Bond Agreement Samples

-

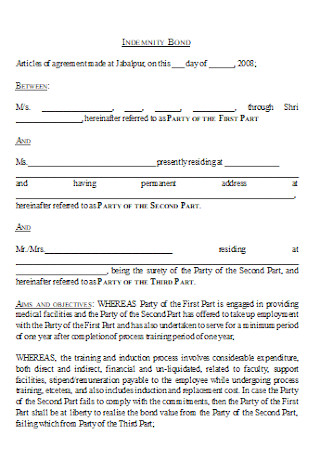

Training Bond Agreement

download now -

Scholarship Bond Agreement

download now -

Employee Bond Agreement

download now -

Bond Agreement for Employment

download now -

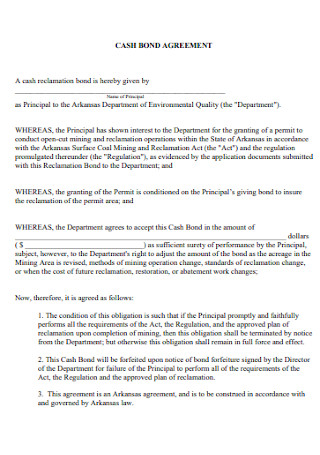

Cash Bod Agreement

download now -

Performance Bond Agreement Template

download now -

Bond Purchase Agreement

download now -

Bond Cum Agreement

download now -

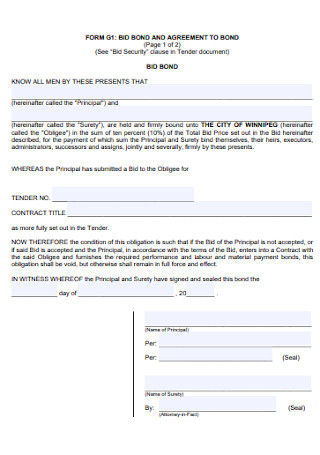

Bid Bond Agreement Template

download now -

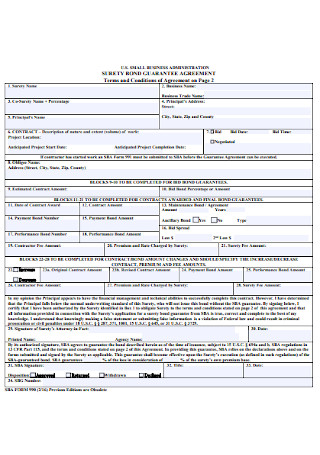

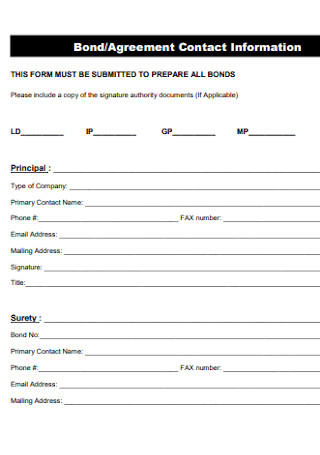

Surity Bond Agreement Template

download now -

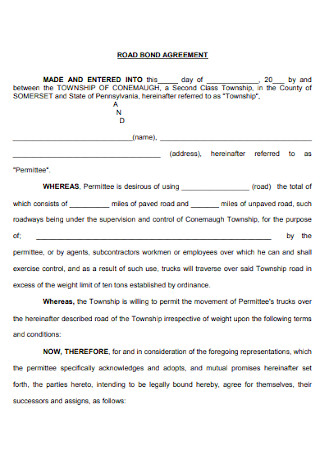

Road Bond Agreement Template

download now -

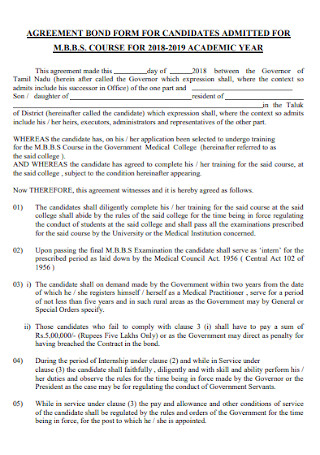

Bond Agreement for Course

download now -

