3+ Sample House Purchase Agreement

FREE House Purchase Agreement s to Download

3+ Sample House Purchase Agreement

What is a House Purchase Agreement?

Other Types of Real Estate Agreements

How to Write a House Purchase Agreement

Understanding The Components Of a House Purchase Agreement

FAQs

Can I cancel a house purchase agreement?

What does a legal description of the property mean?

What is a house purchase agreement?

What does real estate fixtures mean?

What is a House Purchase Agreement?

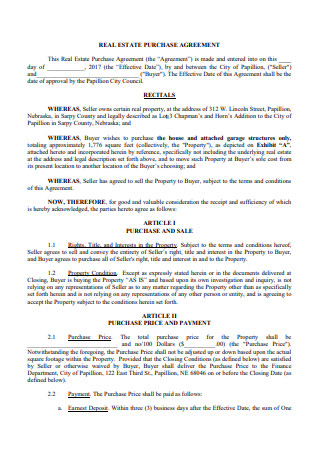

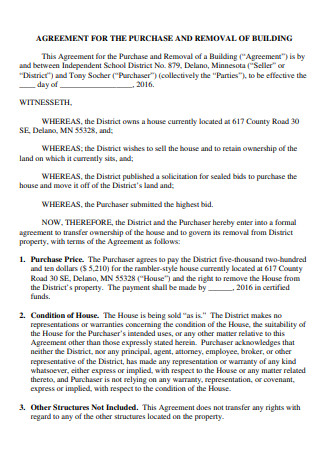

The Home Purchase Contract is a contract or contract form that will be used when your home is ready to be sold to an interested buyer and want to describe the conditions or if you wish to buy a property, and you want to set the seller’s parameters.

In real estate, a purchase agreement is a contractual agreement between a buyer and seller that describes a house selling transaction. The purchaser proposes the contract conditions, including their offer price, that are accepted, rejected or negotiated by the seller. Negotiations between buyer and seller might go back and forth until either party is satisfied. Once the two parties have agreed and signed the deal, they are deemed under contract.

The agreements for house purchases might vary significantly from nation to country. Accords are sometimes quite short and are just used to start the negotiation process. In other situations, a purchase agreement might be a full legally enforced contract.

Other Types of Real Estate Agreements

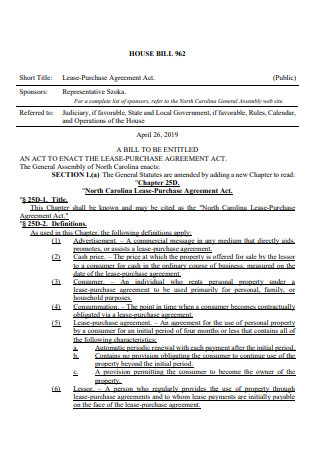

Aside from a Home Purchase Agreement, there are also other agreements used in transacting with real estate. Here are some from the list.

How to Write a House Purchase Agreement

There are several house purchase agreement samples provided above that you can download. If you want to tailor your own, you can follow the steps below. In making this, however, you can make the samples above as reference for your tailored house purchase agreement format.

Step 1: Name the parties involved

Details from both the buyer and seller such as the names of the parties and the contact information must be included in the agreement. The information contains full names, residences, and whether the individuals concerned are people, married couples, a firm or a trust as this will impact how the document is transferred.

Step 2: State the legal description of the property

The property’s address not only includes the legal description of the land. The legal description generally comprises meters, limits and is manufactured by a competent inspector or a certified inspector. Further elements may include the condition of the property and equipment and services for sale.

Step 3: Purchasing price and terms

The price accepted by the seller and the ways to be given should be clearly mentioned in the buying agreement. Common alternatives include full cash payment, cash down payment with a new loan, or current mortgage arrangements. This information can be provided in the purchase contract or in an additional funding which clearly illustrates the scenario for payment and loans paid by the purchaser.

Step 4: Financing

Your purchase agreement provides specifics on how the property is to be paid for. If the buyer does not pay in cash, it needs some type of financial support, an example would be a loan to buy the home stated in the contract.

