Checkbook Register Samples

-

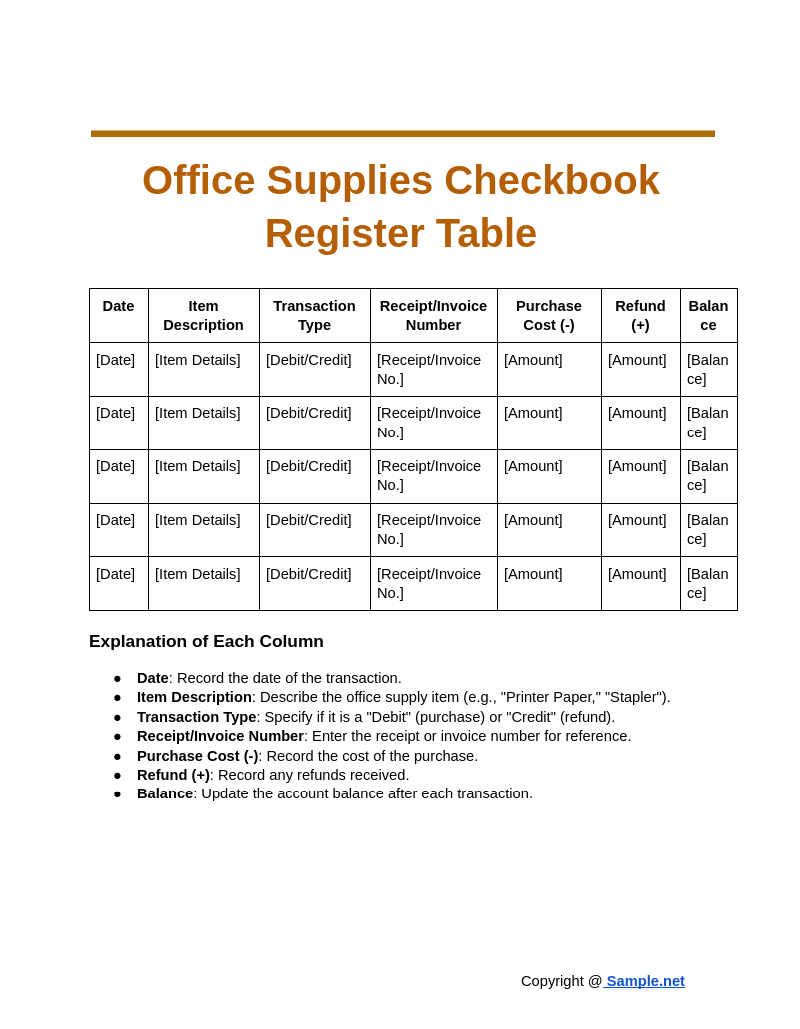

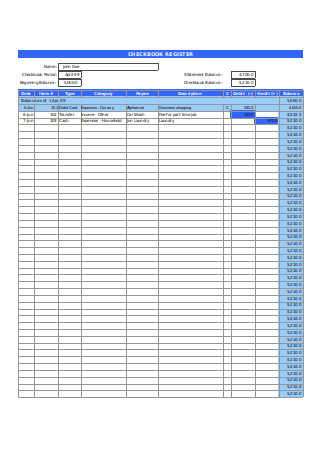

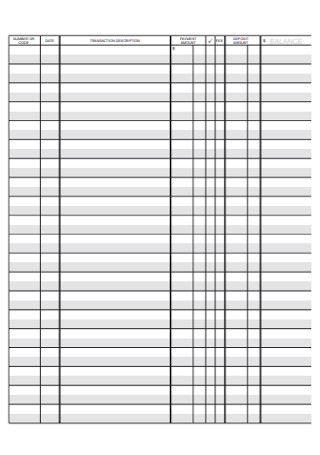

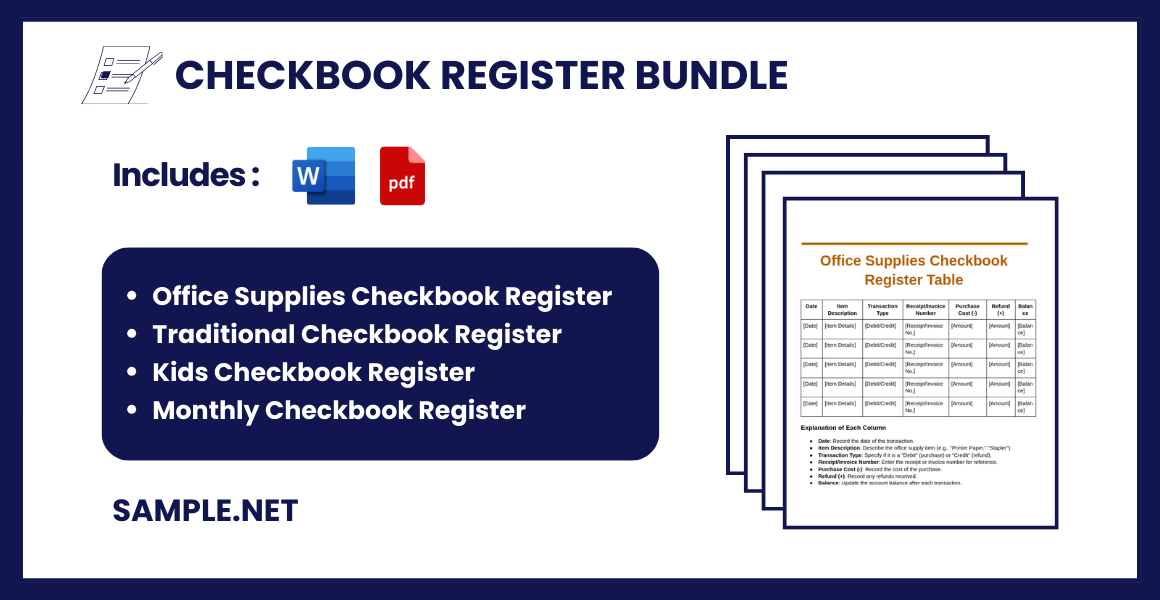

Office Supplies Checkbook Register

download now -

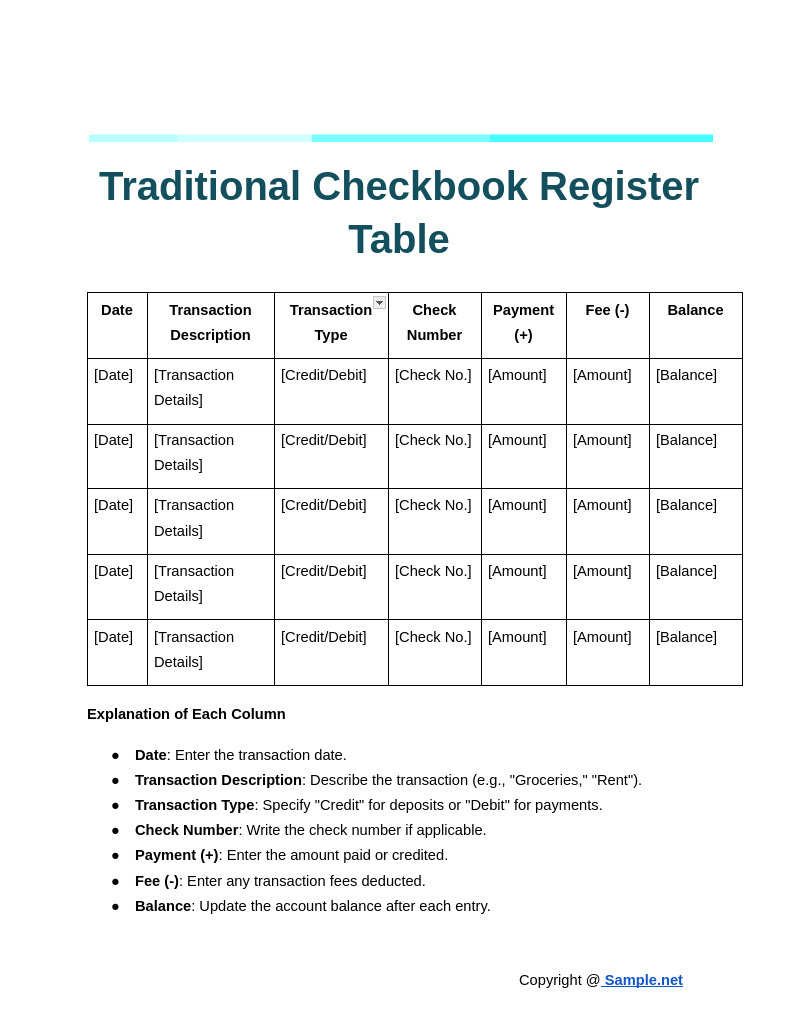

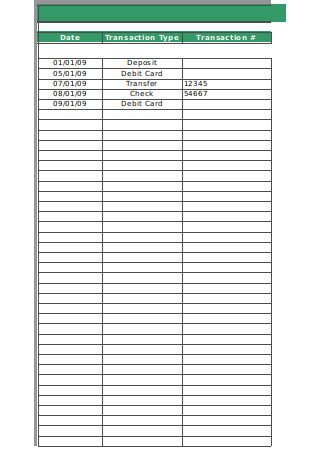

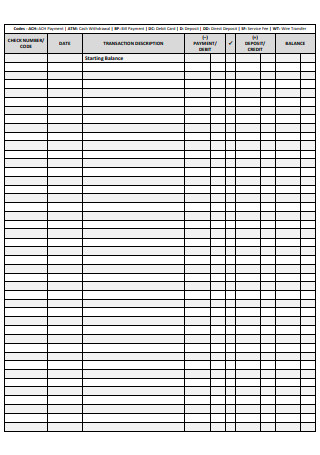

Traditional Checkbook Register

download now -

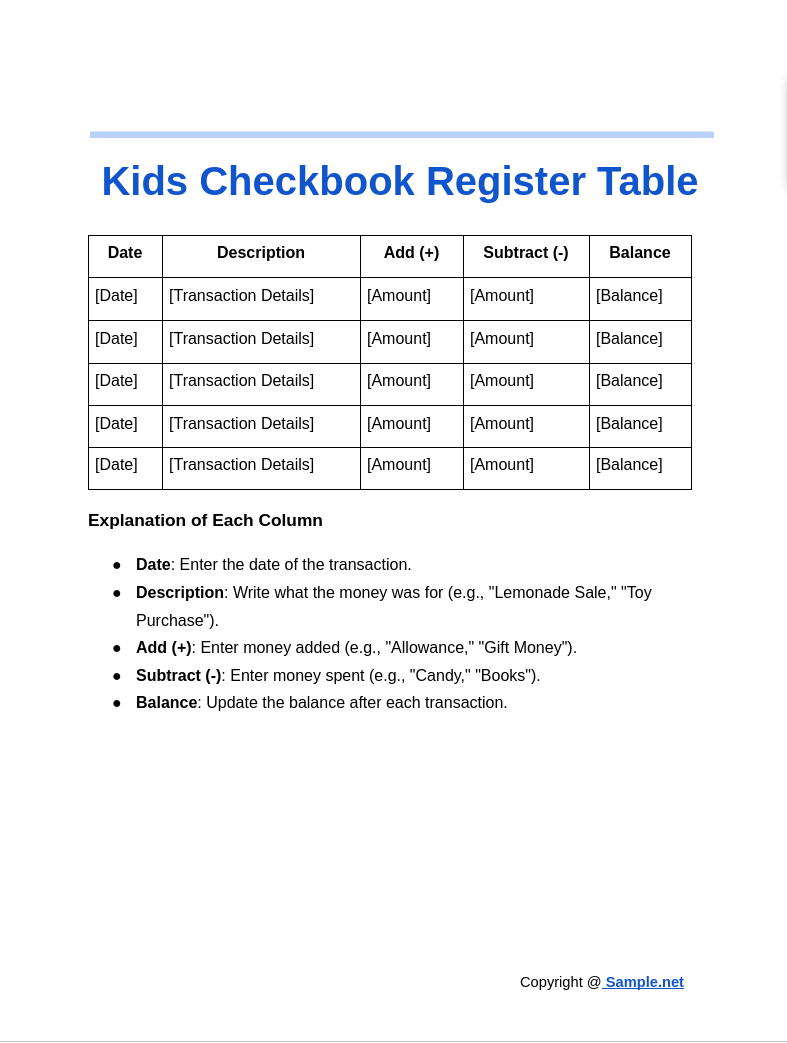

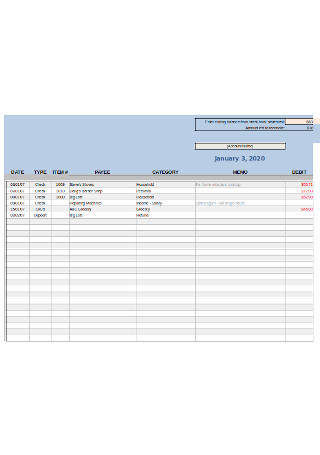