Corporate Bond Agreement Template

download now -

Cash Bond Agreement Example

download now -

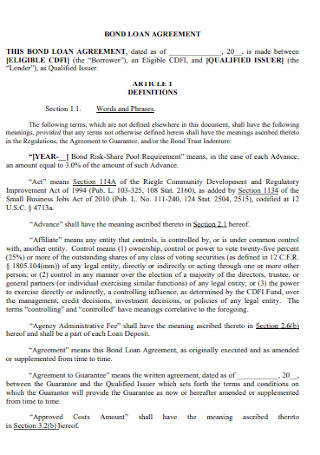

Bond Loan Agreement Template

download now -

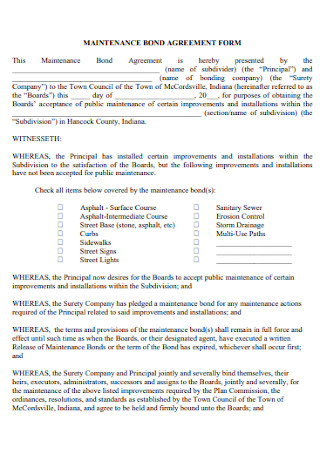

Maintenance Bond Agreement

download now -

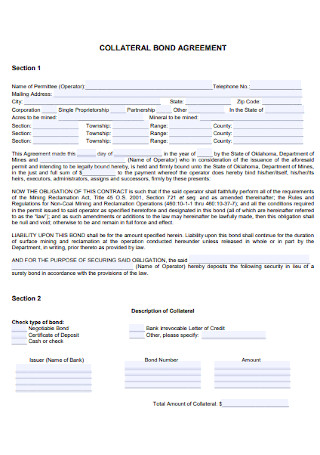

Collateral Bond Agreement

download now -

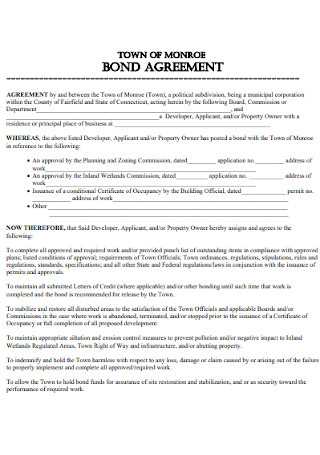

Sample Bond Agreement

download now -

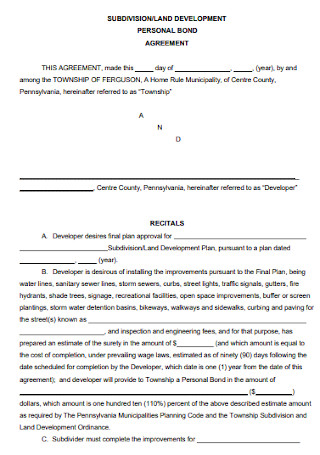

Personal Bond Agreement

download now -

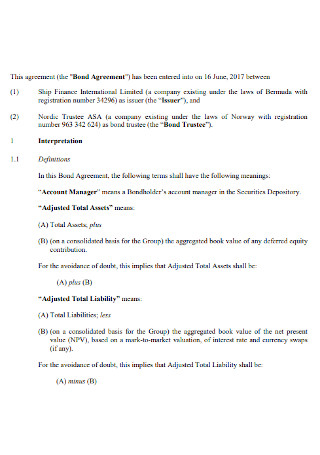

Financial Bond Agreement

download now -

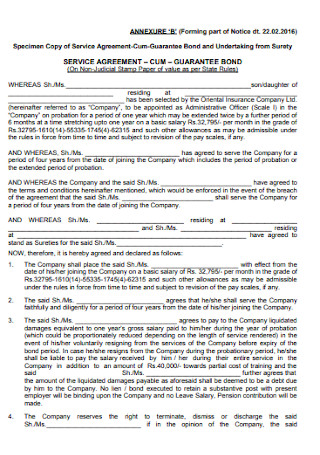

Bond Service Agreement

download now -

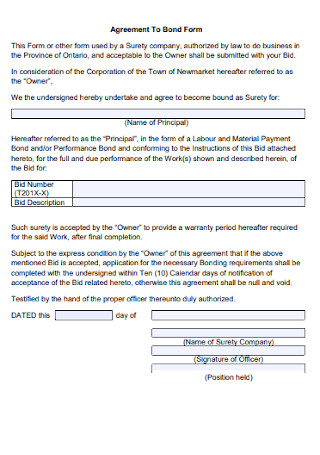

Sample Agreement top Bond Form

download now -

Agreement for Bond Contract

download now -

Guaranty Bond Agreement

