35+ Sample Finance Agreements

-

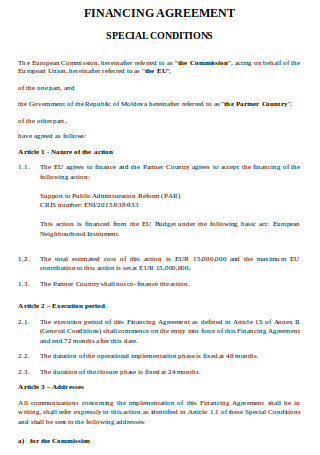

Financing Agreement

download now -

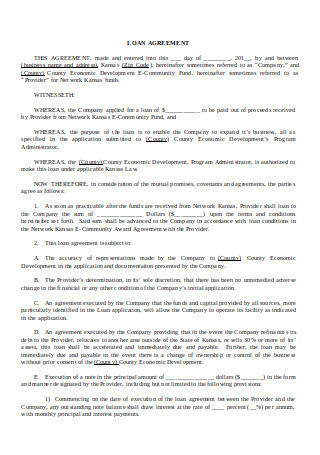

Loan Agreement

download now -

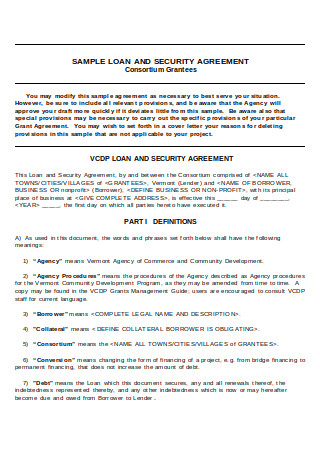

Sample Loan and Security Agreement

download now -

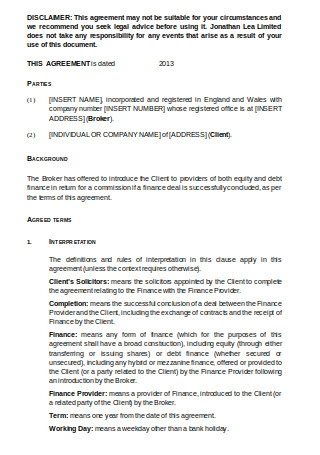

Finance Introduction Agreement

download now -

Project Financing Agreement

download now -

Loan Modification Agreement

download now -

Tripartite Agreement

download now -

Marine Loan Agreement

download now -

Finance Memorandum of Agreement

download now -

Master Loan Agreement

download now -

Supplemental Loan Agreement

download now -

Sample Equipment Loan Agreement

download now -

Indemnity Agreement

download now -

Consumer Loan Agreement

download now -

Finance Contract

download now -

Sovereign Loan Agreement

download now -

Sample Finance Loan Agreement

download now -

Business Finance Loan Agreement

download now -

Mortgage Loan Agreement

download now -

Subsidiary Loan Agreement

download now -

Finance Loan Agreement

download now -

Cargo Finance and Security Agreement

download now -

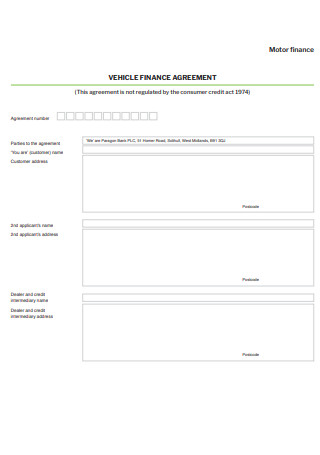

Vehicle Finance Agreement

download now -

Equipment Finance Agreement

download now -

Personal Finance Agreement

download now -

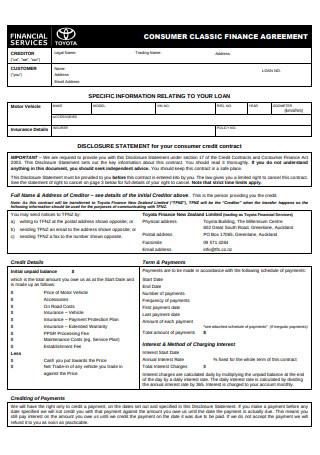

