16+ Sample Asset Purchase Agreement

-

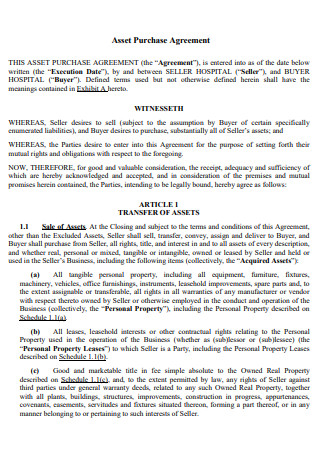

Asset Purchase Agreement Template

download now -

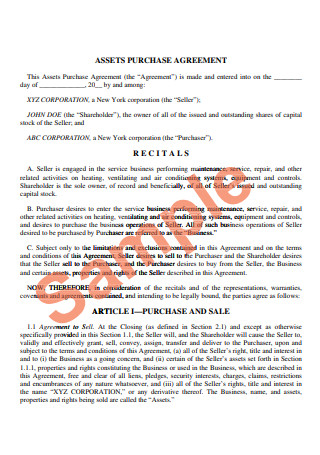

Sample Asset Purchase Agreement

download now -

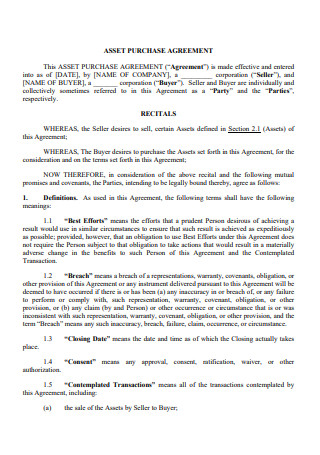

Basic Asset Purchase Agreement

download now -

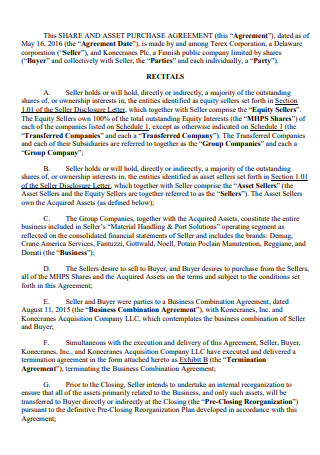

Share and Asset Purchase Agreement

download now -

Formal Asset Purchase Agreement

download now -

Asset Sale and Purchase Agreement

download now -

Asset Purchase Agreement in PDF

download now -

First Amendment to Asset Purchase Agreement

download now -

Standard Asset Purchase Agreement

download now -

Stock and Asset Purchase Agreement Template

download now -

Asset Purchase Agreement Example

download now -

Printable Asset Purchase Agreement

download now -

Asset Purchase Agreement Disclosure Schedule

download now -

Simple Asset Purchase Agreement

download now -

Asset Purchase Agreement Format

download now -

Draft Asset Purchase Agreement

download now -

Asset Purchase Agreement in DOC

download now

FREE Asset Purchase Agreement s to Download

16+ Sample Asset Purchase Agreement

What Is an Asset Purchase Agreement?

Components of an Asset Purchase Agreement

Steps in the Asset Purchase Transaction Process

FAQs

How does an asset purchase work?

Who is responsible for drafting the asset purchase agreement?

What is the difference between an asset purchase and a stock purchase?

What Is an Asset Purchase Agreement?

An asset purchase agreement goes by many names in the industry. Asset sale agreement, business purchase agreement, or APA all refer to the same thing. It is a legally binding and written document that formalizes an arrangement of purchasing a significant portion or whole of a business asset. It details the structure of the deal, including the agreed price, limitations, and implemented warranties. Assets purchase agreements contain legal and financial implications. As such, it is advisable to seek the aid of a corporate attorney in creating the document or negotiating the deal of the agreement. Having expert counsel guarantees that the arrangement is fair, unbiased, and enforceable under the rule of law.

According to the Sovereign Wealth Fund Institute’s Top 100 Largest Company Rankings by Total Assets, AT&T, from North America, is the world’s largest company by total assets, with an estimated worth of 551 billion US Dollars. After which is followed by Royal Dutch Shell PLC from Europe with an estimated asset value of 404 billion US Dollars. Exxon Mobil Corporation from North America completes the top three list of companies, trailing 355 billion US Dollars worth of total assets.

Components of an Asset Purchase Agreement

An asset purchase agreement is an essential document whether you choose to buy or sell parts of an asset or the existing business to another individual or entity. Depending on the terms and details parties agree on, the asset purchase agreement varies in its length and content. As such, there is a fundamental structure when it comes to an asset purchase agreement that remains similar, regardless of stipulations.

