47+ Sample Credit Agreements

-

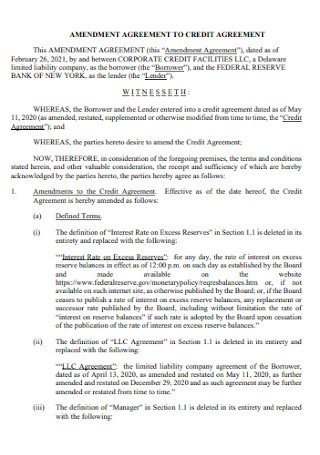

Amendment to Credit Agreement

download now -

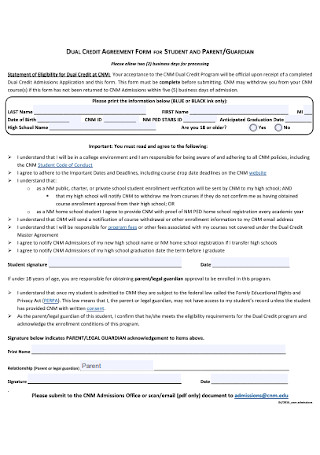

Dual Credit Agreement Form

download now -

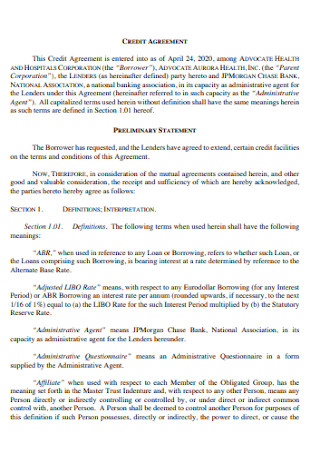

Syndicated Credit Agreement

download now -

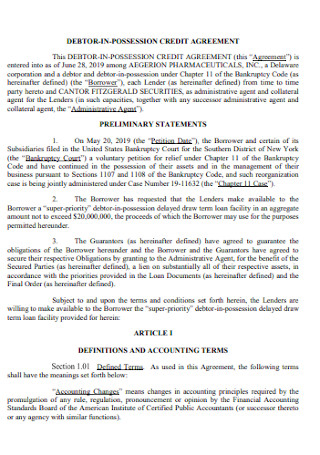

Debtor Possestion Credit Agreement

download now -

Company Credit Agreement

download now -

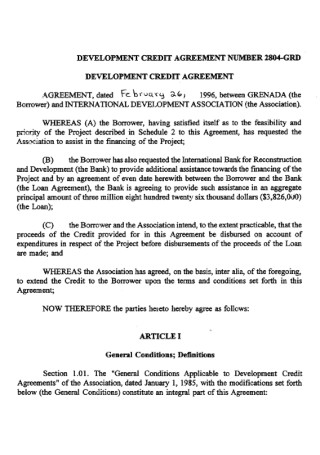

Standard Development Credit Agreement

download now -

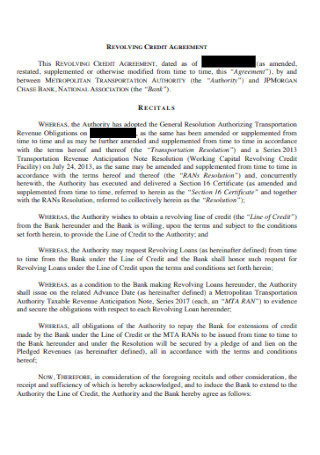

Printable Revolving Credit Agreement

download now -

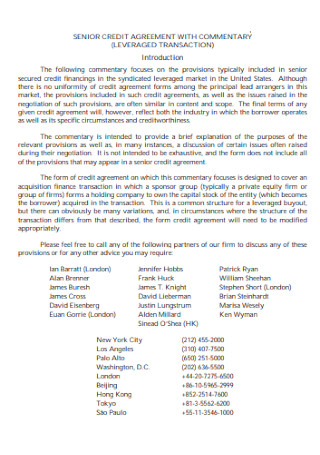

Senior Credit Agreement

download now -

Explanation of Your Credit Agreement

download now -

Credit Law Agreement

download now -

Installment Credit Agreement

download now -

Simple Credit Agreement

download now -

Line of Credit Agreement

download now -

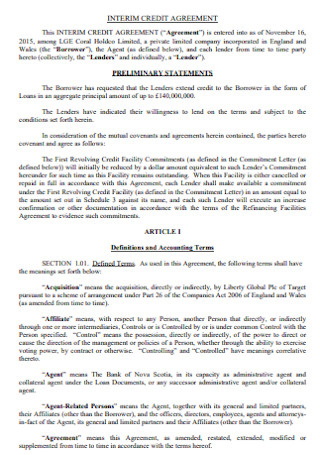

Interim Credit Agreement

download now -

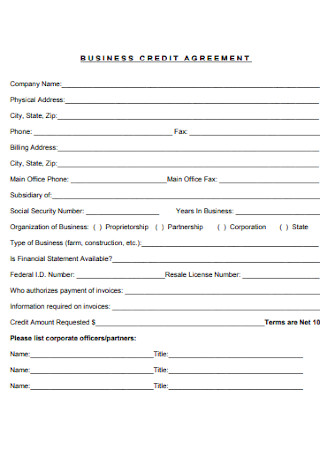

Sample Business Credit Agreement

download now -

Revolving Credit Agreement

download now -

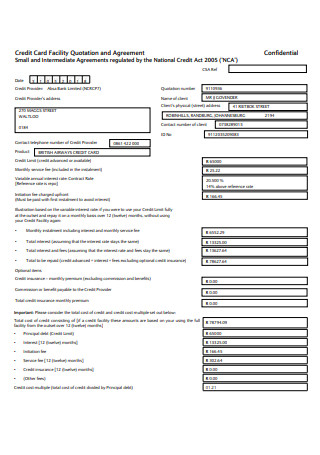

Credit Card Facility Agreement

download now -

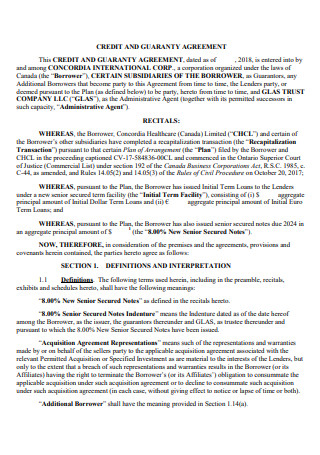

Credit and Guaranty Agreement

download now -

Business Credit Agreement

download now -

