8+ Sample Business Partnership Agreement

-

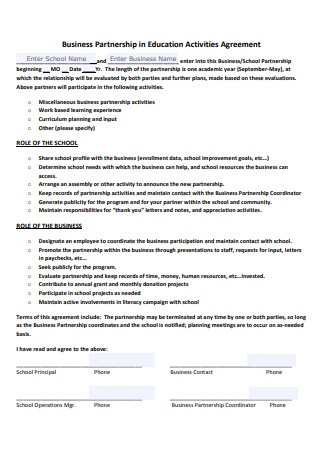

Business Partnership in Education Activities Agreement

download now -

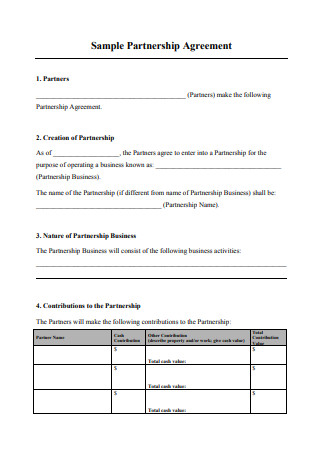

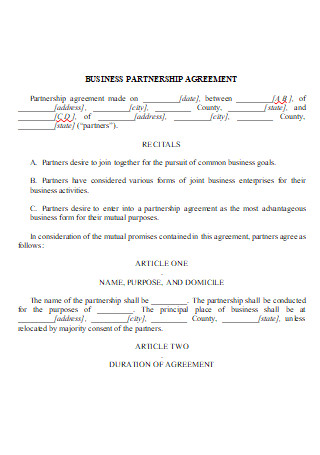

Sample Business Partnership Agreement

download now -

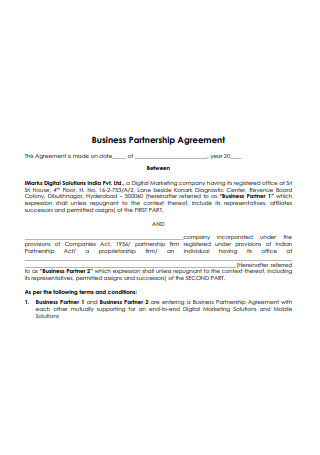

Basic Business Partnership Agreement

download now -

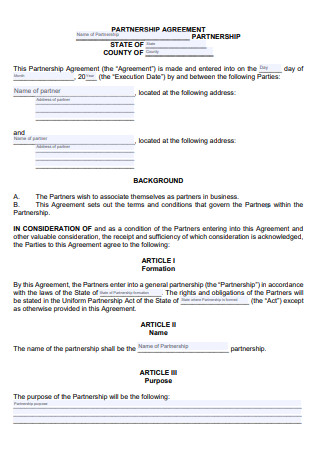

Business Partnership Agreement in PDF

download now -

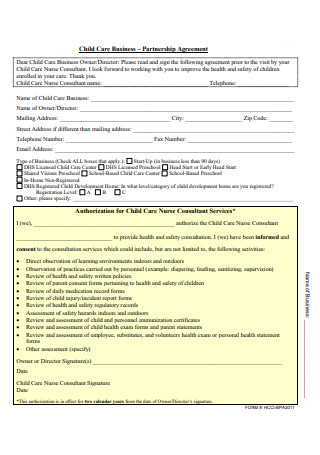

Child Care Business Partnership Agreement

download now -

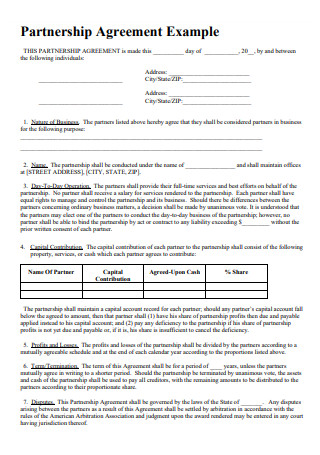

Business Partnership Agreement Example

download now -

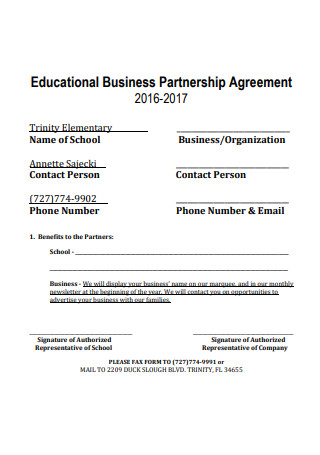

Educational Business Partnership Agreement

download now -

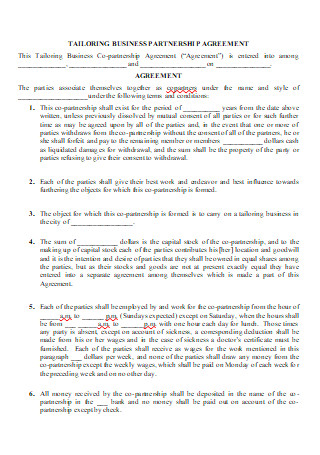

Tailoring Business Partnership Agreement

download now -

Business Partnership Agreement in DOC

download now

FREE Business Partnership Agreement s to Download

8+ Sample Business Partnership Agreement

What is a Business Partnership Agreement?

Types of Business Partnership Agreement

What are Included in a Business Partnership Agreement?

Tips on Business Partnership Agreement

How to Write a Business Partnership Agreement

FAQs

What if a Dispute Arise With the Partnership?

What Will Happen if a Partner Dies or Become Incapacitated?

What is a Business Partnership Agreement?

A business partnership agreement is a contract between two businesses. This is an agreement between two people to be business partners in a company. They would establish a partnership which deals about capital sharing and financial reporting. One of the things that they would agree upon is the profit. Because they are business partners, they would divide the business profits for the both of them. But they are also responsible for all the business debt and all other obligations. They are liable for each other’s action when it comes to the business. This partnership document also spells out how the company would be sold or what woud happen if one of them leave the business. Their conventions of decision making are also talked about in it. It serves as a roadmap on how business partners can talk about the issues that can arise in the business. The main purpose of it is that the business partners could know what to do in all their dealings. Whatever problem that they could face in partnership could have a solution through the partnership agreement. Of course, it was necessary to settle all things first. So afterwards, there would no more problems anymore and both of them will know what to do. They would both know how to do a resort for everything. Also, a business partnership agreement seals a business partnership. It actually tells that you are having a partnership with another businessman.

