25+ Sample Guarantor Agreement

-

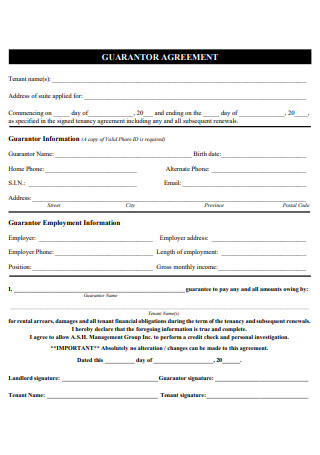

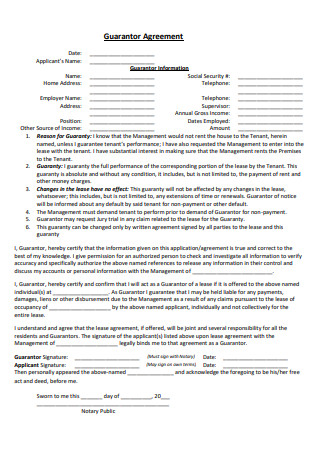

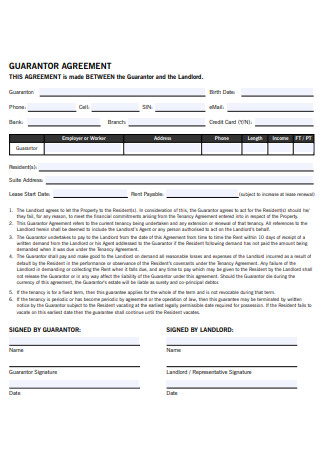

Guarantor Agreement Template

download now -

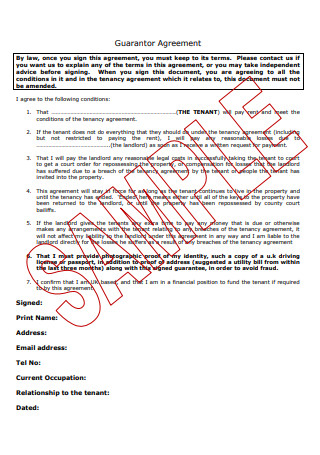

Sample Guarantor Agreement

download now -

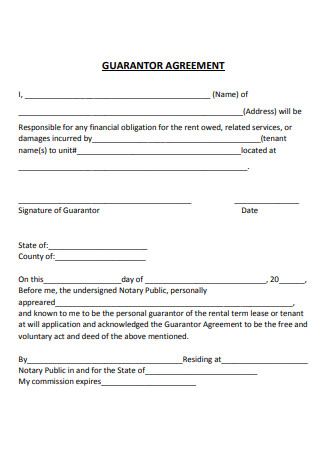

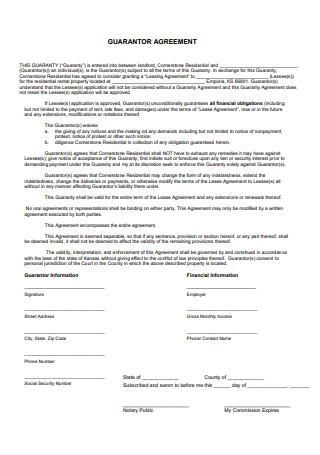

Formal Guarantor Agreement

download now -

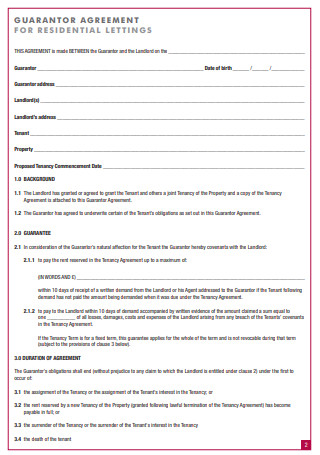

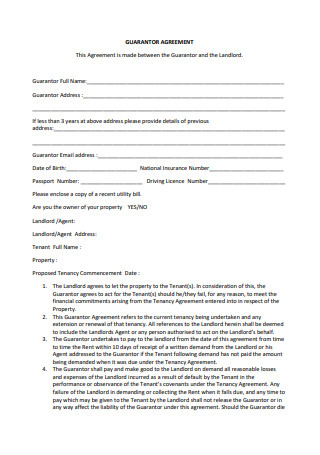

Residential Guarantor Agreement

download now -

Basic Guarantor Agreement

download now -

Guarantor Agreement in PDF

download now -

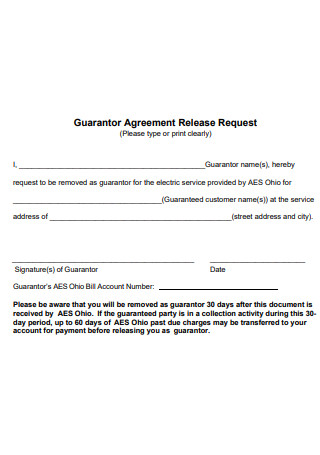

Guarantor Agreement Release Request

download now -

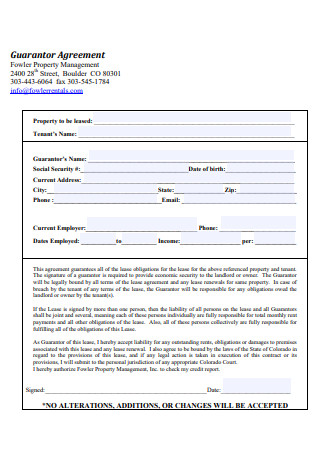

Standard Guarantor Agreement

download now -

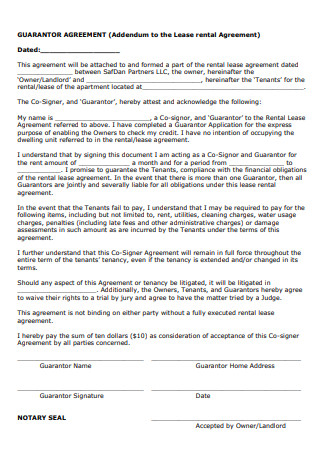

Guarantor Rental Lease Agreement

download now -

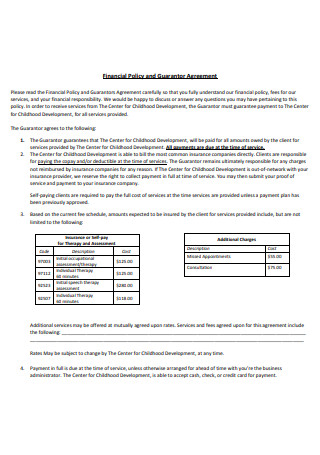

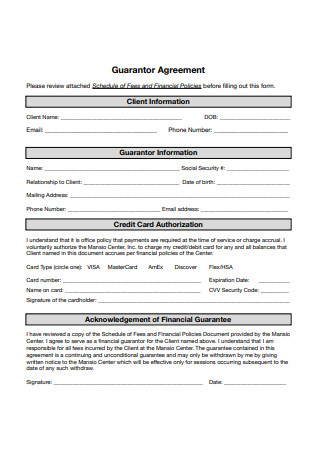

Financial Policy and Guarantor Agreement

download now -

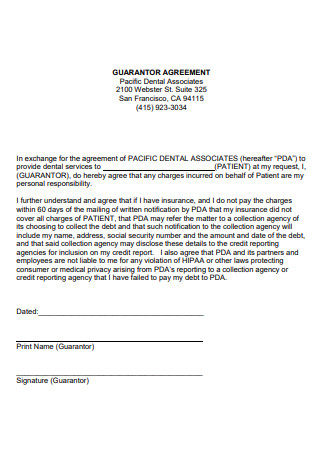

Guarantor Agreement Example

download now -

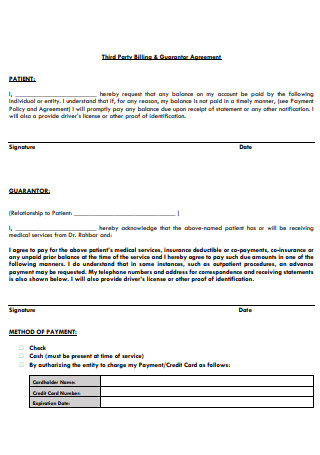

Third Party Billing and Guarantor Agreement

download now -

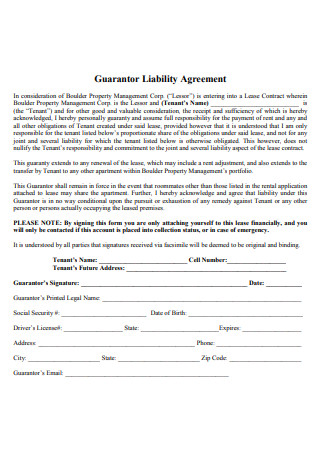

Guarantor Liability Agreement

download now -

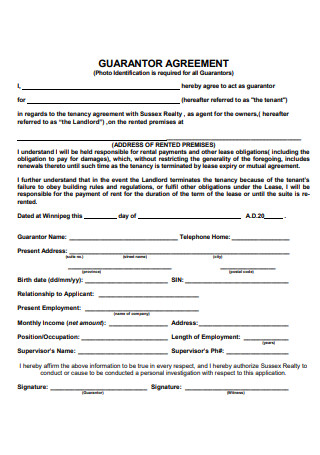

Guarantor Agreement Format

download now -

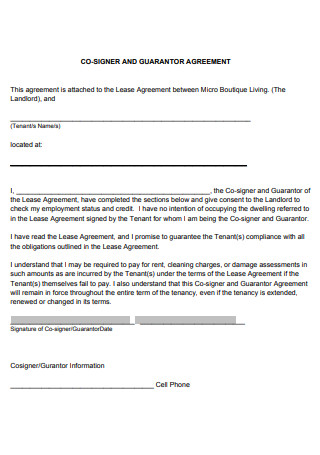

Co-Signer and Guarantor Agreement

download now -

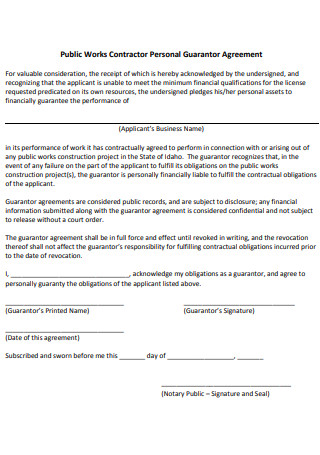