Kids Checkbook Register

download now -

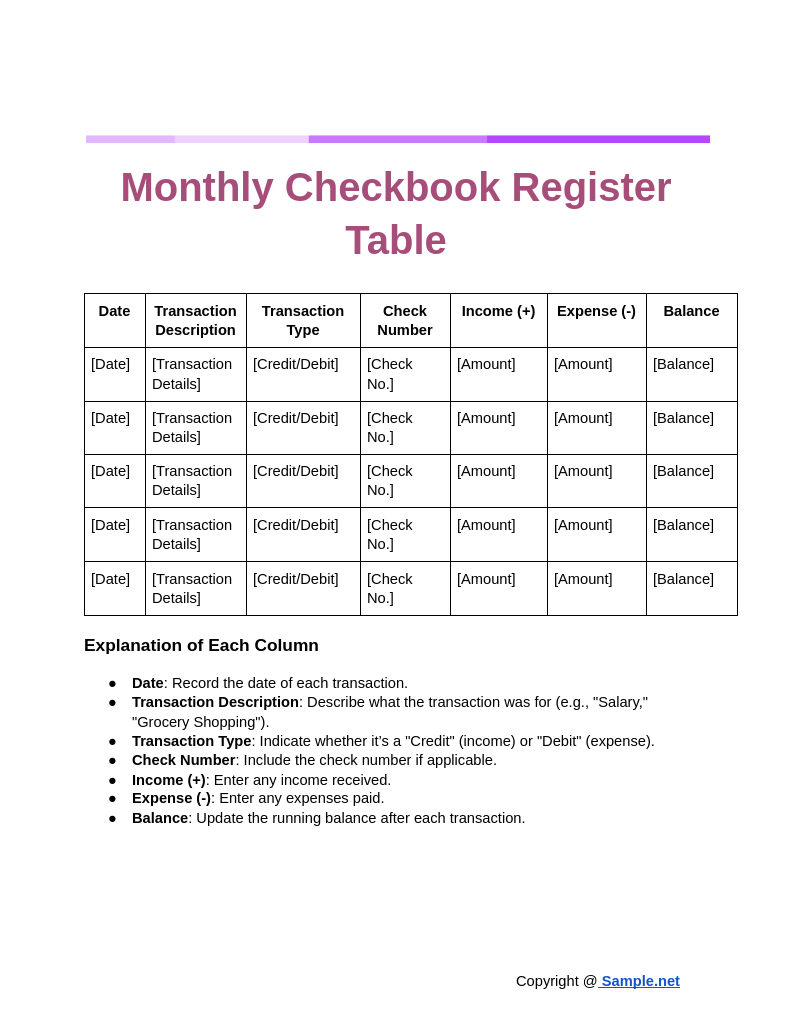

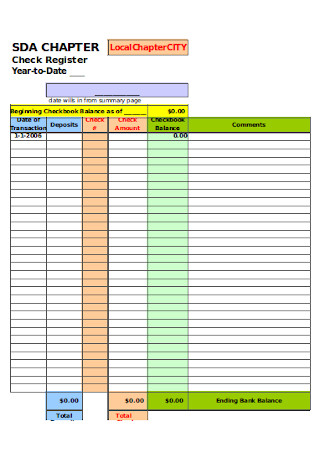

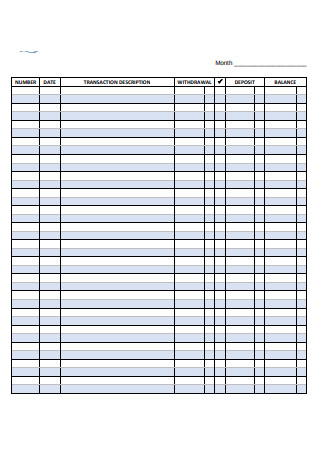

Monthly Checkbook Register

download now -

Checkbook Register Worksheet

download now -

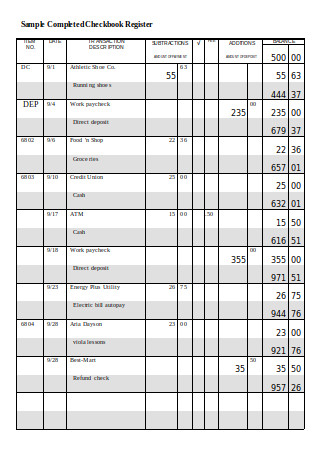

Sample Completed Checkbook Register

download now -

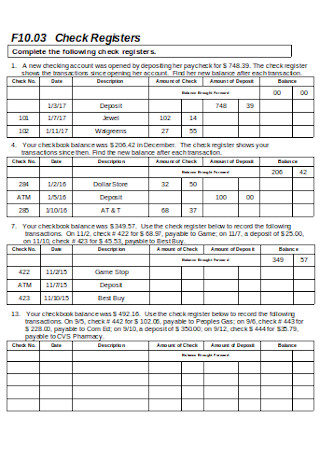

Check Registers

download now -

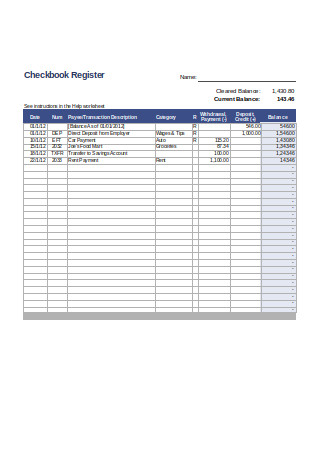

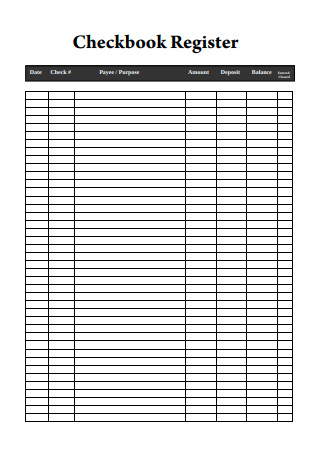

