51+ Sample Gift Agreement Templates

-

Free Gift Agreement Between Individuals Template

download now -

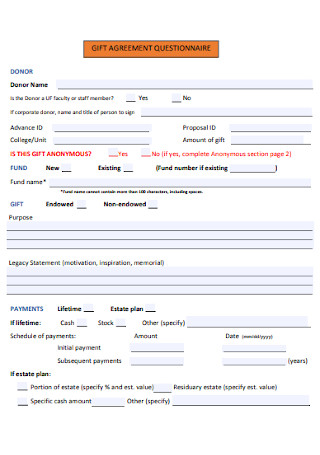

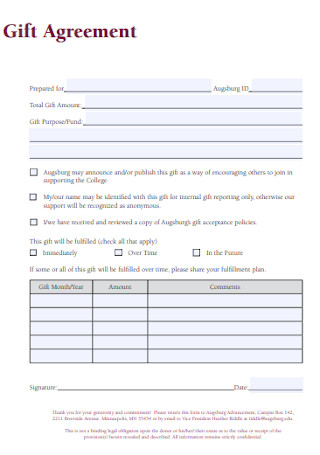

Gift Agreement Questionnaire Template

download now -

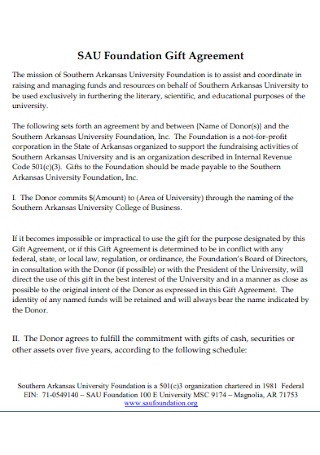

Foundation Gift Agreement

download now -

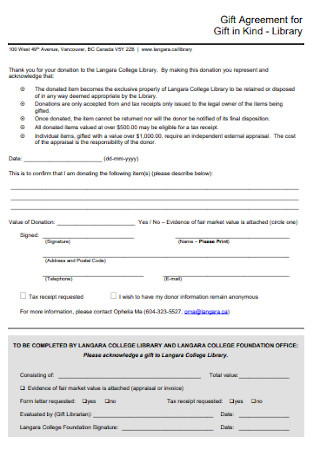

Gif Agreement for Kid

download now -

Sample Gift Agreement Template

download now -

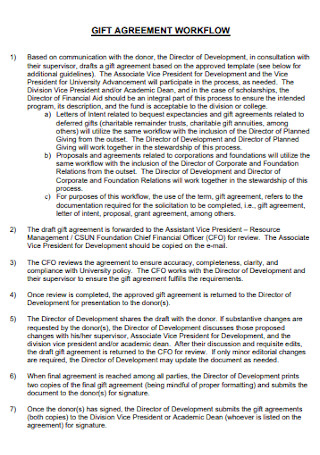

Gift Agreement Workflow Template

download now -

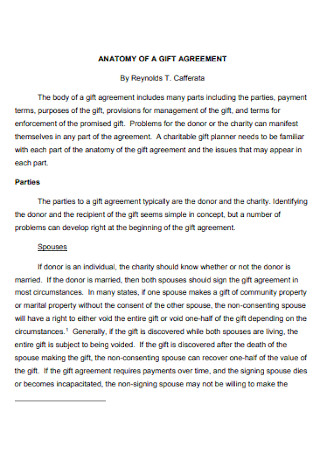

Anatomy of a Gift Agreement

download now -

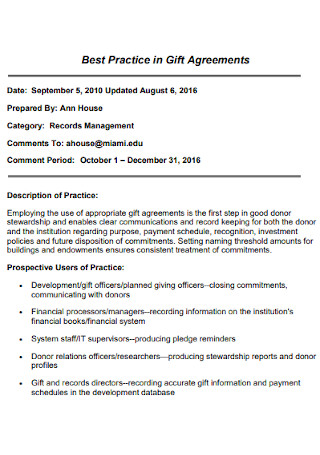

Best Practice in Gift Agreements

download now -

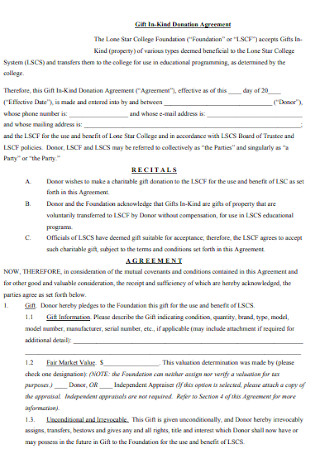

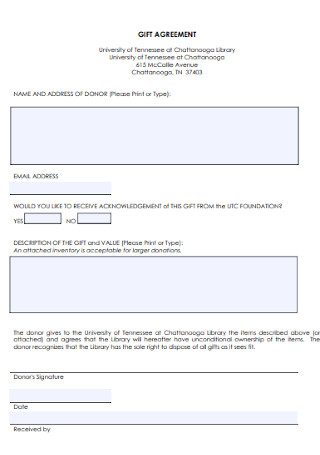

Gift In-Kind Donation Agreement

download now -

Basic Gift Agreement Template

