11+ SAMPLE Equipment Finance Agreement

-

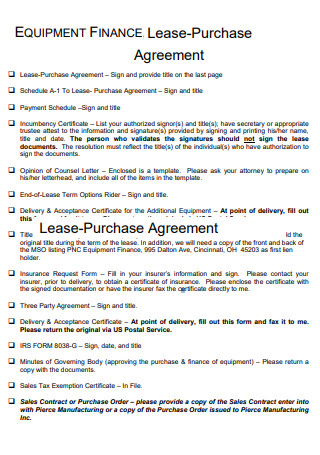

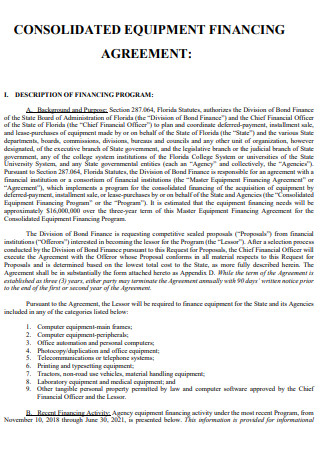

Equipment Finance Lease Purchase Agreement

download now -

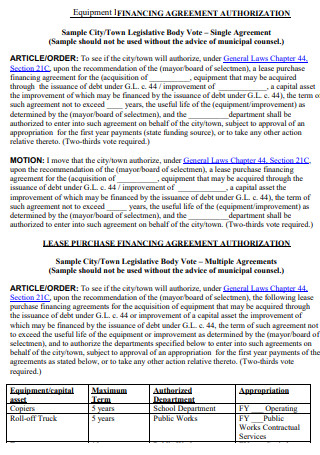

Equipment Finance Agreement Authorization

download now -

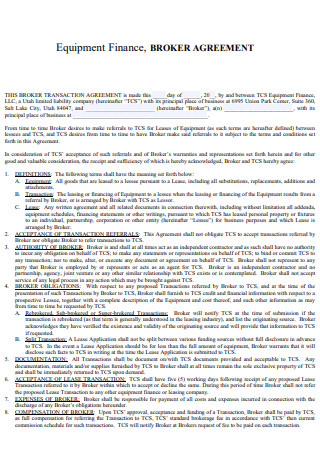

Equipment Finance Broker Agreement

download now -

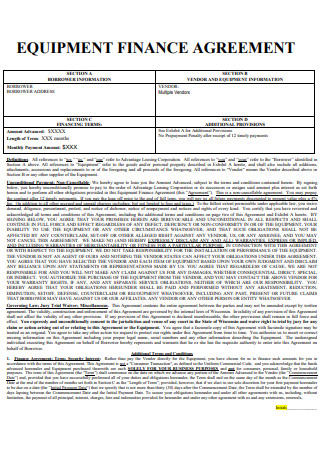

Equipment Finance Agreement

download now -

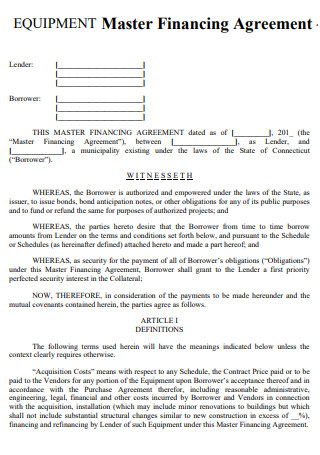

Equipment Master Finance Agreement

download now -

Equipment Rural Finance Loan Agreement

download now -

Equipment Financing Agreement

download now -

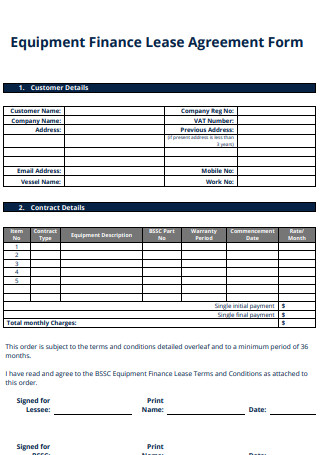

Equipment Finance Lease Agreement Form

download now -

Equipment Finance Agreement Example

download now -

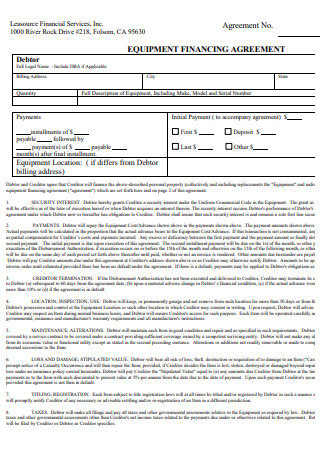

Equipment Finance Agreement Template

download now -

Benefits of Equipment Finance Agreement

download now -

Editable Equipment Finance Agreement

download now

FREE Equipment Finance Agreement s to Download

11+ SAMPLE Equipment Finance Agreement

What Is an Equipment Finance Agreement?

