45+ Sample Buy and Sell Agreements

-

Sample Buy-Sell Agreement

download now -

Buy-Sell Agreement

download now -

Agreement to Sell Business

download now -

Purchase and Sale Agreement

download now -

Buy-Sell Agreement in Word

download now -

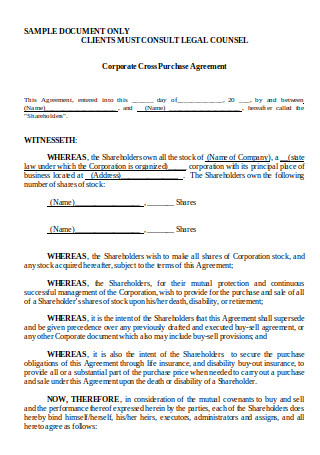

Corporate Cross Purchase Agreement

download now -

Agreement for Sale

download now -

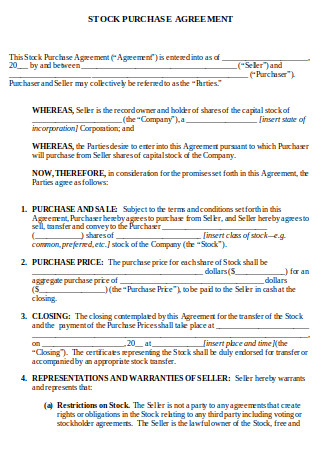

Stock Purchase Agreement

download now -

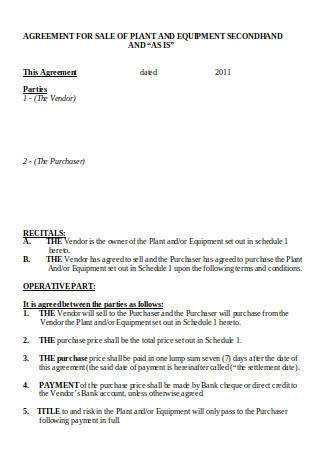

Agreement for Sale of Plant and Equipment

download now -

Share Purchase Agreement

download now -

Sample Real Estate Purchase Agreement

download now -

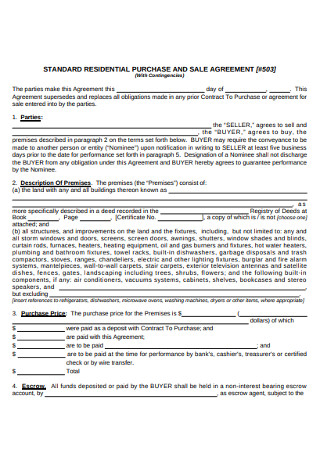

Standard Residential Purchase and Sales Agreement

download now -

Gas Sales and Purchase Agreement

download now -

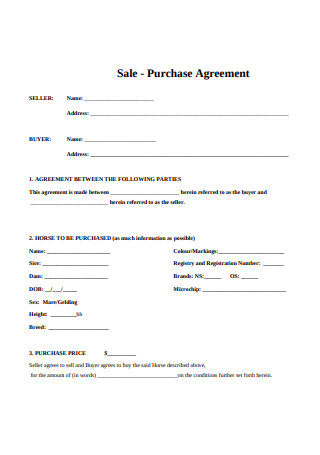

Horse Purchase and Sales Agreement

download now -

Mobile and Home Purchase Agreement

download now -

Family Sales Purchase Agreement

download now -

Sales Purchase Agreement

download now -

Agreement to Purchase Real Estate

download now -

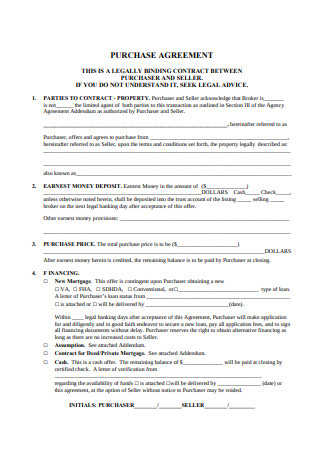

Purchase Agreement

download now -

Property Purchase Agreement

download now -

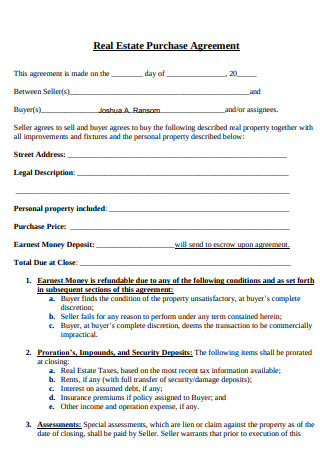

Real Estate Purchase Agreement Sample

download now -

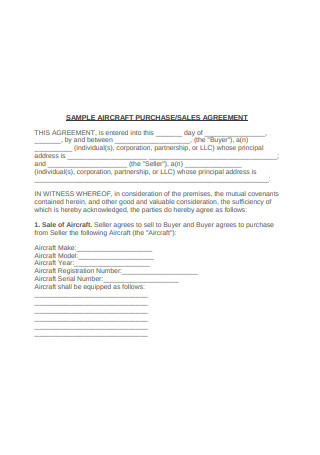

Sample Aircraft Purchase Sales Agreement