Public Works Contractor Personal Guarantor Agreement

download now -

Simple Guarantor Agreement

download now -

Printable Guarantor Agreement

download now -

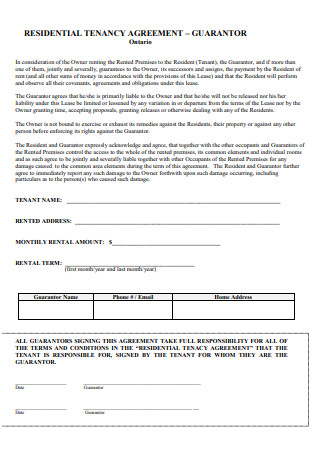

Residential Tenancy Guarantor Agreement

download now -

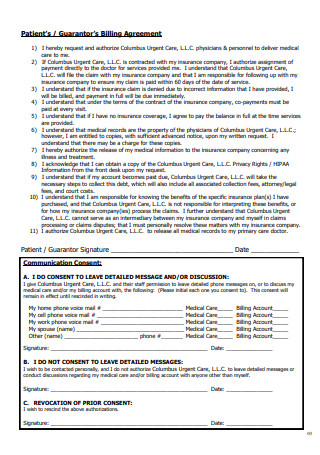

Guarantor Billing Agreement

download now -

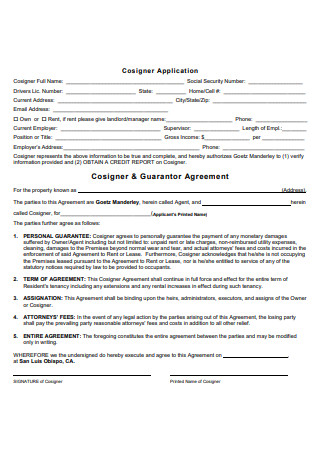

Cosigner and Guarantor Agreement

download now -

Guarantor Agreement Form

download now -

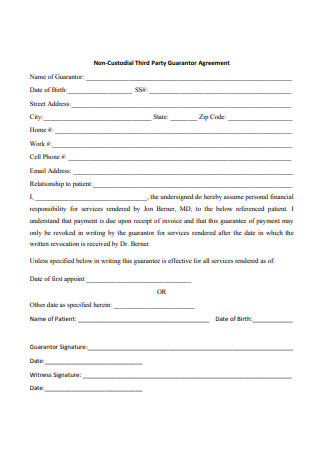

Non-Custodial Third Party Guarantor Agreement

download now -

Student Account Guarantor Payment Agreement

download now -

Draft Guarantor Agreement

download now -

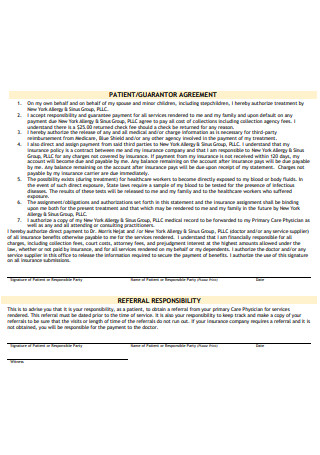

Patient Guarantor Agreement

download now

FREE Guarantor Agreement s to Download

25+ Sample Guarantor Agreement

What Is a Guarantor Agreement?

Elements of a Guarantor Agreement

What Are the Different Types of Guarantors?

What Are the Different Types of Guarantees?

What are the Risks That Come With Being a Guarantor?

Steps in Writing a Guarantor Agreement

FAQs

Can a guarantor agreement be challenged?

Is a guarantor the same as a co-signer?

When will the liability of the guarantor end?

How can you be a guarantor?

What Is a Guarantor Agreement?

A guarantor agreement is a legal document that refers to an arrangement in which a third party, known as a guarantor, agrees to provide payment assurance in the event that the party participating in the transaction fails to live up to their half