download now -

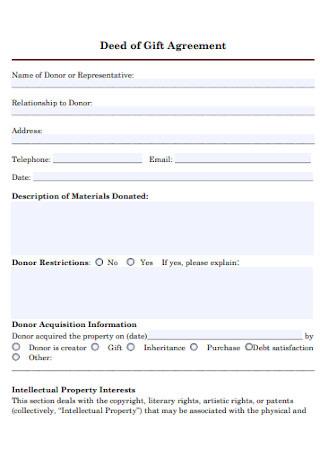

Deed of Gift Agreement

download now -

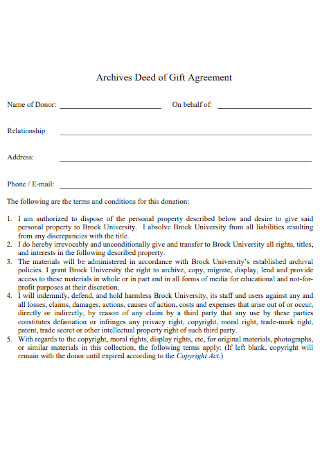

Archives Deed of Gift Agreement

download now -

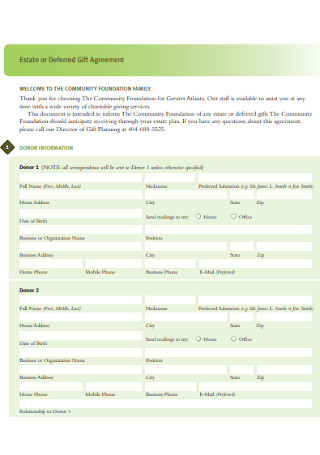

Estate or Deferred Gift Agreement

download now -

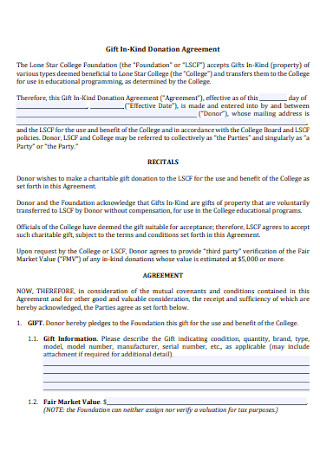

Sample Gift In-Kind Donation Agreement

download now -

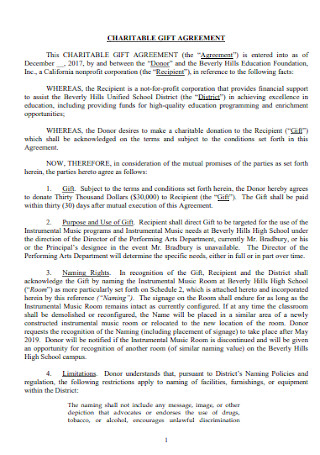

Charitable Gift Agreement

download now -

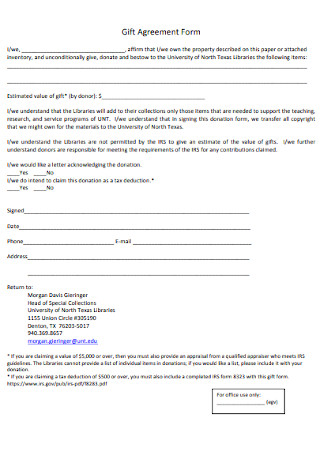

Gift Agreement Form Template

download now -

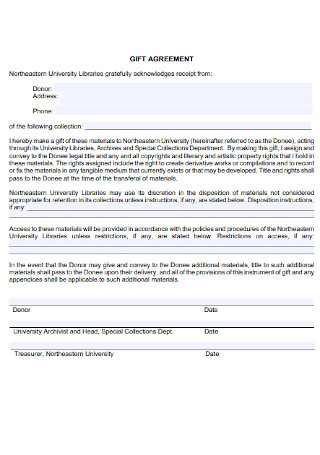

Standard Gift Agreement Template

download now -

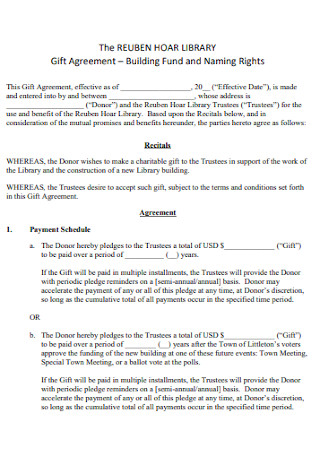

Building Fund Gift Agreement

download now -

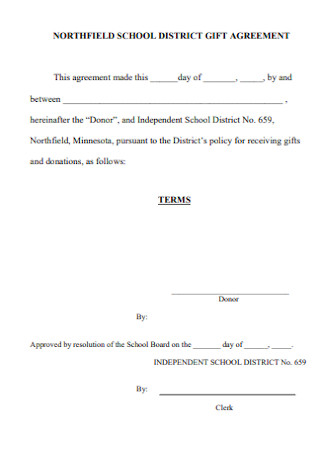

School District Gift Agreement

download now -

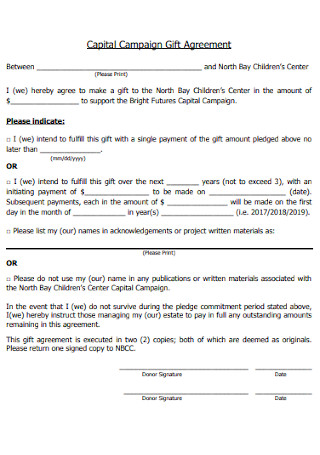

