7+ SAMPLE Cash Flow Forecast

-

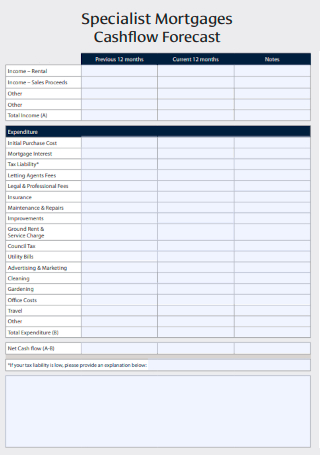

Specialist Mortgages Cashflow Forecast

download now -

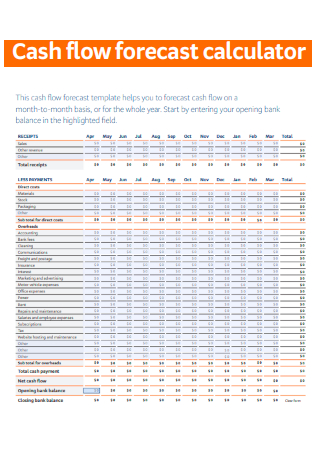

Cash Flow Forecast Calculator

download now -

Forecast Your Financing Needs With a Cash Flow Projection

download now -

Business Cash Flow Forecast

download now -

Twelve Month Cash Flow Forecast

download now -

Analysts Cash Flow Forecasts

download now -

Smart Cash Flow Forecasting

download now -

Cash Flow Forecasting and Behavioural

download now

What Is a Cash Flow Forecast?

Cash flow forecasting is forecasting the inflow and outflow of cash within a business over a specified time. A precise cash flow forecast enables businesses to forecast future cash positions, avoid crippling cash shortages, and earn the highest possible returns on any cash surpluses. According to statistics, automating the entire cash flow management process can save up to 90% of the time required to create and analyze a forecast using a spreadsheet manually.

Benefits of Cash Flow Forecast

Every day, small business owners face difficult financial decisions. The level of commitment and risk can be enormous, but this is changing with the advent of cloud analysis and the availability of more sophisticated reporting. Online cash flow solutions, in particular, have played a significant role in reducing business owners’ stress levels. However, some business owners are unaware of the benefits of cash flow forecasting; therefore, we’ve compiled a list of why business owners should use a cash flow forecast. However, what are the primary benefits of creating a cash flow forecast for your clients?

Types of Cash Flow

Cash flow reveals if a business has sufficient funds to operate. Any transaction involving cash or cash equivalents is recorded in a cash flow statement to maintain track of the business’s financial position and the closing cash balance at the end of the accounting period. Cash equivalents are securities that can be converted into cash within three months. Short-term government bonds, marketable securities, treasury bills, commercial papers, money market funds, and other short-term assets are included. If you’re still interested, the following describes the many forms of cash flows.

Tips In Making A Useful Cash Flow Forecast

Effective cash flow management is a crucial skill for company leaders to master if their organizations expand successfully. A well-thought-out strategy plan is worthless unless it is accompanied by a cash flow forecast that predicts the company’s cash requirements. Accurate cash flow forecasting is challenging because it entails measuring and monitoring numerous variables and making educated assumptions about the company’s performance. For business leaders who wish to be personally involved in estimating their companies’ cash flow, the following steps will get you started:

1. Cash flow is a more critical metric to track than earnings.

Too many business executives base their cash flow forecasting on the monthly profit and loss (P&L) statement. While your profit and loss statement is critical, it does not provide a clear picture of your organization’s cash going into and out. The cash flow statement is the direct source of information for determining your business’s financial requirements. This is because it takes noncash expenses such as depreciation and amortization. Additionally, it includes cash expenditures and inflows from operational activities, investment activities, and financing activities. You cannot generate an accurate cash flow forecast until you have mastered the fundamentals of your business’s cash flow statement.

2. Understand your business’s cash conversion cycle.

Understanding your business’s cash conversion cycle — the time required for a dollar spent to return to your bank account — is critical for monitoring and optimizing your cash flow. Business leaders should spend time with their finance and accounting departments to better understand how money enters and exits the organization from vendors and clients. Analyze variable costs, fixed costs, and other vital expenditures. Forecasting accurately requires knowing the timing and amounts of revenue and expenses that affect your cash flow.