Credit Dusters Affiliate Agreement

download now -

Credit Facility Trust Agreement

download now -

Credit Assignment Agreement

download now -

Tax Credit Property Agreement

download now -

Credit Card Guarantee Agreement

download now -

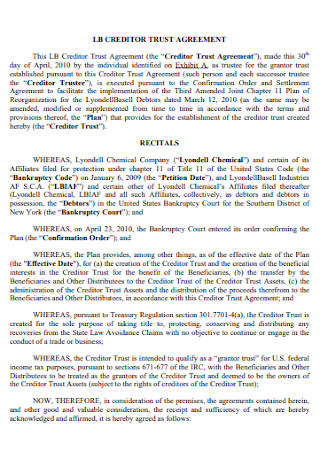

Creditor Trust Agreement

download now -

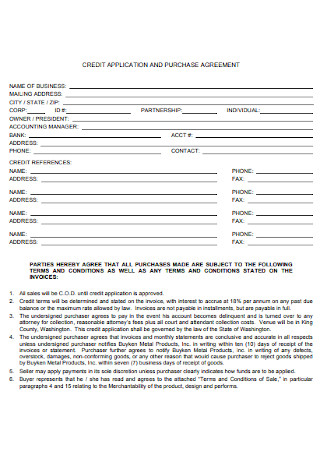

Credit Purchase Agreement

download now -

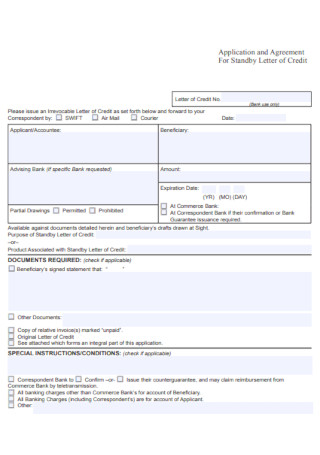

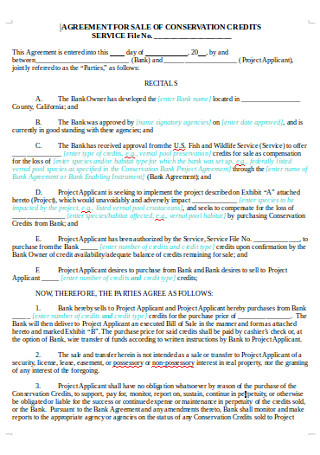

Agreement for Letter of Credit

download now -

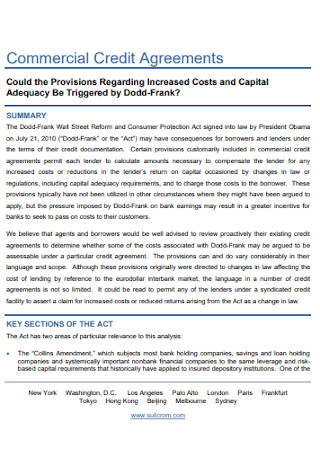

Commercial Credit Agreement

download now -

Credit Facility Agreement

download now -

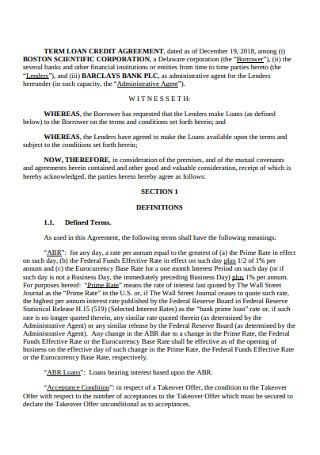

Term Loan Credit Agreement

download now -

Credit Sales Agreement

download now -

Business Access Credit Agreement

download now -

Retail Credit Agreement

download now -

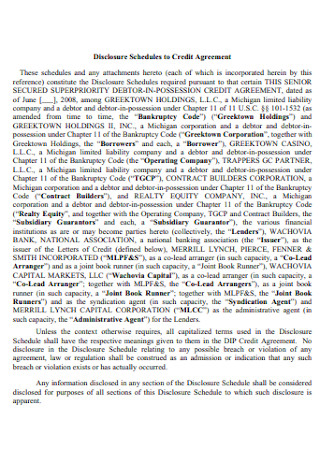

Disclosure Schedules to Credit Agreement

download now -

Subordination and Intercreditor Agreement

download now -

Bill Credit Agreement

download now -

Requirements of Credit Agreement

download now -

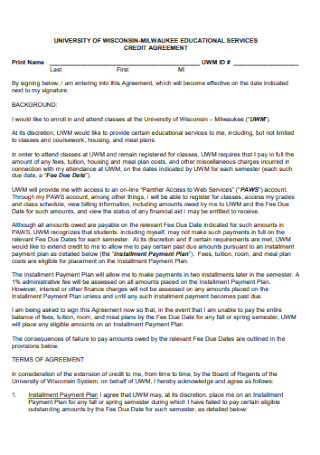

Educational Service Credit Agreement

download now -

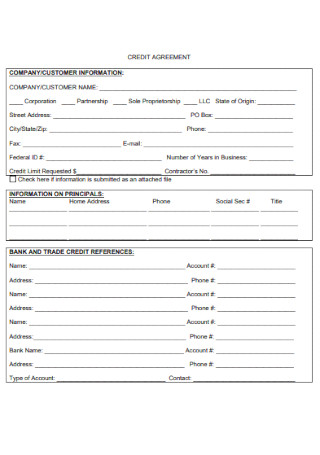

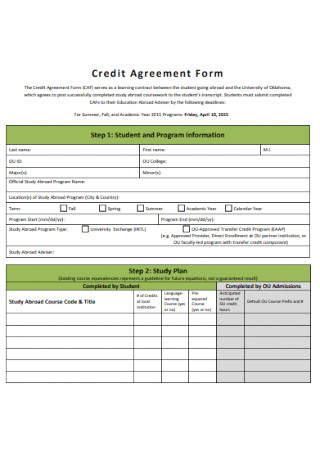

Credit Agreement Form

download now -