Consumer Classic Finance Agreement

download now -

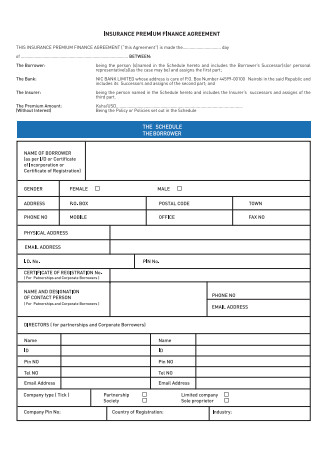

Insurance Premium Finance Agreement

download now -

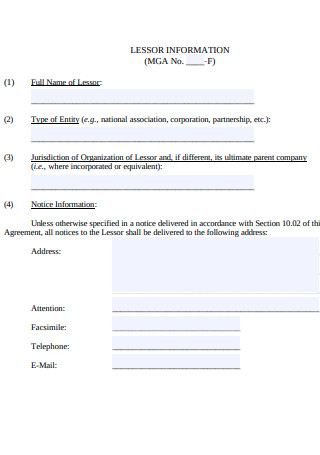

Finance Lease Agreement

download now -

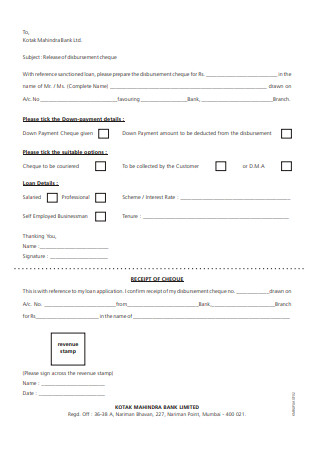

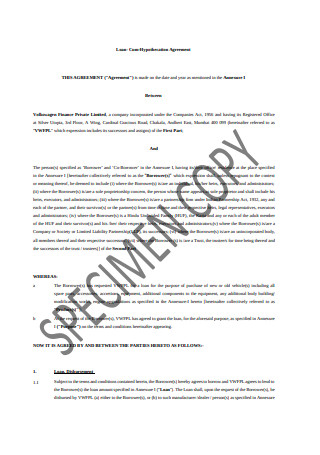

Loan Cum-Hypothecation Agreement

download now -

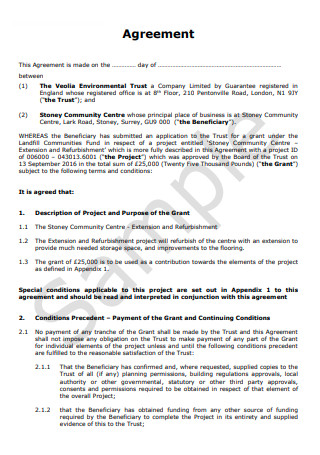

Simple Finance Agreement

download now -

Commercial Loan Agreement

download now -

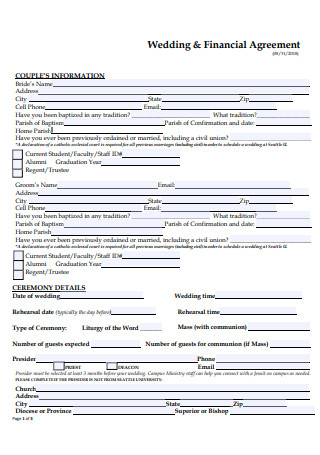

Wedding Finance Agreement

download now -

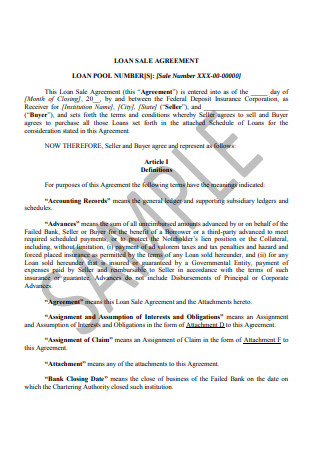

Loan Sale Agreement

download now -

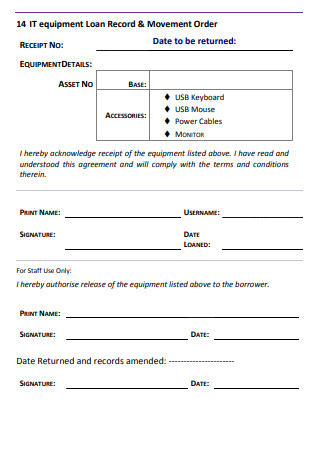

IT Equipment Loan Agreement

download now -

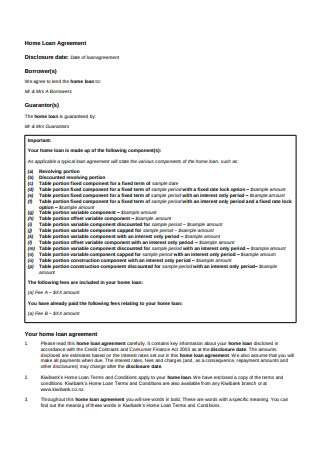

Home Loan Agreement

download now -

Personal Loan Agreement in PDF

download now

FREE Finance Agreement s to Download

35+ Sample Finance Agreements

What Is a Finance Agreement?

The Different Types of Business Loans

How To Apply for a Small Business Loan

FAQs

Can I still apply for a loan even if I don’t have collateral?

Do I need experience in the industry to qualify for a loan?

Can I still apply for a loan even if I have a history of bankruptcy?

Do I need a final location for my business before applying for a loan?

How long will it take to get the funds?

What Is a Finance Agreement?