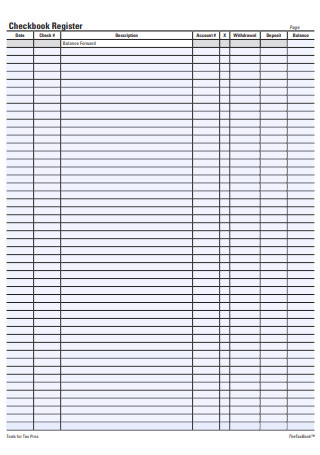

Checkbook Register

download now -

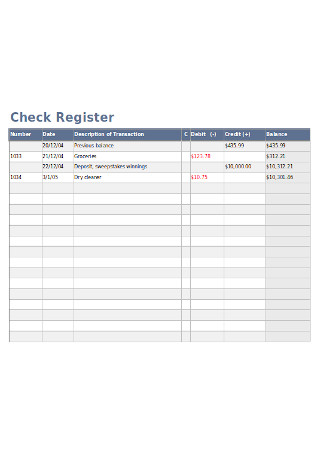

Check Register

download now -

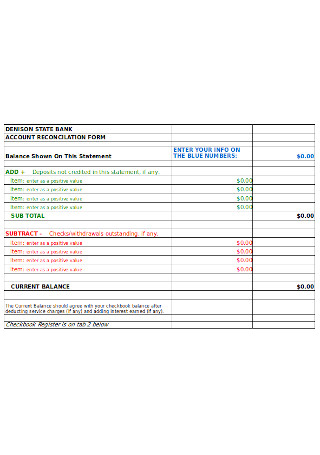

Account Reconciliation Form

download now -

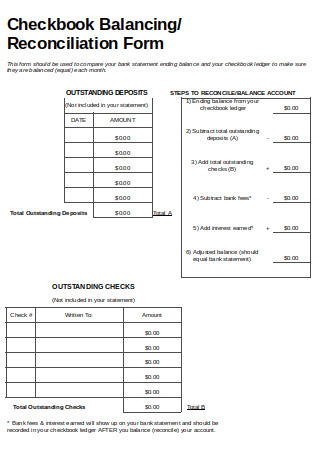

Checkbook Balancing/ Reconciliation Form

download now -

Check Log Template

download now -

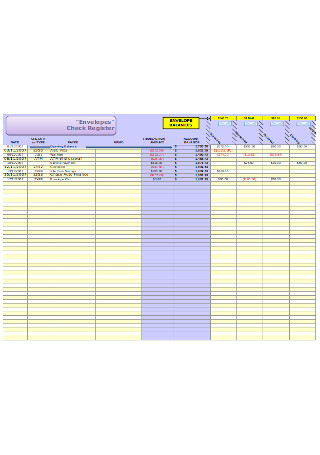

Checkbook Register Sample

download now -

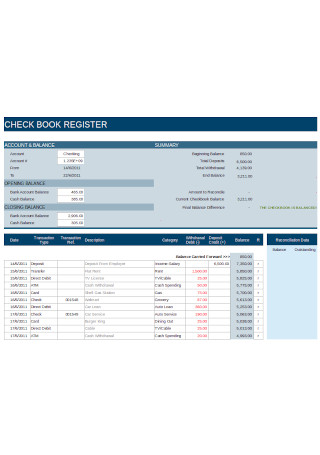

Check Book Register

download now -

