50+ Sample Agreement for Payment Plan Templates

-

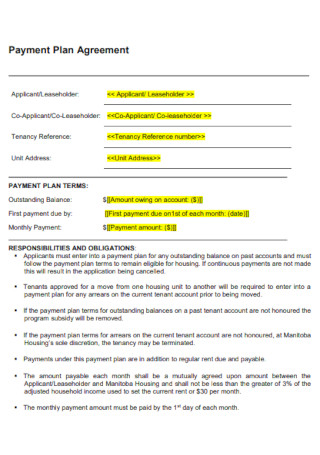

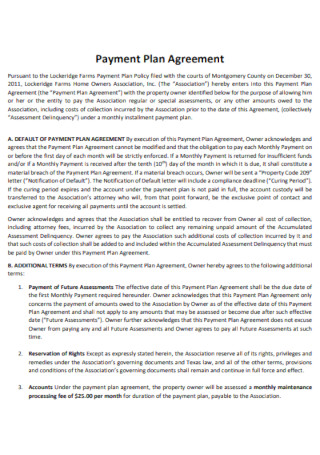

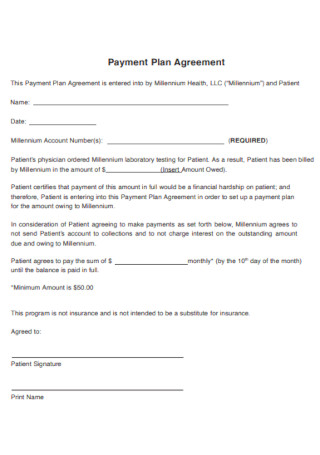

Sample Payment Plan Agreement Template

download now -

Payment Plan Agreement for Outstanding Charges Template

download now -

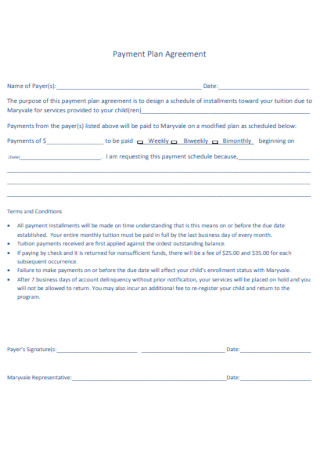

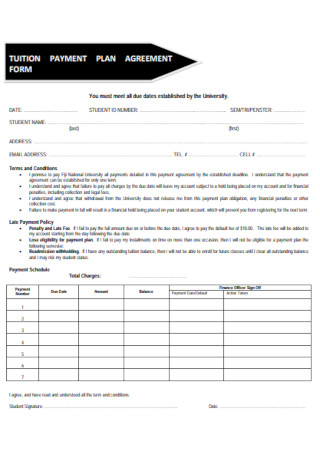

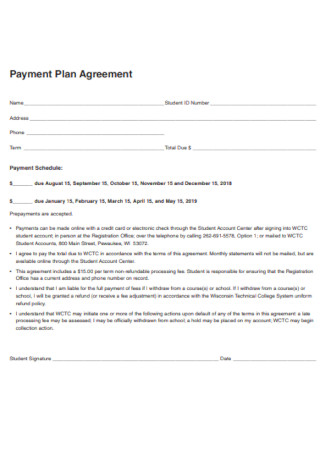

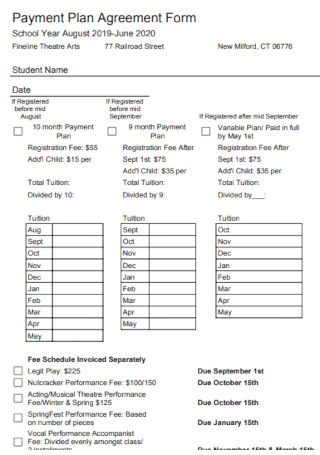

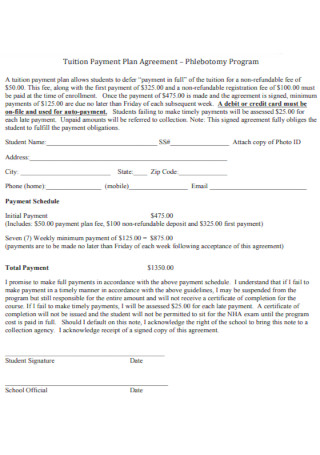

Tution Payment Plan Agreement Form

download now -

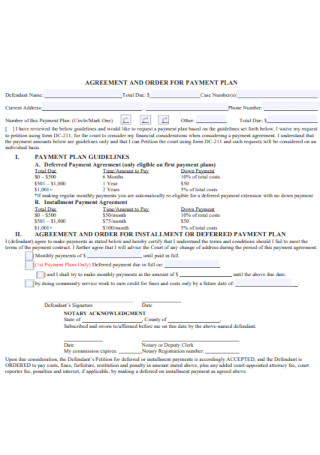

Agreement and Order for Payment Plan

download now -

Basic Payment Plan Agreement Template

download now -

Payment Installment Plan Agreement

download now -

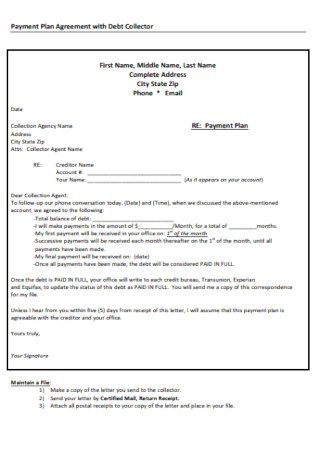

Payment Plan Agreement with Debt Collector

download now -

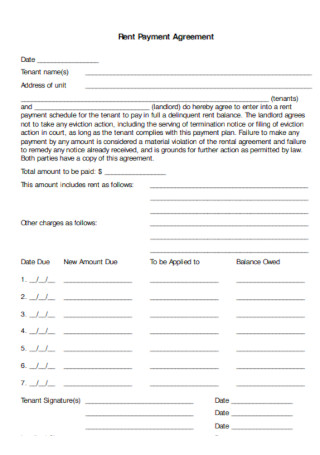

Rent Payment Plan Agreement

download now -

College Monthly Payment Plan Agreement

download now -

Sample Tution Payment Plan Agreement Form

download now -

