10+ SAMPLE Debenture Pledge Agreement

-

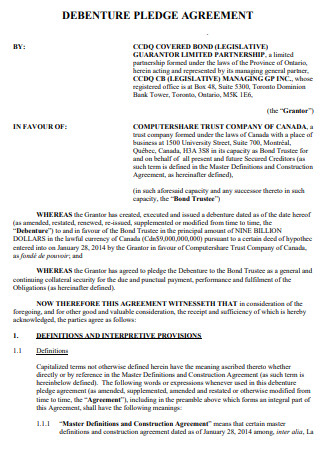

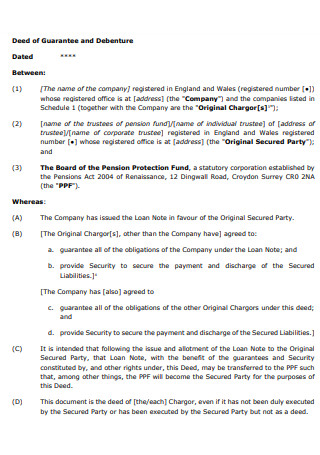

Debenture Pledge Agreement

download now -

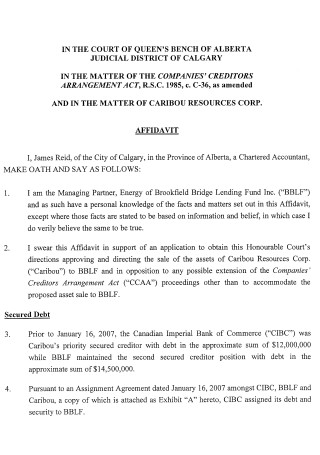

Sample Debenture Pledge Agreement

download now -

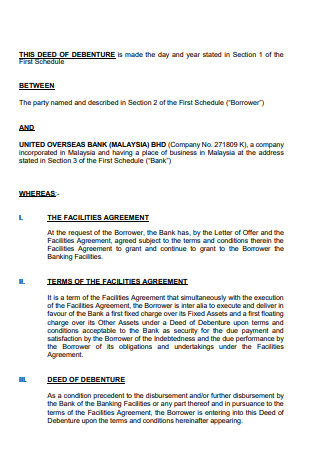

Deed of Debenture Pledge Agreement

download now -

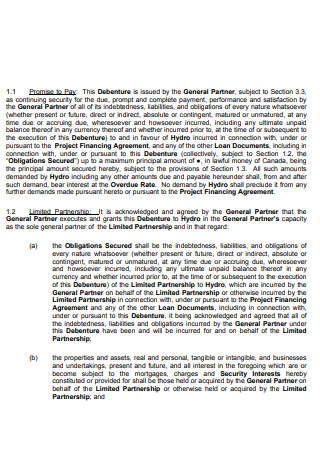

Simple Debenture Pledge Agreement

download now -

Debenture Trustee Pledge Agreement

download now -

Basic Debenture Pledge Agreement

download now -

Company Debenture Pledge Agreement

download now -

Restated Debenture Pledge Agreement

download now -

General Debenture Pledge Agreement

download now -

Debenture Pledge Security Agreement

download now -

Debenture Pledge Agreement Example

download now

FREE Debenture Pledge Agreement s to Download

10+ SAMPLE Debenture Pledge Agreement

What Is a Debenture Pledge Agreement?

Benefits of Loans

Factors That Keep You From Getting a Loan

How to Pay Off Your Loan Debt Faster

FAQs

What is the easiest loan to get?

Do personal loans require proof of income?

Do personal loans check bank statements?

What Is a Debenture Pledge Agreement?

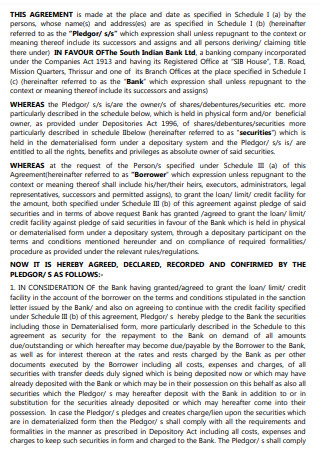

A debenture is a legal document that confirms and explains the terms of a loan. Generally, interest must be paid on debentures to the lender before dividends can be given to shareholders. Due to the high level of guarantee for the lender, one of the main benefits of using a debenture agreement is that the yield curve is usually lower than, for example, an overdraft capacity or a traditional term loan. Bankrate’s latest survey of 2490 U.S. adults found that 60% have helped a friend or family member by giving them cash with the expectation of getting it back. Another 17% gave a friend or family member their credit card, and 21% co-signed for a financial product like a rental or loan. But more than 35% of the people who did at least one of these things ended up losing money, having their credit score go down, or hurting relationships.