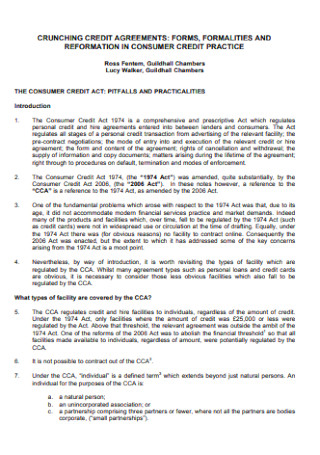

Crunching Credit Agreement

download now -

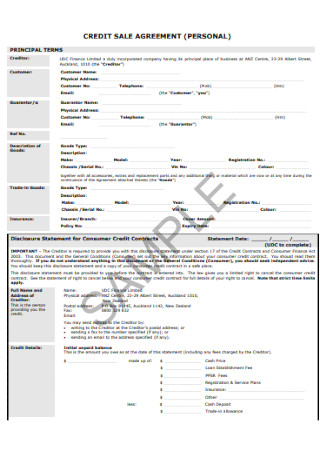

Personal Credit Sale Agreement

download now -

Restated Credit Agreement

download now -

Credit Agreements In Insurance

download now -

Renewable Energy Credit Agreement

download now -

Tax Aspects of Credit Agreement

download now -

Standard Credit Agreement

download now -

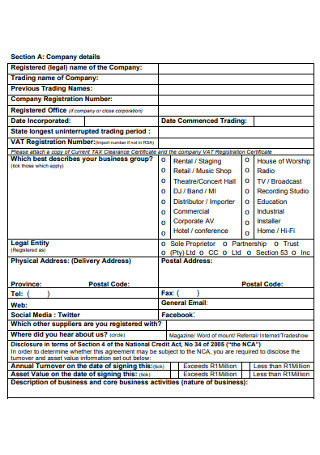

Credit Application and Agreements

download now -

Subordinator Revolving Credit Agreement

download now

They are common in the modern world and many people have credit cards. Loans are also inevitable, that is why we go to a bank and request for a loan. Credit is a part of our life. We usually make credit now and then. But before we can actually have a credit, we usually enter first in a credit agreement. This agreement is essential for us to have a credit. A credit application is submitted to the lender, so the lender can decide whether to give us a credit or not. All types of credits have a credit agreement. It is usual in the way of doing business. A promissory note is not enough that a definite agreement should be made. If you are a borrower, you have to have knowledge about credit agreement. In this article, you will be informed about things on credit agreement. It has tips that can help you. You will learn the advantages of credit agreement. You will also learn how to write a credit agreement. You will know its forms. Now, make yourself relaxed and keep on reading.

What is a Credit Agreement?

A credit agreement is a binding document of a loan. It is a contract between a borrower and a lender. It gives all the terms that is involved with the loan or credit. It is a prerequisite before borrowers can use the money that they have borrowed from the lender. It is created for all institutional and business loans. It is necessary for all types of loans including personal loans, auto loans, mortgage loans, bank loans, credit cards, and others. Before you can actually have the money that you are going to borrow, you have to enter into this agreement first. This is for the lenders to secure the terms that they want to have regarding your credit. There are different types of credit agreements and usually, you have to fill up first a credit application. The most common type of credit agreement that we have is through credit cards. Just as Credit Agreement Act 75 of 1980 said, that certain transaction for movable goods can be rendered through credit, we use credit cards to purchase goods that we need. It is a lot easier at times and gives us the convenience in times that we lack money. So, a credit agreement is not bad after all. It can help us in times of need.