download now -

Bond Agreement Application Template

download now -

Basic Cash Bond Agreement Template

download now -

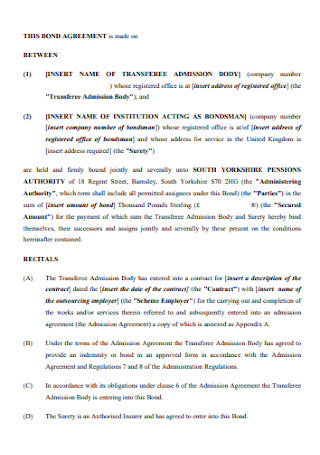

Pensions Bond Agreement Template

download now -

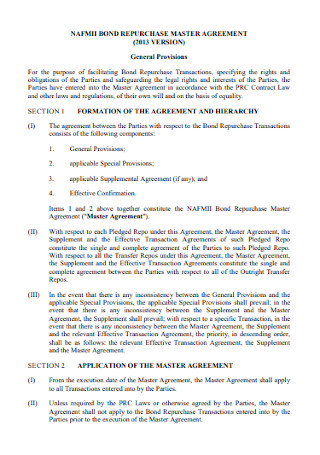

Bond Repurchase Master Agreement

download now -

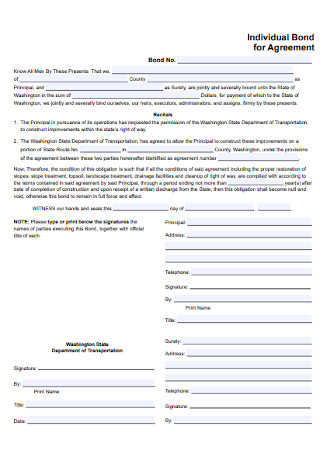

Individual Bond for Agreement

download now -

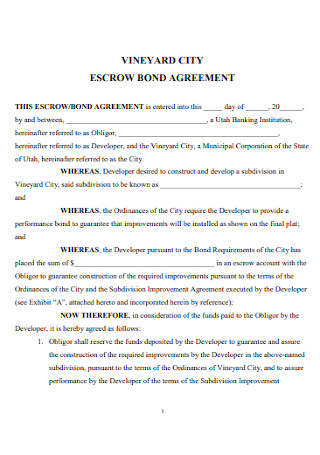

Escrow Bond Agreement Template

download now -

Engineering Bond Agreement Template

download now -

Standard Bond Agreement Template

download now -

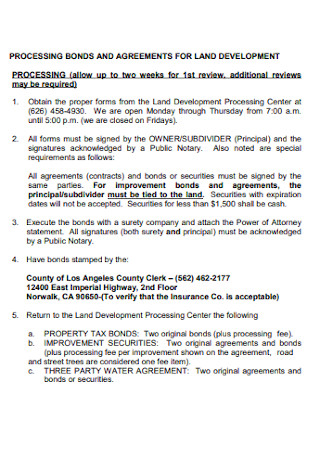

Land Bond Agreement Template

download now -

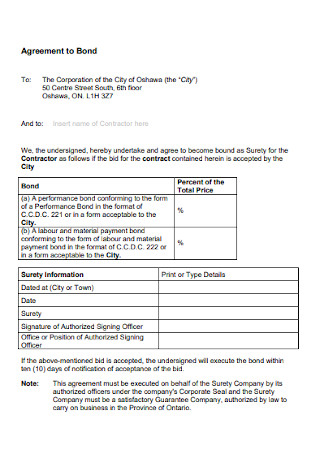

Formal Bond Agreement Template

download now -

Construction Bond Agreement Template

download now -