Editable Checkbook Register

download now -

Checkbook Register Spreadsheet

download now -

Personal Checkbook Register

download now -

Check Register Template

download now -

Checkbook Balance Register

download now -

Blank Check Register

download now -

Printable Checkbook Register

download now -

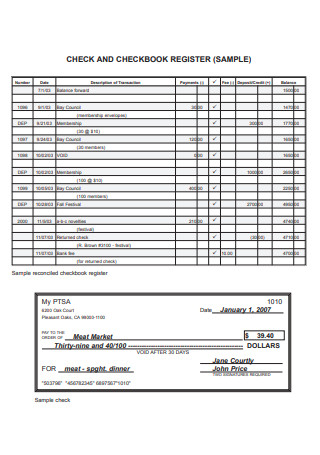

Check and Checkbook Register Sample

download now -

Manual Checkbook Register

download now -

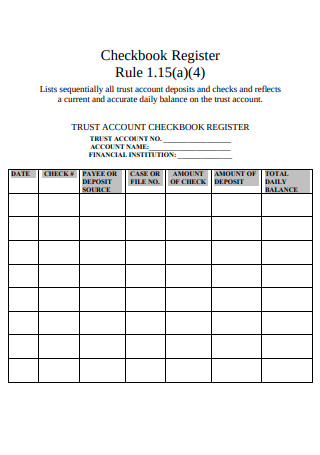

Trust Account Checkbook Register

