50+ Sample Grant Agreement Templates

-

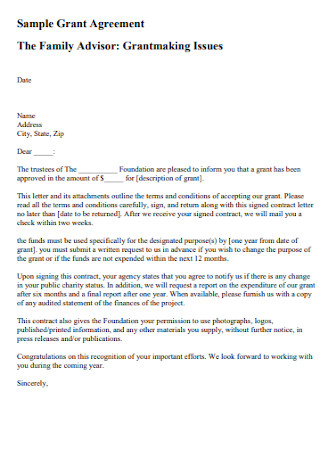

Family Grant Agreement

download now -

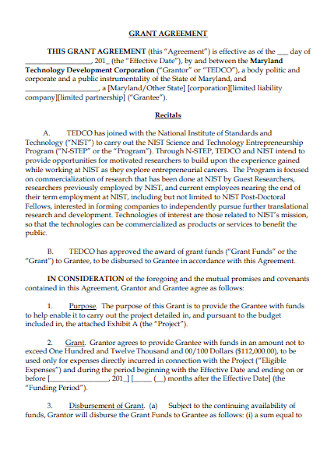

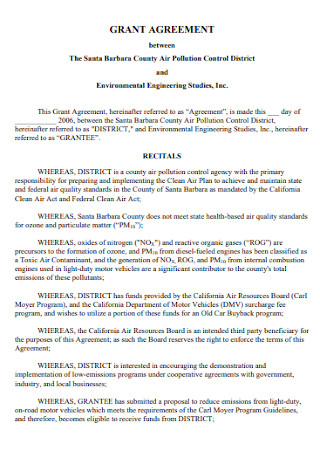

Sample Grant Agreement Template

download now -

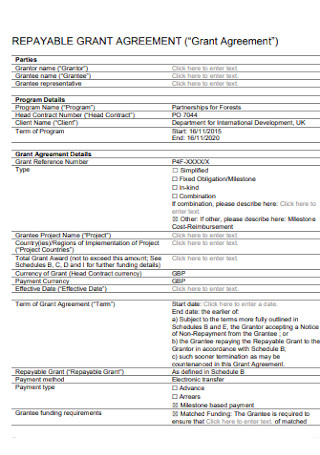

Repayble Grant Agreement

download now -

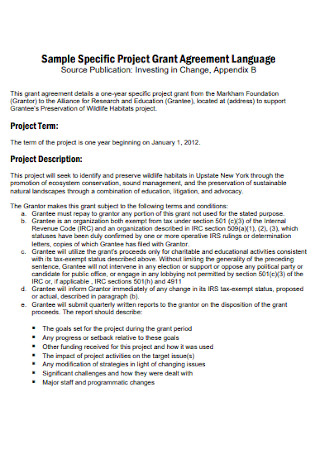

Project Grant Agreement

download now -

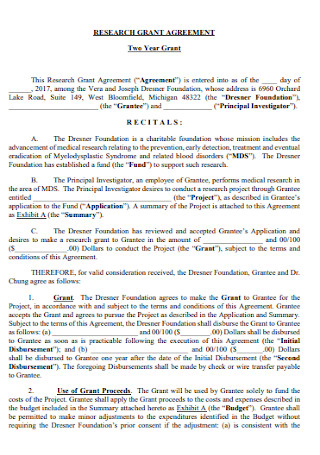

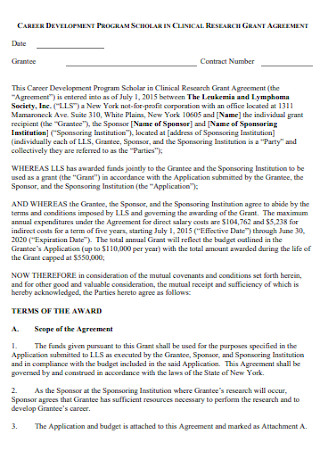

Research Grant Agreement

download now -

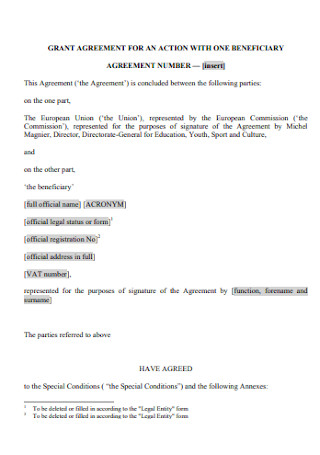

Action Grant Agreement Template

download now -

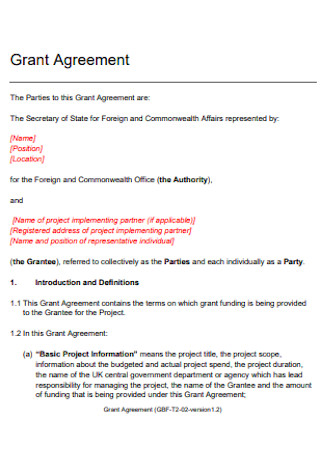

Basic Grant Agreement Template

download now -

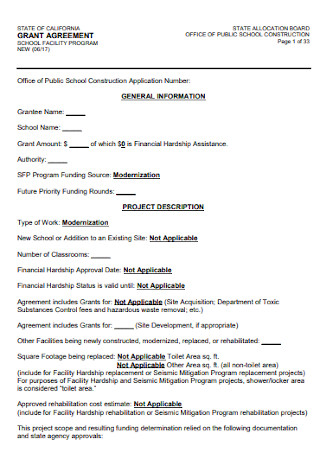

School Grant Program Agreement