download now -

General Purchase Agreement

download now -

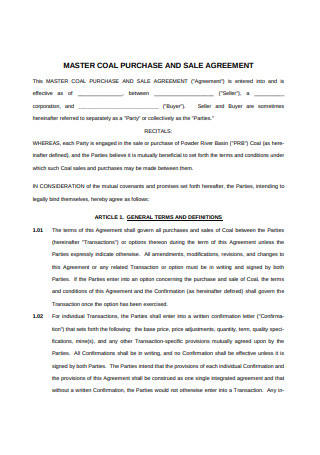

Master Coal Purchase and Sale Agreement

download now -

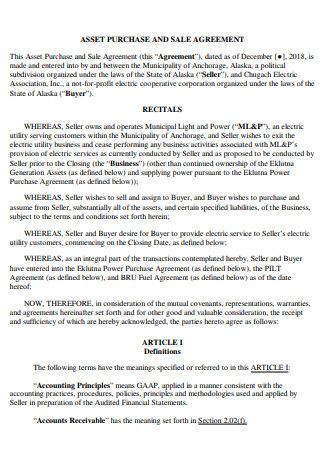

Asset Purchase and Sale Agreement Format

download now -

Sale-Purchase Agreement

download now -

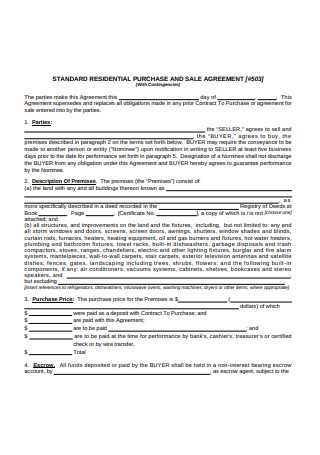

Standard Residential Purchase and Sale Agreement

download now -

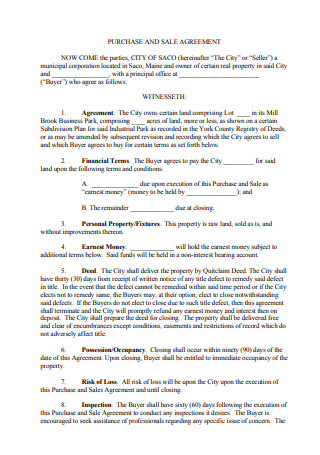

Standard Purchase and Sale Agreement

download now -

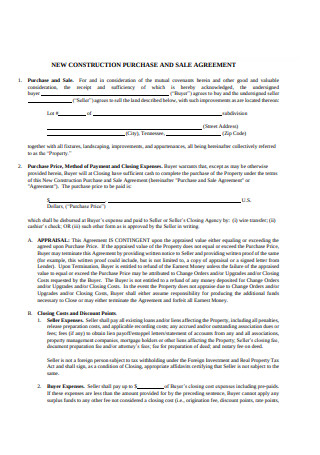

New Construction Purchase and Sale Agreement

download now -

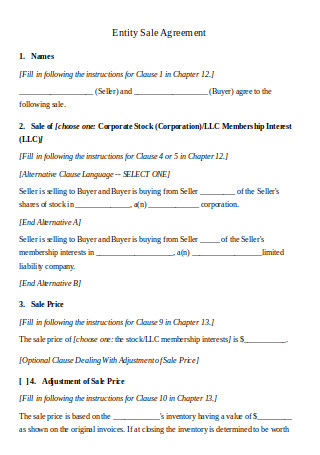

Entity Sale Agreement

download now -

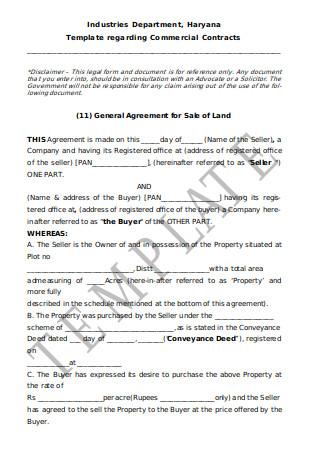

General Agreement for Sale of Land

download now -

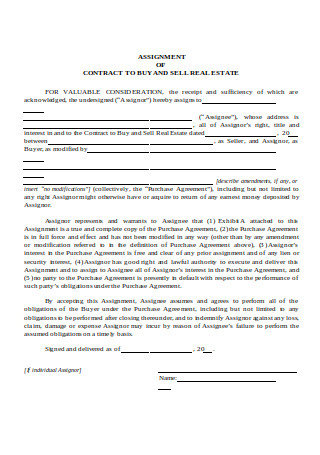

Contract to Buy and Sell Real Estate

download now -

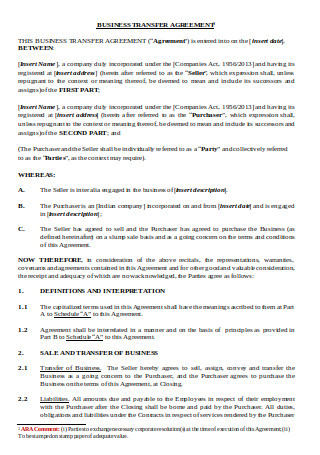

Business Transfer Agreement

download now -

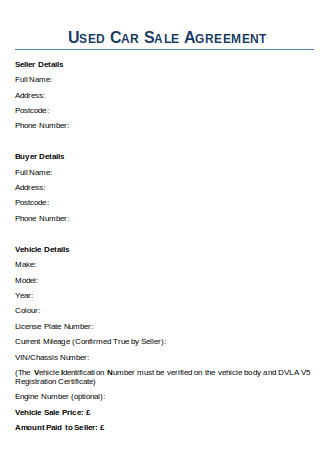

Used Car Sale Agreement

download now -

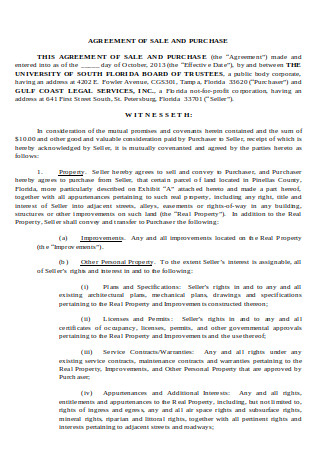

Agreement of Sale and Purchase

download now -

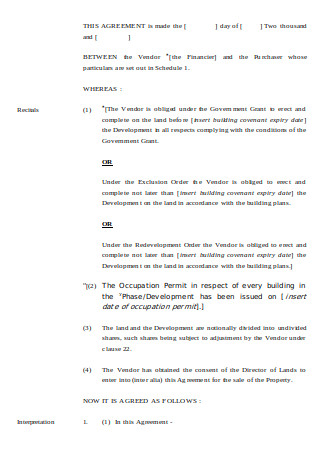

Form of Agreement for Sale and Purchase

download now -

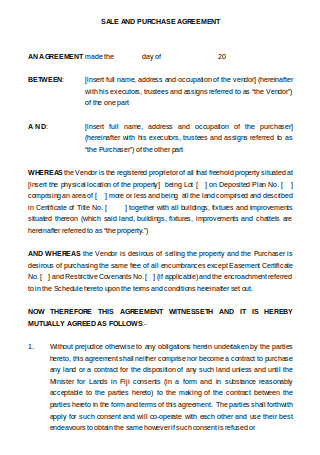

Sale and Purchase Agreement

download now -

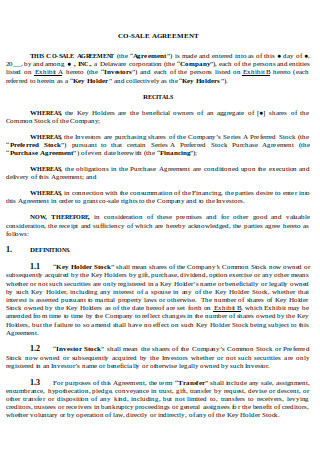

Co-Sale Agreement

download now -