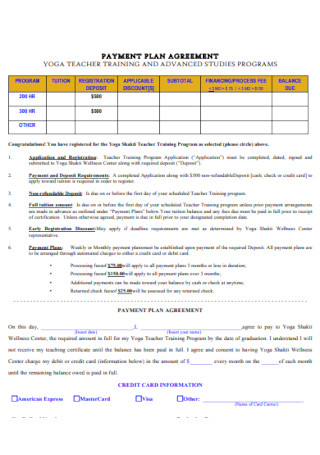

Yoga Teacher Payment Plan Agreement Template

download now -

Office Payment Plan Agreement

download now -

Standard Payment Plan Agreement Template

download now -

School of Medicine Payment Plan Agreement

download now -

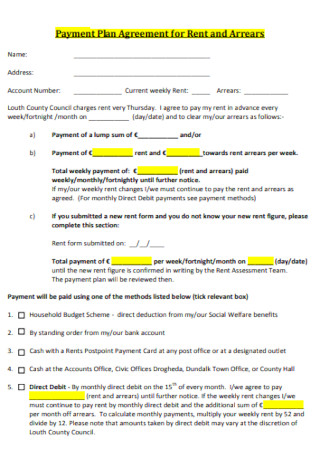

Payment Plan Agreement for Rent and Arrears

download now -

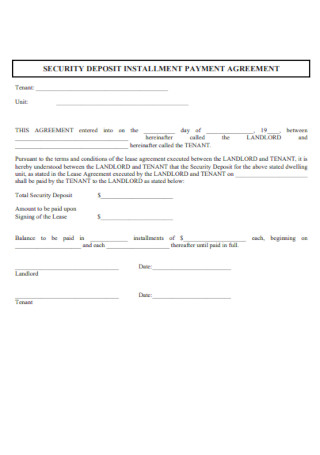

Security Deposit Installment Payment Plan Agreement

download now -

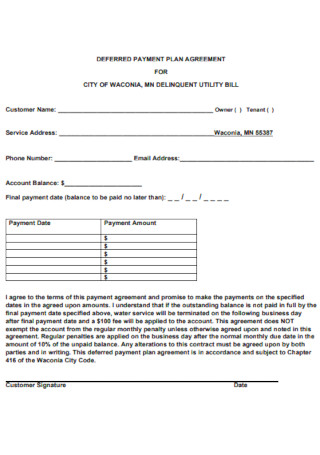

Sample Deferred Payment Plan Agreement

download now -

Tuition Payment Plan Loan Agreement

download now -

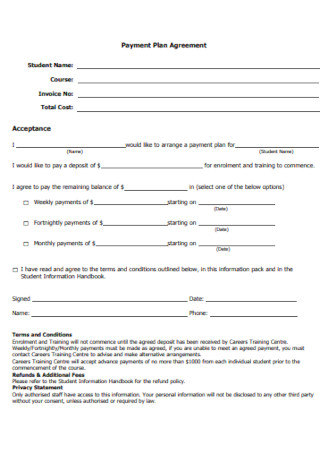

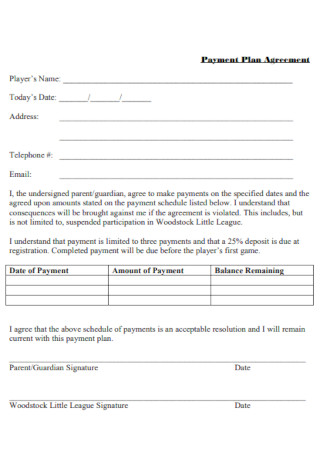

Simple Payment Plan Agreement

download now -

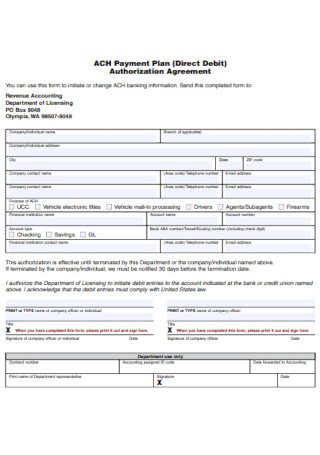

Payment Plan Authorization Agreement

download now -

Partial Payment Plan Agreement

download now -

Formal Payment Plan Agreement

download now -

Basic Deferred Payment Plan Template

download now -

Post-Tenancy Payment Plan Agreement

download now -

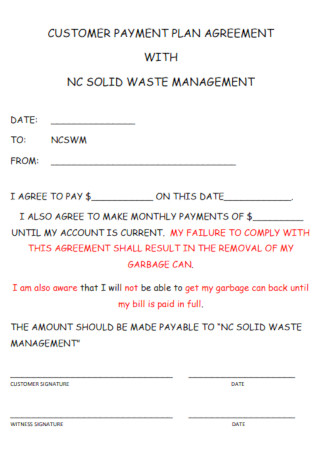

