50+ SAMPLE Funding Agreement

-

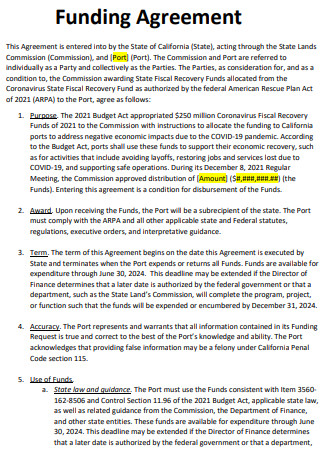

Funding Agreement

download now -

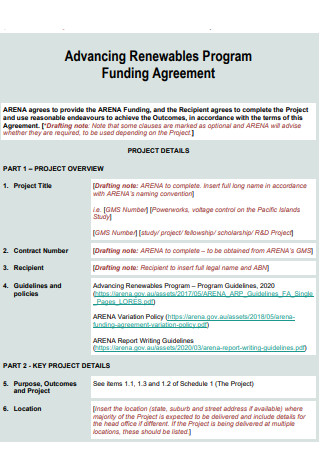

Advancing Renewables Program Funding Agreement

download now -

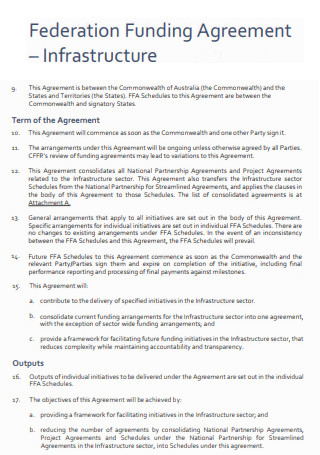

Federation Funding Agreement

download now -

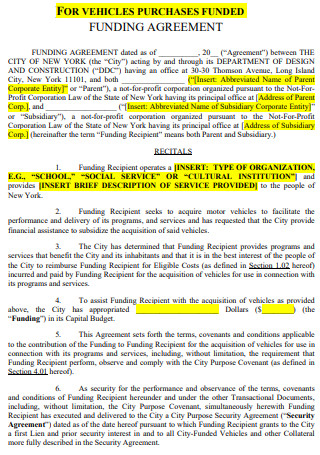

Vehicle Funding Agreement

download now -

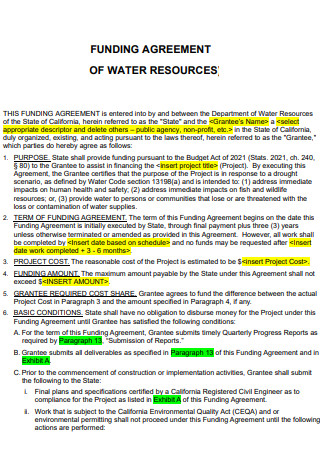

Water Resource Funding Agreement

download now -

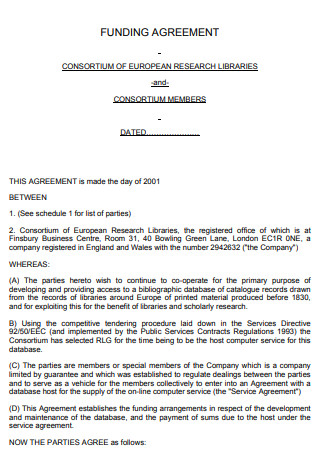

Funding Agreement of Reserach Library

download now -

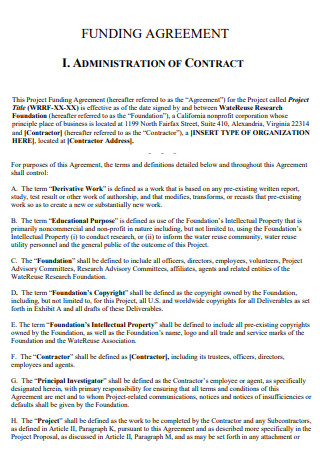

Funding Agreement Contract

download now -

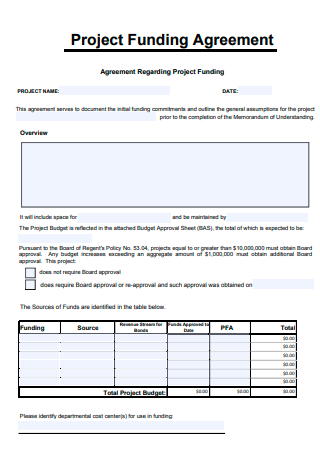

Project Funding Agreement

download now -

Funding Cycle Grant Agreement

download now -

Provision of Funding Agreement

download now -

Employees Funding Agreement

download now -

Funding Agreement Certification

download now -

Health Research Funding Agreement

download now -

Floating Rate Funding Agreement

download now -

Funding Agreement Terms And Conditions

download now -

Sample Funding Agreement

download now -

Defence Funding Agreement

download now -

Programs Funding Agreement Certification

download now -

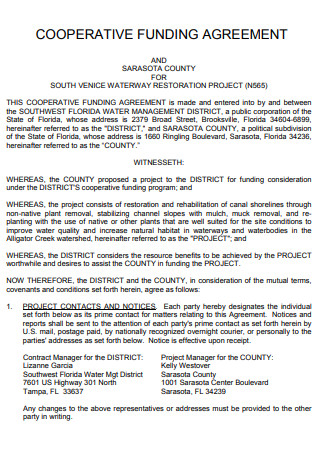