of the bargain. This document is frequently used in real estate and banking transactions. The guarantee bears all of the risks in this agreement because if the borrower fails to make the agreed-upon installments, the guarantor is responsible for repaying the loan. This document also adds extra safety to a loan which makes it more appealing to potential lenders because having the presence of a guarantee in a loan reduces the likelihood of a lender not being repaid.

Elements of a Guarantor Agreement

Here are the common elements that are usually included when making a guarantor agreement:

What Are the Different Types of Guarantors?

Listed below are the different types of guarantors, with each type varying according to the situations that a guarantor may be used.

- Certifiers – in this scenario, guarantors can be used as certifiers so that they can help individuals secure the jobs that they want and secure documents such as passports. In these types of situations, guarantors should certify that they know the applicants on a personal level and confirm their respective identities by providing evidence of identification such as a valid photo ID.

- Limited Guarantor – a limited guarantor is only responsible for a certain percentage of the loan amount, which is referred to as the penal sum. This guarantor is also asked to guarantee a loan only for a short period of time, after which the borrower is solely responsible for the remaining payments and bears the repercussions of default.

- Unlimited Guarantor – an unlimited guarantor is different from a limited guarantor in that they are responsible for the full amount of the loan and they should keep that responsibility for the entire duration of the loan contract.

What Are the Different Types of Guarantees?

Here are some of the different forms or types of guarantees that exist:

- Absolute Guarantee – This type of guarantee contains no stipulations that prevent a creditor from proceeding to assume relief immediately if the party who committed to the initial transaction defaults on the contract. A guarantee is presumed to be absolute in the absence of conditions.

- Conditional Guarantee – This type of guarantee is different because if the parties enter into an agreement that includes a conditional guarantee, it takes more than just a debt default to trigger the guarantor’s obligation to repay the debt. It necessitates some action on the part of the creditor.

- Payment Guarantee – This type of guarantee makes the guarantor obligated to pay the creditor when the debt becomes due if the borrower defaults at that time. It happens automatically on a predetermined day by default.

- Performance Guarantee – This type of guarantee refers to a guarantee that a service will meet specific expectations or that a product will continue to operate properly for a specified length of time.

- Continuing Guarantee – This type of guarantee refers to a commitment by the guarantor to be liable for someone else’s responsibilities to the lender, even if the obligations are made, renewed, or reimbursed over time.