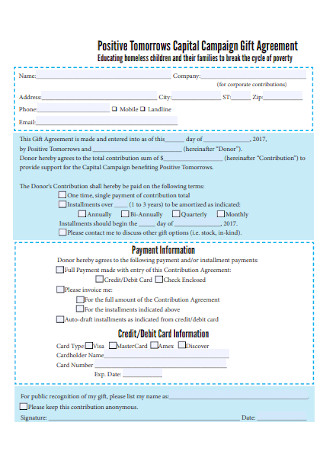

Capital Campaign Gift Agreement

download now -

Common Gift Agreements

download now -

Formal Gift Agreement Template

download now -

Additional Gift Agreement Form

download now -

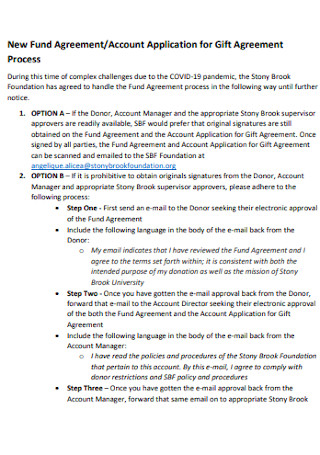

Account Application for Gift Agreement

download now -

Formal Giift Agreement Template

download now -

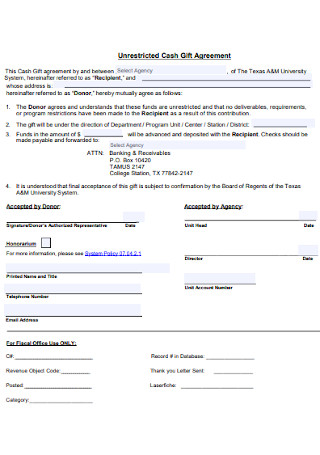

Unrestricted Cash Gift Agreement

download now -

Sample Gift Administration Agreement

download now -

Gift Agreement Format

download now -

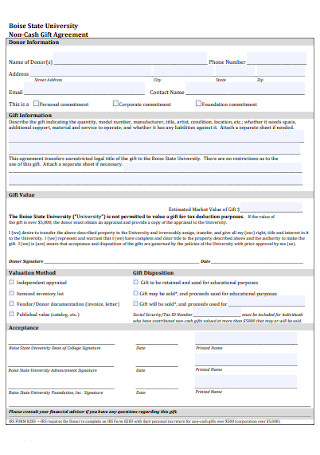

Non-Cash Gift Agreement

download now -

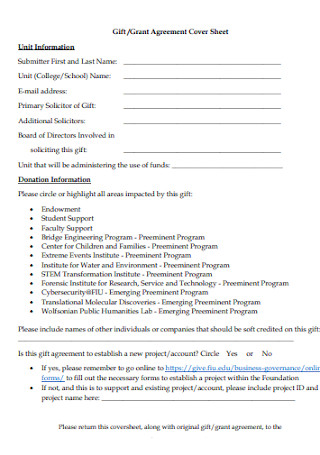

Gift Grant Agreement Cover Sheet

download now -

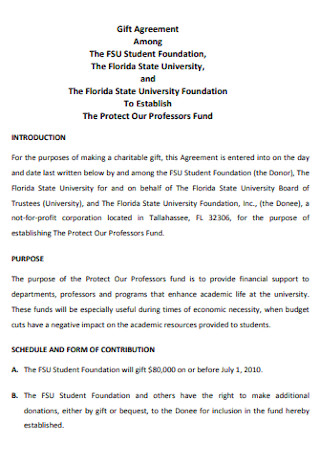

University Gift Agreement

download now -

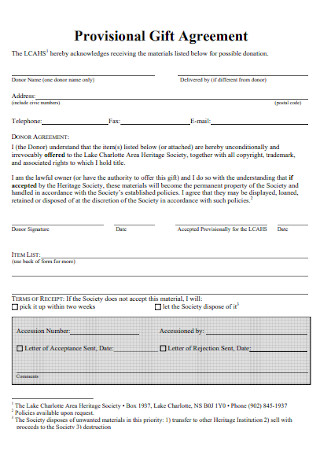

Provisional Gift Agreement

download now -

