6+ Sample Equity Investment Agreement

-

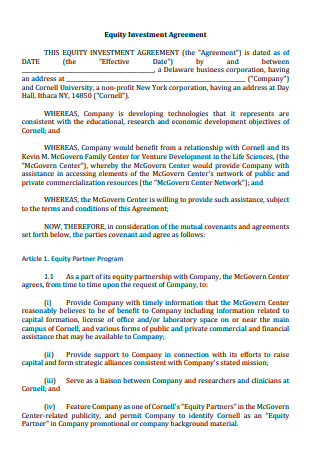

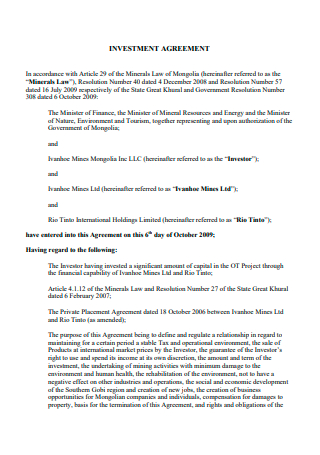

Equity Investment Agreement Template

download now -

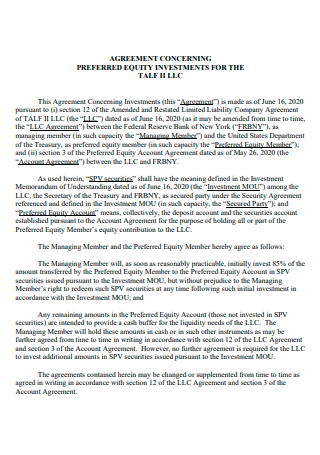

Preferred Equity Investment Agreement

download now -

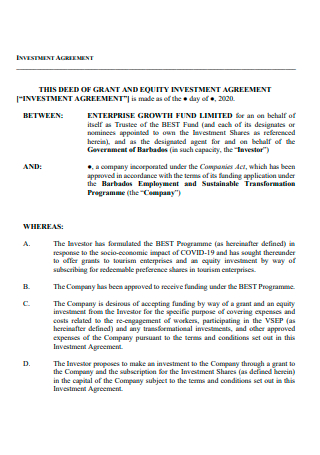

Equity Equivalent Investment Agreement

download now -

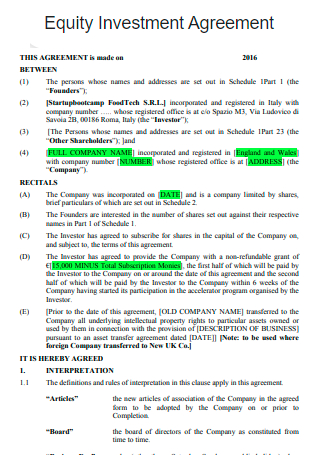

Equity Investment Agreement Example

download now -

Equity Investment Agreement in PDF

download now -

Printable Equity Investment Agreement

download now -

Simple Equity Investment Agreement

download now

FREE Equity Investment Agreement s to Download

6+ Sample Equity Investment Agreement

What Is an Equity Investment Agreement?

What’s In an Equity Investment Agreement?

How to Create an Equity Investment Agreement

FAQs

What is an example of a type of equity?

What is a type of investment risk?

Can an equity investment agreement come with disadvantages?

What Is an Equity Investment Agreement?

Before we get to know what this document entails, first of all, what is equity investment all about? Well, equity investment is described as a form of financial operation in which a specific number of shares of a specified company or fund are purchased, entitling the owner to compensation based on his ownership percentage. The most basic form is the purchase of a common share, but it can also take the shape of equity mutual funds, shares, private equity investments, retained earnings, and so on. Investors in equity investments have the benefit of generating enormous returns even in a continuously changing environment, but they must also be aware that the risk factor is rather significant since this investment requires a seamless trading procedure to succeed.

