50+ Sample Indemnification Agreements

-

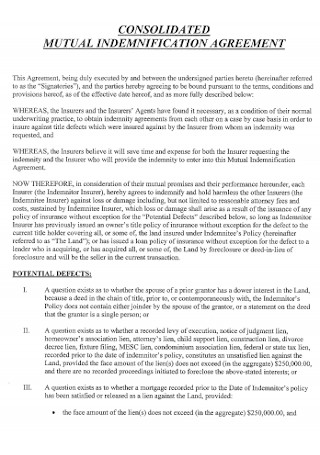

Mutual Indemnification Agreement

download now -

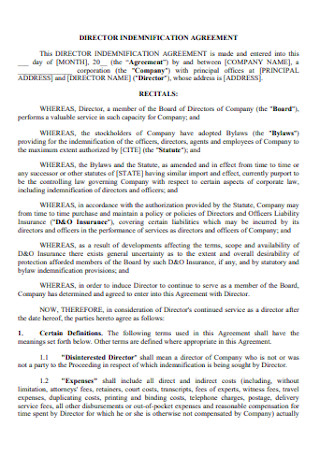

Director Indemnification Agreement

download now -

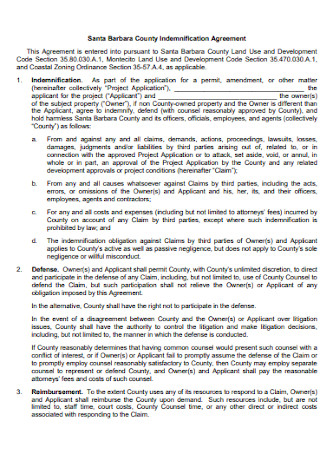

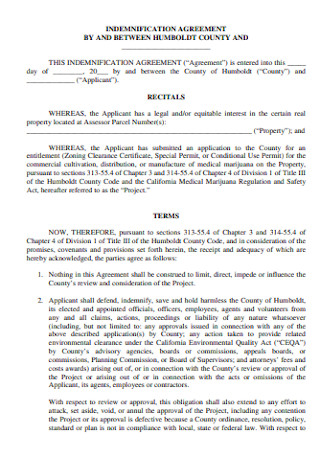

County Indemnification Agreement

download now -

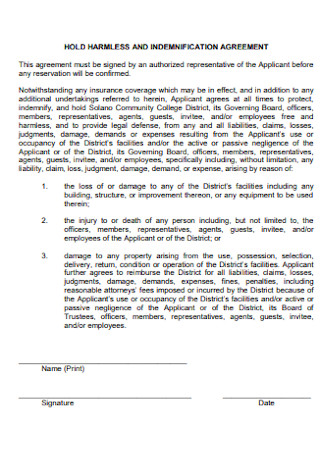

Hold Harmless Indemnification Agreement

download now -

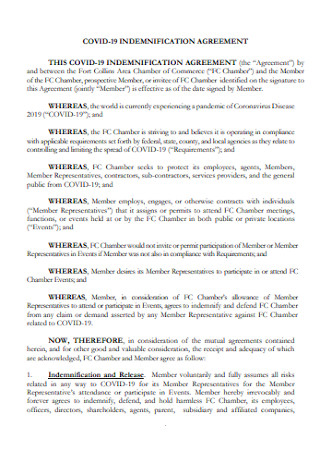

Covid 19 Indemnification Agreement

download now -

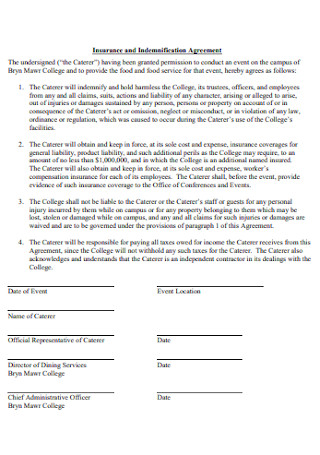

Insurance and Indemnification Agreement

download now -

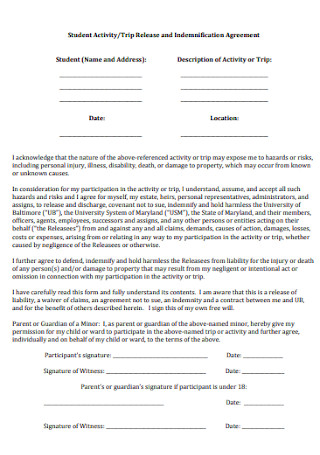

Trip Release and Indemnification Agreement

download now -

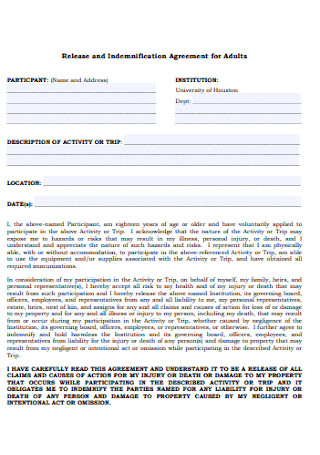

Indemnification Agreement for Adults

download now -

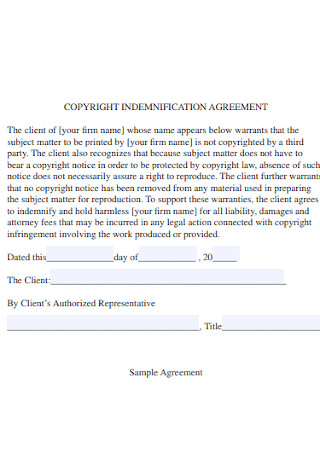

Copyright Indemnification Agreement

download now -

University Release and Indemnification Agreement

download now -

Personal Indemnification Agreements

download now -

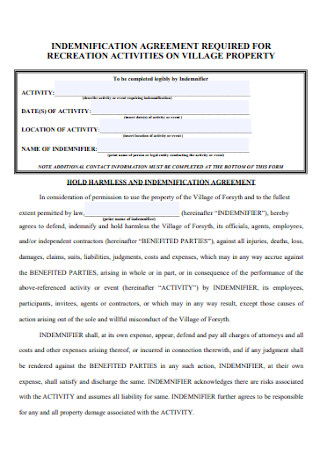

Indemnification Agreement for Village Property

download now -

Indemnification Agreement Format

download now -

Sample Indemnification Agreement

download now -

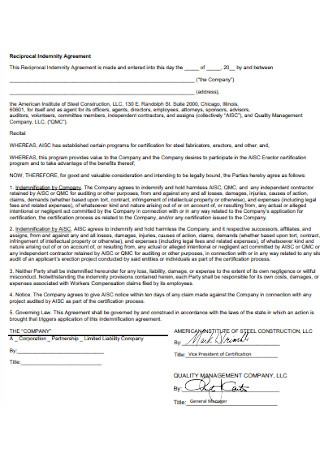

Reciprocal Indemnity Agreement

download now -

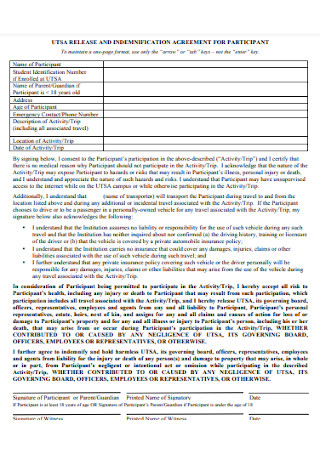

Indemnification Agreement for Participant

download now -

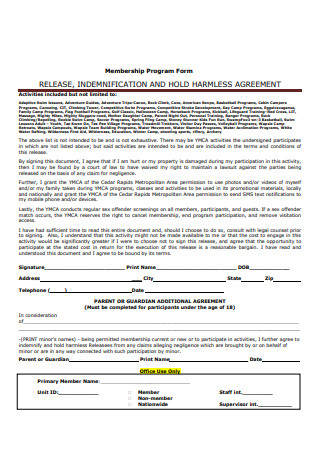

Indemnification and Hold Harmless Agreement

download now -

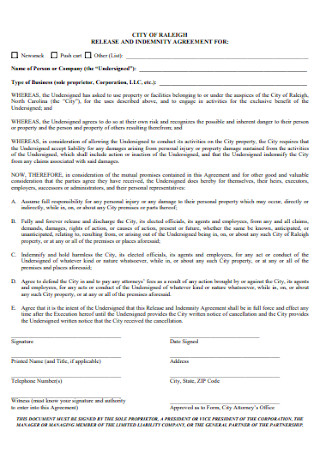

City Indemnification Agreement

download now -

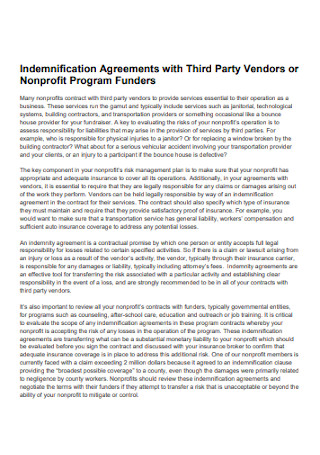

Indemnification Agreements with Third Party Vendors

download now -

Subcontractor Insurance and Indemnity Agreement