Forms of Credit

Credits can be introduced in different forms. Here are the common credit facilities:

Overdraft Credit

A business can have credit when it has no funds that can be found in its cash account. It is going to pay all the interests and all the fees according to the amount that it has borrowed.

Credit Line

Credit line can give you the full access to the funds that you need. It has competetive rate and has many priviliges. Many use this type of facility in credit.

Revolving Credit Accounts

This type of credit line agreement has a limit and has no requirements for monthly payments. The interest that has been accrued will be increased to the principal amount of credit.

Term Loans

This is a commercial loan that can finance any investment. The terms in this type of credit are fixed and also the interest rate. One example of this is a short-term loan which has monthly payments. When a loan is longer, it requires a collateral.

Tips on Credit Agreement

If you are new in the credit world, you may have the desire to be acquainted with all the things about it. Here are some practical tips that can help you in making a credit or a credit agreement:

Advantages of a Credit Agreement

A credit agreement has certain benefits. You may want to know its advantages so you will be aware of the benefits that you can get from it. Here are the advantages of a credit agreement:

How to Write a Credit Agreement

Are you a lender? You must present a credit agreement to every borrower that wants to borrow from you. Consider the following simple steps for you to be able to write a credit agreement.

Step1: Know the purpose of the credit agreement.

First, you must understand the purpose of the credit agreement. This will help you decide on the following:

- the amount of the money that will be borrowed

- the repayment schedule and the interest that you can give to the amount of credit

- what will you do if the borrower will have a late payment or will not pay

Step 2: Decide if you will lend and tell the borrower.

After having some predetermined thoughts about the credit agreement, tell the borrower that you can lend the money after you have decided on doing it. Ask the borrower with these following questions of creditworthiness:

- What is your credit report? – You must be aware of the credit report of the borrower. Ask for it. This can tell whether the borrower is a good payer or not. In case that the borrower has a bad credit report, you can change your mind and should not lend money.

- Can I have your proof of income? – Of course, you should know if the borrower can pay you. You should ask for a proof of income that will tell whether the borrower can provide payment or not. Ask for a recent pay slip or proof of financial accounts.

- Can I have your work references? – The borrower should be employed for you to give them credit. Ask for the phone number of the employer of the borrower, so you can check whether the borrower is working there or not. Not that you are doubtful. But you have to be sure about the borrower’s employment.

- Do you agree with my interest rate? – If the loan is more than $10,000, an interest should be given with the credit. Otherwise, it can be counted on as a “gift” by the IRS (Internal Revenue Services). You should apply all the applicable laws within your state.

Step 3: Negotiate about the terms.

The lender and the borrower should talk about the terms that they will have in the agreement. They must agree on the amount of the loan, the interest rate, and the payment schedule. Left nothing undecided before you are going to darft an agreement.

Step 4: Write the credit agreement.

First, title the document. In your Word processor, center the title “Credit Agreement” in bold letters. Then the next thing is the identification of the parties. Address both parties as the “Borrower” and the “Lender”. Put your names in the right category. Include both party’s addresses. Then be specific about the date. Put the date when you have crafted the agreement. After that, state the amount of money that the lender will lend to the borrower. Be clear in writing this. Then state the interest rate, whether you want it per month or per annum. Afterwards, give the repayment schedule. Finally, include a clause about late fees and prepayment. Also, provide a default provision.

Step 5: Finalize the credit agreement.

Add a law provision, a merger clause, and a severability clause. Then insert a signature block for the two parties’ signatures. Provide also a notary block because you may need to notarize the credit agreement. After all these, then your credit agreement is ready.

FAQs

How Can I Get a Credit Card?

To get a credit card, you must apply for a credit card to credit companies and banks. There are banks that instantly give a credit card after opening an account from them. They will just deliver you a credit card after months or a year or so of banking with them.

Making a credit is inevitable. There are things that we need to buy or purchase sometimes and the only solution to our problem is to have credit. Just brace yourself and do not get too much credit on your shoulders. It is addictive and you must not get yourself into trouble when it is time for you to pay. Have credit only that is sufficient for your needs. With that, you will not lose the convenience of having a credit. It can help you rightfully.