29+ SAMPLE Auto Pay Agreement

-

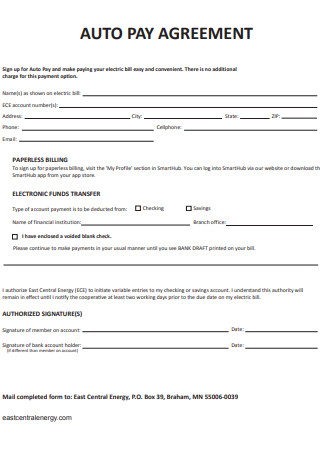

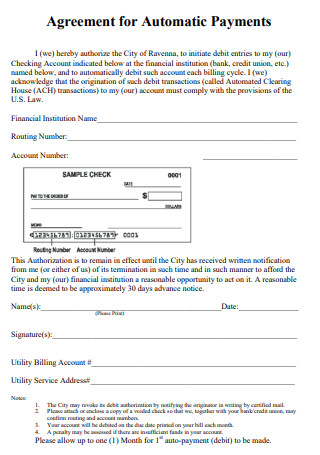

AutoPay Agreement

download now -

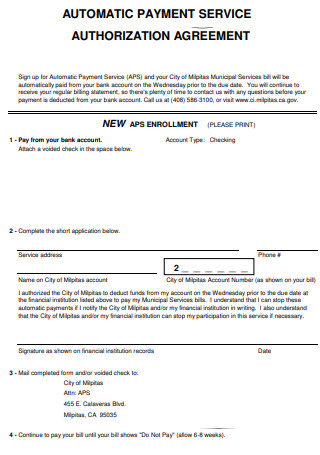

AutoPay Service Authorization Agreement

download now -

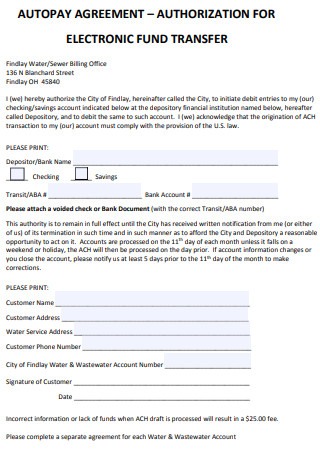

AutoPay Agreement for Electronic Fund

download now -

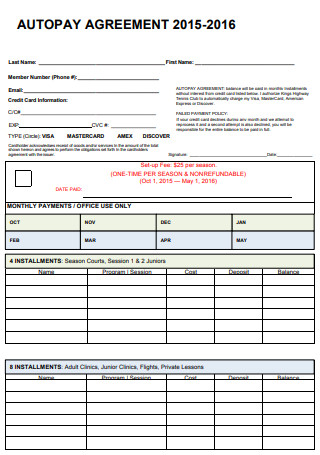

Autopay Billing Agreement

download now -

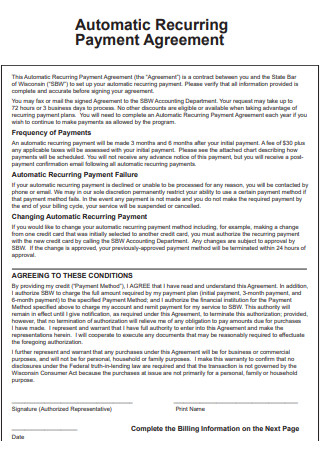

Automatic Recurring Payment Agreement

download now -

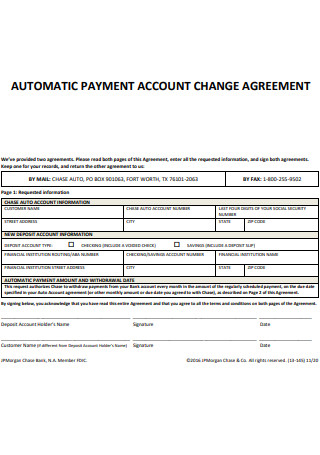

Automatic Payment Account Change Agreement

download now -

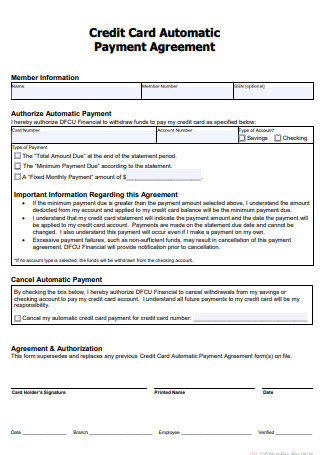

Credit Card Automatic Payment Agreement

download now -

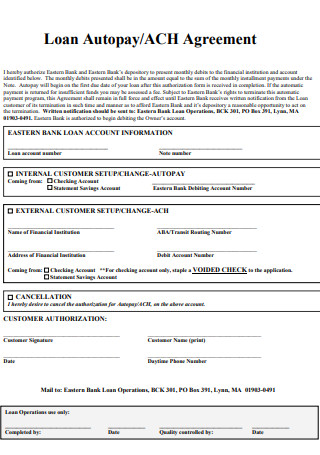

Loan Autopay Agreement

download now -

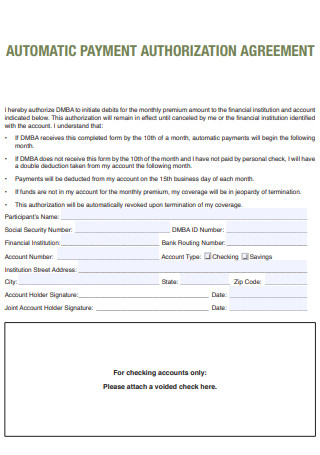

Automatic Payment Authorization Agreement

