35+ Sample Guaranty Agreement

-

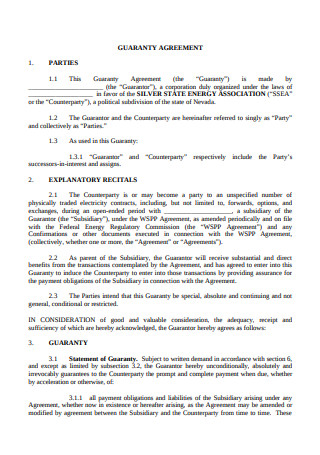

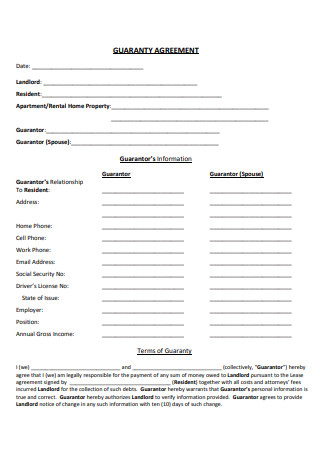

Guaranty Agreement Template

download now -

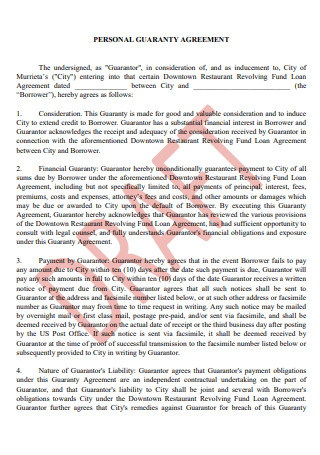

Personal Guaranty Agreement

download now -

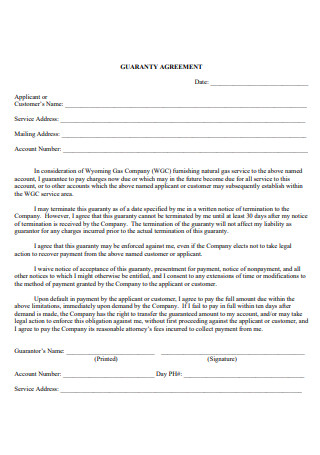

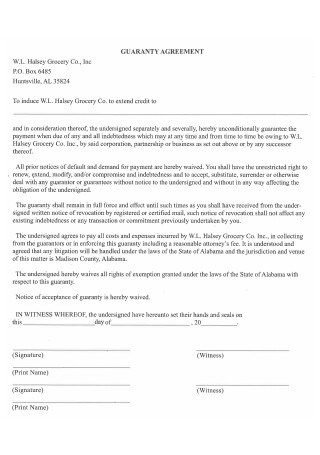

Basic Guaranty Agreement

download now -

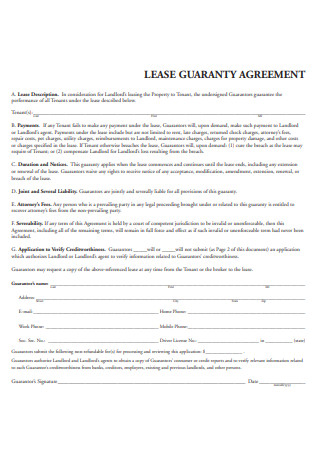

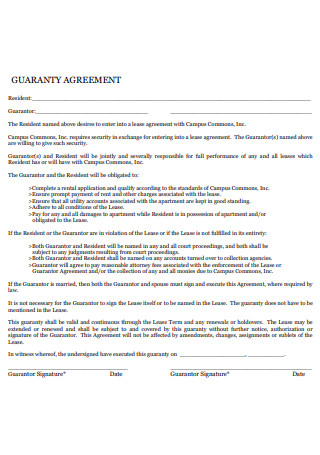

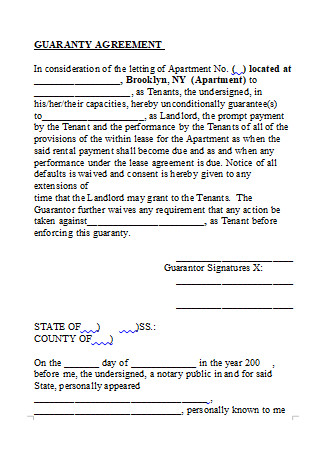

Lease Guaranty Agreement

download now -

Formal Guaranty Agreement

download now -

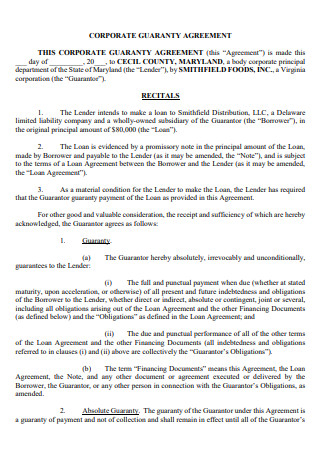

Corporate Guaranty Agreement

download now -

Guaranty Agreement in PDF

download now -

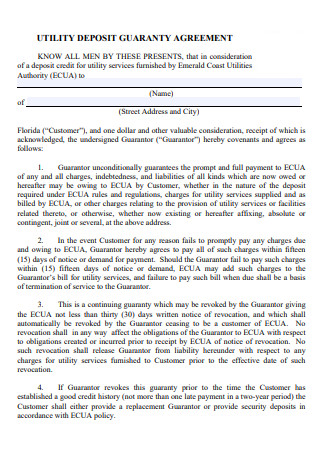

Utility Deposit Guaranty Agreement

download now -

Standard Guaranty Agreement

download now -

Guaranty Agreement Example

download now -

Indemnity and Guaranty Agreement