A finance agreement is a contract between a borrower and a lender or a financial institution and a business. It is a legal document that sets out how a lender will finance a project or a business plan. Several businesses need start-up money to begin operating. For that reason, a financing contract is necessary to guarantee that a business plan will push through. Some financial institutions allow borrowers to settle their loans using the money they gain from their new businesses. For example, a lending company may release a loan bond to a business owner who wants to build an amusement park. The owner can then use the profit they generate from tickets to pay back the loan.

The Different Types of Business Loans

According to the Small Business Administration, there are about 550,000 small businesses that opens every month in the United States, and more than half of the people in the U.S. are owners or workers of small businesses. If you are looking for funds to start your own business, you can ask for financial assistance from banks, private lenders, or even your credit card. They will guide you to decide what type of loan is appropriate for your business. Nevertheless, it is important to have a basic idea of what the different types of loans are so you’ll easily come to terms with your lender. So, here are the different types of business loans.

How To Apply for a Small Business Loan

Applying for a business loan agreement is easier when you prepare beforehand. Follow the steps below so you will get the money you need to start with your business.

Step 1: Establish Your Credit Score

A credit score can range from 300 to 850, the higher your score is, the better. Lenders base your ability to pay by assessing your credit score. Also, most lenders base your credit on the FICO score. The FICO score depends on factors such as the latest credit inquiries, present credits, credit duration, debts, and payment history. Therefore, you must pay your bills on time to establish your credit score. However, be aware of incorrect credit reports, which may also affect your score. You should know what your exact credit score is based on the factors influencing it.

Step 2: Know the Requirements of a Loan

You must meet a lender’s requirements before you apply for credit. This is to increase your chances of actually getting a loan. Usually, borrowers have to meet the lender’s criteria concerning annual revenue, credit scores, and business years. If you want to apply for a loan in the Small Business Administration of the United States, you will also have to meet their criteria. Moreover, your business shouldn’t be part of SBA’s unqualified list. This list includes real estate, banks, and insurance companies.

Step 3: Prepare the Necessary Documents

Financial institutions and conventional lenders usually ask for legal and financial files during application. These documents may include income tax returns, financial statements, a valid I.D., business licenses, business leases, and articles of incorporation. Completing these requirements may take some time, but if you need money for your business, that will not be an issue for you. If you want fast money, you can apply for a loan from online lenders instead.

Step 4: Create a Reliable Business Plan

Before lenders approve your loan, they will need to know how you are going to use the money. If you plan to put up a business, then normally a lender will ask for a reliable business plan. The scheme should display that you will have an ongoing cash flow to pay for your expenses and debts. Your business plan must have a company description, service or product description, operating team, industry survey, operating plan, marketing strategies, and SWOT analysis. With a reliable business plan at hand, a lender will most likely approve your application.

Step 5: Offer Collateral

A collateral is a valuable asset that a lender has the right to own if you can’t repay your loan. Most often, to apply for a business loan, you must provide collateral. Collateral can be an inventory, equipment, or real estate. Aside from that, a lender may ask for a personal guarantee, which can be more than 20% of your business.

FAQs

Can I still apply for a loan even if I don’t have collateral?

Yes. Collaterals do increase your chances of getting a loan, yet not having doesn’t mean that you are no longer qualified. There are loans below $50,000 that do not demand collateral, but if you need a big amount of money for a business, you will need collateral. Also, if your collateral is weak, a lender may ask for a co-signer to justify the loan. Established businesses with good cash flow may apply for a loan without collateral.

Do I need experience in the industry to qualify for a loan?

Experience is a big indicator that your business will succeed. A lender will want to assist an owner who has enough experience in the business industry to guarantee success. Note that some loans based on credit do not necessarily require experience. If you have a prospect manager who has more than two years of experience, you may be qualified to apply for business credit.

Can I still apply for a loan even if I have a history of bankruptcy?

Lenders will take note if you have been responsible financially after filing bankruptcy. Your history of bankruptcy should be three years ago before you apply for a loan. Moreover, you must not have any history of late payments or other bad records on your account since your declaration of bankruptcy.

Do I need a final location for my business before applying for a loan?

New businesses must at least know their operating location before applying for a loan because it is a factor that affects the beginning costs and remodeling costs for the site. You can try talking to a landlady and convince her to reserve the area for you. Once you do, you can include the site in your business plan and calculate the possible expenses needed to operate on that site. Also, you have to request for a Letter of Intent from the landlady indicating that the area is available for you.

How long will it take to get the funds?

This mainly depends on the type of loan you are applying for. Some loans may take longer to approve than others. It also depends on the situation and your needs as of the moment. You can ask your lender directly to know what type of loan fits your current needs, and you can also ask when you will get the fund.

If you want to put up a business, but your funds are not enough to let it operate, then apply for a loan. You may have a lot of plans going on inside your head, but the thought of money is troubling you. The good news is, you can easily apply for a loan to support you. Just make sure your plans are feasible so your lender will trust you and sign a finance contract with you.