download now -

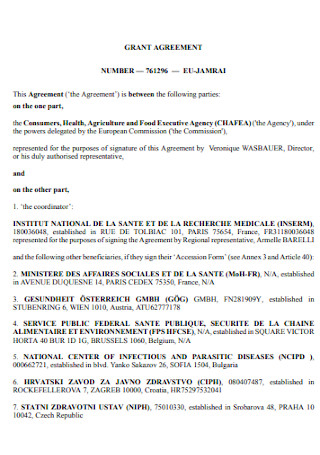

Grant Commission Agreement

download now -

Simple Grant Agreement Template

download now -

Program Research Grant Agreement

download now -

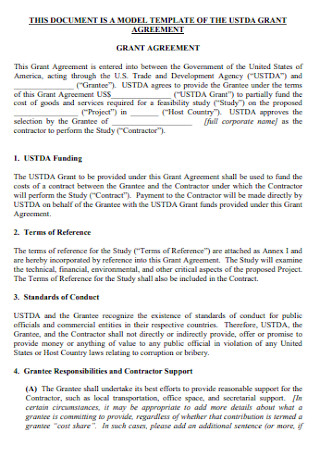

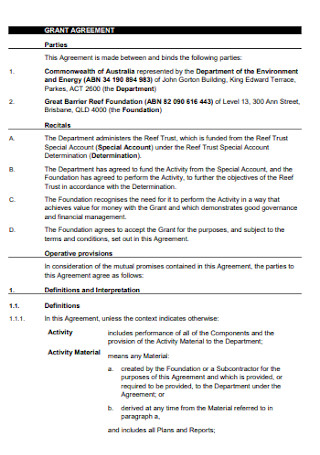

Grant Model Agreement

download now -

Sample Sub Grant Agreement

download now -

Master Grant Agreement

download now -

Model Bonus Grant Agreement

download now -

Standard Grant Agreement

download now -

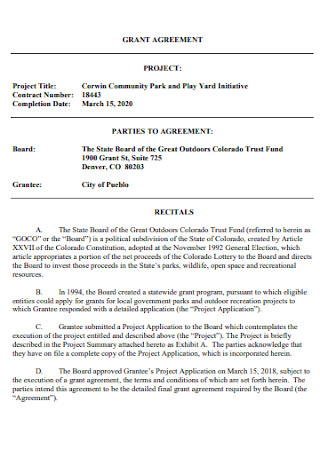

City Grant Agreement

download now -

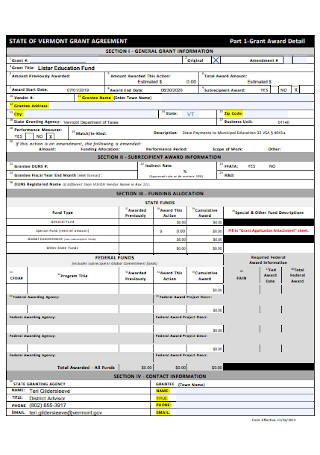

Grant Award Agreement

download now -

Project Grant Agreement

download now -

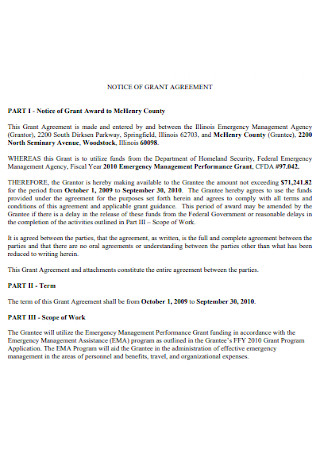

Notice of Grant Agreement

download now -