download now -

Blank Printable Check Register

download now -

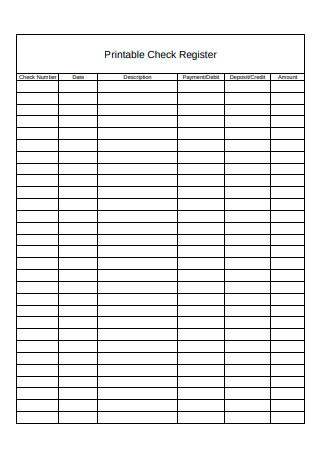

Printable Check Register

download now -

Simple Checkbook Register

download now -

Checkbook Reconciliation Sheet

download now -

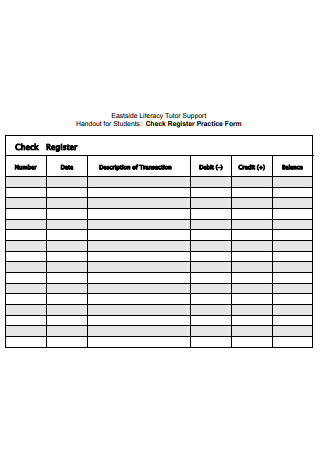

Check Register Practice Form

download now -

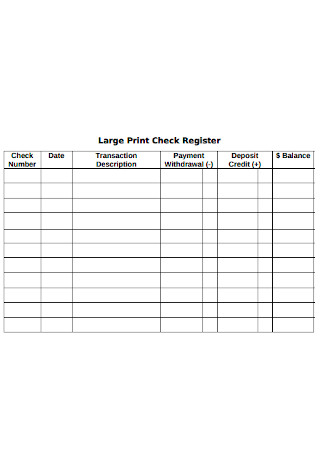

Large Print Check Register

download now -

Sample Checkbook Register Example

download now

FREE Checkbook Register s to Download

Checkbook Register Format

Checkbook Register Samples

What is a checkbook register?

Why should you use a checkbook register?

How to Balance a Checkbook Register

FAQ

What types of transactions appear on a checkbook register?

How different is a checkbook register from a general ledger?

Are there checkbook register applications?

How can one maintain a checkbook register?

Are digital checkbook registers more reliable than manual ones?

Why is it important to reconcile a checkbook register with a bank statement?

