9+ SAMPLE Call Option Agreement

-

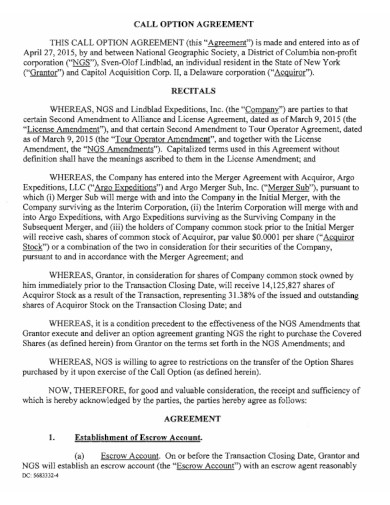

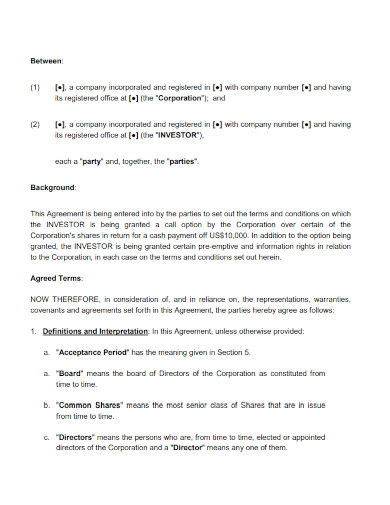

Sample call option agreement

download now -

Standard Call Option Agreement

download now -

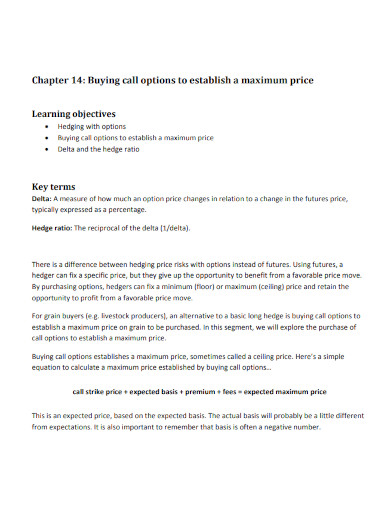

Buying call option Agreement

download now -

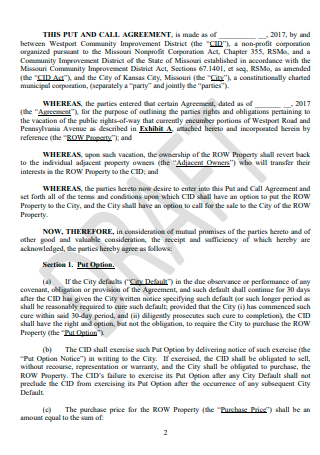

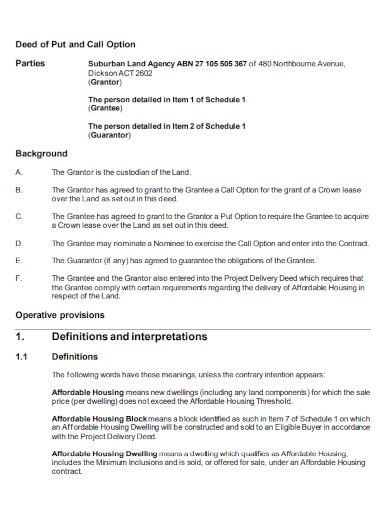

Put and Call Option Agreement

download now -

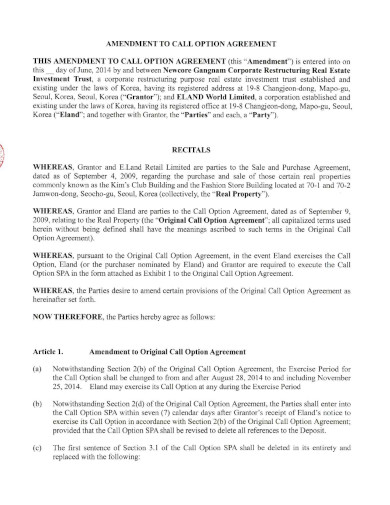

amendment to call option agreement

download now -

Call Option Investor Agreement

download now -

Deed of Put and Call Option Agreement

download now -

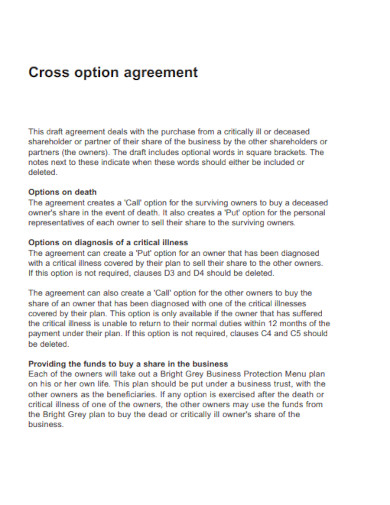

Cross Call Option Agreement

download now -

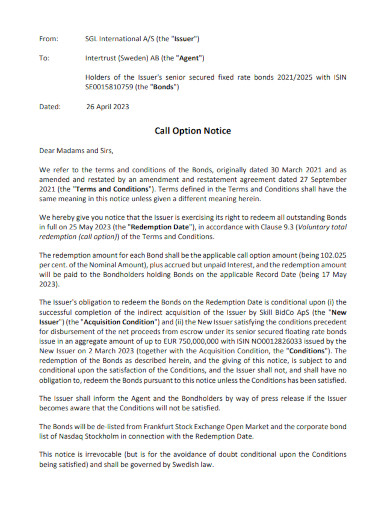

Call Option Agreement Notice

download now -

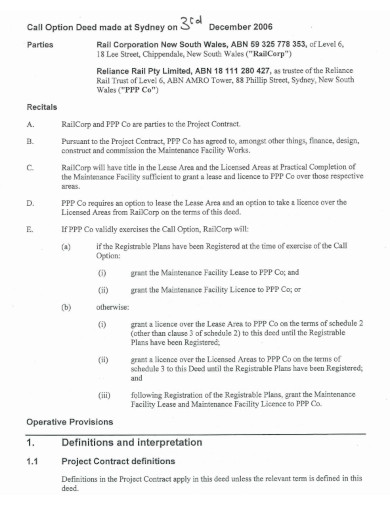

Call Option Deed Agreement

download now

FREE Call Option Agreement s to Download

9+ SAMPLE Call Option Agreement

What is an Example of a Call Option Agreement?

How do You Make Money on a Call Option?

What are the Key Components of a Call Option Agreement

Are there Risks Associated With Call Option Agreements?

How long does a Call Option Agreement last?

What is a Call Option Agreement?

A Call Option Agreement is a financial sample contract that gives the holder the right, but not the obligation, to buy a specific quantity of a financial instrument, such as stocks, at a predetermined price within a specified time frame. In simple terms, it provides the option holder the opportunity to purchase the underlying asset at a predetermined price, known as the “strike price,” before the option expires.

Here’s a breakdown of the key components:

1. Holder/Buyer: The individual or entity purchasing the call option, acquiring the right to option to buy the underlying asset.

2. Writer/Seller: The individual or entity selling the call option, agreeing to sell the underlying asset if the option holder decides to exercise their right.

3. Strike Price: The predetermined price at which the option holder can agreement of option to buy the underlying asset.

4. Expiration Date: The date when the option expires, and the right to exercise the option lapses.

Call Option Agreements are often used in financial markets for speculation, hedging, or income generation. If the market price of the underlying asset rises above the strike price before the option expires, the holder may choose to exercise the option, profiting from the difference between the market price and the strike price.

It’s crucial to note that the buyer is not obligated to exercise the option; they can let it expire if it’s not financially advantageous. This flexibility makes call options a versatile tool in financial strategies.

What is an Example of a Call Option Agreement?

Let’s consider a practical example of a Call Option sample Agreement:

Scenario:

Suppose an investor is interested in the stock of ABC Inc., which is currently trading at $100 per share. The investor expects the stock to rise in the next three months and wants to capitalize on this potential gain.