Sample Customer Payment Plan Agreement

download now -

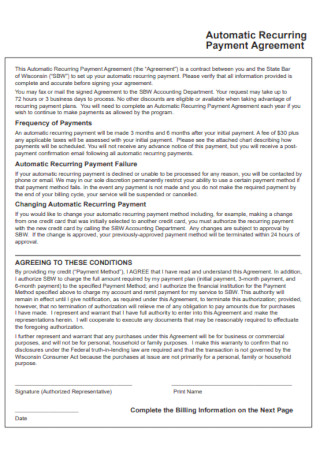

Automatic Recurring Payment Plan Agreement

download now -

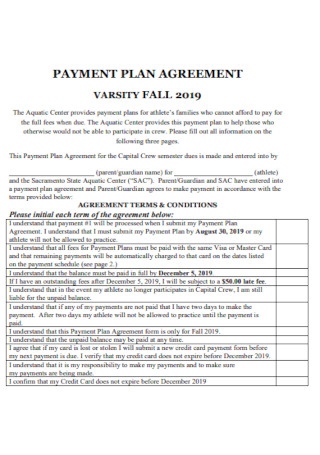

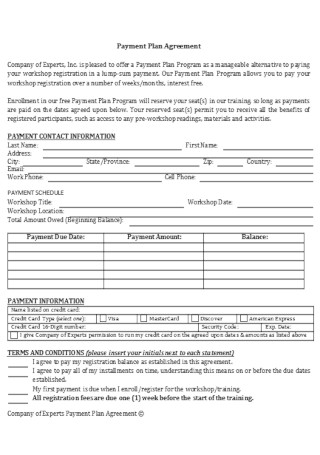

Sample Program Payment Plan Agreement Template

download now -

Petition for Payment Plan Agreement Template

download now -

Direct Debit Payment Plan Agreement

download now -

College Payment Plan Agreement Template

download now -

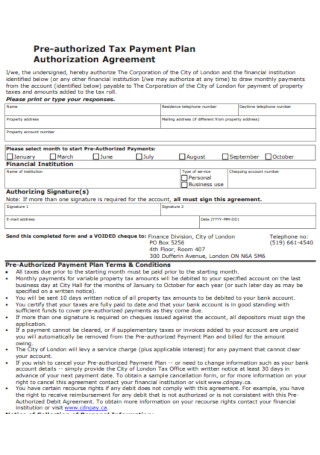

Pre-authorized Tax Payment Plan Authorization Agreement

download now -

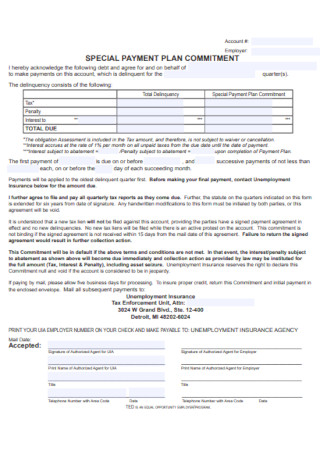

Special Payment Plan Commitment Agreement

download now -

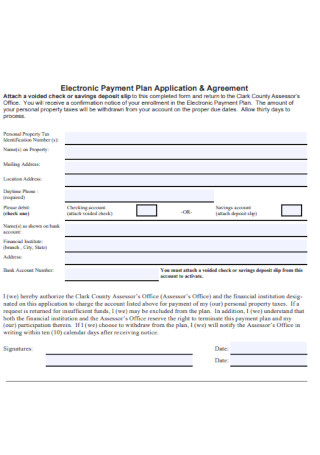

Electronic Payment Plan Application Agreement Template

download now -

Tuition Installment Payment Plan Agreement

download now -

Corporation Payment Plan Agreement

download now -

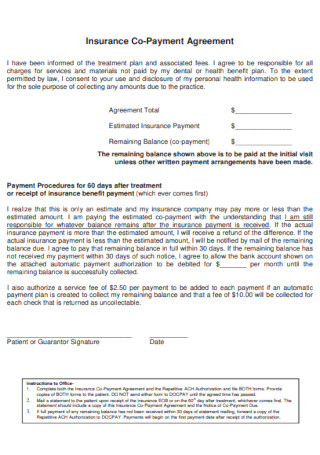

Sample Insurance Co-Payment Plan Agreement

download now -

Payment Plan Agreement Form Example

download now -

