50+ SAMPLE Compensation Agreement

-

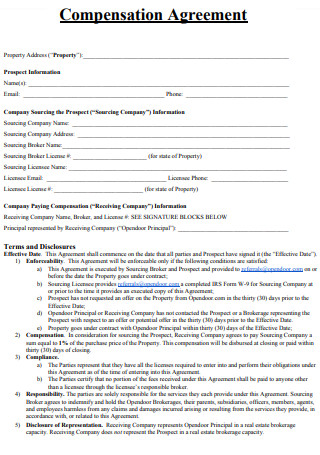

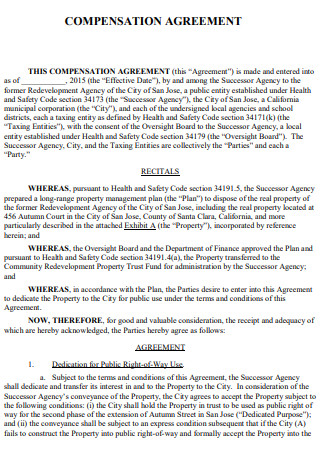

Compensation Agreement

download now -

Employer Compensation Agreement

download now -

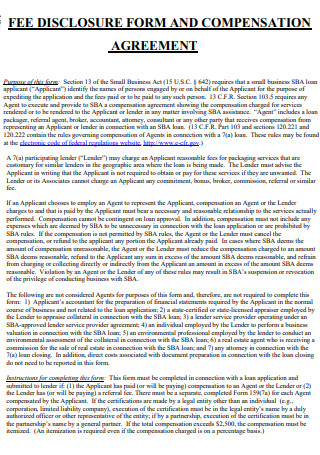

Compensation Agreement and Fee Disclosure Form

download now -

Deferred Compensation Agreement

download now -

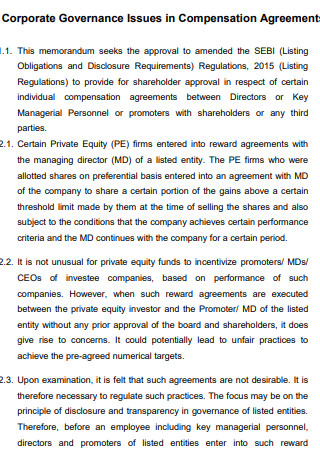

Corporate Governance Issues in Compensation Agreement

download now -

Sample Compensation Agreement

download now -

University Compensation Agreement

download now -

Elective Deferred Compensation Agreement

download now -

Showing and Compensation Agreement

download now -

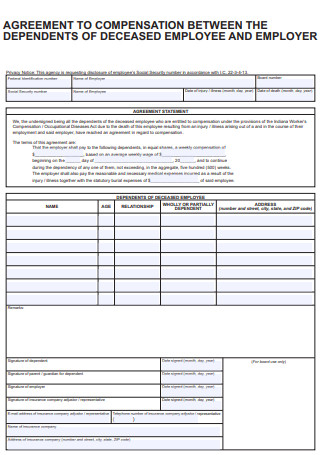

Compensation Agreement for Death

download now -

Compensation Paid Agreement

download now -

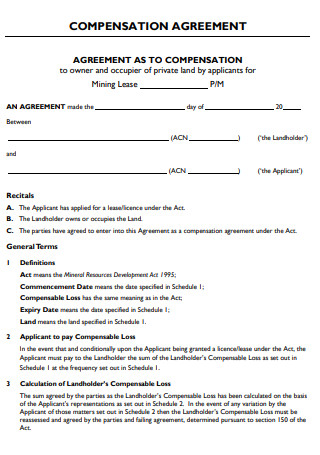

Private Land Compensation Agreement

download now -

Compensation Agreement for Disability

download now -

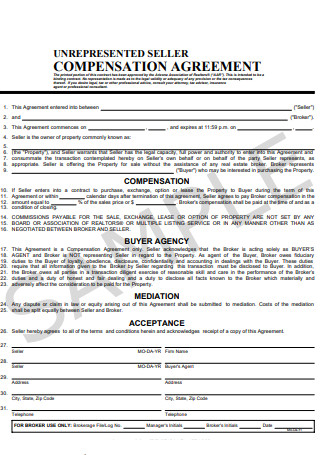

Unrepresented Seller Compensation Agreement

download now -

Simple Compensation Agreement

download now -