Capital Fund Gift Agreement

download now -

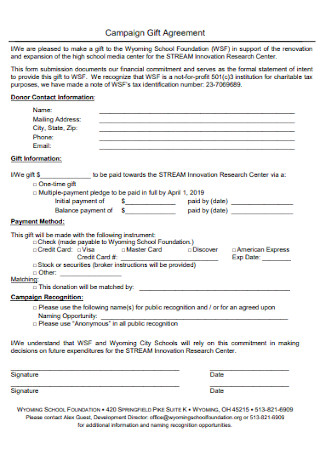

Campaign Gift Agreement

download now -

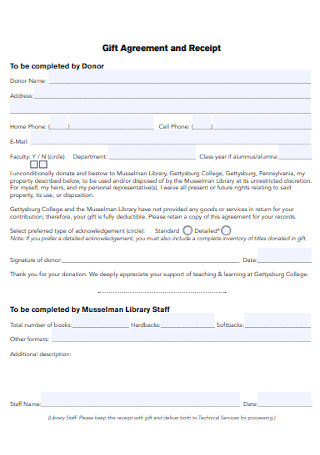

Gift Agreement and Receipt

download now -

Fund Gift Agreement

download now -

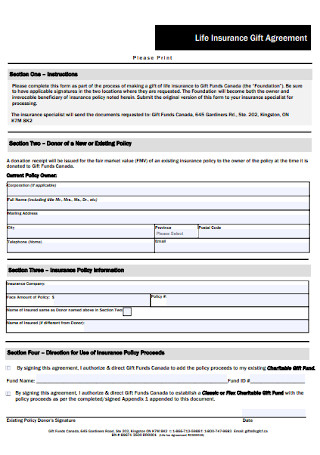

Life Insurance Gift Agreement

download now -

Sample Capital Campaign Gift Agreement

download now -

Student Gift Agreement

download now -

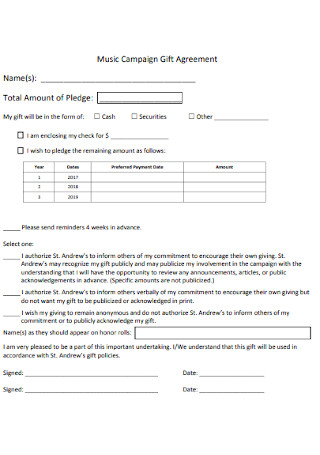

Music Campaign Gift Agreement

download now -

Periodic Gift Agreement

download now -

Income Funds Gift Agreement

download now -

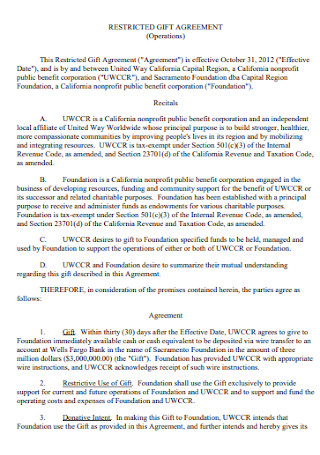

Restricted Gift Agreement Template

download now -

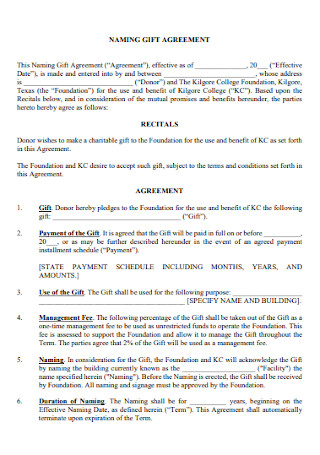

Naming Gift Agreement Template

download now -

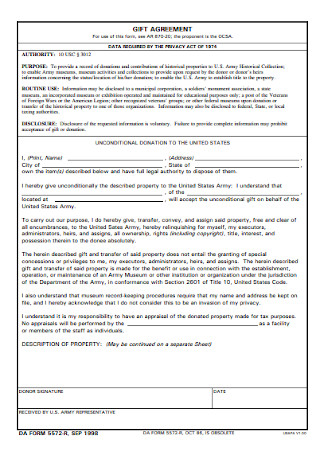

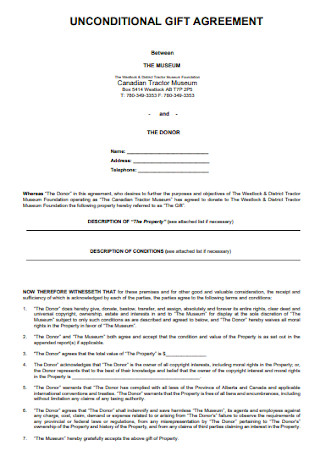