download now -

General Indemnification Agreement

download now -

Indemnification Agreement for Minor Account

download now -

Simple Indemnification Agreement

download now -

Oil Pollution Indemnification Agreement

download now -

Assumption of Risk and Indemnity Agreement

download now -

Confidentiality Indemnification Agreement

download now -

Lead Paint Indemnification Agreement

download now -

Seller Indemnity Agreement

download now -

Corporation Indemnification Agreement

download now -

Food Waiver and Indemnification Agreement

download now -

Latent Defect Indemnification Agreement

download now -

Indemnification Agreements for Trading Floor Access

download now -

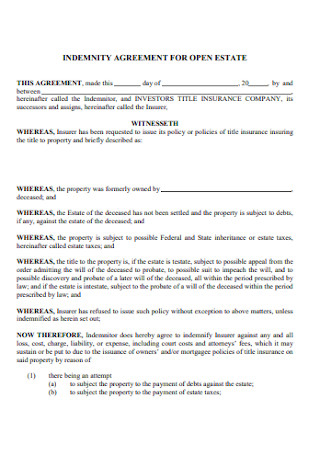

Indemnification Agreement for Open Estate

download now -

Defense and Indemnification Agreement

download now -

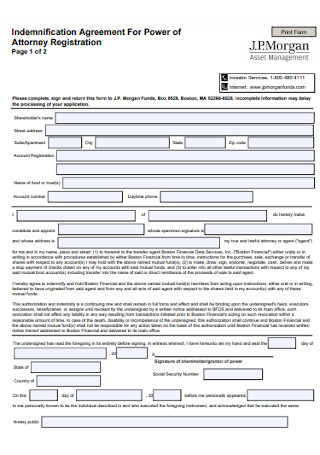

Indemnification Agreement For Power of Attorney

download now -

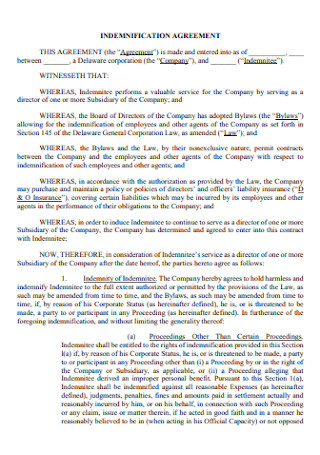

Standard Indemnification Agreement

download now -

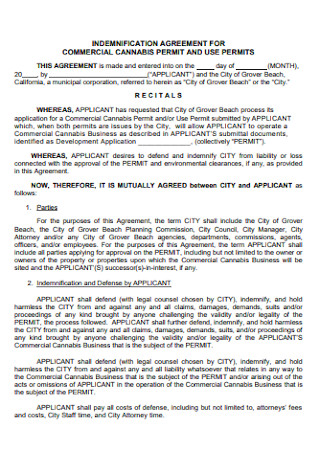

Indemnification Agreement for Commercial

download now -

Donation and Indemnification Agreement

download now -

Power of Attorney and Indemnification Agreement

download now -

Liability Indemnification Agreement

download now -

Acknowledgment and Indemnification Agreement

download now -

Indemnification Agreements and the Anti-Deficiency

download now -

Event Indemnification Agreement

download now -

Pet Release Indemnification Agreement

download now -

Environmental Indemnification Agreement

download now -

Indemnification Agreement with Private Vehicle

download now -

Filming Indemnification Agreement

download now -

Office Indemnification Agreement

download now -

Indemnification Agreement for Medicinal

