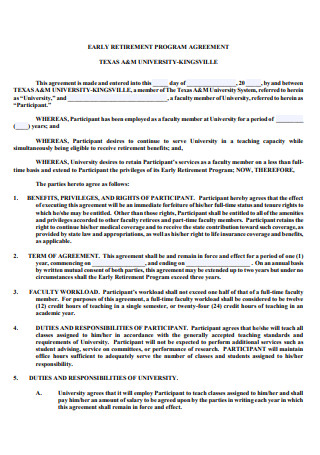

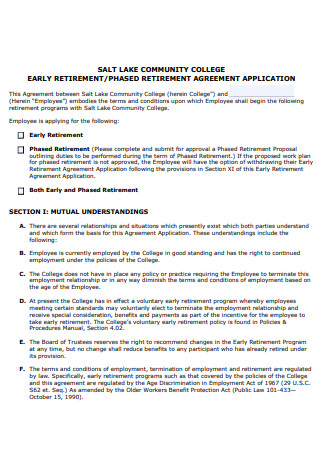

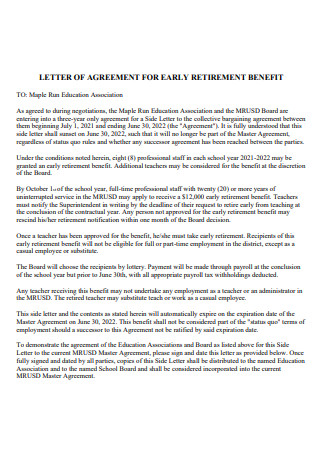

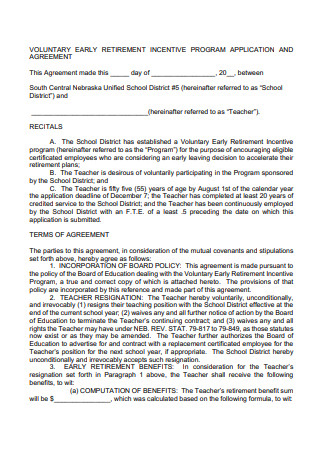

3+ Sample Early Retirement Agreement

FREE Early Retirement Agreement s to Download

3+ Sample Early Retirement Agreement

What Is an Early Retirement Agreement?

Tips on Early Retirement Agreement

How to Write an Early Retirement Agreement

FAQs

What is a retirement package?

Why is an early retirement agreement necessary?

What is the reason companies for offering an early retirement agreement?

What is the benefit of an early retirement agreement?

What are the incentives of having an early retirement?

Is it wise to have an early retirement?

What Is an Early Retirement Agreement?

An early retirement agreement is a document that contains the retirement package of an old employee who is about to resign from the company before retirement age. The agreement has collective bargaining for all the benefits that the employee can get from the company. It includes incentives like health insurance. It has great benefits that can encourage the employee to accept the deal. Why would a company offer early retirement? It is because they will like to replace the employee with a younger employee.

The retirement package will encourage employees to leave their jobs. This offer is made for employees who are near their retirement age. Sometimes, it may be offered to younger employees and will be considered a buyout. Companies usually do this because they want to change the workforce. Maybe they want to have younger employees for the job. Or sometimes, they just want to reduce the payroll costs. Sometimes, the job may have become too challenging for an old employee. The job may require younger people to do it. Or maybe the management may simply want to have new employees.

Tips on Early Retirement Agreement

Are you looking for a sample early retirement agreement? Do you need it because you want to have some tips that you can use for an early retirement agreement? If tips are what you are looking for, we have got you covered. We have some practical tips that you can use for an early retirement agreement. Read and consider the following tips:

How to Write an Early Retirement Agreement

Do you need an early retirement agreement template? Are you about to write an early retirement agreement? Maybe you need some steps in writing. Well, we can offer you some steps that you can use. Have the following steps:

1. Address the Right People

You should identify the parties that are involved in the agreement. Write the name of the employee and the employer. You should also include their contact information. This includes the contact number, email address, home address, and business address.

2. Specify the Date of the Retirement

The next thing is you have to specify the date of the retirement. This will be the last day of the employee working at the company. Be definite in stating the date of retirement.

3. List the Benefits

Then, the employer should list the benefits that the employee can get. This includes health insurance, life insurance, severance pay, education fund, and pension benefits. Usually, the retirement benefits are negotiated by the employer and the employee. Though sometimes, the company has a ready retirement package for employees.

FAQs

What is a retirement package?

A retirement package is a benefits package that will be given to employees when they are going to retire before their retirement age. This package encourages employees to leave their jobs.

Why is an early retirement agreement necessary?

The early retirement agreement is necessary to ensure that you can give the right benefits to the employee who is about to leave the company. It ensures the rights of the employee after working for so many years for the company.

What is the reason companies for offering an early retirement agreement?

Companies may offer an early retirement agreement because they want to have new employees for the company. Older employees may not be as effective as before that companies may want to hire younger workers. And sometimes, they want to reduce the payroll costs and the older employees are the employees that they will want to remove from their companies.

What is the benefit of an early retirement agreement?

The benefit of an early retirement agreement is you can have incentives from your company. You can get a lump sum money as your severance pay. You can start anew even if you are having an early retirement.

What are the incentives of having an early retirement?

In having an early retirement agreement, you can have a retirement package that can give you a variety of compensation. You can have great incentives like the following:

- Ample severance pay – This is a lump sum of money that will be given to the employee. This money is given upon consideration after evaluating the retirement package of an employee.

- Extended medical insurance – You can have your health benefits up to the last day of your employment.

- Life insurance – This benefit can give a great perk for the employee. You do not have to pay for your life insurance.

- Continuing education fund – This can make the retirement package more attractive. The employee will have a fund that can be used if he or she wants to go back to college or likes to have professional training.

- Full pension benefits – You may negotiate for a full pension benefit that can give you continuous money monthly when you can no longer work.

Is it wise to have an early retirement?

The decision to accept the offer of your company to have an early retirement package may depend on the employee. But there may be times that the company will still fire you even if you do not accept the early retirement package. So, it may be a wise decision for employees to accept the early retirement agreement because, through it, they can get good benefits when leaving their jobs. If you will still lose your job after the offer, then there will be no reason for you to not accept the early retirement package. You can use the benefits that you can get from the agreement to arrange your future and have an early retirement.

If you are offered an early retirement agreement, or if you are the employer offering early retirement to your employees, remember that they must accept it to claim their retirement benefits. After all, they can use these benefits when they’re retired. Plus, they can have incentives and a good amount of money that they may use for their future. So, should you need a template for an early retirement agreement, this post has 3+ SAMPLE Early Retirement Agreements templates in PDF for you to edit and download. What are you waiting for? Download now!