Unconditional Gift Agreement

download now -

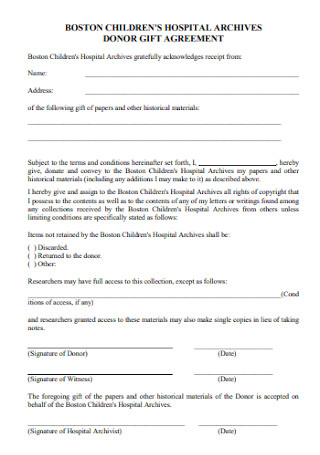

Donor Gift Agreement

download now -

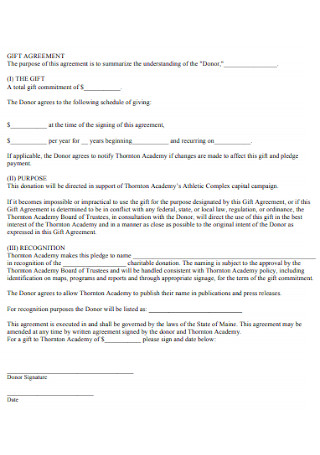

Academy Gift Agreement

download now -

Prepaid Gift Agreement

download now -

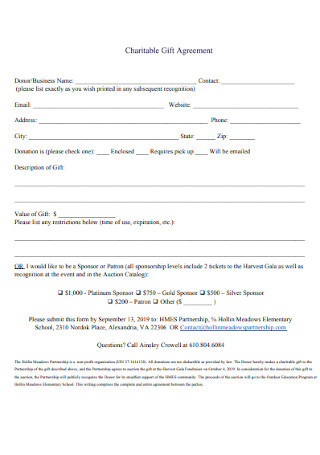

Charitable Gift Agreement Example

download now -

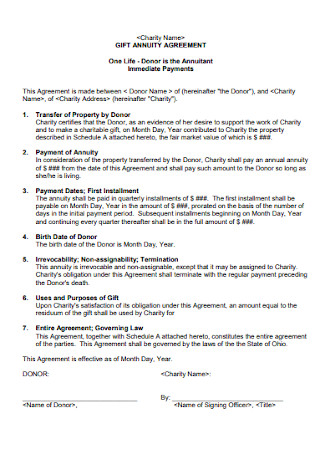

Gift Annuity Agreement

download now -

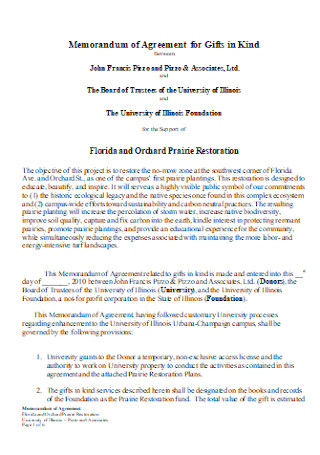

Memorandum of Agreement for Gifts

download now -

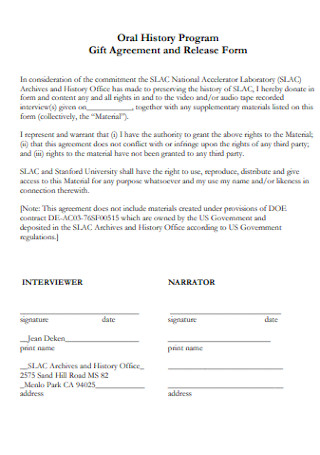

Gift Agreement and Release Form

download now

What Is a Gift Agreement?

In preparing presents, you usually have things in gift wraps and send those to the receivers. However, those involving a significant amount of cash donation, along with restricted purposes, must document what the donor will provide. This documented form serves as