Basic Compensation Agreement

download now -

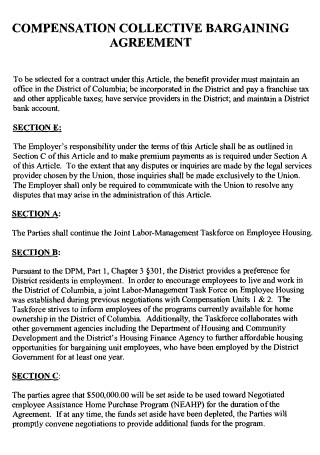

Compensation Collective Bargaining Agreement

download now -

Compensation Agreement Example

download now -

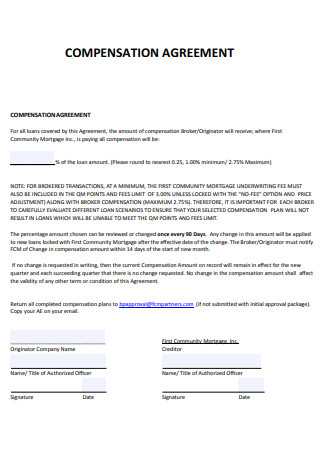

Originator Compensation Agreement

download now -

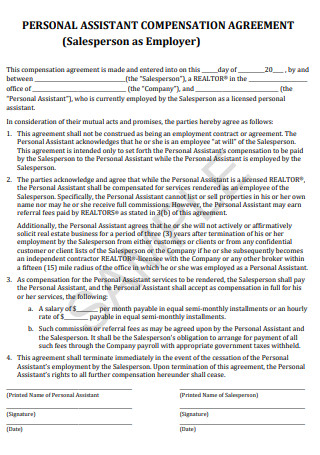

Personal Assistant Compensation Agreement

download now -

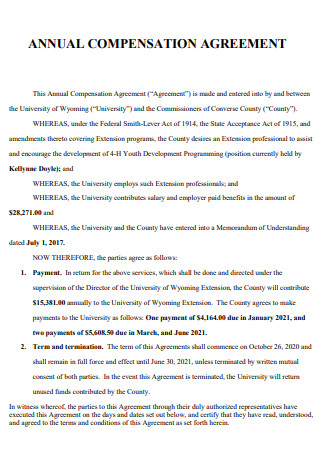

Annual Compensation Agreement

download now -

Act on Indemnity Compensation Agreement

download now -

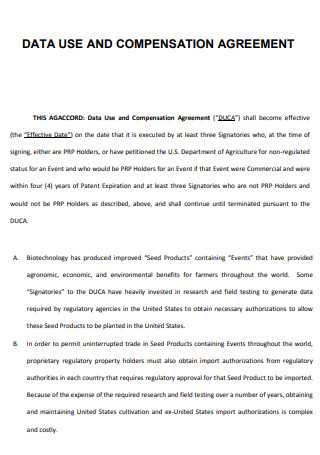

Data Use and Compensation Agreement

download now -

Supplemental Compensation Agreement

download now -

Compensation Agreement for Asynchronous Online Teaching

download now -

Workers Compensation Agreement

download now -

Virus Yellow Compensation Agreement

download now -

Compensation Negotiation Agreement

download now -

Broker Compensation Agreement

download now -

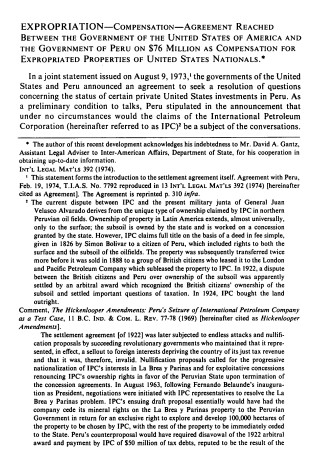

Expropriation Compensation Agreement

download now -

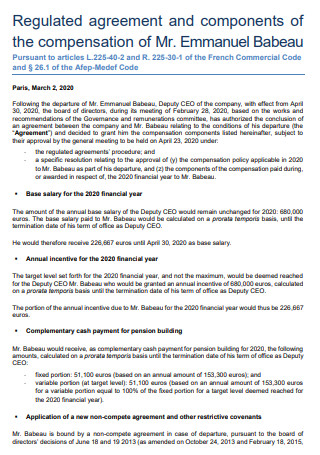

Regulated Compensation Agreement

download now -