Download Checkbook Register Bundle

Checkbook Register Format

| Date | Description | Check No. | Category | Payment Method | Debit (-) | Credit (+) | Balance | Notes |

|---|---|---|---|---|---|---|---|---|

| YYYY-MM-DD | [Transaction Details] | [No.] | [Category] | [Method] | $0.00 | $0.00 | $0.00 | [Additional Details] |

Column Descriptions

- Date: Enter the date of each transaction.

- Description: Briefly describe the purpose of the transaction (e.g., “Grocery Store”, “Utility Bill”).

- Check No.: Include the check number if it’s a check payment. Leave blank for other payment types.

- Category: Specify the category, such as “Groceries,” “Utilities,” “Rent,” “Salary,” etc.

- Payment Method: Indicate the payment type, such as “Cash,” “Check,” “Debit Card,” or “Online Transfer.”

- Debit (-): Enter the amount spent, withdrawn, or paid.

- Credit (+): Enter the amount deposited or received.

- Balance: Update the running total of the account balance after each transaction.

- Notes: Include any relevant notes or additional information about the transaction.

What is a checkbook register?

A checkbook register is a ledger used to track checking account transactions, including deposits, withdrawals, and balance changes, providing an accurate record of account activities. You can also see more on Payroll Check Format.

Why should you use a checkbook register?

Considering the plethora of existing methods or alternatives to keep track and records of your business transactions, why exactly should you opt to use a checkbook register? Here, some of the multitude of benefits checkbook registers can grant to the efficiency of your business will be tackled, as they truly are an essential part in the accounting process through the real time depictions of your transactions, which is an exclusive good of the checkbook register. You can also see more on Sample Check Writing.

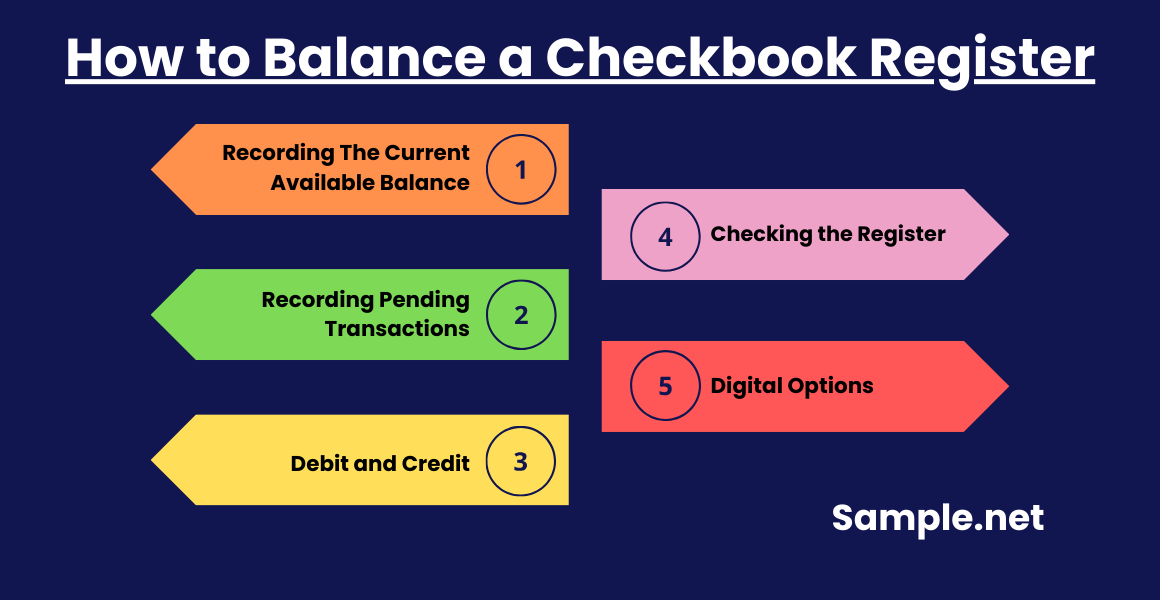

How to Balance a Checkbook Register

Your financial health is a priority especially when you are managing a business company. Balancing your checkbook register is a critical aspect in making sure your spending is still within the budget, and to see if your cash flow is doing well. Aside from that, balancing your document means that you are able to detect errors within the system which is something not easily done when records are all over the place and may cut you short due to cases relating to the delay in generating the actual expenses, hence making the process a lot more taxing. With this, you are able to make projections that allow you to have a more strategic way in managing your company and its transactions. In here, the process in balancing your checkbook register both manually and digitally will be tackled. You can also see more on Payroll Slip.