the gift agreement; thus, such an agreement specifies the donor’s promise and helps manage expectations between donors and donees (receivers). Expect gift agreements when major gift-giving is already planned out by a specific party. However, try not to confuse this agreement with a sponsorship or donation acceptance policy since that policy is only a part of the gift agreement’s anatomy.

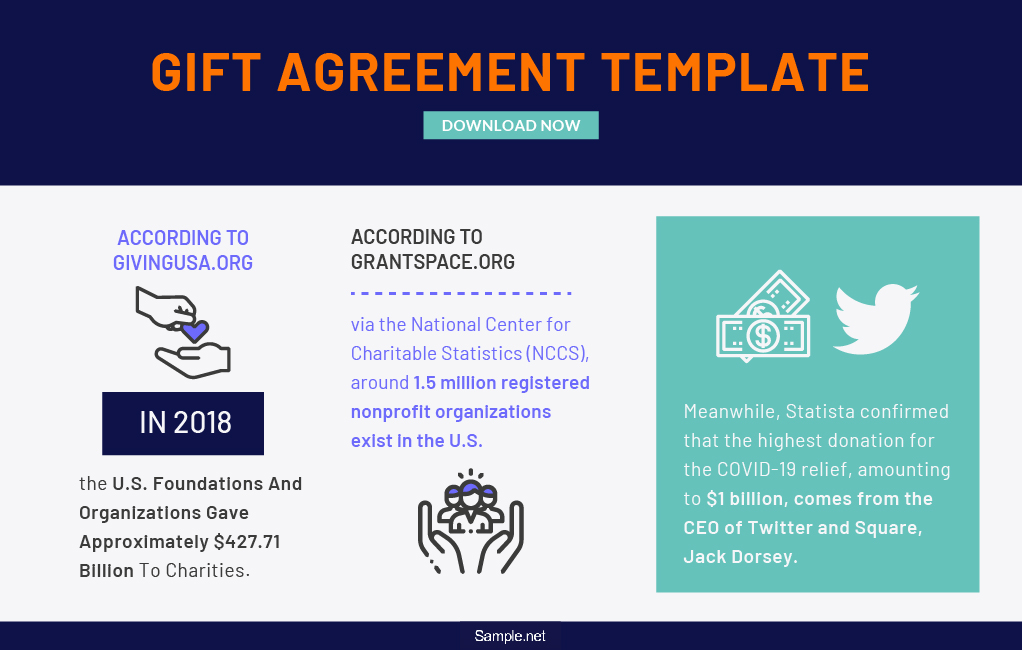

In 2018, the U.S. foundations and organizations gave approximately $427.71 billion to charities.

According to GrantSpace.org, via the National Center for Charitable Statistics (NCCS), around 1.5 million registered nonprofit organizations exist in the U.S.

Meanwhile, Statista confirmed that the highest donation for the COVID-19 relief, amounting to $1 billion, comes from the CEO of Twitter and Square, Jack Dorsey.

Why Is a Gift Agreement Important?