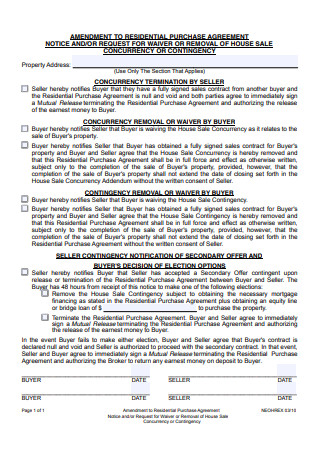

Step 5: Contingencies

Before selling a property, the agreement must be subject to certain requirements that must be met. It is important to understand all contingencies in the purchasing agreement, because many additional conditions can also be placed on both buyers’ and sellers’ websites in real estate contracts. Before the sale may occur, the conditions must be satisfied. Some of the conditions in domestic sales contracts most commonly reported are below.

Step 6: Mineral Rights

Mineral rights encompass legal rights to minerals below property surface, including coal, oil, gas, metals and more, although the rights to air and water are not typically covered by mineral rights. The mineral property may be governmental in the country or may be owned by property depending on where you are in the world. In the US, the owner of the property initially possesses minerals.

Step 7: Title

A kind of insurance covering the loss of value in the property as a result of future findings of flaws in the title. The buyer or seller will usually be provided with the insurance on behalf of the buyer.

Step 8: State the condition of the property

Another important piece of information is whether or if the property requires repairs. This includes any building, foundation, wall, support structure, roof, water and electrical systems, fueling or mechanical systems which have or are disruptive, either structural or mechanical. Unless the buyer decides otherwise, the vendor is required to fix these products. However, the buyer can always fail to fulfill the seller’s repair duty.

Step 9: Closing and possession dates

When the property is officially transferred, the buyer obtains ownership of the property. All contracts have been finished, money has been given, documents have been endorsed and replaced and title is transferred to the customer. The title company generally records the deed in the Land Recorder county office and, when completed, tells all parties.

Step 10: Earnest Money Deposit

Paying Earnest Money deposit is a typical practice when you are expressing your desire of buying an asset, which is high in value. This is why token payment is a widespread practice in real estate deals worldwide. Simply put, a deposit of Earnest Money is the sum paid by a buyer to demonstrate its sincere interest in such an estate. The money is typically given after an offer is verbally accepted. Also known as a binder, money token or deposit in good faith, the deposit is Earnest Money. One percent of the value of the property as a token is payable by a buyer. The buyer and the seller both have a duty to pay the token money

Step 11: Important Signatures

In the presence of notary public or two witnesses, the Parties will simply sign and date the Agreement for its implementation. In many areas, only one notary is a witness. The signing of mortgage agreements is always a matter of responsibility for two witnesses in Connecticut, Florida, Louisiana and South Carolina. These countries also allow a notary to subscribe to one of their witnesses.

You can also download our free house purchase agreement examples above.

Understanding The Components Of a House Purchase Agreement

While many elements of your contract are quite straightforward, like how much you spend and when it closes, some sections of the purchase agreement, especially for first time home purchasers may be very puzzling. Make sure you understand everything fully before signing the purchasing agreement. Some instances of the complex sections and their explanation are given below.

Contingencies

Contingencies are requirements that must be fulfilled in advance of sales. Some of the most frequent contingencies may be found in domestic sales contracts. There are many different types of contingencies which may be included in both the buyer and the seller’s real estate contracts; therefore it is vital to understand any contingencies contained in your house purchase agreement.

- Home sale contingency: One sort of provision often included in an agreement to buy real estate is a domestic sales contingency. The deal depends on the sale of the buyer’s home with a house-sale contingency. If at the stated date, the home of the buyer sells, the agreement shall proceed. The home purchase is contingent on the buyer’s ability to sell their current home.

- Financing contingency: A finance contingency is a condition in a property purchase and sale agreement which states that your offer will require funding for the house to be secured. A buyer often utilizes this clause to provide a certain time frame for applying for a loan and/or closing the transaction. Sale is contingent on the buyer being able to obtain financing. Protects the buyer in the case they are unable to secure a mortgage.