Investors giving their equities to a certain company in the hopes of generating a significant return in the future will need to have an equity investment agreement in place. This is a legal document that may also function as a partnership between two or more parties that want to enter a venture at the same time. This type of agreement binds the persons involved and holds them personally accountable for commercial obligations. When the parties involved decide to execute the equity investment agreement, each partner accepts responsibility for the activities of the other. Furthermore, having this agreement in place makes it easier for the entrepreneurs to remain motivated and sustain their efforts to expand the firm, as well as for the investors and the company to handle their funds more effectively since it generates less strain on them.

What’s In an Equity Investment Agreement?

Since this agreement is a crucial part of the process of equity investment, it needs to be effective. And in order to be effective, here are the key elements that need to be in place:

How to Create an Equity Investment Agreement

Now that the definition and the key components of the equity investment agreement have been discussed, it’s time to know what are the necessary steps to be taken in order to create an effective equity investment agreement:

1. Begin With the Introductory Parts

The first step to be followed in writing the equity investment agreement is to start with the introductory parts of the agreement. The introductory parts of the agreement include the title of the document, which simply dictates the entire purpose of the document, the preamble section/the preface which briefly addresses a few key parts of the agreement, and the parties section which serves to identify the parties involved in the equity investment agreement along with some of their key details such as their address, their roles in the agreement, and any other descriptors that may be necessary to include here.

2. Follow-up With the Main Parts

After writing the introductory portion of the agreement, it’s time to follow up with the parts that make up the core of the entire document. Some of the main parts of the equity agreement are the issuance of shares, the investment offer, and the intention section. The issuance of shares section details how the equity shares are going to be issued and can also state that the shares are going to be issued on a specific date. The investment offer section consists of the information on the full investment plan, as well as the names of the shareholders and the value of assets they will invest throughout the agreement’s duration. The intention section of this type of agreement discusses the intention to form a relationship between the parties involved in the agreement and is essential since it states the purpose to form legal connections in order for this agreement to be executed.

3. Write the Standard Parts

After writing down the core parts of the equity investment agreement, it’s time to follow it up with the standard or the boilerplate parts of the agreement. The boilerplate parts of the agreement are usually included in the latter portion, and some of them are the notices section, the severability section, and the waivers/amendments clause. The notices section of this agreement states that all notices that should be delivered must be in written form and must be delivered personally to the party to be notified at a predetermined address. The severability section permits the remaining elements of the law or agreement to remain effective even if one or more of its other terms are unenforceable, and the waivers/amendments clause dictates that except with the express approval of the parties participating in the agreement, neither the entirety of this equity investment agreement nor any component of this agreement may be changed or amended.

4. Finalize the Document

After the core and standard parts of the agreement have been completed, this is the final step of creating the equity investment agreement. In this step, perform the necessary final checks, such as verifying for any inconsistencies, spelling, and/or grammatical errors, or any missing provisions that may be necessary to the agreement. When the final checks have been completed, then the document is considered to be done and the signatures may now be affixed by the parties involved.

FAQs

What is an example of a type of equity?

An example of a type of equity is equity mutual funds. Equity mutual funds are a kind of equity in which money is pooled from several participants and invested in the equity shares of various companies. These are intended for investors with low trading experience and limited time to conduct research. They provide the advantages of professional supervision and asset diversification, as well as more transparency and the ability to invest in smaller quantities.

What is a type of investment risk?

One type of investment risk is called inflation risk. Inflation risk is the danger of losing buying power as the value of assets does not keep pace with inflation. Inflation gradually erodes the purchase value of money, making it a risk in one’s investments. This means that the very same sum of money will now purchase fewer products and services. Inflation risk is especially significant if one owns cash or debt investments such as bonds.

Can an equity investment agreement come with disadvantages?

Yes, it can. An example of a disadvantage that can come with this agreement is that there can be a likelihood of disagreement. Sharing ownership and partnering with others may produce friction and even conflict if there are disparities in purpose, style of management, and ways of running the organization.

Investing in equities can mean that the investor will have a chance in long-term wealth generation. Additionally, when someone invests in equities, he/she can have much higher returns at a much faster rate. Documents such as an equity investment agreement will help the investor and the company being invested establish a long-term commitment while protecting their interests. In this article, you can find sample templates of this document should you require further understanding.