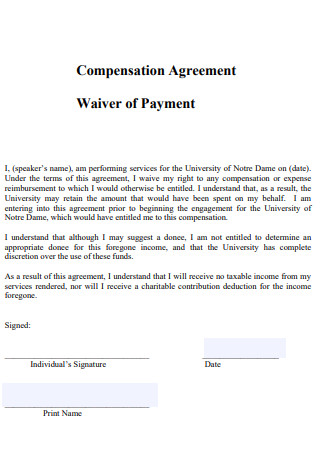

Waiver of Payment Compensation Agreement

download now -

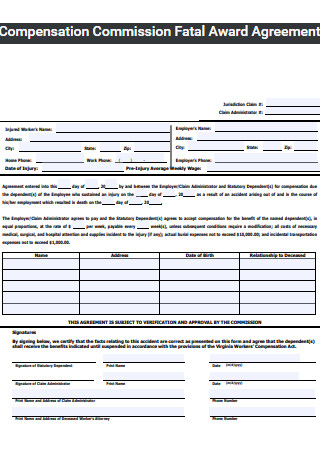

Compensation Commission Fatal Award Agreement

download now -

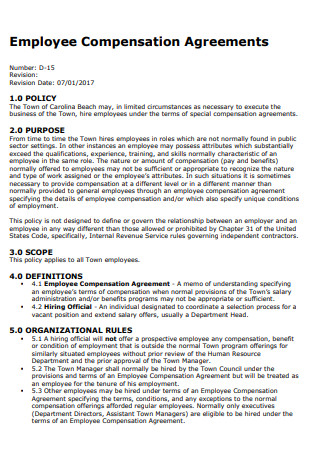

Employee Compensation Agreement

download now -

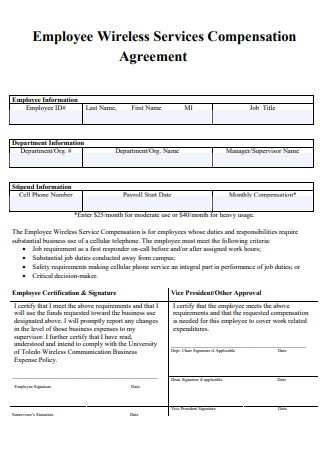

Employee Wireless Services Compensation Agreement

download now -

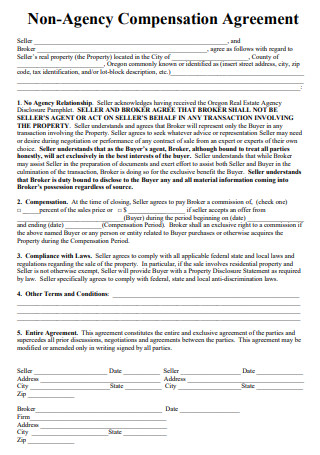

Non-Agency Compensation Agreement

download now -

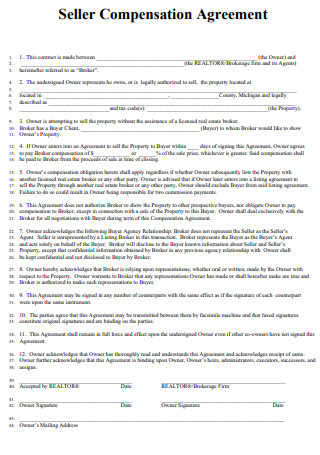

Seller Compensation Agreement

download now -

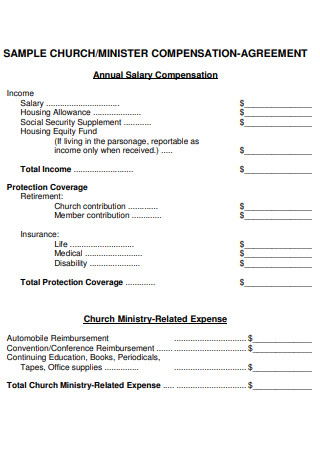

Church Compensation Agreement

download now -

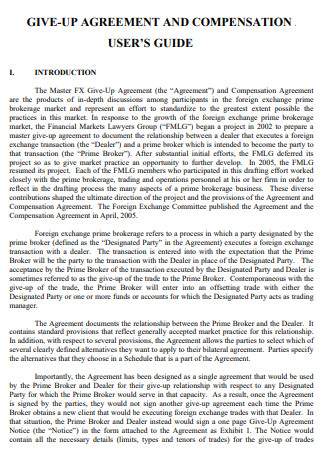

Guide for Compensation Agreement

download now -

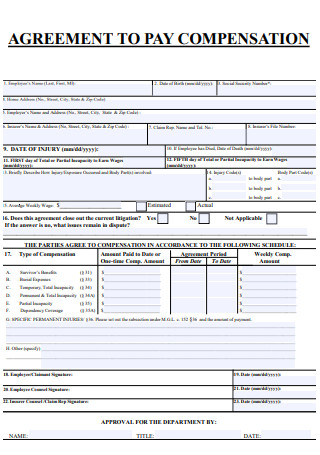

Agreement to Pay Compensation

download now -

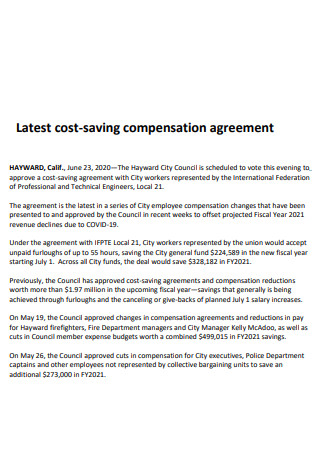

Latest Cost-Saving Compensation Agreement

download now -

Lender Paid Compensation Agreement

download now -

Loan Originator Compensation Policy & Agreement

download now -

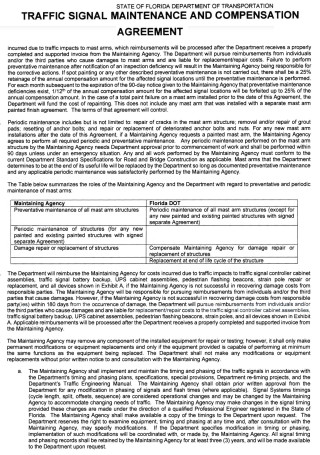