Benefits of Equipment Finance

Tips To Do Before Applying for a Business Loan

How To Make an Equipment Loan Agreement

FAQs

What type of loan is an EFA?

Are our equipment loans amortized?

Why do companies lease instead of buying?

What Is an Equipment Finance Agreement?

Equivalent to a loan, security agreement, and promissory note, an equipment finance agreement (EFA) combines these elements into a single contract. In addition to their unique characteristics, EFAs are among the most popular and versatile equipment financing options. According to statistics, institutional lenders have the most excellent acceptance rate of any lender, at 66%, and 43% of small firms applied for business loans last year.

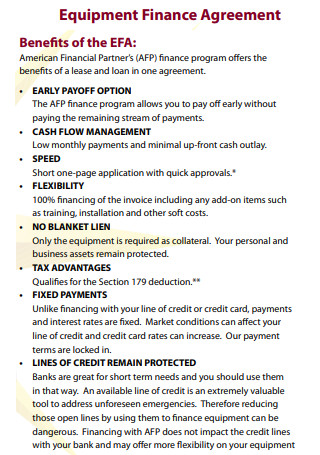

Benefits of Equipment Finance

Purchasing new equipment for your organization entails a substantial investment of funds. Many companies lack fast access to significant liquid resources or funds. Buying commercial cars, wheel-based assets, earthmoving and construction equipment, or general engineering and manufacturing equipment can harm cash flow due to the high upfront cost. This is especially true when installation and commissioning fees are included. Traditional bank loans may impose stringent eligibility requirements on borrowers and restrict the types and ages of equipment that can be financed. Equipment financing from a non-bank lender may be the answer for your company. A broader range of quality new and used assets, including the equipment you already own, are eligible for financing. You can safeguard your cash flow and working capital by financing the acquisition of new or used equipment or tapping into the equity in equipment you already own. Both scenarios can help your organization stabilize cash flow while leaving sufficient working capital for future expansion. Let’s examine some of the advantages of equipment financing.

Tips To Do Before Applying for a Business Loan

A business loan is generally the most dependable form of funding for a local business needing funds. However, banks only approve approximately 13% of company loan applications, making it more challenging to obtain an outstanding loan. The world of company financing can be difficult to navigate, especially for novices. Therefore, organizing is essential, especially if you ask for a large bank loan. This guide will give all the details necessary to create a loan application for your small business if you seek funding. Obtaining capital frequently requires proper preparation. Even if you have solid revenues and acceptable credit, you may not qualify for business finance if you lack the following.

1. Start with a business plan

You must first write a business plan if you want a lender to give you a business loan. Lenders will want to know that your business is legitimate and that you have the knowledge and skills to grow it into something extraordinary. Include everything about your business, including your goals, competitors, past and projected income and expenses, a market analysis, and how you plan to grow your business. Show why you’re the best person for the job, and when you’re done, write a summary that will get the lender interested in your plan. This will be the first thing they read; if they aren’t interested immediately, it could be the last. According to research, company strategies can aid in securing financing and attracting new business partners. Having one in place will give investors confidence that their investment will yield a return. You will use your business plan to influence others that working with you is wise.

2. Prepare financial statements

As previously said, you should include any past and prospective financial figures you can give lenders. Create a strategy that you will adhere to, and provide anticipated numbers so that your lenders can see your objectives and be confident that you will be able to pay them back. Include your cash flow records, income statements, balance sheets for the past three to five years, and your projections for the following few years, considering seasonal fluctuations and how you intend to use the borrowed funds. According to research, the most important financial statement components are the income statement, balance sheet, and statement of cash flows. The purpose of these financial statements is to provide a thorough picture of the financial condition and results of a corporation.

3. Specify the loan’s purpose and amount in detail.

After completing the financial statements and the business plan, you should clearly understand what you wish to achieve with the loan and how much money you will need. If you can articulate your objectives in writing and person, it will be easier to convey what you require to lenders. Determine the equipment you will need, the marketing approach you will use, and any other products you will purchase with this loan, and conduct pricing comparisons for each of these items. This study will demonstrate to the lender that you are treating this matter seriously and are not attempting to take the easy road.