Cooperative Funding Agreement

download now -

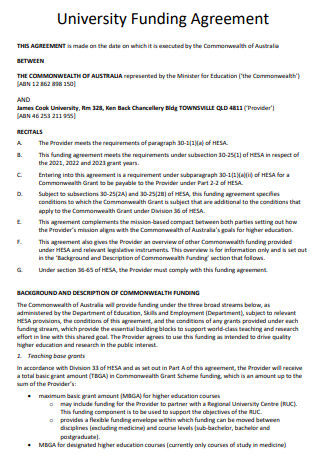

University Funding Agreement

download now -

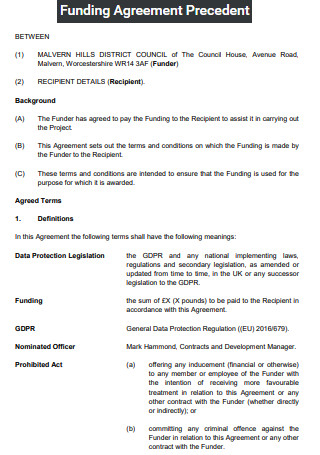

Funding Agreement Precedent

download now -

Infrastructure Funding Agreement

download now -

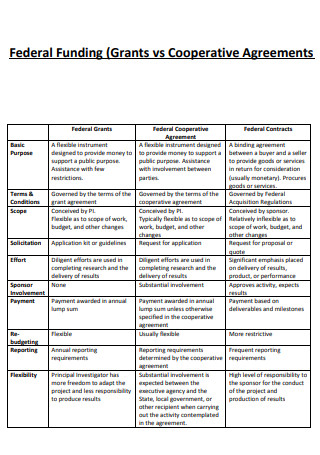

Federal Funding Agreement

download now -

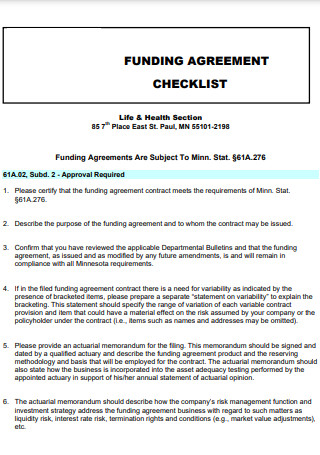

Funding Agreement Checklist

download now -

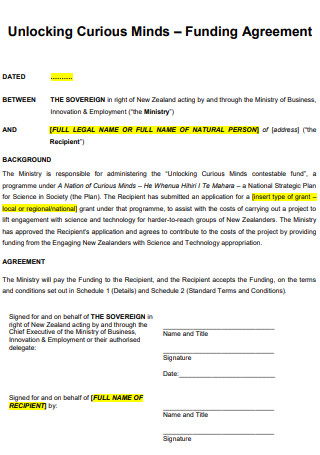

Unlocking Funding Agreement

download now -

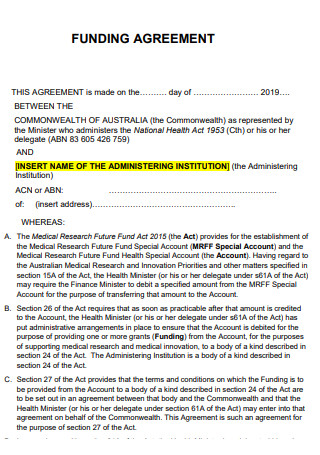

Simple Funding Agreement

download now -

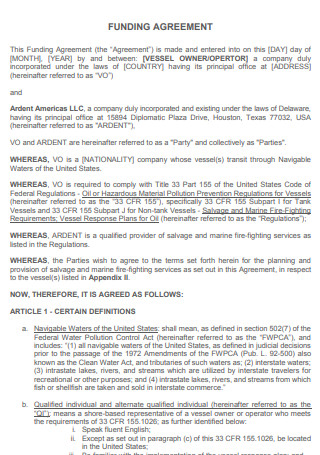

Basic Funding Agreement

download now -

Third Party Funding Agreement Management

download now -

External Research Funding Agreement

download now -

Funding Model Concession Agreement

download now -

Government Funding Agreement

download now -

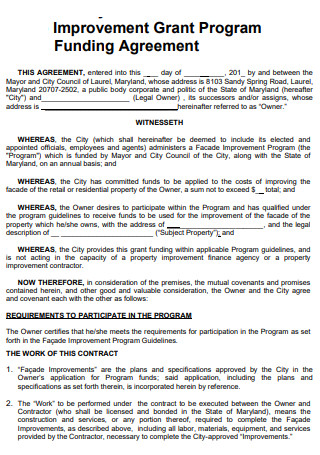

Improvement Grant Program Funding Agreement

download now -

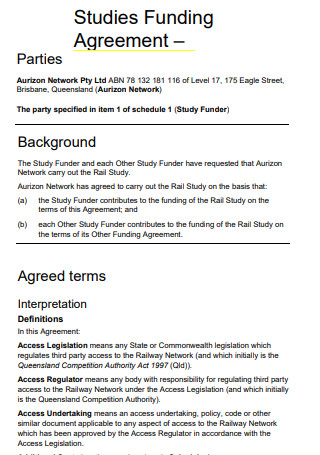

Studies Funding Agreement

download now -

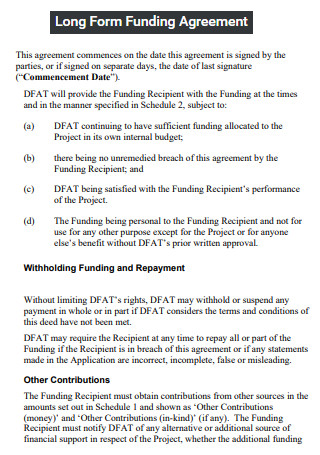

Long Form Funding Agreement

download now -

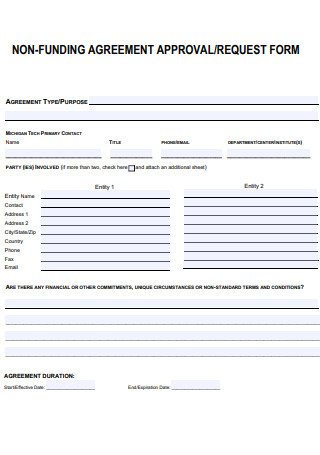

Non Funding Agreement Approval