Traffic Signal Maintenance and Compensation Agreement

download now -

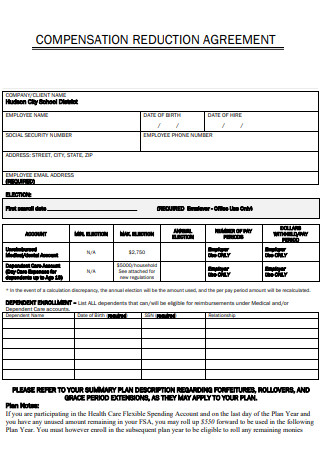

Compensation Reduction Agreement

download now -

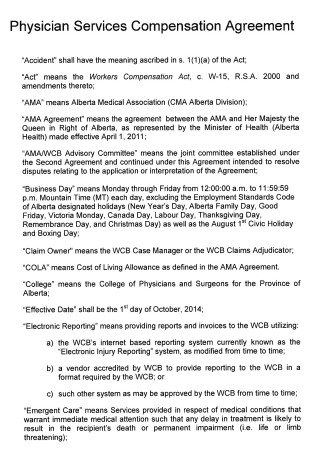

Physician Services Compensation Agreement

download now -

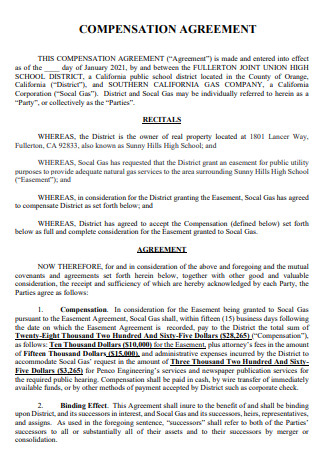

Compensation Agreement Template

download now -

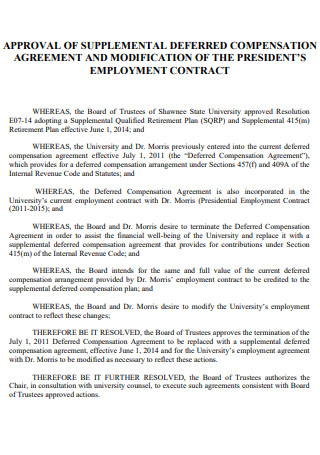

Approval of Supplement Compensation Agreement

download now -

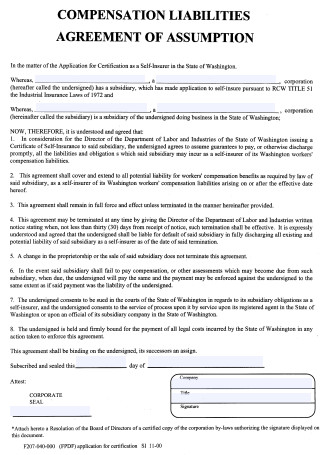

Compensation Liabilities Agreement

download now -

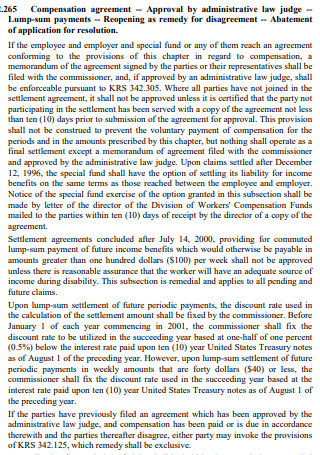

Administrative Compensation Agreement

download now -

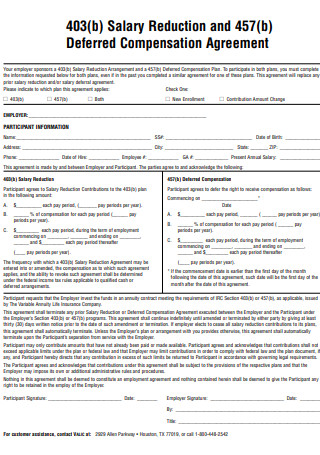

Salary Reduction and Compensation Agreement

download now

FREE Compensation Agreement s to Download

50+ SAMPLE Compensation Agreement

a Compensation?

Benefits of Compensations

Types of Compensation

How To Develop a Compensation Strategy

FAQs

What are the terms of the pay and benefits policy?

What is an allowance for benefits?

Is compensation the same as a salary?

What Is a Compensation?

Compensation is any monetary payment an employer makes to employees throughout their job time. The employee will contribute their time, work, and expertise in exchange. Compensation may take the shape of a salary, pay, benefits, bonuses, paid time off, pension funds, and stock options, among other forms. Outside of the United States and Canada, compensation is occasionally referred to as remuneration. Understanding the various types of income is crucial for developing an enticing compensation package for current employees. Not only will this help you in keeping top talent, but it will also help you in attracting new talent to your organization—as long as you differentiate yourself from your competition. According to statistics, 33% of employers in the United States offer year-end bonuses.

Benefits of Compensations

Astute employers understand that retaining quality employees entails offering a fair wage and benefits package. Wages, salaries, bonuses, and commission arrangements all constitute compensation. Employers should not ignore the benefits component of employee remuneration and perks, as benefits sweeten employment contracts by addressing the needs of most employees.

