8+ Sample Business Operating Agreements

-

Business Account Operating Agreement

download now -

Company Business Operating Agreement

download now -

Business Operating Agreement Checklist

download now -

Digital Business Operating Agreement

download now -

Hudson Business Operating Agreement

download now -

Sample Business Operating Agreement

download now -

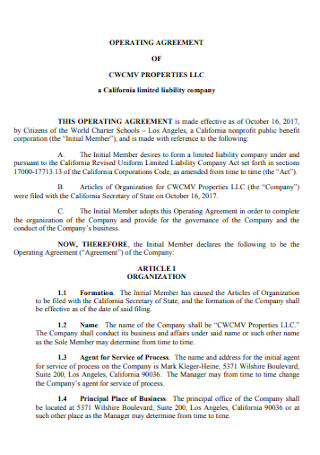

Business Property Operating Agreement

download now -

Sample Business Account Operating Agreement

download now -

Standard Business Operating Agreement

download now

FREE Business Operating Agreement s to Download

8+ Sample Business Operating Agreements

What Is a Business Operating Agreement?

Purposes of Making a Business Operating Agreement

Scope of a Business Operating Agreement

Factors That Affect a Business

How to Create a Business Operating Agreement

FAQs

Is an operating agreement necessary for single-member business owners?

What is a limited liability company?

Is a business plan still needed even if an operating agreement is present?

What Is a Business Operating Agreement?

Before everything else is to be defined, it is important to know that whenever you require more protection in your business but seek fewer liabilities, forming an LLC, or a limited liability company is considered to be a good practice. And whenever you form an LLC for your business, it should have an operating agreement in place.

A business operating agreement is defined as a document that explains the financial and functional choices of the business, including its respective rules, regulations, and restrictions. The document’s objective is to manage the internal operations of the business in such a way that it meets the demands of the business owners. When the members of the limited liability corporation sign the paper, it becomes a legal contract that binds them to its conditions.

Purposes of Making a Business Operating Agreement

Why would a business operating agreement be necessary? Here are some answers to that question:

- It protects the limited liability status of a business. Members of the limited liability company are protected from personal responsibility to the LLC under business operating agreements. Without this formality, your LLC may resemble a sole proprietorship or partnership, putting your personal liabilities at risk.

- It clarifies any form of verbal agreement. Misunderstanding or misinterpretation can occur even if the members of the limited liability company have verbally agreed to particular agreements. It is usually preferable to have the operating conditions and any other kind of business arrangements clearly and concisely documented in writing so that they may be referred to in the case of a problem.

- It protects the LLC from the state. Without an explicit operating agreement, LLCs are governed by state default laws. This means that each state has its own set of default standards for enterprises that do not sign operating agreements. Because the state default regulations are so broad or vague, relying on a governing body state to handle your agreement is not recommended.

Scope of a Business Operating Agreement

What is the scope of a business operating agreement? Here are some of the necessary topics that this document should cover:

Factors That Affect a Business

There are different factors that affect the way a certain business is operated. Here are some of them:

How to Create a Business Operating Agreement

Here are the steps that should be followed whenever a business operating agreement is to be created; Since businesses are different from each other, some unique steps may be needed to conform to your needs.

-

1. Start With the Company Basics

Every kind of business agreement, regardless of the deal and the size of the organization should have the company’s basic information written at the start. Begin this step (and this document) by writing the company’s name, its business address, the date that the company was formed or founded, and the important details of the registered agent. Make sure that all the information that is written down is accurate.

-

2. Write the Information of the Members

To follow-up, this step is accomplished by writing down the information of the company members. The information can include the members’ names, their respective contact details, their contributions to the company (which can include their capital, their assets, their services, or even their real property), each of their rights and responsibilities, and, if applicable to the situation, the details of the company manager or company officer. As with the first step, it is important to ensure that the information written down here is accurate.

-

3. Write the Main Elements of the Agreement

Now it is time to write the main elements of the business operating agreement. In this step, write down the accounting procedures that the business will follow. Each procedure will be unique to the type of business involved in the operating agreement. Also included here are other factors that describe how the business runs such as when their fiscal year will start and end, how their respective records will be kept, how the profits made by the company will be distributed and the respective duties and responsibilities of the manager of the business and their members.

-

4. Follow-up With the Auxiliary Factors of the Agreement

After writing the main elements of the operating agreement in the previous step, it is now time to write the auxiliary elements of the document such as any other processes that the company can undertake. These can include the voting rules and procedures of the members of the company, terms that dictate what will happen in case any member of the company leaves, is found to be incompetent, or in case the member dies, and any plans to follow in case the limited liability company will enter dissolution.

-

5. Verify the Entire Document

After writing all the main and auxiliary elements of the document, it wouldn’t hurt to give the document a second look. In this step, verify and ensure that everything is written down clearly and concisely, no grammatical and typographical mistakes exist (proper writing can make or break some terms and cause unnecessary confusion), and every important element which is unique to your business is present. Finally, ensure that what you’ve written down conforms to the needs of your business and the laws of the area where your business is registered. Another wise step would be to consult legal help if you wish to do so since this is a legal document.

FAQs

Is an operating agreement necessary for single-member business owners?

It is not required, however, it is recommended. This is because an operating agreement can demonstrate how the owner of a single-member business intends to segregate their personal spending from those of the business. This document can also be used to designate someone to operate the firm while the owner is unable to. Furthermore, insurance companies may need an operating agreement, and it can be used to specify regulations particular to the business.

What is a limited liability company?

A Limited Liability Company (LLC) is a type of company structure that serves to combine the limited liability protection of a corporation with the tax efficiency and operational flexibility of a business collaboration. One advantage of being an owner of a limited liability company is that unlike shareholders of a corporation, they are not taxed as a distinct business entity. Instead, all earnings and losses are “distributed through” the company to each member. The members of an LLC, like partnership owners, declare gains and losses on their own federal tax returns.

Is a business plan still needed even if an operating agreement is present?

Yes, it is still necessary. Both of these essential legal documents should be present in your company. While there is some commonality, they serve different objectives. The purpose of the Operating Agreement is to establish how the firm will be operated. Other company details, such as market analysis, financial goals, product specifications, and finance requirements, are communicated in the Business Plan. If you have any more concerns or require additional clarity before drafting your LLC Operating Agreement, it is a good idea to consult with a lawyer or look into other resources for beginning a corporation.

Effectively creating a business operating agreement can be an intimidating task to undertake, but once the basics of writing this document are fully understood and once you figure out what you need to be included in the agreement, it can be an easy task. Having an effective operating agreement for your business is necessary since it gives freedom, protection, and control that the owner needs for his/her business. In this article, examples of a business operating agreement are readily available so that you can have something to use as a reference when the time comes to make one for yourself.