download now -

Common Funding Agreement

download now -

Integrated Wholesale Funding Agreement

download now -

National Team Funding and Support Agreement

download now -

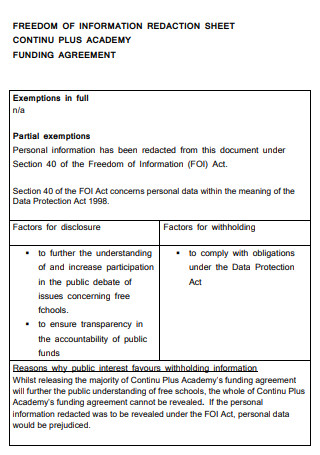

Academy Funding Agreement

download now -

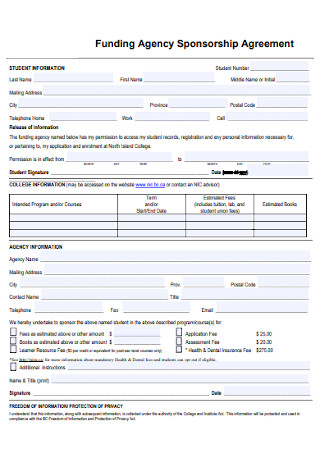

Funding Agency Sponsorship Agreement

download now -

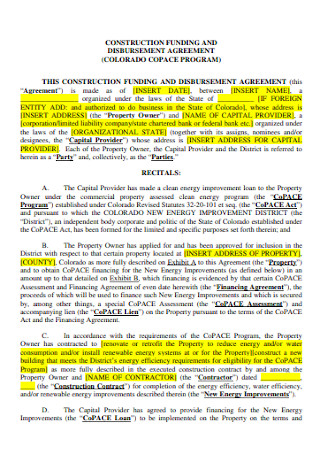

Construction Funding and Disbursement Agreement

download now -

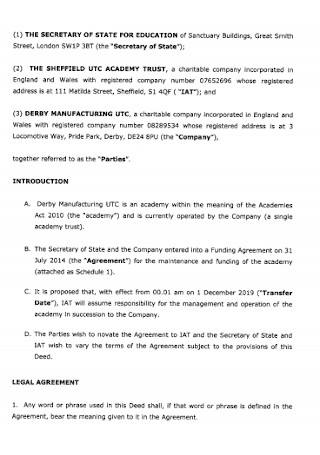

Funding Novation Agreement

download now -

Addendum Funding Agreement

download now -

Commercial Funding Loan Agreement

download now -

Insurance Solutions for Funding Buy Sell Agreement

download now -

Statutory Funding Agreement

download now -

Joint Funding Agreement

download now -

Acquisition Funding Agreement

download now -

Advance Funding Agreement

download now -

Instructions for Funding Agreement

download now -

Capital Works Funding Agreement

download now

FREE Funding Agreement s to Download

50+ SAMPLE Funding Agreement

What Is a Funding Agreement?

Importance of Funding

Business Can Go to For Funding

How to Write a Funding Agreement

FAQs

How does funding work for businesses?

What are the disadvantages of self-financing your business?

How much should you get for funding?

What Is a Funding Agreement?

Federal Reserve gives the funding agreement meaning as a deposit-type contract that is often sold by life insurance companies and pays a guaranteed rate of return over a set period. A funding agreement is a contract that is entered between an issuer and an investor. The issuer promises a predetermined rate of return over a set length of time, while the investor gives a flat sum of money. Due to their low-risk, fixed-income character, funding agreements are popular among high-net-worth and institutional investors. You should prepare a funding agreement for your project funding, use a funding agreement example for reference.

Importance of Funding

Money’s importance in business cannot be underestimated. With few exceptions, money is required to get a business off the ground. Once revenues begin to flow in, a portion of that money can be re-invested in the company to attract additional consumers and increase profitability. Business funds are not spent on initiatives that have a low return on investment because of appropriate planning and cash management. If you are unconvinced on why you should look into funding, then this curated list is for you.