3. Bear in mind seasonality.

There’s a good chance your company has seasonality. There will undoubtedly be months when customers are more interested in buying your company’s goods or services. Seasonality can have a substantial impact on your company’s cash flow. A solid cash flow forecast will predict when cash outlays and cash collections will be higher or lower, allowing you to manage the company’s working capital needs better.

4. Create a variety of scenarios.

Business executives must anticipate market shifts to prosper. Create several alternative cash flow scenarios to ensure that you are not caught off guard if client demand declines. Having a few models enables you to move decisively — rather than defensively — to prevent any negative impact on your company’s cash flow if revenue slows. On the other hand, if sales increase, the forecast will assist you in more effectively allocating resources to build the business.

5. Forecast monthly, quarterly, and yearly data.

Maintain a competitive edge by developing cash flow predictions for the near (weekly or monthly), medium (quarterly), and long (yearly) terms. The business’s requirements will define which time is most helpful. On the other hand, monthly or quarterly predictions are often more helpful for established, stable businesses. Weekly predictions will be critical for businesses expanding or undergoing significant changes, such as the reorganization or merger/acquisition.

6. Conduct a review, make necessary adjustments, and repeat.

Once you’ve created a prediction, revisit it frequently and make necessary revisions. I’ve worked with numerous business owners who haven’t examined their cash flow estimates in months. Your clients’ needs are constantly changing, as is the economy. Revisiting the prediction enables you to respond and adapt more quickly than your competitors. Cash is required to build a business, and having a reliable forecast enables you to make more informed decisions about maximizing your return on invested capital. If you follow these recommendations, you will be able to forecast your business’s financial demands more accurately and better position your organization for future growth.

How To Forecast Your Cash Flow

Forecasting cash flow entails estimating future sales and expenses. A cash flow prediction is critical for your business because it determines whether you will have enough cash to operate or expand. Additionally, it will indicate when the business is losing more money than it brings in. Cash flow is entirely dependent on timing, so while generating your forecast, make every effort to be as precise as possible with your inflow and outflow projections. Prepare your cash flow forecast by following these steps.

1. Predict your revenue or sales

To begin, select a time for forecasting. The majority of people choose monthly. To forecast your sales, examine last year’s numbers to determine if any trends emerge. You can alter your sales prediction based on whether sales increased, declined, or remained constant. If you’re starting a new firm and lack historical sales data, begin by calculating all cash outflows. This will give you a concept of the revenue required to cover it.

2. Calculate cash flow inflows

You’ll estimate your ‘cash inflows,’ or cash sources other than sales. These will vary by business but may involve a debt being repaid, the sale of an asset, owners investing further funds (adding additional equity) in the business, and royalties, franchise fees, or license fees.

3. Calculate outflows and expenses of cash

Calculate your cash outflows by determining the cost of items. Adjusting your actual cost of goods sold will be easier if you need to alter your sales figures later. Expenses can refer to funds used for administration or operation. These will also vary according to the nature of the firm.

4. Put them in your cash flow projection.

Because cash flows are all about timing and money movement, you must begin with an opening bank balance – this is your real cash on hand. Following that, total all cash inflows and subtract all cash withdrawals for each period. The closing cash balance is the figure at the end of each period. This will be the period’s opening cash balance.

5. Compare your projected cash flows to the actual

Once you’ve completed your cash flow projection, double-check your estimates against the period’s actual cash flows. This is the critical phase. This will emphasize any discrepancies between estimated and actual cash flow, allowing you to understand why your cash flow fell short of your expectations. If your organization is not generating enough revenue to maintain itself, you can make efforts to increase your cash flow.

FAQs

What is cash flow?

The direction of money in and out of business is called cash flow. Inflows are represented by cash received, and outflows are represented by cash spent. The cash flow statement is a financial statement that demonstrates how a company’s cash is generated and spent over a while.

How is cash flow determined?

Cash flow is estimated using the indirect approach by altering net income by adding or removing differences from non-cash transactions. Non-cash items are reflected in the changes in a company’s assets and liabilities over time on the balance sheet.

Why is cash flow preferable to profit?

A consistent, positive cash flow invested in your business’s expansion is a far superior strategy to clinging to little profits. Rather than that, continued cash flow increase can result in significant gains in the future. It is indicative of the organization’s long-term viability.

Cash flow forecasting is not an easy undertaking to undertake on your own. You can accomplish it with spreadsheets, but the procedure is tedious and error-prone. Fortunately, affordable choices may significantly simplify the process without the need for spreadsheets or in-depth accounting knowledge. Additionally, you can search for an available software application suitable for you.