download now -

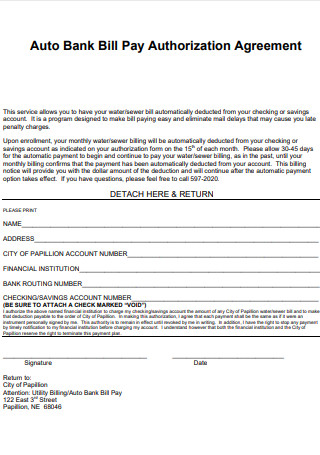

Auto Bank Bill Pay Authorization Agreement

download now -

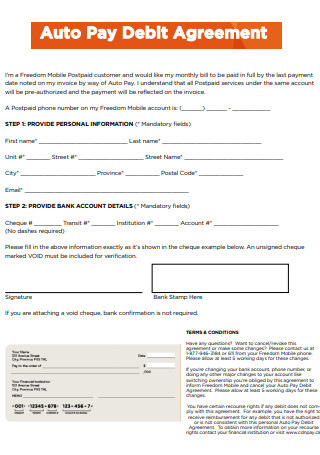

Auto Pay Debit Agreement

download now -

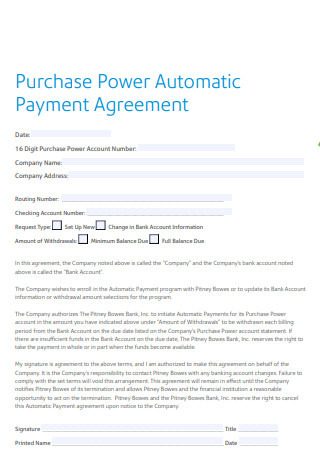

Purchase Power Automatic Payment Agreement

download now -

Automatic Payment Account Agreement

download now -

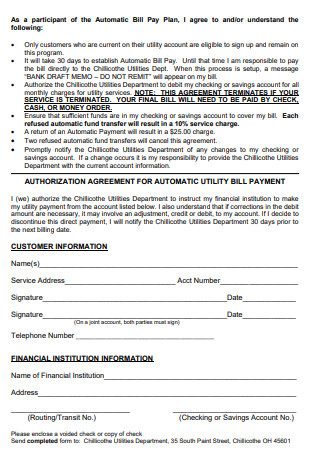

Automatic Utility Bill Payment Agreement

download now -

Sample Automatic Payment Agreement

download now -

Simple Auto Pay Agreement

download now -

Automatic Payment Service Agreement

download now -

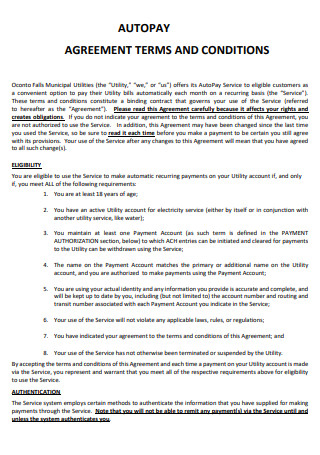

Auto Pay Agreement Terms And Conditions

download now -

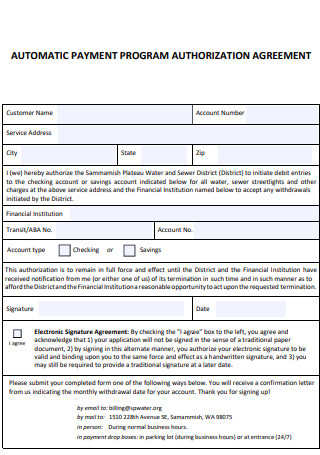

Automatic Payment Program Agreement

download now -

Automatic Payment Provider Agreement

download now -