4. Examine your credit report

Before you apply for a company loan, you should review your credit history, especially if your business hasn’t had time to establish its credit history. Lenders will want to know that they are lending money to a financially responsible individual, so if your credit statement leaves something to be desired, you may want to wait and improve your credit before applying for a loan. Additionally, many lenders may wish to examine your bank records and tax returns from the previous year, so keep this in mind the year before you need the loan. Despite a spike in credit card fraud attempts during the epidemic, only 33 percent of Americans examined their credit reports in the past year, according to research. This declined from 2019, when 39% reviewed their credit reports, to 2018, when 37% did.

5. Know your collateral capacity.

Certain types of loans will require that you provide collateral. If you pick this type of loan, you will need to understand how much your collateral is worth. Lenders will require this number, and you must demonstrate that you have a tangible asset to secure the loan. Ensure you won’t default on the loan and forfeit any property you use.

6. Understand what the debt will ultimately cost you.

You will want to know how long it will take you to pay off your loan. Find out what different lenders can offer you, and use the interest rates and fees to estimate how much it will cost you. All this information should be in your financial statements, but you should also add up all your payments to see how much the loan will cost. Know the terms and conditions of each loan offer before you decide which one is best for you, and show the lender that you are a good investment.

7. Research your borrowing options

It will help if you run an extensive study to choose the bank or lender that will equip you with the most effective terms. Don’t fall for central banks that appear to have excellent deals until you’ve researched smaller banks and credit unions. They may increase your likelihood of approval. You might get rejected, but keep trying. If you continue to modify your plans and investigate your possibilities, you will find a lender willing to provide the loan you require.

How To Make an Equipment Loan Agreement

An equipment loan agreement is a complete and detailed agreement, strictly as a generic agreement. To enter into a contract, one must have an in-depth understanding of the transaction and the applicable laws. However, creating a contract is more apparent, thanks to online agreement samples and templates. Therefore, whether you are drafting a contract or ready to sign one, it is essential to know what to look for in the document. Here are some helpful suggestions.

1. Know the Type of Equipment Loan

There are various equipment loans, and your agreement should reflect your preferences. Confirm whether the documentation indicates that you are leasing or financing the equipment or a combination of both. Acquaint yourself with the terminology and equipment use agreement. Also, identify who will legally own the equipment during the duration of the contract and after it expires. The same holds for a loan agreement for technological equipment.

2. Check the Loan Amount and Interest

The sample borrowing agreement will include the loan amount and interest rate. It should match the agreed-upon amount and percentage with the lender. Do not sign the deal if the talk differs from its terms. You should also examine other information to determine if they have been altered. According to research, the average interest/finance fee ranges between 15% and 20%, depending on the lender, but it may be more. State rules govern the maximum rate of interest that payday lenders can charge. The interest paid is determined by multiplying the borrowed amount by the interest rate.

3. Determine the Terms and Schedule of Repayment

Verify the loan repayment period in the agreement. Again, it must match what you’ve agreed upon with the lender. You should select longer payment terms if you desire a lower monthly payment. This, however, comes with the cost of higher interest rates. You should choose a shorter time if you want the lowest possible interest rates. In light of this, you should anticipate more frequent payment schedules and a more significant amount of repayment.

4. Look for Penalty Details

Not that you intend to miss payments, but many things can occur, so it’s wise to be adequately prepared. Learn about the costs included in the agreement, and if necessary, ask questions. You can utilize this information in the future to your benefit.

FAQs

What type of loan is an EFA?

An equipment finance agreement is a business loan in which the client acquires ownership of the equipment in advance and then makes payments to the lender monthly, annually, or on another agreed-upon basis. It is comparable to auto finance.

Are our equipment loans amortized?

Loans for equipment are amortized, which entails making equal payments on the loan sum until it is repaid. After the loan has been paid, you will own the collateral. You may not own the equipment at the end of a lease or be asked to pay a balloon payment to acquire ownership.

Why do companies lease instead of buying?

As opposed to purchasing equipment altogether, there are fewer initial expenses. If your contract specifies upgrades, it reduces the likelihood that your business will be left with obsolete equipment. Transfers equipment maintenance costs to the leasing firm under the terms of the agreement.

If you wish to enlighten yourself with the layout or format of an equipment finance agreement, you should refer to templates. And if you feel that your contract is missing something, it is time to see a lawyer. Regarding legal concerns, it is usually prudent to rely on the advice of professionals.