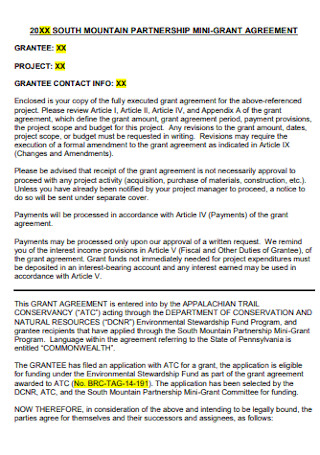

Partnership Mini Grant Agreement

download now -

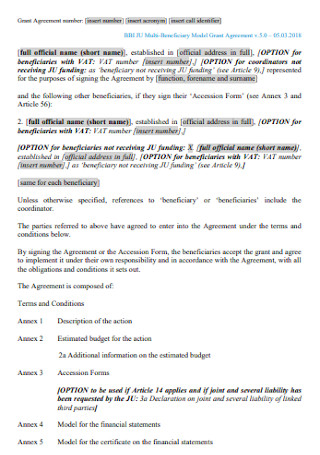

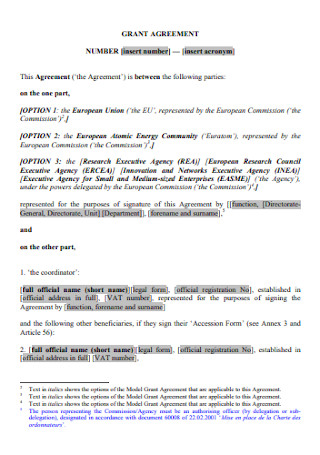

Multi-Beneficiary Model Grant Agreement

download now -

Department of Health Grant Agreement

download now -

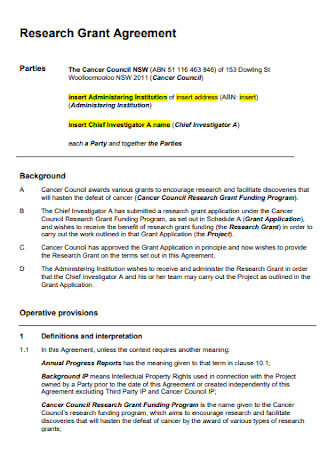

Cancer Research Grant Agreement

download now -

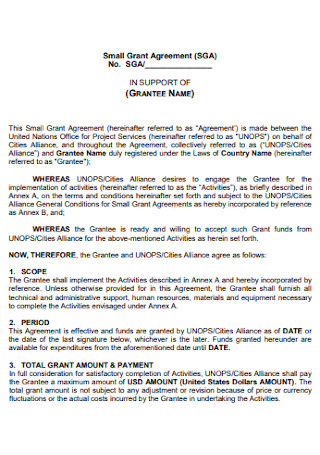

Small Grant Agreement

download now -

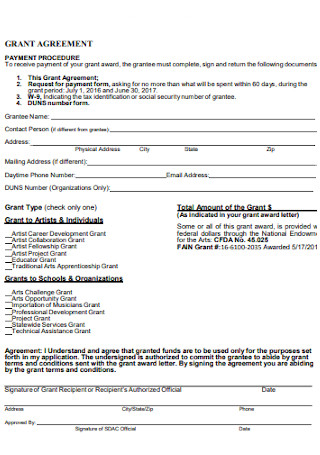

Arts Council Grant Agreement

download now -

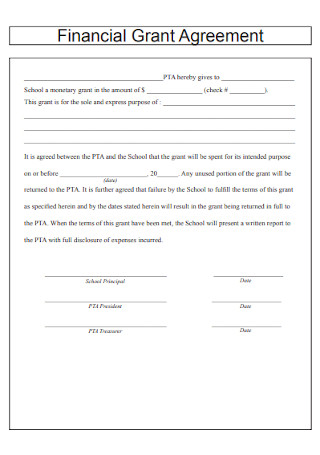

Financial Grant Agreement

download now -

Trust Grant Agreement

download now -

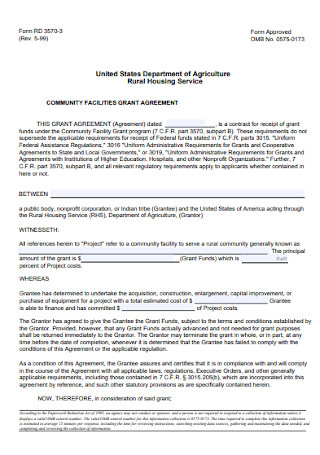

Community Facility Grant Agreement

download now -

General Grant Agreement

download now -