When you think about gift-giving, you can associate it from different roots like the pagan rituals and even the Three Wise Men who gifted baby Jesus. But in the 1800s, gifts were given not only to the low-class individuals but also to kids. In giving presents to children, these senders dress up as Santa Claus, which eventually became an icon every Christmas. While there is magic when children think that Santa is the person behind those gifts, it is also essential to give credit to the real donor. Nevertheless, having a gift tag with the donor’s name is not enough, especially for grand gifts given to important recipients. By using gift agreements, there is clarity that every party (the donor and the donee) is on the same page about the gifts. Therefore, preventing misunderstandings. On the other hand, these agreements keep precise records about the donations as well. If proof is required for the fund amount, the purpose of the contribution, and more, then a written gift agreement confirms it.

Unboxing a Gift Agreement: What Are Its Elements?

Are you already thinking about how to make your donation agreement? Hold your horses for the moment, and make sure to familiarize the common elements of gift agreements. Without adding these important parts to the binding agreement, there is a chance for issues to manifest along the way. That said, here are the essential facets to expect inside a gift agreement:

How to Craft an Acceptable Gift Agreement

According to Giving USA, the American corporations and foundations offered around $427.71 billion to charities in 2018. With that big amount, a lot of charities have benefited for sure. Thus, the need to document gift agreements is pivotal because in trying times like the current coronavirus pandemic, the call for donations is high. One of the well-known donors is Jack Dorsey, the CEO of Twitter and Square. He gave the biggest donation for the pandemic relief, which amounted to $1 billion. No matter what cause you want to give a gift for, it is vital to come up with an acceptable gift agreement. How do you do this? Just follow these steps:

Step 1: Download the Appropriate Template

Have you checked our collection of professionally-written gift agreement templates yet? Making this said agreement will be a whole lot easier after you download and modify the right template. We guarantee you that you can easily edit your document in any compatible program. For example, you may specify the title of the agreement, be it a family gift agreement or, perhaps, a testamentary gift agreement.

Step 2: Insert the Elements of a Gift Agreement

While editing the template, never forget the gift agreement elements discussed earlier. Insert every necessary component, from the parties, payments, recognition, fund restrictions, enforcement, and so forth. By doing this, all you have to do is divide the document into specific segments. One segment will be for recognizing every party, another for the payment agreement, and so on. Your main concern is to avoid missing any relevant element for your agreement, or else your document will not fully serve its purpose.

Step 3: Observe Realistic and Measurable Terms

Think twice and assess if the whole stipulated terms and information were realistic or measurable. Setting expectations is no stranger for the donor and recipient here to keep the experience satisfactory. Also, it is not good when everything is impractical. For example, the restrictions and guidelines regarding how the nonprofit can use the gift possibly were unrealistic, like letting them distribute a budget that is so small to fulfill all strategic plans.

Step 4: Pay Attention to Clarity

Lastly, always be clear from start to finish. By that, you should be clear about the donor’s intention, party expectations, restrictions, use of funds, and many more. It is hard to obtain a mutual agreement when one party hardly understands its content. By reviewing the full content, it is easy to evaluate whether things need more clarification or not. Furthermore, changes may be possible at some point, and incorporating an addendum would be helpful. That way, all parties get ready for additional stipulations and possible changes.

FAQs

Are gift agreements legally binding?

There is no requirement for gift agreements to be legally binding, but you can do so by making it enforceable. Binding agreements and contracts generally incorporate the court when litigation commences anyway. Therefore, an enforceable gift agreement wins at involving the law to avoid misunderstandings and unlawful practices.

What qualifies as a gift in a gift agreement?

The most typical example of a gift is a cash donation. Transferring these funds to the recipient can even be exempted from tax laws since the gifts need not be compensated in return. However, gifts may also refer to equipment donation or other forms of charity that do not involve money. The only concern is to specify what the gift is under the agreement.

What is the gift tax limit?

In 2020, the yearly gift tax exclusion is approximately $15,000 per person. This amount is similar back in 2019, meaning giving around $15,000 for particular individuals is allowed even without paying for tax.

What is known from gift-giving is that even a tad amount of generosity gets shown. Albeit gifts are things to be thankful for, other people abuse those too. As a donor intends to fund an organization for charitable work, the monetary donation may have been used for personal interests instead. Thankfully, any abuse or improper use of gifts will be minimized with the help of a gift agreement, especially if it is legally binding. By keeping every restriction, stipulation, and other details clear, recipients inevitably receive those funds, whereas donors get valued and recognized—thus, a winning situation for both sides.