Call Option Agreement Terms:

Strike Price: $110 per share

Expiration Date: Three months from today

The investor decides to enter into a Call Option Agreement, paying a premium to the option seller. With this agreement, the investor gains the right (but not the obligation) to buy ABC Inc. shares at the predetermined strike price of $110 per share within the next three months.

Outcome:

If, at the expiration date, ABC Inc. shares are trading above $110, the investor can exercise the call option. They buy the shares at the lower strike price, realizing a profit from the market appreciation. However, if the market price is below $110, the investor is not obligated to exercise the option and may let it expire, limiting their loss to the premium paid for the option.

This example illustrates how a Call Option Agreement provides investors with a strategic tool to benefit from potential market movements while managing risk.

How does a Call Option Work?

A call option provides an investor with the right, but not the obligation, to buy a specified quantity of an underlying asset at a predetermined price (strike price) within a specified period (until the option’s expiration date). Here’s how a call option works:

1. Purchase of a Call Option:

An investor believes that the price of a particular asset will rise in the future, The investor buys a call option, paying a premium to the option seller (writer).

2. Key Components:

Underlying Asset: The asset (e.g., stocks, commodities) the option is based on.

Strike Price: The predetermined price at which the investor can buy the underlying asset.

Expiration Date: The date until which the option is valid.

3. Market Movement:

If the market price of the underlying asset rises above the strike price before the option expires, the investor can choose to exercise the call option.

4. Exercise of the Call Option:

When the investor exercises the option, they buy the underlying asset at the agreed-upon strike price, even if the market price is higher.

The profit is the difference between the market price and the strike price, minus the premium paid for the option.

5. Non-Obligatory Nature:

Importantly, the investor is not obligated to exercise the call option. If the market price doesn’t rise above the strike price, the investor can let the option expire without any further financial statemnet commitment.

Profiting from a call option involves correctly anticipating and capitalizing on the upward movement of the price of the underlying asset. Here’s a step-by-step explanation of how an investor makes money on a call option:

1. Market Expectation:

The investor believes that the price of the underlying asset will increase before the option’s expiration date.

2. Market Movement:

If the market price of the underlying asset rises above the strike price before the option expires, the investor can choose to exercise the call option.

3. Exercise of the Call Option:

Upon exercising the option, the investor buys the underlying asset at the agreed-upon strike price, even if the market repot is higher.

4. Profit Calculation:

The profit is calculated as the difference between the market price of the underlying asset at the time of exercise and the strike price.

Subtract the premium paid for the option from the profit to determine the net gain.

5. Example:

Suppose an investor buys a call option for XYZ stock with a strike price of $50, a premium of $2, and an expiration date in one month.

If, at expiration, XYZ stock is trading at $55, the investor agreemnet can exercise the option, buying the stock at the $50 strike price.

The profit would be $55 (market price) – $50 (strike price) – $2 (premium) = $3 per share.

It’s important to note that if the market price doesn’t rise above the strike price before the option expires, the investor may choose not to exercise the option. In this case, the investor loses only the premium paid for the call option. Managing the timing of entering and exiting the market is crucial for maximizing profits and minimizing losses when trading call options.

What are the Key Components of a Call Option Agreement

Key components include the underlying asset, strike price, expiration date, option holder (buyer), and option seller (writer).

Are there Risks Associated With Call Option Agreements?

Yes, there are risks. If the market price doesn’t reach the strike price before expiration, the investor may lose the premium paid for the option.

How long does a Call Option Agreement last?

The duration of a call option is defined by the expiration date. It could be days, weeks, or months, depending on the terms of the specific option.

In conclusion, our guide equips you to skillfully write about Sample Call Option Agreements. Navigate the complexities effortlessly with expert tips on incorporating unique examples, ensuring readability, and optimizing for SEO. Elevate your writing, captivate your audience, and provide invaluable insights with our guide. Craft articles that resonate, educate, and empower your readers in the realm of call option agreements.