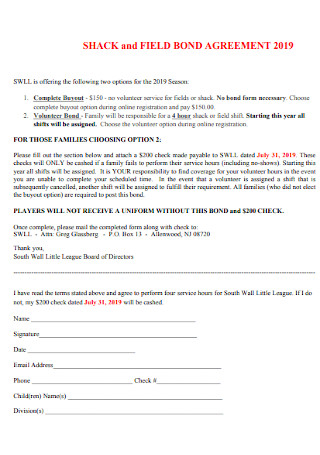

Field Bond Agreement Template

download now -

Sample Road Bond Agreement Template

download now -

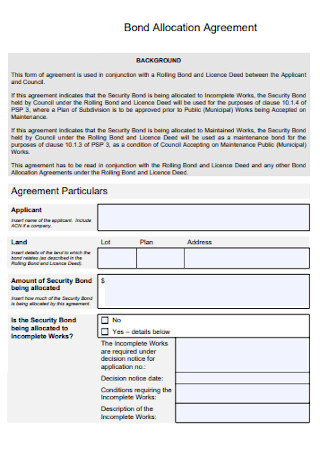

Bond Allocation Agreement

download now -

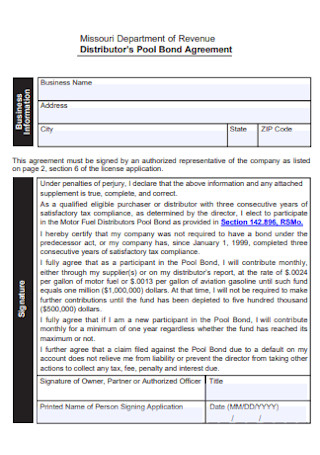

Distributor Pool Bond Agreement

download now -

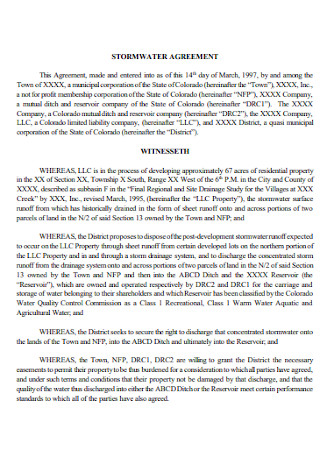

Stormwater Bond Agreement

download now -

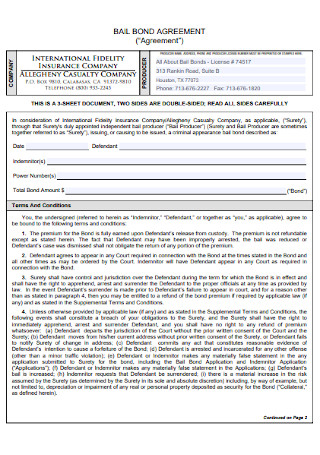

Bail Bond Agreement Template

download now -

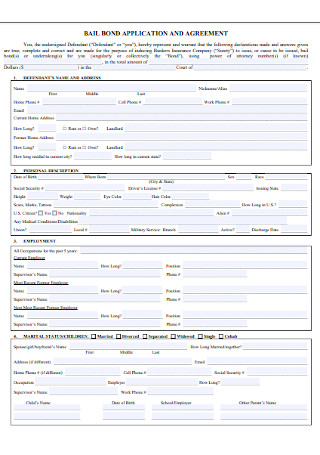

Bail Bond Application Agreement

download now -

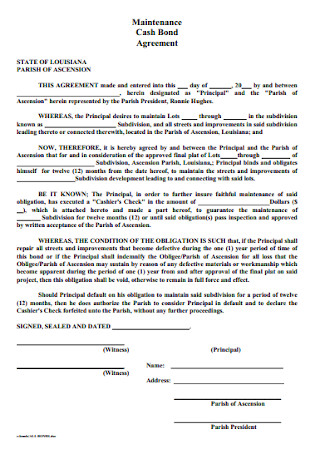

Maintenance Cash Bond Agreement

download now -

Covered Bond Agreement

download now -

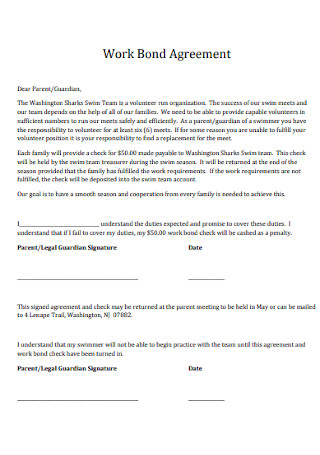

Work Bond Agreement

download now -

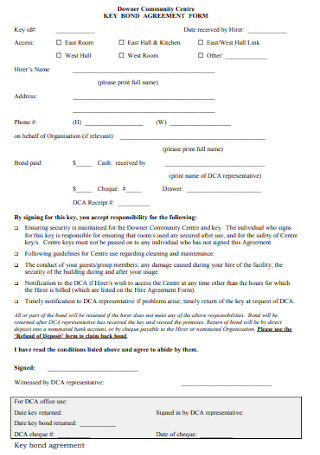

Key Bond Agreement Form