download now -

Performance Guaranty Agreement

download now -

Printable Guaranty Agreement

download now -

Purchase Money Note Guaranty Agreement

download now -

Loan Fund Guaranty Agreement

download now -

Parental Guaranty Agreement

download now -

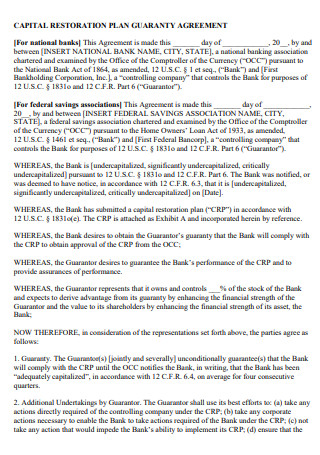

Capital Restoration Plan Guaranty Agreement

download now -

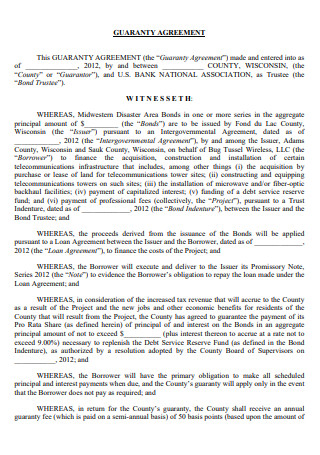

Sample Guaranty Agreement

download now -

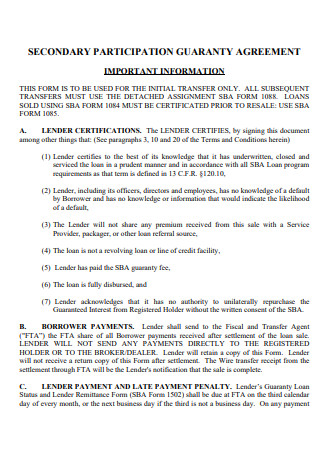

Secondary Participation Guaranty Agreement

download now -

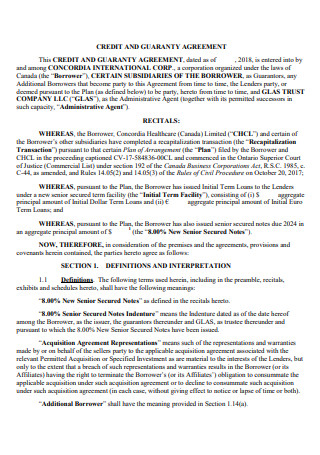

Credit and Guaranty Agreement

download now -

Simple Guaranty Agreement

download now -

Unconditional Guaranty Agreement

download now -

Dealer Registration Guaranty Agreement

download now -

Student Housing Guaranty Agreement

download now -

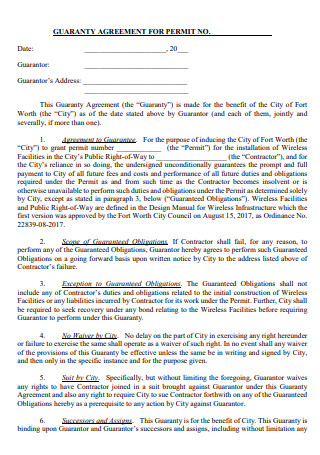

Guaranty Agreement Format

download now -