Partnership Agreement in Sale and Purchase

download now -

Assignment of Purchase and Sale Agreement

download now -

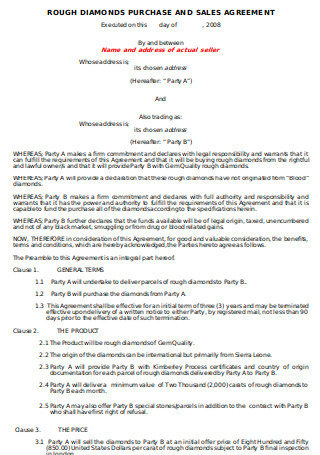

Rough Diamonds Purchase and Sale Agreement

download now -

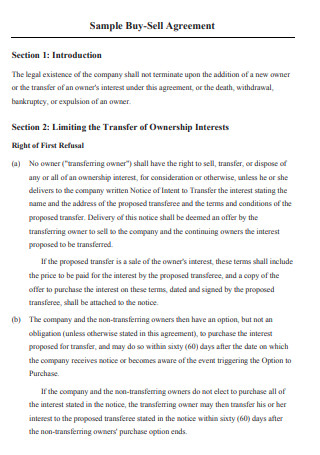

Sample Buy and Sell Agreement

download now -

Sample Buy-Sell Agreement in PDF

download now -

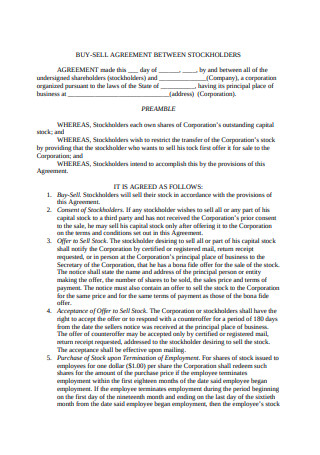

Buy-Sell Agreement Between Stockholders

download now -

Buy-Sell Agreement in PDF

download now -

Sample Solo Buy-Sell Agreement

download now

FREE Buy and Sell Agreement s to Download

45+ Sample Buy and Sell Agreements

What Is a Buy and Sell Agreement?

Common Reasons Why Partnerships Fail

How to Create a Buy and Sell Agreement Template

FAQs

What are the benefits of having a buy-sell agreement?

Why do companies purchase back shares?

What is the difference between a repurchase and a redemption?

How do you determine the market value of a business?

What does the word “shareholder” mean?

What Is a Buy and Sell Agreement?

When a business partner passes away unexpectedly, a buy and sell agreement becomes inevitable. This agreement is a contract that contains provisions involving the transfer of shares of a partner who has left. Typically, a buy and sell contract requires available shares to be sold to surviving partners. You usually use this agreement in corporations, partnerships, and sole proprietorships to ease the transfer of ownership when a partner leaves, retires or dies. There are two forms of buy and sell agreements: the cross-purchase agreement and the redemption agreement. In a cross-purchase arrangement, the surviving owners buy out the available share, while in a redemption agreement, the company purchases the share. In a small business like a sole proprietorship, if the owner dies, a “key employee” may become the successor. A key employee is a worker that owns a significant part of the business or plays a big role in making decisions for the company.

Common Reasons Why Partnerships Fail

Not all partnerships succeed in the end. For that reason, companies must prepare buy-sell agreements in case a co-owner plans to leave the company. In an article published by the Tax Foundation in 2015, the Census Bureau reported that there were about 73.1% sole proprietorships, 13.1% S corporations, and only about 8% partnerships in the United States. So, what are the general reasons why partnership agreements fail?

How to Create a Buy and Sell Agreement Template

Every business has a unique organizational structure. A company with several co-owners would need a more complex buy and sell agreement, while a company with a sole proprietor may only need a simple one. Therefore, let us create a standard buy-sell agreement by following the steps below.