download now -

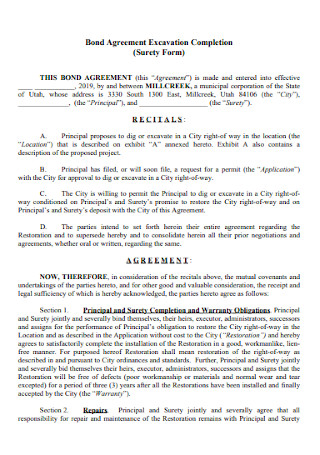

Bond Completion Agreement

download now -

bond Investment Agreement Template

download now -

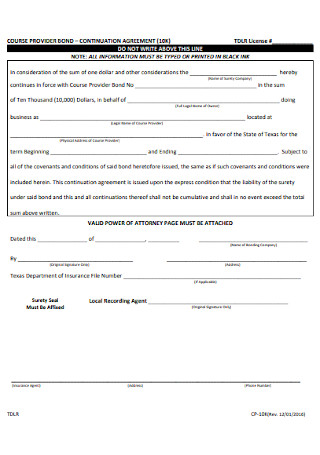

Bond Continuation Agreement Template

download now -

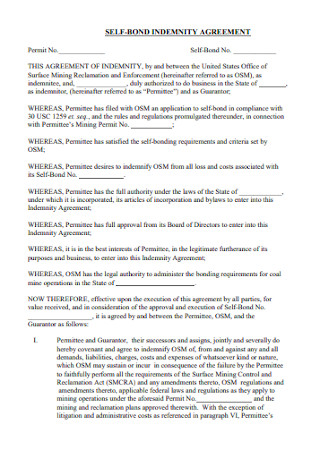

Self Bond Indemnity Agreement

download now -

Indemnity Bond Agreement Template

download now

FREE Bond Agreement s to Download

Bond Agreement Format

Bond Agreement Samples

What is a Bond Agreement?

Purposes of a Bond Agreement

How to Create a Bond Agreement

FAQs

What is an employee bond?

Is a bail bond also a type of investment?

How do you compute for the price of a bond?

What are the key components of a bond agreement?

What happens if an issuer breaches the bond agreement?

How are bond agreements used in corporate financing?

