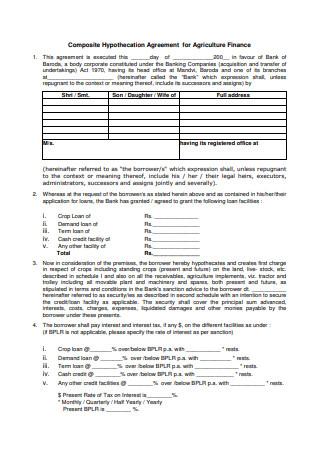

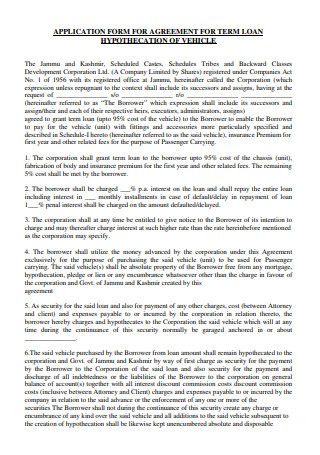

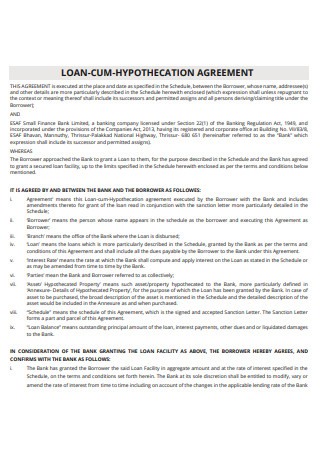

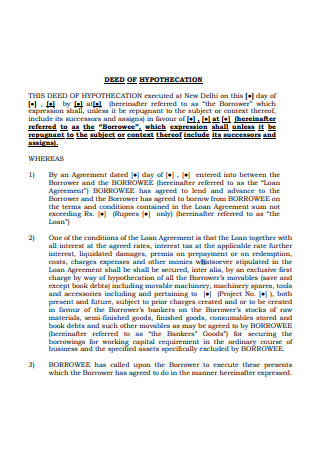

7+ Sample Hypothecation Agreement

FREE Hypothecation Agreement s to Download

What Is a Hypothecation Agreement?

A borrower agrees to put an asset up as collateral for a loan under a hypothecation agreement. It gives the lender the ability to seize the asset if the borrower fails to pay. The borrower, however, would maintain ownership. Nevertheless, seized property might be auctioned or held until the borrower clears the debt.

A hypothecation arrangement may be more advantageous than traditional loan contracts. This is because the higher the monetary worth of the collateral, the greater the likelihood of interest and down payment being decreased. Which could be critical in terms of staying out of debt. According to Experian, consumer debts reached $800 billion by 2020. During the epidemic, more Americans are in debt. As a result, it is important to consider where a debtor may have an advantage.

Collaterals in Hypothecation Agreement

Often, collateral must be worth % to 90 % of the loan’s value. That means that, depending on the size of the loan, not everything can be used as collateral. Before taking out a business loan or signing a personal loans agreement, it’s critical to understand the policies and procedures. The borrower will be at a disadvantage in the long run. Let’s look at some of the collaterals that could be included in a hypothecation agreement.

Real Estate Properties: A person with a broad list of real estate properties would have little trouble obtaining a loan. Typically, business startup costs necessitate a sizable budget. The borrower keeps ownership of their possessions when they use hypothecation. That is, anything gained from it will go directly to its owner. In addition, establishing a collateral with a bigger monetary worth may help lower the interest rate when taking out a loan. In the event of higher-valued properties, the lender would feel more secure knowing that something of equivalent worth is the collateral. Buildings, factories, warehouses, and even the land being purchased are examples of real estate properties. If the bank seizes the property owing to nonpayment, the owner still could reclaim it. That is, however, before the property is auctioned off for sale. After all, the bank must recoup its losses by selling seized properties. Cars: Since a car is a movable asset, it can be used as collateral in a hypothecation agreement. The finest part about a hypothecation arrangement is that the borrower retains ownership. However, the bank has the power to confiscate the property until the debt is paid in full. Vehicles are excellent collateral assets. But one must consider the significance of a car in their daily lives. If a borrower cannot manage without it, they should reconsider putting it up as collateral. Even though it is still owned by the borrower, the bank has the right to keep it when it is seized. The borrower could no longer utilize it till their debt was paid off. In this fast-paced environment, cars are critical for mobility. Putting it as a collateral presents a risk that should be carefully considered. Accounts Receivable: Accounts receivable are commonly used as collateral by businesses. This is since it is a current asset reported on the balance sheet, with payment expected within a year. And that payment is made by customers who have used the company’s services or products. And they still haven’t paid. So, it’s a sum that has yet to be received but is expected to be received. Accounts receivable are the next best thing if the company does not have any other assets to utilize as collateral. Current sales are money that has yet to be collected in an annual report. In some ways, the money is guaranteed, and it is supposed to arrive within a year. However, this can be problematic for the lender. Unlike real estate and other movable assets, it is a current sale rather than “current” money. And the two are vastly different. Primary Residence: A primary residence is a type of real estate. But, just to emphasize its significance, we’ll include it individually. To put it simply, the primary house being purchased also serves as collateral. However, unlike a mortgage, hypothecation ensures that the owner retains ownership. It is not always the case while applying for a loan. There is a possibility that the lender will take title to the debtor’s property under a mortgage. The borrower is severely disadvantaged because of this. However, using the primary residence as collateral should be a last resort. If the debt is not paid, it may force someone to be homeless. Debt snowball is more likely with unsecured loans, but it can still occur. When that happens, not only is the property seized, but there is also an outstanding amount that must be settled. But the good news is that after the debt is paid off, the borrower will be able to reclaim their property. And the ownership remains protected.