Types of Compensation

Assume you haven’t given your compensation and benefits approach much thought. In that case, you risk missing out on opportunities to boost employee satisfaction and engagement, as well as staff retention and employer brand. Compensation schemes differ by country. For instance, in the United States, health benefits frequently account for a sizable portion of an employee’s income and benefits package. Let us examine these various forms of compensation in further detail.

-

1. Hourly Wages

Unskilled, semi-skilled, temporary, part-time, or contract workers frequently receive hourly earnings in exchange for their time and labor. Retail, hotel, and construction industries all hire personnel hourly. Employees paid on an hourly basis are typically eligible for overtime compensation. This compensation is for any additional hours performed above the hours specified in their contract. When setting compensation for your employees, you must adhere to local minimum wage laws.

2. Bonuses

Businesses frequently award bonuses to employees based on the company’s year-end financial achievements or the individual’s predetermined goals. Occasionally, the management makes the call. Bonuses might be granted annually, quarterly, or even project-by-project basis. Commissions and bonuses, piece rates, profit sharing, stock options, and shift differentials all fall under the category of incentive compensation. However, bonuses can be granted even if an employee does not fulfill a specific goal. For instance, suppose a corporation had a banner year and decided to thank everyone. The bonus would be classified as variable compensation in this situation. Also, tips are a prevalent type of pay in service-oriented businesses, most notably hospitality. Deferred pay is another type of direct remuneration that encompasses savings plans and annuities. Merit pay is frequently awarded to employees who meet their targets or perform admirably in their current employment.

3. Benefits

Health insurance, life insurance, retirement plans, disability insurance, legal insurance, and pet insurance are all examples of typical employee benefits. As previously said, healthcare is a popular benefit in the United States, owing to its high cost. In the United Kingdom, healthcare is provided for free through the National Health Service. Employees also frequently check for retirement funds and pension schemes when choosing a new career at a new firm. According to a survey, 48% of job seekers in the United States stated it would be possible to apply for a job that offered good perks. Thus, while the basic pay you give is critical, it is also vital to consider your complete compensation package.

4. Total compensation

The full payment comprises a compensation package that includes all of the categories mentioned above of balance. Total pay can have a range of awards and bonuses at various work levels. A statement of full payment is beneficial to employees. They begin with explicit knowledge of their rights and the many sorts of compensation available. Divide basic pay, incentives, and commissions, for example, to help employees understand what they are automatically entitled to and what they must earn by meeting targets. Compensation could be divided into two columns: direct compensation and indirect compensation. Alternatively, you may take it a phase further and divide remuneration into several subcategories within each of those categories—for example, healthcare, a company car, stock options, and a pension fund. Each recruit should receive a detailed, transparent report outlining their overall salary and be assigned a manager to whom they can direct any questions. This requires that all managers have a working knowledge of the remuneration package on offer. They should be able to explain how it works and address any concerns. Employee engagement increases, turnover decreases, and employer brand improve when a business is innovative and honest with compensation management. As a result, human resource teams must be strategic regarding the entire pay packages they provide employees and how they present them throughout the hiring and employment process. By law, a certain level of compensation is necessary, and your staff must maintain compliance with these constantly changing requirements. A premium compensation package will undoubtedly help you differentiate yourself from the competition and recruit the best people to your firm while retaining existing staff.

5. Non-monetary compensation

Silicon Valley companies offer an array of constantly attractive incentives to their employees, including concerts, onsite yoga sessions, massages, accessible vacation accommodations, foosball tables, and catered meals. While some of these forms of remuneration may appear insignificant or unneeded, they can significantly impact an employee’s day. This can increase their overall satisfaction both in and out of a job. It would be best to give a range of perks that appeal to the many types of people you employ and may hire in the future. For instance, if any of your employees have recently become new parents or are considering starting or growing a family in the following years, they will place a premium on parental leave and daycare. Also, various types of remuneration can be perceived as a perk or a disadvantage, depending on the regulations. For example, if you supply each employee with a company laptop, are they compelled to use it exclusively for business purposes, or are they free to use it for personal purposes? Having two laptops may seem inconvenient to some. Others may object to the thought of their personal browser history being tracked and monitored by the firm. This is why it is necessary to ascertain your core personnel and what they desire before developing a compensation plan. Once again, there are distinctions amongst organizations about what constitutes non-monetary compensation.