Download Bond Agreement Bundle

Bond Agreement Format

This Bond Agreement (“Agreement”) is made and entered into as of this [Date] by and between:

1. Obligee: [Name and Address of the Obligee (Party receiving the assurance)]

2. Principal: [Name and Address of the Principal (Party providing the assurance)]

3. Surety: [Name and Address of the Surety (Party guaranteeing the obligation)]

RECITALS

WHEREAS, the Principal has agreed to perform certain obligations as described below and the Obligee requires the Principal to furnish a bond as security for the performance of said obligations.

WHEREAS, the Surety has agreed to provide the required bond, subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

1. DEFINITIONS

- Bond Amount: The total amount guaranteed under this Agreement, which is [Amount in Words and Figures].

- Obligation: The performance or payment requirement of the Principal as specified in [specific agreement or contract reference].

2. SCOPE OF THE AGREEMENT

The Surety guarantees the performance of the Principal’s obligations as defined in the [specific contract, project, or obligation details].

3. TERM

This Bond Agreement is effective as of the date written above and remains in effect until the Obligation has been fully satisfied or as specified in [duration or termination conditions].

4. OBLIGATIONS OF THE PARTIES

4.1. Principal’s Obligations:

The Principal agrees to perform its obligations under [specific contract or agreement reference] in a timely and complete manner.

4.2. Surety’s Obligations:

The Surety agrees to make payments or perform obligations up to the Bond Amount if the Principal fails to fulfill its duties under this Agreement.

4.3. Obligee’s Obligations:

The Obligee agrees to notify the Surety in writing of any breach or default by the Principal under the referenced agreement.

5. CLAIMS AND NOTIFICATIONS

- 5.1. Filing a Claim:

The Obligee must provide written notice to the Surety of any breach or failure by the Principal, including details of the default and the amount claimed under the Bond. - 5.2. Surety’s Response:

The Surety will investigate and respond to the claim within [specified timeframe, e.g., 30 days].

6. LIMITATION OF LIABILITY

The Surety’s total liability under this Agreement is limited to the Bond Amount of [Amount in Words and Figures].

7. TERMINATION

This Agreement shall terminate upon:

- Completion of the Obligation by the Principal;

- Payment of the Bond Amount in full by the Surety;

- Mutual agreement of the parties.

8. GOVERNING LAW

This Agreement shall be governed by and construed in accordance with the laws of [State/Country].

9. MISCELLANEOUS

- 9.1. Amendments: Any amendments to this Agreement must be in writing and signed by all parties.

- 9.2. Notices: All notices under this Agreement must be sent to the addresses listed above.

- 9.3. Entire Agreement: This document constitutes the entire agreement between the parties.

10. SIGNATURES

IN WITNESS WHEREOF, the parties have executed this Bond Agreement as of the date first written above.

For the Obligee:

Name: ___________________________

Signature: ______________________

Date: ___________________________

For the Principal:

Name: ___________________________

Signature: ______________________

Date: ___________________________

For the Surety:

Name: ___________________________

Signature: ______________________

Date: ___________________________

What is a Bond Agreement?

A bond agreement is a contractual document that legally binds the issuer of the bond and the bondholder. It details the terms of the bond issuance, including the interest rate, payment frequency, maturity date, and any covenants or conditions that the parties must follow. The agreement ensures mutual understanding and compliance, protecting both the investor’s and issuer’s rights throughout the bond’s lifecycle. You can also see more on Employee Training Agreement.

Purposes of a Bond Agreement

1. Legal Framework

A bond agreement provides a legally binding framework that governs the relationship between the bond issuer and the bondholder. It ensures both parties clearly understand their rights and obligations.

2. Financial Clarity

The agreement outlines critical financial details such as interest rates, payment schedules, and the bond’s maturity date, offering transparency and reducing ambiguity in the transaction. You can also see more on Agreement Forms.

3. Investor Protection

Bond agreements safeguard bondholders by specifying the issuer’s obligations, covenants, and default remedies. This reduces investment risks and instills confidence.