Benefits of Hypothecation Agreement

If the borrower is able to enter into a hypothecation arrangement, they should. This is since ownership of their properties would remain in their names rather than the lender’s. Consider the worst-case situation, which is that things do not proceed as planned. Furthermore, the loan may not be paid. Taking this into account, the collateral would be taken. Still not convinced. Let’s go over the advantages of a hypothecation agreement in greater detail.

Retains Ownership: A loan hypothecation agreement safeguards both the bank and the borrower. In other circumstances, confiscated collateral may imply that ownership has been transferred to a lender. Which is a huge drawback with rental properties. Any income generated after the transfer of ownership would be paid straight to the lender. In contrast to hypothecation, where ownership is retained, any earnings may still flow directly to the owner. Although the former may result in a faster resolution of the debt, it may leave the owner with no personal allowance. However, in the worst-case scenario, a person would prefer to settle the obligation without having to worry about ownership. They would not only pay off the debt, but they would also collect something in return. This is not necessarily the case with other types of loans. Can Help Reduce Interest and Down Payment: We are all aware that when it comes to loans, the most important guideline is to choose the lowest interest rate and pay it back in the shortest length of time. That way, interest won’t eat up all your money. I mean, there’s a household budget worksheet that needs to be balanced. And interest can eat up a large portion of your bills and budget. However, not everyone has the luxury of making large down payments. Neither is it a wise financial decision in some situations. Since that would necessitate a large sum of money. Another option is to enter into a hypothecation agreement and place collateral. When an asset has a larger monetary value, it is easier to negotiate a lower down payment. After all, the lender can see that the collateral provides about the same value as the loan. Thus, it would be less of a disaster for them. Guarantees of this type can provide borrowers with some leeway. There is some room for flexibility. It’s prudent to take advantage of this. Isn’t it better to take use of a borrower’s available privilege if there’s an asset to fall back on? Although it is uncommon, lowering interest rates can be quite beneficial, particularly with large loans. The longer a loan is outstanding, a person may find oneself paying the same amount as the original loan plus interest. Offers Greater Security: For lenders, hypothecation is synonymous with security. That means that they may be able to recuperate money if their borrower defaults. With this type of collateral, a lender may be more willing to make loans. Protection works both ways. It shields both parties from any consequences of the borrower’s inability to pay. When lending money, lenders are also taking a tremendous risk. They frequently manage multiple accounts at the same time. It ultimately comes down to cycling the funds to the next borrower. And if a significant sum is deducted from their account, they are vulnerable. That is, it is more dangerous. And what happens if the borrowers fail to make their payments? They, too, must scramble to pay their losses. At worst, it might put a halt to their operations because money is no longer flowing back and forth between clients. It’s only natural for them to be rigorous with their policies. For example, they may only make a loan if there is proof of funds. Lenders expect a guarantee, and their services are not cheap. Availability: An asset could move a borrower to the front of the queue for a loan. It implies that approvals may be simple rather than complicated. As a result, obtaining a loan is nearly effortless. That’s fantastic news for everyone in a hurry. It aids in the avoiding delays and other complications such as additional paperwork or waiting time. Taking out a loan can be beneficial at times. Asset liquidation may take longer. Or there isn’t any cash on hand at present. What is the solution? Obtaining a loan via a hypothecation agreement. Not only will you get the financing faster, but you won’t have to give up ownership of your property. However, this is highly unfair because the persons who require these loans are often those who cannot provide collateral. However, lenders must weigh their risks. When it comes to keeping money safe, it’s an understandable conclusion.