6. Salary

Most full-time or skilled employees, as well as those who hold managerial roles, get annual salaries. A salary frequently suggests that the company has made a long-term commitment to this person. Teachers, accountants, doctors, and retail and hospitality management are examples of salaried employees. An employee’s base payor base salary is both hourly wages and salary.

How To Develop a Compensation Strategy

One of management’s most essential obligations is to design a payment plan that is equitable, competitive, and motivates individuals to perform at their best. However, because no one-size-fits-all method applies to all firms, learning how to develop one is critical for your business. The following are the essential steps in developing a compensation plan:

-

1. Create a philosophy of compensation

The first stage in developing a compensation plan is determining the reward philosophy and strategy that your firm will follow. A compensation philosophy is the fundamental tenet of a compensation plan. A good compensation philosophy helps business operations increase competitive advantage and contributes to achieving the organization’s strategic goals. The concept informs all of your decisions regarding the amount of compensation, incentives, and benefits you provide to your staff. Instead of depending on the ad hoc approach, its responses assist in determining the foundation of remuneration. Nowadays, most firms have a performance-based compensation system, with high-performing employees claiming more perks and vice versa. This method enables businesses to maximize their investment in employee remuneration.

2. Collect pertinent data from a variety of sources

It is critical to collect sufficient data when developing a compensation plan to assess current market trends and position your firm effectively. The type and quantity of information required vary according to the company’s size, the duration of the task, and whether you are modifying an existing plan or creating a new one. It is best to collect it from numerous reputable sources. This enables triangulation and filling data gaps to increase the dependability of the data; unreliable data might jeopardize the integrity of conclusions and result in costly errors.

3. Comparing external roles to internal positions

After acquiring market data, it is necessary to undertake data analysis to establish benchmarking jobs priced using market externalities. Benchmarking 50%–65% of jobs using market pricing to include at least 70% of all employees is recommended. Review current pay rates against market data after the benchmarking process. This enables you to develop appropriate pay structures consistent with your organization’s compensation philosophy and market reality.

4. Each role should have its job description.

Create a detailed explanation of each position’s duties and responsibilities. Consider the job descriptions and salaries for comparable positions in the market. If numerous places perform essentially the same function, you may wish to consolidate them. Current market conditions and organizational policy should assign appropriate job titles to each position.

5. Create a pay structure

Pay structures are established by generating job grades, establishing a market pay line, and establishing pay ranges. A job grade is a collection of different but comparable jobs. Selecting work grades enables matching jobs to be compensated equally. Also, they define the criteria for advancement from one stage to the next. A market pay line helps you convert market data into useable internal information. Degree of education and performance is made possible by establishing pay ranges within job grades. Additionally, select the advantages you will supply by the company’s budget. When creating a wage structure, ensure that you adhere to all applicable federal and state employment rules.

FAQs

What are the terms of the pay and benefits policy?

Employers compensate and benefit their staff in a variety of ways. These policies should establish clearly defined and equitable strategies for employees. Also, they should represent the company’s salary and benefits programs.

What is an allowance for benefits?

A benefit allowance is money provided to an employee by a company or government agency for a specified purpose, such as transportation, healthcare bills, or a flexible spending account. Employee benefit allowances might be distributed through regular salary.

Is compensation the same as a salary?

Compensation is the sum of earnings, wages, and benefits employees receive in exchange for doing a specific job. It may consist of an annual salary or hourly compensation in addition to bonuses, benefits, and incentives.

Creating a compensation agreement may appear to be complicated. However, it will be simple with the right ideas and templates in place. As a result, bear the preceding facts in mind while creating a compensation contract. Additionally, feel free to utilize the provided templates. They are simple to use and quite effective.