Addendum to Grant Agreement

download now -

Assistance Grant Agreement

download now -

Park Program Grant Agreement

download now -

Housing Repayable Grant Agreement

download now -

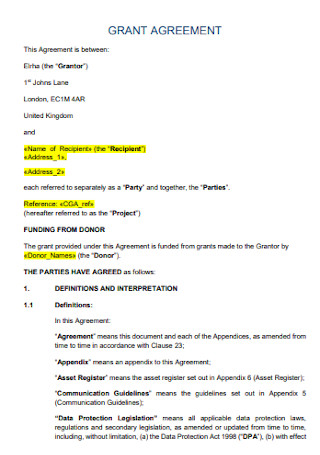

Grant Funding Agreement Template

download now -

Grant Agreement Format

download now -

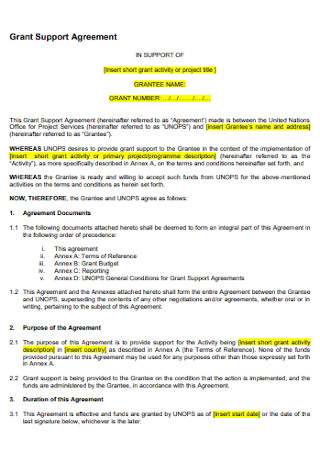

Grant Support Agreement

download now -

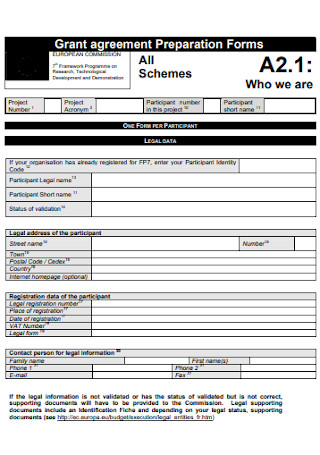

Grant Agreement Preparation Forms

download now -

Education Grant Agreement Form

download now -

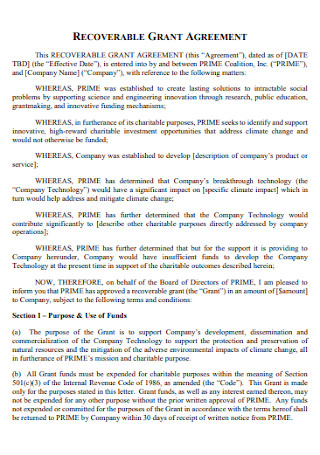

Recoverable Grant Agreement

download now -

Global Grant Agreement

download now -

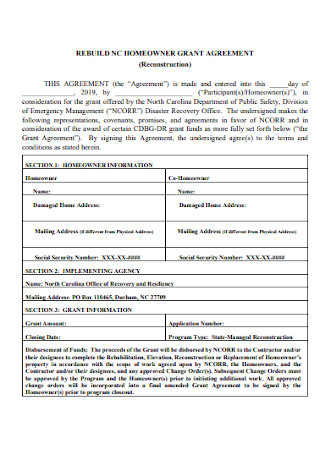

Homeowner Grand Agreement

download now -

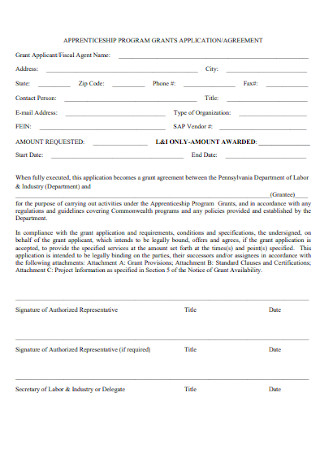