Types of Business Partnership Agreement

Business partnership agreement falls in some categories. These categories are the following:

General Partnership Agreement

This is a type of business partnership agreement where more than two business owners enter a partnership contract. They will share the profits that they are going to have but the liabilities are going to be retained with themselves. They may have a tax advantage through this contract, where they can get a very low tax rate. This partnership is good because the owners will not have the chance to fight when losses came because they are responsible for their own losses. They just have to divide profits that the business could have.

Limited Partnership Agreement

With this agreement, there must be one partner. Both will share for profits or losses. The business will have an operating capital. The liabilities that can be used for investment are restricted.

Limited Liability Partnership Agreement

This business partnership agreement has tax priveleges. It gives protection from liabilities to all the business partners. The partner members are little free when it was about having debts. They can count on their business partners to help them.

Professional Limited Liability Partnership Agreement

This agreement are used by professionals like doctors, lawyers, and accountants. They must be licensed to have this kind of agreement. It is because licensure proof is needed.

What are Included in a Business Partnership Agreement?

If you are about to have a business partnership with another company, you must be accurate with all the contents of your business partnership agreement. Include the following:

Stake of Ownership

Partner’s stake must be spelled out. It would clearly say your ownership of the business or what percentage does both of you have of it. If you agreed on a 50-50 ownership, then it must be clear. If both of you decided on a 70% to 30% ownership, then you must be sure to include it in the business partnership contract. This is important for the both of you to know how you will divide the profit. Or how to divide the business when one of you wants to end the partnership. Even a small business should have an ownership stake.

Capital Shares

Your proposal of business partnership agreement should have the responsibility of capital contribution. It must be clear how much will the both you will contribute for the business. You can agree on a certain amount and should put it in the general partnership agreement.