Benefits of Loans

A personal loan may be a suitable alternative if you need a short infusion of cash to cover essential expenses. Individual loan rates are typically lower than credit card rates, especially if you have an excellent credit score. You should constantly consider the advantages and disadvantages. After all, taking out a personal loan entails incurring debt, for which you must be prepared to make payments for several years. If you cannot afford monthly principal and interest payments, evaluate the amount you need to borrow or the method of borrowing. Personal loans are sometimes the most excellent method to fund a significant purchase or project you cannot pay for in full. Here are the leading eight motives for obtaining a personal loan.

Factors That Keep You From Getting a Loan

Business loans can be vital for beginning a new company or expanding an existing one, as the money is frequently used to acquire inventory, buy equipment, rent office space, pay staff, and cover other expenses. However, it might be difficult for fledgling businesses to obtain business loans. Be aware of these six obstacles preventing you from receiving a small business loan.

1. Poor credit history

Credit reports are one of the instruments used by lenders to determine a borrower’s creditworthiness. A loan application may be denied if your credit history reveals a lack of responsibility in repaying obligations. Unfortunately, this is a significant barrier to entering the world of small business, as often extremely good people have credit problems for reasons beyond their control. Additionally, before asking for a company loan, you should create a solid personal credit score and pay down any outstanding debt. Consider nontraditional financing options, which tend to place less importance on credit scores, before giving up on obtaining a loan if, after taking these steps, your credit score still needs improvement.

2. Limited cash flow

Cash flow, a measure of how much money you have on hand to repay a loan, is typically the first metric used by lenders to evaluate the health of a business. Inadequate cash flow is a fault most lenders cannot afford to overlook. Therefore, it is the first factor to consider when determining if you can afford a loan. To determine how much of a loan payment you can afford, calculate your debt service coverage ratio by dividing your net operating revenue by your total yearly debt. If your cash flow equals your monthly loan payments, your balance will be 1. Although a ratio of 1 is okay, lenders prefer a ratio of 1.35, which indicates you have a financial cushion. If you are still determining your present financial condition or capacity, see a financial planner who can help you obtain the necessary perspective and develop a plan to address any deficient areas.

3. Lack of a solid business plan

In the financial world, having a plan and sticking to it is considerably more attractive than being spontaneous. It also improves your chances of obtaining company financing. It’s not unusual for tiny enterprises to lack a formal business plan – or any strategy – but you’ll still need to put in the time and effort to construct a thorough business plan before approaching a lender. A conventional business plan includes an overview of the company, its market, its products, and its finances. If you are uncertain whether your business plan is appealing enough to persuade the lender, you may wish to see a business plan expert for feedback. It would benefit if you also were prepared to explain how you intend to utilize the borrowed funds. At the very least, loan applicants should be able to explain why they need a loan and how they plan to return it.

4. Disorganization

Before going to possible lenders, business owners should ensure everything is in order. That means you need to have all the paperwork you need to get a loan on hand. Legal paperwork like franchise agreements, business licenses, and registrations, as well as a detailed business plan and proof of collateral, are often required. Business owners can get help from many places when completing their loan applications. For example, the Small Business Administration gives people who want a loan a detailed list of things to do. Using these tools makes it less likely that you’ll need to be more organized and prepared.

5. Failure to seek expert advice

When you apply for a company loan, the lender will want to witness that you have consulted with qualified counsel. Accountants may be an invaluable resource for small business owners. Business owners receive financial guidance from business networking organizations and research the websites of the leading alternative funders since many provide extensive resource sections for small firms on the many types of finance available and the best ways to prepare for funding.