Basic Auto Pay Agreement

download now -

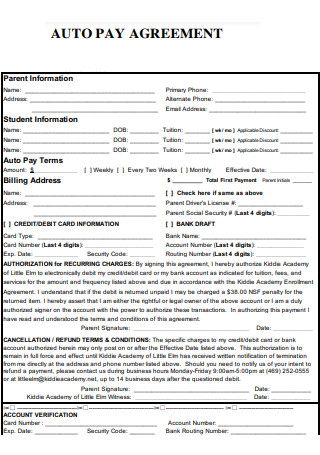

Child Care Auto Pay Agreement

download now -

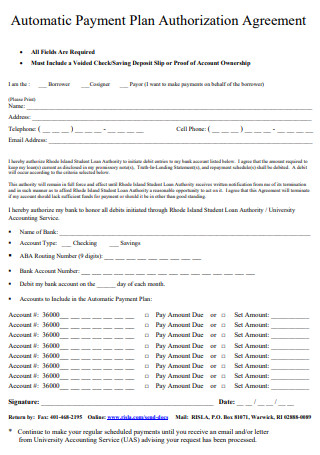

Automatic Payment Plan Authorization Agreement

download now -

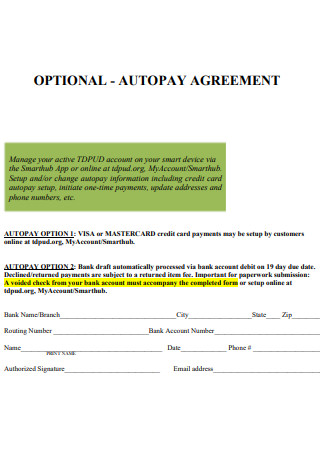

Optional Auto Pay Agreement

download now -

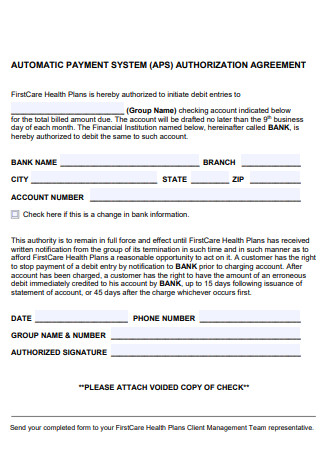

Automatic Payment System Agreement

download now -

Auto Pay Agreement Example

download now -

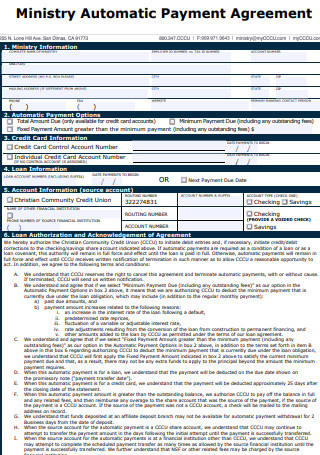

Ministry Automatic Payment Agreement

download now -

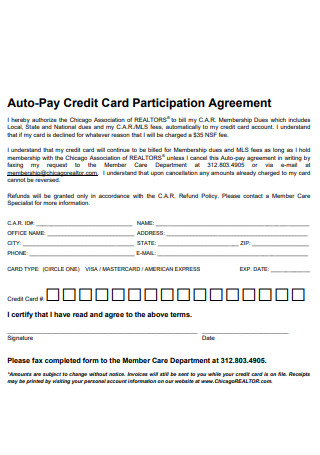

Auto Pay Credit Card Participation Agreement

download now -

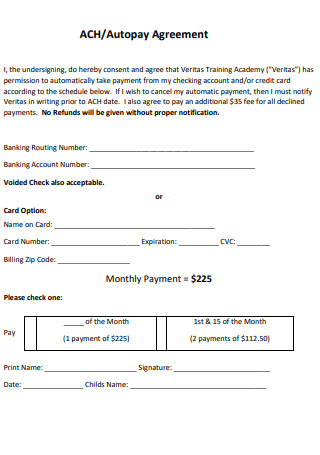

Auto Pay Agreement Form

download now -

General Auto Pay Agreement

download now

FREE Auto Pay Agreement s to Download

29+ SAMPLE Auto Pay Agreement

What Is an Auto Pay Agreement?