Profit and Loss Percentage

As you are partners, you of course, should divide the profits among you. To make the division legal, put it in the written contract of partnership. You can make it easier to divide if you will set and agree on a specific percentage. With that, both of you will know what to expect on the business profit. Losses should also be shared so have a fixed percentage for it also.

Business Management

You can decide about the management of your business through voting. This is essential in general because you have to know how the business would run or how much each of you will participate in running it. Make strategic decisions for works that you can divide for the both of you. You can make a draft about the business management and then show it to your business partner for approval.

Tax Elections

There are tax rules about how IRS (Internal Revenue Service) treats partnership. They audit partnership as a whole and not individually. So you have to decide who will become the partnership representative. The representative will be the figurehead to the tax rules.

Future Withdrawal

If the time will come that one of you will have to end the partnership or want to leave the company, you should state the rules for partnership withdrawal. You can state it in the business partnership agreement roles and responsibilities or have a separate clause for it.

Business Dissolution

You must state how assets can be divided among you in case of dissolution. Some of the reasons of dissolution are:

- The death of the business partner

- End date for the partnership

- Bankruptcy of a partner

- Withdrawal of a partner

Tips on Business Partnership Agreement

There are rules that we follow in business. This is also true in a partnership agreement or partnership operating agreement. Have these tips with your business partner.

How to Write a Business Partnership Agreement

When you send your business partnership agreement to your business partner to sign them, the things about your business would be final. So you must make your agreement well-crafted for you to not be sorry about anything. Follow these steps to create a good business partnership agreement.

Step 1: Be prepared to write the contract.

One of the preparations that you could have is to have a knowledge about the Uniform Partnership Act. It could greatly tell you many things about a partnership agreement. Then meet with your business partner and discuss these things:

- The business purpose – Talk about the service that you want to have or the type of business that the both of you will want to engage. Agree on the timeline that you want for the business.

- The business name – Both of you should decide on the name that you will going to give to the company.

- The initial capital – Decide on the amount of money that the both of you can contribute to the company.

- The distribution of profits – Agree on a specific percentage that you will allot for the profits that you can get from the business.

- The liability – The things about the debts should both of you talk about also. Have a proper percentage where you can divide the responsibility of paying.

- The authority of decision-making – You should decide who will have the authority in decision-making and who will run the business. Divide tasks for the both of you.

Step 2: Make a draft and consult an attorney.

After talking about the partnership, take important notes that you can put in your business partnership agreement. Then get a lawyer to consult everything. An hour of consultation could cost $200 and a draft agreement could cost $500-2000. You might need a lawyer’s assistance to have a perfect draft of the agreement.

Step 3: Put the contents of the draft in a document.

You can download a template or make your own document in a Word or Doc file. Give your document a good title. Put the important information which includes the business name, ownership stake, capital contibution, profit percentage, liability percentage, business dissolution, withdrawal, and management. Have also terms and conditions that you can follow and be clear of the roles and responsibilities.

Step 4: Finalize the agreement and schedule a date to sign it.

Polish the agreement and put a signature block at the end of it. Choose laws that will govern your agreement and consult a lawyer again to make sure that the agreement is perfect. Then schedule a meeting with your business partner when you can both sign the agreement.

FAQs

What if a Dispute Arise With the Partnership?

Things like that happen in business partnerships. That was why it is crucial to put all the terms and conditions of an agreement. All the things that you agree upon should be included and all things must be clear. In this way, you have something to look into when something unexpected happens like disputes. You can settle what you are arguing about if you will make everything clear in the agreement.

What Will Happen if a Partner Dies or Become Incapacitated?

When things like that happen, you can look into your agreement in the dissolution part. You may end the agreement or divide the business depending on what you have agreed upon. So it is always better to put the conditions about the dissolution so you would know what to do if things like that will happen.

Business partnership agreement has helped a lot of businessmen who was about to lose their property. With a partner’s help, their business continues to go on. If this is a help in business, we should also enter into a business partnership agreement if we are a businessman. We can have more capital and we can expand our business. Anyway, it is always better to have a helping hand.