Payment Plan Agreement Format

download now -

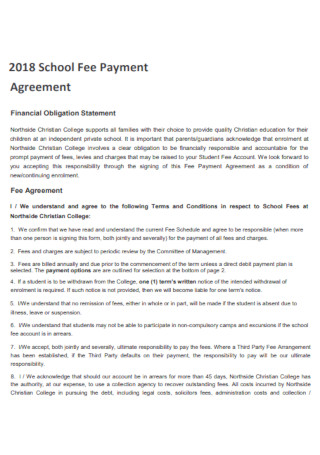

School Fee Payment Plan Agreement Template

download now -

School Program Payment Plan Agreement

download now -

Heallth Payment Plan Agreement Template

download now -

Student Payment Plan Agreement

download now -

Tuition Program Payment Plan Agreement

download now -

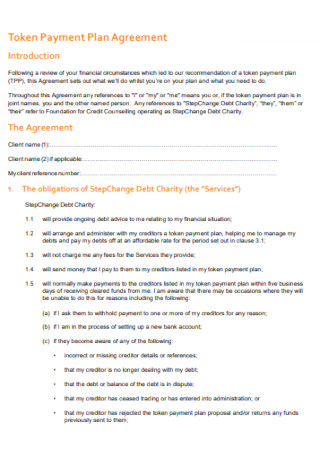

Sample Token Payment Plan Agreement

download now -

Academy Installment Payment Plan Agreement

download now -

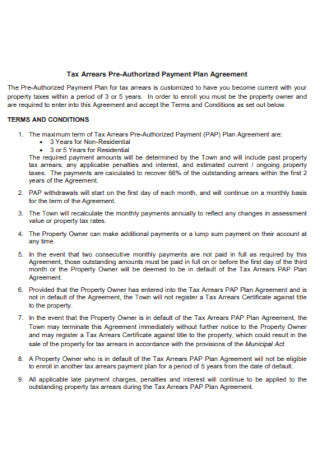

Tax Arrears Pre-Authorized Payment Plan Agreement

download now -

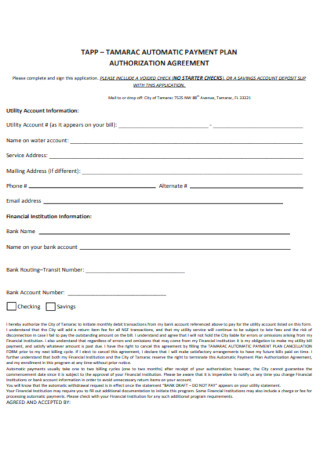

Automatic Payment Plan Authorization Agreement Template

download now -

Formal Payment Plan Agreement Example

download now -

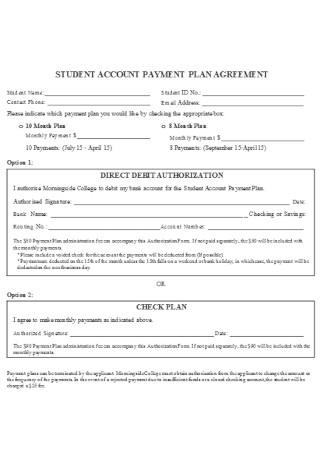

Student Account Payment Plan Agreement

download now -

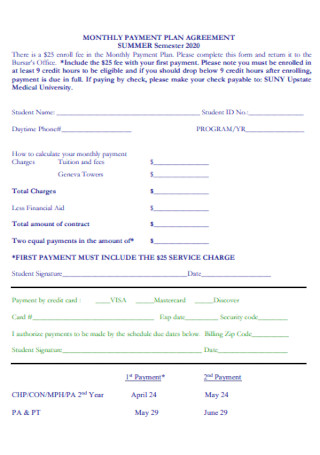

Sample Monthly Payment Plan Agreement

download now -

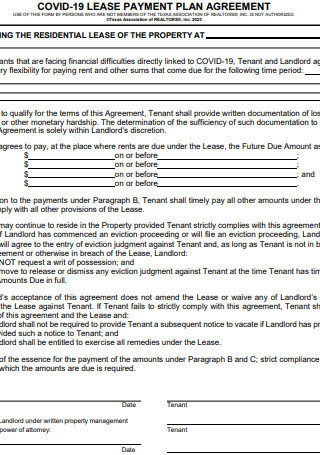

Lease Payment Plan Agreement

download now

FREE Agreement for Payment Plan s to Download

50+ Sample Agreement for Payment Plan Templates

What is an Agreement for Payment Plan?

Ways to Effectively Keep Up with Your Payment Plan

How To Draft an Agreement for Payment Plan Template

FAQs

What is financial planning?

What is an installment payment plan with the Internal Revenue Service?

Does the IRS send a bill?

What are the reasons why some individuals cannot keep up with their IRS installment plan?

What will happen if you miss a payment?

What is an Agreement for Payment Plan?

The idea of someone paying for a particular thing over a set timeline is called a payment plan. Payment can be for debt, tuition, rent, car, etc. An agreement for the payment plan is a contract between a payer and a payee that sets out the terms and conditions for settlement. It simply outlines the obligations of a payer towards a payee. It is a type of loan where the creditor allows one to have a deal with the payer while considering his/her financial situation. Usually, there is little to no interest in payment as long as it is given on time.