Grant Agreement Application Template

download now -

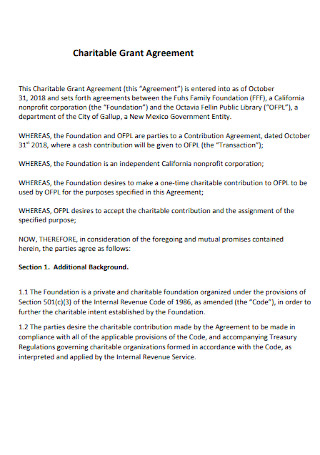

Charitable Grant Agreement

download now -

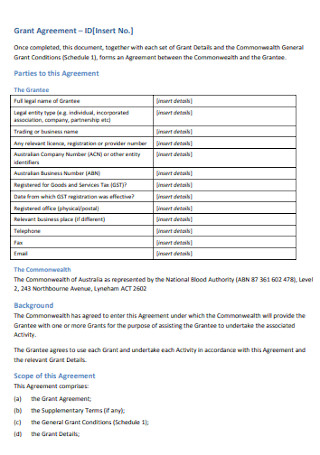

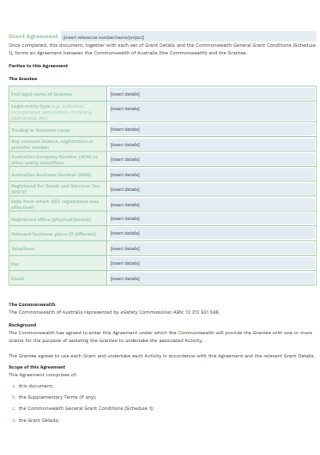

Simple Commonwealth Grant Agreement

download now -

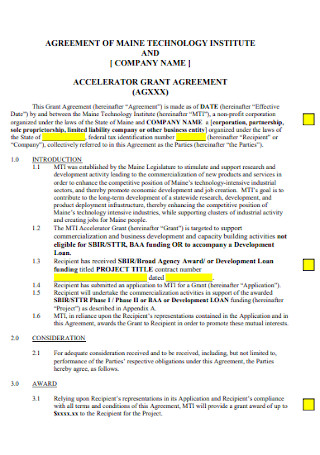

Accelerator Grant Agreement

download now -

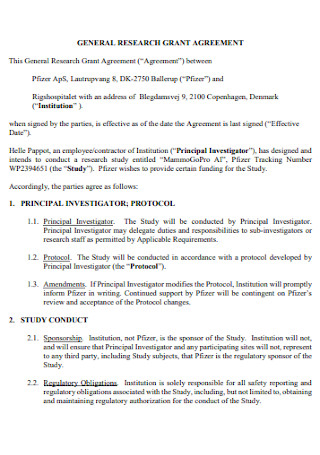

General Research Grant Agreement

download now -

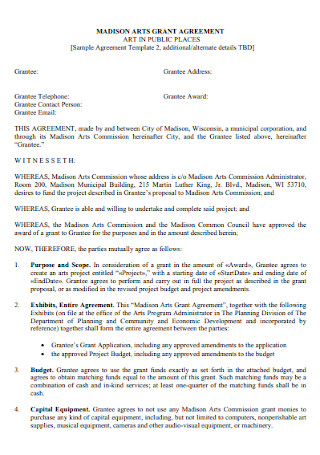

Sample Arts Grant Agreement

download now -

Sanitary Sewar Grant Agreement

download now -

Energy Efficiency Grant Agreement

download now -

Amending Development Grant Agreement

download now

FREE Grant Agreement s to Download

50+ Sample Grant Agreement Templates

What Is a Grant Agreement?