4. Regulatory Compliance

They help issuers adhere to local and international financial regulations, ensuring that the bond issuance process meets the required legal standards. You can also see more on Contract Agreements.

5. Risk Mitigation

By detailing default clauses and remedies, bond agreements minimize potential risks for both parties. They provide a clear course of action in case of disputes or non-compliance.

How to Create a Bond Agreement

Step 1: Define the Purpose and Parties Involved

Start by identifying the primary purpose of the bond and the parties involved. Clearly specify whether the bond agreement is for corporate financing, project funding, or other purposes. Include details of the issuer (borrower) and the bondholder (investor). Establishing this foundation ensures the agreement is tailored to the specific needs of both parties. You can also see more on Mutual Agreement.

Step 2: Specify Financial Terms

Detail the financial elements of the bond, such as the principal amount, interest rate, payment schedule, and maturity date. Include whether the interest is fixed or variable and specify the frequency of interest payments (e.g., monthly, quarterly, or annually). Accurate financial terms ensure clarity and trust between the parties.

Step 3: Include Legal Covenants

Outline the issuer’s obligations and restrictions. These may include maintaining certain financial ratios, restrictions on additional debt, or requirements for using bond proceeds. Also, add clauses on what constitutes a default and the actions to be taken in such scenarios. This ensures legal protection for both parties. You can also see more on Trainee Agreement.

Step 4: Draft Redemption and Call Provisions

Define the conditions under which the bond can be redeemed before maturity. Include details of call provisions, if applicable, specifying if the issuer can repay the bond early and under what terms. These provisions offer flexibility and ensure that both parties are aware of potential scenarios.

Step 5: Review and Finalize the Agreement

Once the agreement is drafted, review it thoroughly for accuracy and completeness. Engage legal and financial professionals to validate the document. After final revisions, the agreement should be signed by all involved parties, ensuring it becomes a legally binding document. You can also see more on Corporate Agreement.

A bond agreement is an essential document for managing financial and legal obligations between bond issuers and holders. It fosters transparency, reduces risks, and ensures compliance with regulatory requirements. By clearly outlining terms, conditions, and remedies, it safeguards the interests of all involved parties. Whether for corporate, municipal, or government bonds, a well-drafted bond agreement plays a vital role in building trust and fostering smooth financial transactions.

FAQs

What is an employee bond?

An employment bond is an insurance that safeguards an employer when employees perform dishonest or fraudulent acts. Typically, employers buy fidelity bonds for workers who can access the company’s assets (e.g., an accountant). This type of insurance reimburses a company in case an employee does a criminal act. You can also see more on Indemnity Agreement.

Is a bail bond also a type of investment?

Bail is money that serves as an insurance between a defendant and the court. Defendants can opt to pay bail with cash, yet many cannot since it requires a large sum of money. So, they ask help from a bail bondsman, who can post a bond for them. With that said, a bail bond is a surety bond that a bond company provides by commissioning bail agents. It ensures that a defendant will be released from jail.

How do you compute for the price of a bond?

You can use the YTM or yield-to-maturity formula. It is the total amount of money an investor anticipates if the bond reaches maturity. The rate of YTM is expressed annually. The YTM formula can be complex but it is useful in evaluating bonds. So, here’s the formula: YTM is equal to the nth root of the bonds face value over its present value. Then, you subtract one from the outcome. You can also see more on Relationship Agreement.

What are the key components of a bond agreement?

A bond agreement includes the issuer’s and bondholder’s details, bond terms (principal, interest, maturity), covenants, default clauses, and legal remedies. These elements provide a comprehensive framework for bond management.

What happens if an issuer breaches the bond agreement?

A breach typically activates default clauses, allowing bondholders to demand immediate repayment or pursue legal remedies. This can include seizing collateral or initiating litigation. You can also see more on Construction Agreements.

How are bond agreements used in corporate financing?

In corporate financing, bond agreements enable companies to raise funds by issuing bonds. They outline repayment terms and covenants to reassure investors of the issuer’s financial stability. You can also see more on Guaranty Agreement.