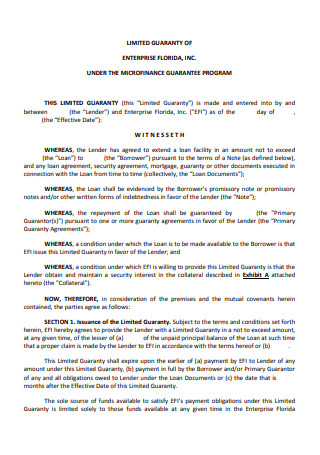

Limited Guaranty Agreement

download now -

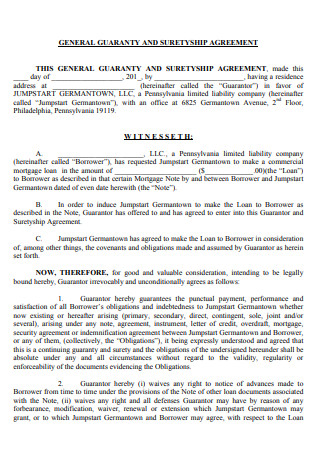

General Guaranty and Suretyship Agreement

download now -

Draft Guaranty Agreement

download now -

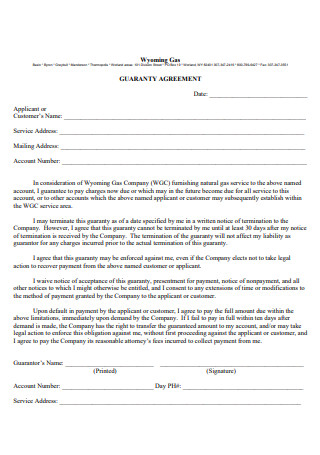

Gas Company Guaranty Agreement

download now -

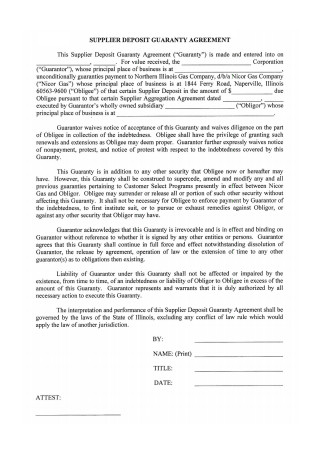

Supplier Deposit Guaranty Agreement

download now -

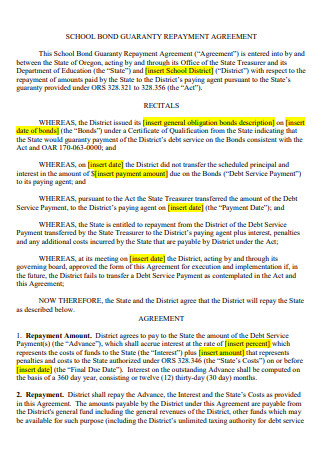

School Bond Guaranty Repayment Agreement

download now -

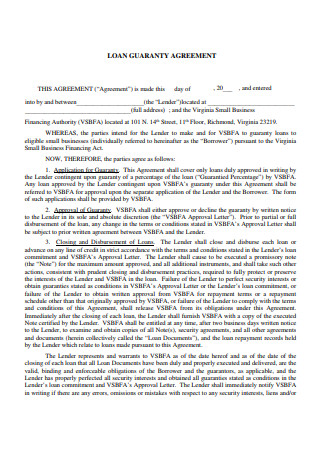

Loan Guaranty Agreement

download now -

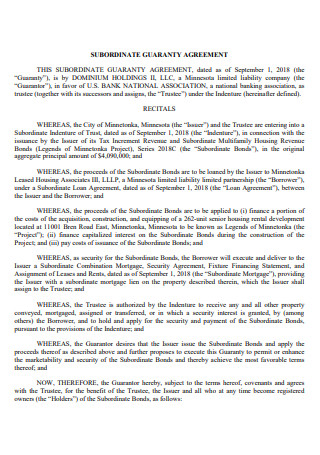

Sub Ordinate Guaranty Agreement

download now -

Guaranty Agreement in DOC

download now -

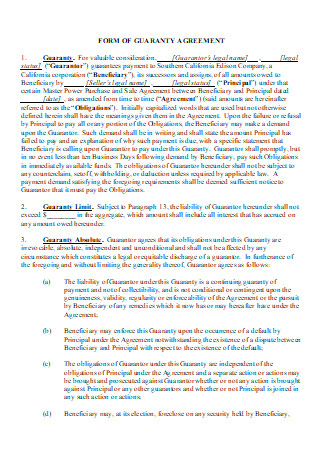

Form of Guaranty Agreement

download now -

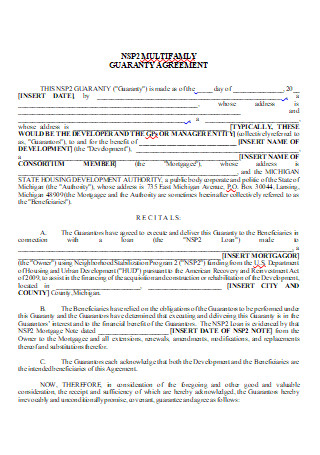

Multi Family Guaranty Agreement

download now

What is a Guaranty Agreement?