What are the Risks That Come With Being a Guarantor?

Steps in Writing a Guarantor Agreement

Before someone can be a guarantor, it is required that they agree to the terms of a guarantor agreement. Here are the steps to follow when writing one:

-

1. Gather All the Necessary Materials or Documents

Before you start writing the guarantor agreement, make sure that you have all the necessary materials or documents that you need. For instance, documents such as bank statements or tax returns may be required depending on the type of guarantor agreement. It is important that you have the materials, or at least the vital information on those materials, present with you as you start writing the agreement.

-

2. Start Writing Your Personal Information

Start with your personal details when creating the document. This will include information such as your name, address, social security number, and phone number. You must supply this information so that the company with whom you are signing the agreement can run a credit check.

-

3. Include the Secondary Elements of the Guarantor Agreement

In this step, begin including the secondary elements of the agreement. These include the introduction of the agreement, any other basic information, the definition of terms, and so on. These are called secondary elements because while they are important to the guarantor agreement, they do not have the same bearing/importance compared to the main elements that follow them.

-

4. Start Writing the Main Elements

In this step, you can now begin writing the main elements of the guarantor agreement. These elements include the guaranty, the guaranty absolute, the continuation and reinstatement clause, the waivers, the subrogation clause, the subordination clause, the representations and warranties clause, the right of set-off clause, the indemnification clause, and lastly, the waiver to jury trial clause. The contents of a guarantor form may also be included here, such as the borrower’s income, employment status, and banking information.

-

5. Finalize the agreement

Once all the parts of the guarantor agreement have been written, it won’t hurt to give it a second look. Verify if there are any other missing elements that could play a big part, or you can also check if there are parts that can be deemed unnecessary that you may have missed. Also, check for any inconsistencies that can be present in the agreement and also check for any typographical or grammatical errors, because they may lead to unnecessary trouble in the future should any party involved take too many liberties in interpreting a certain clause just because a mistake was left uncorrected.

-

6. Sign the agreement

Once the guarantor agreement has been finalized, it is now time for all the parties involved to come into agreement with the terms stated. If everything goes well, they immediately sign it, and the agreement will take effect either immediately or on the date stated on the document. If they don’t agree on certain things but still need the agreement to push through, a compromise can be reached so that the chances of backing out are lessened. Once the document is signed, getting it notarized can be a big advantage in case there are any legal disputes.

FAQs

Can a guarantor agreement be challenged?

Yes, a guarantor agreement can be challenged in court. A condition that can trigger a court challenge includes being made a guarantor through forced persuasion, such as being put under pressure, experiencing blackmails, or being made a guarantor out of fear. Other situations that can call a court challenge include having a disability or mental illness at the time of signing the agreement, having little to no legal advice prior to signing such agreement, and having a hunch that you were tricked into signing such document.

Is a guarantor the same as a co-signer?

These terms may be used and thrown around interchangeably, especially by a layman. It is important to understand that these terms are completely different. A guarantor is only responsible for paying if the main borrower is unable to pay the loan amount and will only do so once he/she is notified by the lender of the loan. A co-maker shares the same responsibility as the borrower right from the start of the agreement. He/she co-owns the asset and is responsible for completing the payments right from the start of the agreement.

When will the liability of the guarantor end?

The liability of a guarantor is limited to what is stated in the guarantee agreement or what is agreed upon verbally. Many guarantor agreements are vague or open-ended, referring to the guarantor’s liability as ‘under this tenancy/agreement.’ This implies that obligation may extend beyond the defined period, to any extension, and to any other certain alterations. In such cases, it can be ended by a valid notice or by a court challenge.

How can you be a guarantor?

There are several agreements in place, and each lender has distinct requirements for someone to act as a guarantor. A guarantor must have a high credit score and no negative scores present on their credit report. They must also have an income that is a multiple of the monthly or annual payouts or compensations.

Sure, securing your dream place to live in the city through a loan or through other financing methods can prove to be a big sigh of relief, but, since this is such a massive investment, you always need to make sure that you have a reliable guarantor in the agreement in case something happens out of your control which will render you unable to continue paying the loan amount for a certain period or permanently. In this article, examples of a guarantor agreement are readily available so that you can have something to look at when drafting your own.