Grants: Pros and Cons

How to Make a Grant Agreement

FAQs

What are the types of grants?

What is the difference between a cooperative and a grant agreement?

What are different names for someone who gives a grant?

How can I qualify for grants?

What Is a Grant Agreement?

First things first, a grant is any fund given by a party known as grantmakers or grantors. A grantor can be a government entity, trust, foundation, or special organization. On the other hand, receivers are known as grantees, and they earn the non-repayable grants to achieve a specific proposal. Proposals may involve processing for business startup, funding special projects, and other plans. Meanwhile, recipients are introduced to grant writing to confirm that they received grants. When the nature and stipulations of a grant need clarification between parties, that is when an agreement or contract comes to play. Thus, a grant agreement is an official document that tackles the terms, requirements, and conditions to apply for grants between grantors and grantees.

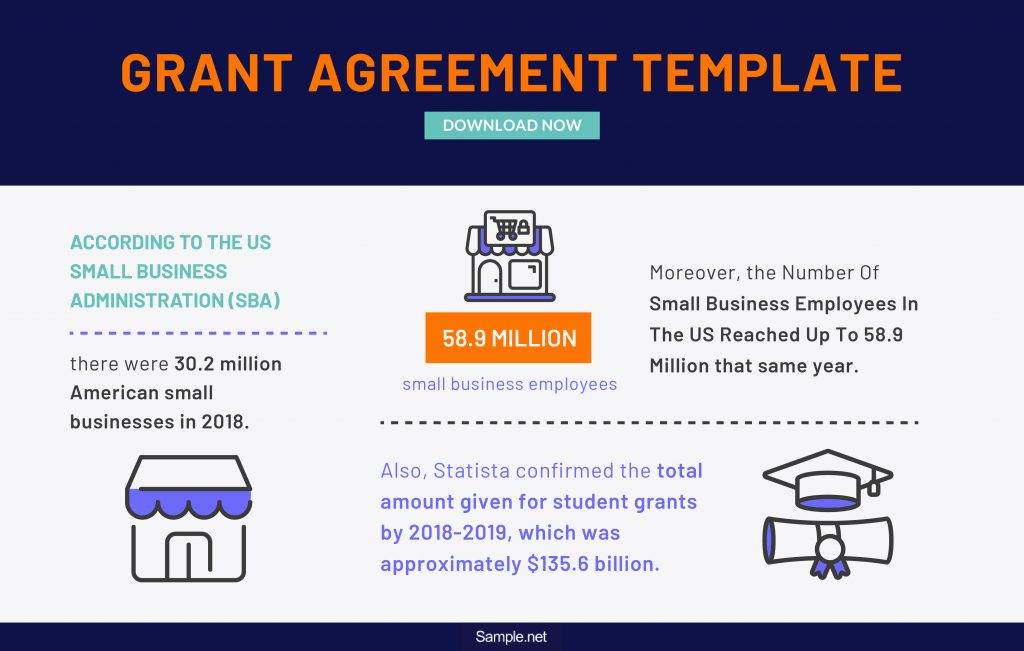

According to the US Small Business Administration (SBA), there were 30.2 million American small businesses in 2018.

Moreover, the number of small business employees in the US reached up to 58.9 million that same year.

Also, Statista confirmed the total amount given for student grants by 2018-2019, which was approximately $135.6 billion.

Grants: Pros and Cons

SBA.gov introduced us that in 2018, 30.2 million small businesses existed in the US. Furthermore, it had around 58.9 million small business employees to boot. Even with that massive number, it is no stranger that startup or small business owners often struggle to maintain a successful business venture. Such owners would need business budgets and funds to meet their vision. Thankfully, fundraising letters are an opportunity to get help, particularly with grants. But before being involved with grants, advantages and disadvantages are part of the deal too. To manage your company wisely, familiarize both the pros and cons of grants:

How to Make a Grant Agreement

Ready to come up with your grant agreement? Do not forget that we have ready-made templates for you to download and use anytime. Just select the appropriate template you need and edit its content and format. With a template prepared, your only concern is to figure out the steps in making a standard grant agreement. Without further ado, here are the steps for you to manage it:

Step 1: Begin with an Introductory Statement

First of all, do not immediately give the main meat of the agreement because there are some terms and definitions to introduce. How to do this? Begin with an introductory statement that should include the label grant agreement. That way, anyone who checks this form can identify what the deal is about from the introduction alone. Some difficult words to understand by the general public require definition here too. And most importantly, recognize who are the parties involved. Identify the legal name and business name of both grantors and grantees with the correct spelling for confirmation.