A Guaranty Agreement is an agreement through which someone else guarantees loans or debts of an individual. In other words, when a person takes out the loan or debt defaults or does not pay, the guarantor party agrees to pay the amount being owed. The Guaranty Agreement is signed by just one party only which is the Guarantor but the agreement is concluded between the three parties: the creditor, which extends the credit, the debtor who owes money and the guarantor, who agrees to pay the amount if the debtor fails to. This type of agreement is most commonly used in loans for college tuition where the government would agree to be the guarantor. The parties involved in this situation are the creditor which is the bank who provides the money for tuition, the guarantor which is the government, and the debtor which is the student. If the time comes and the student fails to pay the loan, the government will pay the loan for the student as a guarantor.

Types of Guaranty

Even though there are several types of guaranty agreements, it all boils down into one purpose – to safeguard the lender against unpaid or unsolved debts and loans. Here are the many forms of guarantee agreements, which differ depending on their usage.

Steps in Making a Guaranty Agreement

Whether what type of guaranty agreement you are looking for, this article has got your back. You can choose from continuing guaranty agreement, commercial guaranty agreement, personal guaranty agreement form, loan guaranty agreement, guaranty agreement real estate, mortgage guaranty agreement or more from the many guaranty agreement samples above. You can also make your own guaranty agreement template by following the steps below.

Step 1: Title of the Agreement

The name for the document, which is the Guaranty Agreement, should be at the top of the page, ideally in the middle. To emphasize the title, the font must be bigger than the rest. This is so that the readers know what the document is all about.

Step 2: Introductory Paragraph

Introduce the agreement in a short paragraph to tell the reader what the next paragraphs are all about. The effective date and duration of the contract might be included. It can also include the names of the companies involved and the essential locations of the pacts; just the guarantee agreement style you want is to be determined.

Step 3: Introduce the creditor, debtor, and guarantor.

The parties’ names may be placed in the opening paragraph or in a separate short paragraph, in accordance with your chosen formatting. The creditor, the debtor and the guarantor are listed here. The creditor or the lender is the party that lends money to the other party, like a big financial institution like a bank. Debtors are individuals or businesses who owe money, be they banks or other persons. Debtors are frequently called borrowers if the money is due to a financial institution or a banking institution. Guarantors are people or institutions who commit themselves to reimburse debt if the debtor or borrower does not pay in due time.

Step 4: Body of the Agreement

Here, you enumerate all the important details you want to happen. This includes clauses that describes that the guarantor guaranties to provide sufficient funds to assure the payment of covered service contract claims, and all other liabilities, guarantor guaranties the payment of covered service contract benefits and any extensions, modifications or innovations thereof, the guaranty is continuous and not cancellable without certain days notice to the health maintenance organization and the written approval of the court. It also includes a clause that states any modification of the agreement is subject to the prior approval of the court. Just make sure that the clauses included are designed to protect the lender. In this part, there are several clauses you must include but that depends on what your needs are, as a lender. This part is very complex and it should be.

Step 5 : Guarantor’s details

In this agreement the guarantor is the only party that is required to sign. Other authorized people can sign too but the most needed sign is that of the guarantor’s because this entire agreement is for the guarantor. Naturally, the parties involved should submit signatures, like any other legal documents or contracts, to ensure that they have read, understood and approved all the conditions contained in the contract and to maintain the terms of the agreement.

FAQs

Does a guaranty agreement need to be notarized?

No, the only party require to sign a guaranty agreement is the guarantor but anyone who isn’t a guarantee party should witness the paper and sign it. Most countries require the execution of the promise by a notary public witness. Some countries nevertheless allow a person to bear witness to the guarantee provided they do not benefit in any manner from the loan or guarantees.

Who are the involved parties to a guaranty agreement?

Different types of guaranties are used depending on their purpose but there are usually 3 main parties involved in a guaranty. These are the creditor, the debtor and the guarantor. The creditor or a lender is the one that lets the other party borrow money like a large financial organization such as a bank. Debtors, be they banks, or other persons, are individuals or companies which owe money. Debtors are often referred to as borrowers when the funds are owed to a financial institution or a bank. Guarantors are individuals who pledge to repay the debt if the debtor or borrower fails to do so.

Are guaranty agreement and insurance the same?

They are not the same because between insurance and guarantees there are several main distinctions. The insurance is a direct agreement between the insurance provider and the policyholder, whereas a guarantee comprises an indirect agreement between an insurance beneficiary and a third party and the main and beneficiary’s primary agreement.

Like any other legal contract, a guaranty agreement allows parties to cooperate better and legally binds them from their responsibilities. Make sure that everybody understands and acts on what is mentioned there. Simply put, ensuring that a quality guaranty agreement is executed to secure the protection of the lender. A clear and written guarantee agreement, regardless of the length of time it will take, demonstrates clearly what the parties, whether they be a person or a company, what the plans are and what their positions are.