, cash flow, and profit and loss statements to support future business credit applications. In the article above, several business credit application samples are available for use and download for your company’s future credit requests.