Step 1: Recording The Current Available Balance

The total available balance you own is important to keep track and take note of in making sure your document is holistic, and in order to obtain accurate results. To do this, go to your checking account and look for the current available balance, which is visible in your bank’s website and available to view using your electronic device. Record this amount in the area where you reflect your transactions.

Step 2: Recording Pending Transactions

Pending transactions are also a crucial part in balancing your checkbook register. The transactions that have not been cleared yet should be reflected in the document. These include checks that have been given by your company albeit not being cashed yet, or any forms of debit and credit. In this portion, you should write the date these amounts were given, as well as a description of the nature of this transaction. You can also see more on Registration Form.

Step 3: Debit and Credit

Debit and credit are two big parts in the world of transaction. In dealing with them, you must subtract the debits from your total balance. On the other hand, you must also add the credits to the overall amount.

Step 4: Checking the Register

Decide on a duration of time in order to settle on a period of how often you total and check if you have balanced your amounts. Check your bank account and compare it to your document to see if the transactions match and do not have any deficiencies. Double check your document as well to see if all of the contents are correct. You can also see more School Fee Receipt.

Step 5: Digital Options

As mentioned in the introductory part of what a checkbook register is, it has been mentioned that aside from manual methods of keeping such document, there is always the digital method, which is majorly universally considered as more efficient and more strategic in maintaining accuracy and even speed. Digital options are important to consider, such as software that does the job for you. Examples of which are Mint.com and Personal Capital which are generally called account aggregators. Their main purpose is to accumulate all of your financial accounts and project them in one place, making tracking easier for you. But of course, being shown your balance and finished transactions isn’t quite enough, which is why it is also advisable to use accounting programs that not only populate your spending and earning, but also walk you through how to balance your records efficiently. You can also see more on Petty Cash Receipts.

A checkbook register is essential for accurate financial management, helping you maintain control over your checking account. By tracking transactions consistently, you can avoid overdrafts, detect unauthorized transactions, and achieve better financial stability. Stay organized, informed, and confident with your money management. You can also see more on Biweekly Payroll.

FAQ

What types of transactions appear on a checkbook register?

All types of payments are present in a checkbook register since it is an all-recording tool used by companies to check and balance their spending. This includes, cash, wire transfers, checks, as well as credit and debit cards. The amounts reflected in a checkbook register are inclusive of any method of payment. You can also see more on Tracking Sheet.

How different is a checkbook register from a general ledger?

A checkbook register is posted in a general ledger after being completed. A general ledger is a compilation of accounts used by the company. It is very detailed, and contains the important account activities made by the company in a certain period of time. With that said, a checkbook register is part of the general ledger and does not make it up as a whole since the latter is only a summary of the accounts aspect of the company.

Are there checkbook register applications?

Yes. There are a lot of applications that make it easier for people to balance their transactions. These applications are not only for the benefit of small or big business companies, but also individuals on the ground who want to keep track of their spending and cash flow. Examples of which are Volkron Checkbook, Checkbook Pro, My Budget Organizer – Budget Planner with Sync, Chear Checkbook Money Management. You can also see more on Risk Registers.

How can one maintain a checkbook register?

For businesses, it is important to hire a good accountant to make sure that the financial skills needed to be able to keep a holistic checkbook register are present. Aside from that, the applications mentioned earlier on are also very helpful in making the task a lot easier and more comfortable for the working end. But generally, the most important skill to possess in being successful in maintaining a checkbook register is consistency. This is important in making the timely entries in the checkbook register, as it is a document that should be kept up to date, as well as ensuring that the entries are accurate in and of themselves. This cautionary trait is something that should be sustained in order to efficiently maintain our friendly accounting tool.

Are digital checkbook registers more reliable than manual ones?

Both digital and manual registers have their advantages. Digital registers offer convenience, automation, and real-time updates, while manual registers require discipline but offer a tangible understanding of transactions. You can also see more on Monthly Rent Receipt.

Why is it important to reconcile a checkbook register with a bank statement?

Reconciling the checkbook register with a bank statement ensures that both records match. It helps identify unauthorized transactions, errors, and discrepancies, promoting accuracy and preventing potential financial issues. You can also see more on Goal Trackers.