Business Can Go to For Funding

Small businesses frequently require funding to expand. This money might come from several places. You must have a good business strategy and a clear overview as to how you plan to spend the money before looking for funding. You will also need to know how you will repay the loan and why your company is good investment risk. Investors will still want to know about the company’s management so they can trust the business strategy and the people behind it, even if you have a wonderful idea.

How to Write a Funding Agreement

Having gone through both curated lists found in the article means you have gathered all the necessary information as part of your prior preparation before coming up with the contents of the funding agreement. This leads you to the part where you finally write your funding agreement and with the guide provided for you found below, you will find yourself easily following through with the funding agreement format. And if you ever need further assistance, you can look into the agreement letter sample available as well.

-

1. Date and Parties Involved

For the first section of the agreement, you will need to state the official parties involved. This can be your company, business, or organization since you require the initial financial assistance to start your project, the respective contact information, and the official logos of your organization followed by the financial funder or lender who has agreed to receive your funding agreement. Make sure to also include the date of when both parties have come to an understanding on when you are meeting to exchange documents. Clarify that no party has the power, authority, or right to bind other uninvolved parties into the Document.

-

2. Use of Funding

There are various uses for funding, and although the lender may have an initial idea from a prior meeting and discuss it with them, it is still better to include all the details in writing. Comprehensively laying out the details is important because other readers would want to know where your funding will be used and how will you be utilizing the budget they are offering you. As previously mentioned above, investors may not want to put their money into a business plan that has no strategy in mind and could instead be a waste of their cash.

-

3. Termination

This section will specify the terms involved in what both parties can be responsible for regarding the agreement. This usually acts as a reminder of what to avoid so that the agreement stays intact and won’t lead to further complications. But if any of the terms are breached, then the defaulting party may need to be sent a written notice to notify of the failure of the terms followed. You can look into specific terms and conditions and set the boundaries with regards to what can lead to a Termination of the agreement.

-

4. Indemnity

An indemnification contract is a legal agreement between two parties. One party ensures to compensate the other for any potential losses or damages in this agreement. You must indemnify the lender against all claims, losses, demands, actions, payments, suits, recoveries, judgments, or settlements of any kind brought against or recovered from the lender in any way directly or indirectly caused, occasioned, or contributed to in whole or in part, by any act, omission, fault, or negligence of your company or anyone acting under its direction, control, or on its behalf in connection with or incident to completing the project.

FAQs

How does funding work for businesses?

Similar to governmental services, the quality of a business’s product or service is determined by its Financial status. A company that lacks adequate financial sources will drown in a sea of debt. The engine that propels a corporation ahead is funding. To obtain finance, a company might employ a variety of paths and channels; in many cases, many channels are used. The type of financing chosen is determined by the sort of business, the existing state of the business, and the owners’ plans for growth.

What are the disadvantages of self-financing your business?

Utilizing your money to fund your business could place stress on your personal and family life. It’s possible that you won’t have the money left over to meet your rent and bills. You should strive to set up a contingency fund in case you need more funds to get you through a tough time. You might lose all your money and other personal belongings if your business fails. If you fund your firm yourself, you will have to build your relationships and mentorship chances. Several financiers and venture capitalists can also give mentoring and networking possibilities for you and your Business.

How much should you get for funding?

The necessary Budget depends on the type of business you are opening, due to the variety of options, you need to select an appropriate amount for it. Most financial experts recommend having a cash reserve equivalent to six months’ worth of expenses: if you require $5,000 per month to survive, save $30,000. Most financial experts recommend setting aside an emergency fund of eight months because that is roughly how long it would take the typical person to find work. Include the suggested amount as you prepare for your funding proposal and include it in the funding agreement.

Reaching the end of the article signifies you are more than ready to tackle the serious part of filling up the contents of the agreement templates provided for you. Although you have the option to start from scratch, it is ill-advised as you will consume important time you can instead have used for something else. With that being said, make sure your money transfer agreement is not lacking any sections to impress the potential lenders.