Benefits of Using Auto Pay

Different Kinds of Payment Options

Steps On Making an Auto Pay Agreement

FAQS

Why Is an Auto Pay Agreement Necessary?

Why is it Preferable to Set Up an Autopay?

How Does Auto Pay Work?

What Is an Auto Pay Agreement?

An auto pay agreement is a written document that explains how auto payment works. This could be related to a particular service that a client uses, resulting in a recurring payment. The billing information, contact information, and information regarding the recurring bill are all included in the autopay agreement pdf. It should also include an area where the customer’s signature can be used to provide authorization.

Benefits of Using Auto Pay

Technology has provided us with a valuable commodity that is difficult to pass up. If you have a vehicle payment plan, an automated payment agreement could save you money. It’s all about using the best resources to your advantage. In addition, computerized bill receipts and invoices reduce the possibility of misplacing them. Autopay is this other convenient alternative for automatically paying your bills electronically. Certainly, the late fees would stop appearing from your bill.

Different Kinds of Payment Options

When it comes to paying a bill, you have several options. Knowing your options will help you choose the most convenient one for you. Nowadays, purchasing items in stores can be done with a watch or a phone. People now have more payment options thanks to technological advancements. What you must ensure in autopay are the autopay terms and conditions. It’s critical to read what could influence you in any agreement or contract. It’s also a good idea to understand the benefits and drawbacks of various payment methods before deciding.

Steps On Making an Auto Pay Agreement

The autopay agreement is easy and uncomplicated. The most critical aspect is informing the user of what they are agreeing to. Auto pay is commonly used for recurring monthly fees. It also eliminates the need for clients to manually pay their invoices. Let’s go over how to set up an auto pay agreement.

-

Step 1. Describe the Agreement

There should be a quick explanation of what the auto pay arrangement is all about and what it is used for. Moreover, the store or entity upon which the automatic recurring payment customer agreement is bound to. It should include a declaration and disclaimer stating that all information presented is accurate. This should indicate how long the approval process for the auto pay takes. As well as how frequently the agreement needed to be renewed. It should be done every year.

-

Step 2. Frequency of Payments and Payment Failure

Not every recurring payment would be made on a monthly basis. Some would be between three and six months. It is critical to specify how frequently the payment will be made in the agreement. A schedule of when the money will be withdrawn automatically from the customer’s account should be attached. Concerning the failure of the automatic payment to occur owing to a shortage of funds, there should be a method in place to address this issue. It should be specified in the agreement how a contact would be made via email or phone before suspension or cancellation occurs.

-

Step 3. Agreeing To the Condition

The autopay terms and conditions should be summarized in this section. As in an overview of payment frequency and due dates. As well as the customer’s automatic payment authorization. This should include any disclaimers and make the customer aware of what they are agreeing to. The costumer’s signature and date would appear underneath. In addition to their printed name.

-

Step 4. Customer and Billing Information

Customer information includes things like name, address, phone number, and email address. Customers must confirm the accuracy of the information. The zip code, city, state, or municipality where the person resides should all be included in the address. In terms of billing information, a fillable field for billing address and card details should be included. Card details could contain the card number, expiration date, and security code.

-

Step 5. Payment Authorization

Payment authorization, in addition to permitting automated payments, should be specifically indicated in the agreement. The buyer should express their agreement by writing their name or signing. This is to establish the fact that a specified sum will be removed from their finances in accordance with the agreement. Furthermore, they are aware that a deduction will be made on particular and scheduled dates.

FAQS

Why Is an Auto Pay Agreement Necessary?

The auto pay agreement is essential, especially so that the customer understands what they are agreeing to. When it comes to automatically deducting payments from their funds, it would require legal approval. It would also offer the customer with legal protection in the event that their information was compromised. Or if there are any unauthorized deductions from their funds.

Why is it Preferable to Set Up an Autopay?

Auto pay eliminates late fees and enables for a more seamless transaction. Because it is automatic, a person does not have to pay their bills manually. It could be useful for folks who are always on the go. It is a time-saving method, especially for recurrent payments whose amounts never vary. It’s also a good idea to set up an auto pay when you’re confident that the amount won’t fluctuate based on how much you use the service.

How Does Auto Pay Work?

Auto pay is a method of automatically deducting money as part of a payment. When a person uses auto pay to pay bills, no matter how much the payment is, it is automatically deducted on the due date. That is why they must supply billing information, including the source where the charge will be deducted.

Autopay is the ideal solution for recurring payments with constant value. It saves time spent manually transferring and paying bills. And an autopay agreement template would show you how to set up the contract. Get it now!