Steps in the Asset Purchase Transaction Process

When it comes to selling or buying parts of an asset or the business as a whole, you must know the indicative differences of purchasing assets or shares of the company. Below is a helpful guide that outlines the steps and methods when acquiring assets of a business.

Step 1: Identify the Parties Involved in the Asset Purchase Agreement

Correctly identifying the purchaser and seller of assets is the most fundamental step of creating the asset purchase agreement. This step is especially critical when dealing with corporate entities that contain multiple and independent sub-divisions within the organization. It is the duty of the individual creating the document to identify the participating entity in the agreement. The typical purchase agreement will always distinguish the buyer and seller in the document explicitly. Afterward, it specifies the individual or group of individuals by outlining their names and addresses in the agreement.

Step 2: Carefully Outline the Assets to Be Purchased by the Buyer

It is necessary to indicate the supposed asset list of purchase by the buyer. The agreement must accurately and descriptively recognize the assets as possible. When the asset purchase agreement deals with land purchase, the document must identify the accurate description of the area, similar to official land records. It includes details including acreage, erected buildings, and available space for construction or other purposes. In terms of a business purchase, the agreement must list out all related equipment. When making a service purchase, the document must indicate the nature of services and their inclusions. The further precise the list is, the better. Remember that the file must be similar to the official and government records relating to the purchase.

Step 3: Indicate the Asset Price in the Agreement

Price is an essential element associated with the agreement, just as vital as stating the payment terms. It is especially effective when communicating about buyer financial situations. Debts are also part of the price negotiations, particularly in circumstances of loaned assets. It is critical to indicate who shoulders the responsibility of paying off any remaining payments. It must also include if the buyer decides to deliver fees as a whole or in installments.

Step 4: Indicate the Necessary Representations and Warranties

After indicating the price of the assets for sale, the asset purchase agreement must also include representations and warranties to guarantee the condition or quality of the identified assets in the document. It also ensures the legal status of both parties agreeing. The warranty statement is an understanding between the buyer and seller in situations where the asset is inadequate to preexisting conditions. If the seller fails to secure the quality, they suffer the accompanying consequences, including termination of contract and litigation provisions.

Step 5: Identify the Pre-closing Conditions

The pre-closing requirements include details relating to the delivery of purchase price, sale approval of third-party entities, including government agencies, and other related adjustments or revisions before the closing of the sale. It is also advantageous to indicate any information regarding price adjustments, and these changes depend on interest rates, balance sheet discrepancies, price capital, amortization changes, and net asset values. Identify who handles tax payments and other transactions regarding properties.

Step 6: Be Cautious of the Use of Boilerplate Language in the Agreement

Boilerplate language is a uniform passage that is present across various types of documents, including contracts and agreements, often parts of templates that can be filled or personalized, depending on its use. As it is generic and standard in multiple documents, make sure to change the necessary information relating to provisions like jurisdiction and governing laws. It must include a severability clause to protect the entirety of the agreement in case some provisions are invalid or illegal, with modifications or amendments to the document.

FAQs

How does an asset purchase work?

The first step of asset purchasing is notifying the selling company of the intention to buy. A letter of intent is the starting point of the transaction between the parties. The letter discusses topics, including the value exchanged for assets, escrow account requirements, timeline negotiations, buyer exclusivity, prohibited activities, warranties, guarantees, termination conditions, among others. It is advisable to seek the aid of legal counsel when creating the letter of intent as it bears legal and financial indications.

Who is responsible for drafting the asset purchase agreement?

Remember that the asset purchase agreement is a legal and binding document. Corporate lawyers hold the responsibility to draft these important documents. Guarantee that the legal counsel is practicing and licensed to give legal advice and guidance to topics, including decision-making matters, constructing agreements, and protecting your legal rights for the contract duration. Speak to an attorney first to recognize your objectives, present recommendations, and collate the necessary documents to help you draft the asset purchase agreement.

What is the difference between an asset purchase and a stock purchase?

When it comes to an asset purchase, the purchaser agrees to buy particular assets and liabilities. Meaning, the buyer takes on the risks only of the acquired assets and may include assets such as equipment, furniture, licenses, trademarks, accounts payable, and receivable, among others. Upon the completion of an asset purchase transfers to the new entity from the old and undergoes identifications. On the other hand, a stock purchase agreement happens when the buyer purchases the entire company or business with all assets and liabilities.

Agreements are documents that require the aid and attention of legal lawyers or attorneys. Since most of these documents are legally binding, it is critical to put the security of an individual above others. When making agreements, it is also necessary to conduct proper research on its content. Aside from that, it is also vital to investigate the company to create a relationship, ensuring they are reliable and legitimate. Ensure that your asset purchase transaction goes smoothly by comparing it with the selection of asset purchase agreement samples above for use and download.