6. Failure to shop around

Finding a lender can be so challenging that joining up with the first one that appears may be tempting. However, it is unwise to pursue a single loan provider without investigating choices—research a selection of conventional and non-conventional lenders to find the best fit for your business. Begin with a community bank or credit union more committed to the local community, as they may have initiatives to assist new local businesses. Online lending platforms, peer-to-peer lending websites, and your network of friends and family are further options for conventional lenders. During comparison shopping, you can also request that each lender assist you in calculating their loan’s annual percentage rate.

How to Pay Off Your Loan Debt Faster

School, a new automobile, or even a house may necessitate taking out a loan to pay for them. You may even have to juggle many loan payments simultaneously, which may be highly taxing on your finances and emotional health. Here are five ways to help you pay off your loans more quickly and reach financial enlightenment.

1. Bump up your payments.

Paying more than the minimum amount on a loan will take you less time to pay off the loan. This could be as easy as rounding up your payment. For example, if you owe $255 a month, you could pay $300 a month or add $100 to the principal of your income. You can plan your budget around that if you’re setting aside money each month for a more significant payment.

2. Live cheaply.

This recommendation can be construed in numerous ways, depending on your current lifestyle. If your situation permits it, moving back in with your parents is an excellent way to live inexpensively and save money for a loan payment if you are a recent college graduate with a significant amount of student debt. Or, if you have a car loan plus a mortgage payment, you may need to reevaluate your budget to determine where you can cut back on disproportionate expenses, such as dining out, shopping, expensive vacations, etc. If you look hard, you can identify an area in your budget where you can reduce unnecessary expenditures; remember to apply the money you save to your loan payments.

3. Get some extra cash? Use it to pay off your debts.

If you receive a windfall of cash, such as an inheritance, a lottery prize, or a tax refund, you will be tempted to spend it on luxuries. Resist the temptation and apply the funds to something important, such as paying off your loans with newly acquired funds. It’s not the most appealing scenario, but it’s the most prudent, as it will save you interest payments in the long run. And you’ll thank yourself once you’ve paid off your loans, and it’s time to reward yourself with the desired thing.

4. Apply for an extra job.

If you have spare time, often in the evenings and on weekends, you could pursue a second job as an additional source of money to apply for your loan payments. If you are ready to sacrifice some of your leisure time in the short term in exchange for fewer loan payments in the long term, you will be ahead of those future loan charges. If you are a student, this could involve revisiting the concept of a waitressing job or working as a nanny on the weekends while you work a career-oriented job during the week. If you’re farther along and have last worked part-time in years, overcoming your pride and applying for an hourly-paid position can be difficult. However, it is still worthwhile if you have the time and ability to make it happen.

5. Employer repayment opportunities.

You should examine employer payback schemes if you are currently searching for jobs or have just been recruited by a new employer, especially if you have recently graduated. If you have access to this program through your present work, you should utilize it to assist in the repayment of your student loans.

FAQs

What is the easiest loan to get?

Payday loans, automobile title loans, pawnshop loans, and personal loans with no credit check are the most accessible. These loans provide quick money and have minimum criteria, making them accessible to individuals with poor credit. In most circumstances, they are also quite costly.

Do personal loans require proof of income?

Before approving a loan, personal loan creditors typically ask for proof of income. However, you may be eligible for a no-income loan provided you can demonstrate repayment. There are three varieties of no-income-requirement loans: Stated income loan and assets verification: If you have some income, you can obtain a stated income loan.

Do personal loans check bank statements?

You must supply your salary and employment information when filling out a loan application. It is optional to present pay stubs, tax returns, or bank statements to obtain a loan.

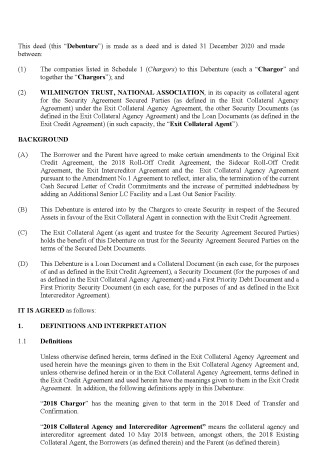

The management or administrator must turn over any investments covered by the debenture to the lender. Typically, the lender agrees to compensate the administrator or liquidator for marketing the assets on their behalf. If you want different samples and templates, please refer to the debenture pledge agreement samples and templates supplied as references in this article.