Steps on How to Make a Hypothecation Agreement

A hypothecation agreement is a legally binding document that ties a borrower’s asset as collateral and security for the lender. Making a hypothecation agreement necessitates a little more detail regarding the mutual obligations of all parties concerned.

-

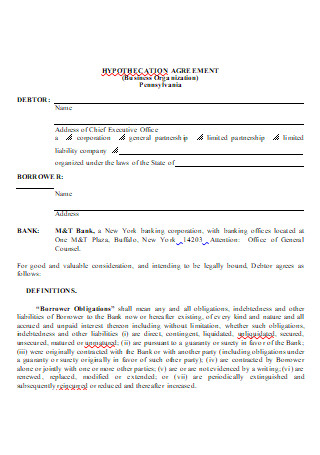

Step 1. Borrower and Lender Information

In any hypothecation, the information of the borrower and lender is a given. If it is a business agreement, then business-related information should be included. It contains the company name as well as contact information such as a phone number or an email address. This might include a quick description of the lender, as well as their complete address and contact information.

-

Step 2. Definitions

Definitions are usually given in the initial section of any agreement. It means that any specific words used in the agreement are described briefly. This enables the borrower to comprehend jargons and terminology that may require further clarification. Terms such as “term basis” or “uncommitted basis” could be included in these definitions. These are terms that the average person would not be familiar with. As a result, it must be included in the agreement to avoid confusion.

-

Step 3. Amount and Purpose of the Loan

The loan amount is an important consideration in the arrangement. It should be mentioned explicitly to the centavo degree. There could also be a brief description of the loan’s purpose. As well as the repayment mechanism agreed upon by both parties. These include interest charges, payment deadlines, and late fees. This section should also include any consequences for failure to pay the exact amount due for each repayment. Also, address the issue of prepayment as well as total payoff, as well as the necessary notice to the lender.

-

Step 4. Collaterals and Movable Assets

There are clarifications on the handling of collaterals. This should also make it clear that collaterals must be kept in excellent shape, and that the borrower is responsible for doing so. Or that the borrower should have ownership and title to the asset. It should also be stated that this particular asset is the agreed-upon collateral for this loan. Furthermore, the lender should have the first exclusive charge on the property.

-

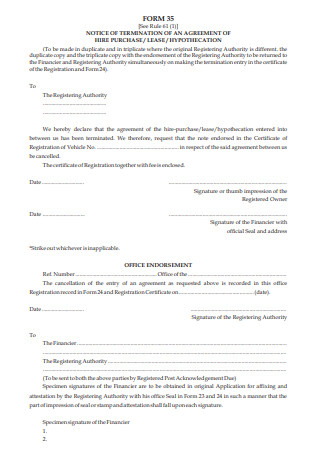

Step 5. Hypothecation

There must be a policy in place that specifies when the collateral will be seized and the measures that will be taken as a result. For example, there should be a provision stating what would happen if the debtor is unable to pay off the debt before it is auctioned. The lender’s ability to grant borrowers time, as well as the status of ownership, should be indicated.

FAQS

Is Making a Hypothecation Agreement Necessary?

Making a hypothecation agreement is an optional step in the loan process. Instead of hypothecating a property, one could choose to mortgage it. After all, the borrower may be obliged to meet specific criteria before entering into a hypothecation agreement. Matching the monetary value of the collateral to the loan is practically a condition. That is, of course, the bank’s security. However, most people may find this difficult. As a result, collaterals might be added to secured loans, but not as part of a hypothecation. Unsecured loans do not require collateral; hence it is not demanded.

Is Hypothecation Better Than Mortgage?

In some circumstances, hypothecation is preferable for the borrower. It is completely free and extremely adaptable. It can also help to reduce interest rates and down payment costs. Most importantly, when property is taken, the debtor retains possession of the ownership.

What Happens When a Collateral is Seized?

When a borrower defaults, collateral is confiscated as payment. That is true whether a hypothecation is in place. So long as the borrower has a contract in place to put an asset up as security. When the property is seized, the lender’s ownership may be transferred. It might potentially be auctioned off to pay off the debt, which includes taxes. If a person can pay off their debt before the lender sells the property, they may be able to reclaim it.

Borrowers have the option of signing a hypothecation agreement. Given that they can meet the lenders’ criteria and have assets to use as collateral. Create one right away by downloading the hypothecation agreement template!