Ways to Effectively Keep Up with Your Payment Plan

According to a study conducted by the Federal Reserve in 2018, most Americans see themselves as stable financially, but about one-third of these Americans are just $400 away from being financially unstable. Keeping up with your payment plan can be hard, especially when you’re at the edge of being broke. To effectively keep up with your payments, you must do financial planning first. So, below are the ways to push through with your payment plan.

How To Draft an Agreement for Payment Plan Template

For a payee to be confident of a payer’s commitment, a written payment plan agreement is necessary. Also, to avoid any conflicts or misunderstandings in the process, the agreement will be the basis for resolution. Follow the steps below to create a sample agreement for a payment plan template.

Step 1: Write Some Basic and Identifying Information

The basic and identifying information of the parties involved is partly what makes a contract binding. In this section of the agreement, the complete legal names of both the payer and the payee are written. Also, don’t forget to include the date the contract takes effect.

Step 2: Lay Out the Payment Terms

Layout in detail what goods or services the payee offers and the amount of payment the payer is accountable for. Write a description of the goods and services rendered. Also, include the schedule for payment, whether it be weekly, bi-weekly, or monthly. Make a timeline list and don’t forget to input the payment conditions. Moreover, determine the mode of payment, whether it be cash, credit card, check, or bank transfer. Lastly, incorporate a policy for delayed payments and interest charges.

Step 3: Include a Condition for Termination

Not all agreements push through in the end, especially if the debtor can no longer continue with the payment plan. It is important to clearly state the process of contract termination. Also, include statements on how you will deal with conflicts or disagreements that may arise. Don’t forget to note a penalty fee if the payer cannot continue with the agreement that he has begun. Moreover, decide on how you will resolve conflicts, will it be through arbitration or a court, and also take note of the governing law of your state.

Step 4: Finalize the Agreement

In the last section of the paper, put a date, and leave a space for the payer and payee to sign. State that, by affixing their signatures on the document, they both agree to everything that is written in the contract. Normally, two copies are made for both parties to sign and keep.

FAQs

What is financial planning?

The process of wisely controlling your money to reach your goals, while making some financial sacrifices is called financial planning. To make a realistic plan, goals must first be identified. Then, information is collected to study and assess your status financially. After that, the plan can be executed. Keeping an eye on your progress and goals together will help you achieve your dreams.

What is an installment payment plan with the Internal Revenue Service?

If you don’t have enough money to settle your taxes, the IRS can help you through an installment plan. This type of payment plan helps you to clear up your taxes without any levies. You will still have to pay for interest and penalties if you delay paying taxes, but it will surely help in making payments less burdensome. The monthly payment depends on your debt, but you are given some freedom to choose the amount you are willing to pay for every month. It is the Internal Revenue Service’s job to consider what you can presently afford.

Does the IRS send a bill?

Yes, IRS sends a bill to individuals who forget to send their payments, and one shouldn’t ignore this notice. The IRS demands high penalties for unpaid debts. As much as possible, immediately pay your taxes in full through a debit card, credit card, check, or fund transfer.

What are the reasons why some individuals cannot keep up with their IRS installment plan?

As we’ve mentioned earlier, the IRS provides installment plans for taxpayers who have a hard time paying their taxes fully. The program gives people a chance to fit their budget with their taxes, but there are instances where taxpayers also cannot pay their installment payment agreements. Unforeseen events such as an illness, a disability, a family member’s death, or job loss can be reasons why they are challenged financially.

What will happen if you miss a payment?

If a person misses a payment with the IRS, but pay it as soon as possible, the installment agreement will stay the same. Remember that penalties apply to late payments. The IRS allows only 30 days for an individual to miss a payment. After the 30 days, the IRS will have the power to terminate the agreement. This means that you have to face your debts alone with levies.

An agreement for payment plan helps people get in touch with their payment obligations. Without one, payers will have the opportunity to take advantage of their creditors. Though statistics show that people have been paying their settlements better than the previous years, payment plan contracts still serve as a protection for payees.