Step 1: Identify the Events that will Require a Buyout

When creating a basic contract, clearly defining the events that will require a buyout is essential. These events may include the disability or death of a co-owner, the resignation of an owner who is at the same time an employee, the divorce of a partner, the bankruptcy of an owner, or the expulsion of an owner. This section of the agreement permits partners to have a smooth exit from the company.

Step 2: Write Stipulations About the Transfer of Shares

Without a buy-out agreement, a partner’s share will automatically be transferred to their family members. This may not be practical for the business, and the remaining partners may object. And that is why the agreement should have written stipulations concerning the transfer of shares in case a co-owner dies or leaves. Note that this may also include a provision regarding a family member buying out the share for a price. In case of a divorce, a part of the contract should state about the company’s right to buy back the shares left by a former partner. Without one, the court may grant the ex-wife/husband to own the shares.

Step 3: Include a Clause Concerning Disability

In a situation where one of the co-owners suffer a disability or long-term disease impairing him/her to function as a member of the company, it is wise to include a clause addressing this issue. The agreement should make a set timeline of how long the disabled party will be allowed to heal before a buyout is triggered. Some agreements may also add a clause stating an owner’s right to buy back his/her shares later on.

Step 4: Add Specifications for Retirement or Early Buyout

Owners are expected to retire in the future. A clause for retirement will specify the allowable age for retirement. Also, write specifications concerning where the shares would go after retirement. Some contracts may write options about founding owners who retire to stay part-time as a consultant. In a case where an owner decides an early buyout. A clause would set regulations for the remaining partners to buy out those available shares.

Step 5: Incorporate the Right of First Refusal

The right of first refusal is an individual’s right to be a priority in a business agreement before anyone else. This section of the contract will verify that the remaining partners have the right to buy back available shares. Shareholders are not permitted to transfer shares to outsiders.

FAQs

What are the benefits of having a buy-sell agreement?

A buy-sell contract gives its owners assurance that the company is in the right hands if one day they could no longer manage it. Other benefits include an equitable market value trade. It encourages the fair and smooth transfer of management, ownership, and wealth while offering some tax benefits. The agreement also assures heirs that a buyer will take over of the assets they couldn’t manage, provide heirs money to pay for expenses, taxes, and estate debts. It further assures surviving partners that the share of the deceased will not be given to an outsider, assures business continuity.

Why do companies purchase back shares?

The main reason why corporations market stocks to the public is to gain more money. Usually, companies sell shares to the public through an initial public offering. After an IPO, the stocks are then traded to secondary markets. The amount being traded to the secondary market affects a corporation because it has an impact on the company’s profitability. Reducing the number of stocks in secondary markets increases a corporation’s EPS or earnings per share. One more reason why companies choose to repurchase shares is to retake the status as majority shareholder, which is only acquired by owning 50% or more of the shares.

What is the difference between a repurchase and a redemption?

Repurchases happen when a company decides to repurchase or buyout shares from its co-owners. The company will pay shareholders of the market value of each share. Note that this is not compulsory on the part of a shareholder. On the other hand, redemptions happen when a corporation demands shareholders to trade a percentage of their shares to them. Redeemable shares have a call price, which is the amount of money a company will have to pay upon redemption. Note that a call price at the beginning of share issuance.

How do you determine the market value of a business?

If you plan to sell your small business as a sole proprietor, here are ways to determine the value of your business. (1) Sum up the value of all your assets and subtract all liabilities. This may include your inventory and equipment. (2) Determine your business’s revenue. How many sales does your company generate annually? You can ask for assistance from a business or stockbroker to calculate for your company’s worth. (3) Use the price over earnings ratio. Compute for the profit your company will get for the upcoming years. (4) Consider your location and the strategic value it offers.

What does the word “shareholder” mean?

A shareholder is an institution or an individual that owns a portion of stocks in a company. There are two types of shareholders, the majority and the minority. A majority shareholder owns 50% or more of the company’s stocks, while a minority shareholder owns 50% percent below the company’s stocks. In most cases, the founders of the company are the majority shareholders.

Buy and sell agreements are created to protect a business and help the parties involved handle unforeseen situations. The deal protects the share of a deceased partner by preventing outside buyers from purchasing it. In other words, it controls and manages company ownership. For a business to achieve its visions and goals, it must ensure its safety through buy-sell agreements.