Step 2: Determine the Grant Offer

How much the grant is will be part of the essential things to disclose in this agreement. State the amount both in figures and in words to clarify it. In most cases, the amount and the function of this grant go hand in hand. A grantor likely has promised about such an amount with the recipient in person. And, it must match with the written promissory note on the form. Otherwise, there is an inconsistency of the grant if the two vary. Before any party signs the document, asking for confirmation of this amount is allowed anyway to avoid making a mistake.

Step 3: Expound the Purpose of the Grant

Of course, funding goes with a purpose, and specifying it on the form is crucial. Grantmakers are the ones who need to expound this correctly, so the grantees receive the gist without hassle. Are the funds to help startup companies open their operations? Is it for a supplier agreement? Or perhaps, the funds are for one of the most common grants; this is the student grant, which provided around $135.6 billion in 2018 to 2019. No matter what its condition is, what matters is that it was stipulated under the form. Therefore, what purpose it serves is no longer questionable.

Step 4: Finalize the Grant Funding Period and Schedule

Another vital point to decide on is the funding schedule and period. Mention first the starting date until the end date of using grants. During that starting date, the grantee must already receive the grant, or the promise would not have been kept. Next, will the budget be given weekly, bi-weekly, monthly, or every three months? That decision is also necessary to write in the agreement. The purpose of indicating these dates and schedules is to prevent wrong assumptions. Hence, a grantee would only look at the expected date to receive the grant.

Step 5: Incorporate the State Laws

The last thing you would want to commit in an agreement is to provide stipulations that do not go according to the law. Laws involve a variety of topics like if the charity is already exempted from tax or not yet. The same goes if there is any possible change to expect along the way. And, all parties demand to be notified about it through an addendum to the agreement. Without leaving any notice to parties, some would complain about it. Before anyone proceeds to litigation, everyone should already be aware of what the legal side of the business is about for clarity.

Step 6: Denote the Breach of Grant Conditions and Termination

If anyone backs out from the agreement or fails to adhere to the obligations, how should those be settled? Any grant condition, termination, or breach of a contract goes under another segment to mention too. Aside from the legal terms, conflicts also lessen with clear consequences to follow. These consequences run after inevitable disagreements are already tackled in that form. On another note, one could inform grantees that monitoring or evaluation is part of the process, too, as a way of checking if they made use of the funds as intended or not. Lastly, review the whole message clearly before having it signed.

FAQs

What are the types of grants?

Expect around four types of grants. These are the competitive, continuation, formula, and pass-through grants. In deciding which support is better for fundraising, make sure to recognize their advantages and disadvantages first.

What is the difference between a cooperative and a grant agreement?

Although grant and cooperative agreements can be associated with each other, sometimes, there are major differences between both too. For instance, cooperative agreements are part of a grant in which federal awarding agencies and non-federal entities work as one. In other words, cooperative means there are many other parties taking part in the grant agreement.

What are different names for someone who gives a grant?

A person who gives grants can be referred to as a grant writer, grantmaker, or grantor. Albeit they have different names, they still mean as one which is a giver of a grant.

How can I qualify for grants?

To qualify for grants, familiarize the different requirements needed by the federal government, state government, university, nonprofit organization, or any corporation who may give a grant. By completing the stipulations and ensuring that you do not fail to meet the application deadline, rest assured you qualify for it.

Any agreement works well when all parties play their roles responsibly. In the case of a grantee and a grantor, they must fulfill their obligations, as stated in the document. Grantors keep their promise of giving a specific grant amount and clearly explain their particular conditions. Also, grantees must prove that they earned those funds by adhering to the conditions. If both parties comply with that, then the effective use of a grant agreement takes place.