- Appraisal Contingency: An appraisal contingency also provides a buyer the chance of withdrawing from the contract but only if a specific amount of finance cannot be secured on conditions which are acceptable to the buyer. If a property fails to evaluate for a specific amount, a homebuyer has the ability to withdraw from the deal. States that the home must appraise at a value equal to or higher than what the buyer agreed to pay.

- Inspection contingency: A contingency for home inspection is a condition included to an immovable agreement in an offer to purchase a house. If an agreement to purchase is subject to the findings of the inspection, a buyer might cancel the transaction or try to negotiate reparations, on the basis of the inspection. Home inspection contingencies, based on local traditions and state legislation, are handled in various ways around the United States. Home inspection contingencies are included in the buying agreement in most states. In certain circumstances, before a purchase contract is signed, house inspections are carried out. Buyer is able to back out of the sale without penalty if they aren’t satisfied with a professional inspector’s assessment of the home.

Financing

The information on how to pay for the house in your house purchase agreement is included. If the buyer does not pay in cash, they will require a financing method like a loan to purchase the property, which is laid forth in the contract.

The contract should indicate, for example, whether the buyer obtains a mortgage for a property or uses a substitute, such as the assumption of the present property mortgage or sellers’ financing in cases where the buyer pays the seller instead of a traditional mortgage lender.

Earnest Money Deposit

Earnest money, also called a good faith deposit occasionally, indicates that a purchaser’s purchase is serious. Sellers don’t want to squander their time; they want to know that the deal is closed by a purchaser. They are confident about the earnest money deposit.

If the buyer decides to back out for a cause not mentioned in the contract between the date of signature of the purchase agreement and the closing of the property, he loses his earned money and the seller gets to pocket it. However, if a buyer is returned because of a contract-specific issue, he can obtain his earnest money back.

Earnest money is usually kept in check by a third party and is reimbursed at closing for down payment or closing expenses.

Closing Costs

Closing costs are fees incurred by purchasers and sellers for the completion of a house purchase transaction, in addition to the price of the property. These expenses may include loan costs, discounts, assessment fees, searches for titles, securities insurance, surveys, taxes, registration fee for deeds and credit reports.

At closing, some fees and charges must be paid. How much each side pays depends on what has been discussed. Closing fees may include agency commission, inspection and assessment fees, tax, loan and insurance charges.

Closing fees may be 3% – 6% of buying price for purchasers. For sellers, the cost of closing may be a little more.

FAQs

Can I cancel a house purchase agreement?

No. In order to begin, an agreement is legally binding and must be fulfilled by everybody who has signed the agreement. Any seller with a change of heart after the agreement cannot simply reverse it, as it might result in legal proceedings and financial consequences. Cancelations may nonetheless be made if the agreement is not still signed, during the attorney’s review time, or if the buyer has not executed the contract properly.

What does a legal description of the property mean?

The legal description of a property defines the property’s exact location but is not the same as the street address as an address may change sometimes. This is available through the Country Record office and also includes information on a title, mortgage contract and tax assessment. The legal description should immediately identify real estate and be expressed in a legal description by specific limitations instead of natural markers.

What is a house purchase agreement?

In real estate, a purchase agreement is a contractual agreement between a buyer and seller that describes a house selling transaction. The purchaser proposes the contract conditions, including their offer price, that are accepted, rejected or negotiated by the seller. Negotiations between buyer and seller might go back and forth until either party is satisfied. Once the two parties have agreed and signed the deal, they are deemed under contract.

What does real estate fixtures mean?

Real estate fixtures are items connected to land or property in a manner that cannot be removed unless the object, the ground or the property is damaged. For example, built-in devices and enclosures, light fits and wall-to-wall tapestries. Many real estate brokers would recommend that sellers remove futures or equipment that is inappropriate and, if necessary, replace it. If the buyer wants to be sure that they are included in the sale of a property that he buys, he can negotiate for things and include them into the sales contract.

It’s still important to understand the legal and contractual aspects of your home sale or purchase even if you aren’t a legal expert. Buying or selling a house is a huge business, and by ensuring that the agreement you get into is good, you may avoid difficulties in the future. Even though you are using a simple house purchase agreement form, it’s good as long as it serves it’s purpose very well so download sample of house purchase agreements now!