download now -

Third Revised Indemnification Agreement

download now

FREE Indemnification Agreement s to Download

50+ Sample Indemnification Agreements

Indemnification Agreements: What Are They?

The Basic Parts of an Indemnification Agreement

How to Create an Indemnification Agreement

FAQs

What is the difference between the indemnitee and the indemnifier?

What are other terms for indemnification agreements?

When was indemnification invented?

Indemnification Agreements: What Are They?

An indemnification agreement, aka hold harmless or indemnity agreement, refers to the official agreement between parties to settle the compensation for any risk, loss, or damage. The agreement may either make a party exempted from damage liability or prepare security or insurance in compensating damages. And indemnification is played out in many legal forms out there to prevent conflicts.

From 2009–2019, more than half of the warranty and indemnity insurance in the UK were caused mostly by tax breaches.

The Basic Parts of an Indemnification Agreement

You already know what indemnification means, but what exactly does this agreement consist of? Even though organizations and businesses create different content for an indemnification agreement, there are also common parts involved. And the basic parts of such agreements are the following:

How to Create an Indemnification Agreement

Protection and security go hand in hand with an indemnification agreement. But, of course, you have to make an excellent agreement to put the indemnification into effect. And you only need to follow these steps to craft the indemnification agreement thoroughly:

Step 1: Analyze and Review Your Business

First things first, how well do you know your business? You can’t just guess what possible damages, losses, or detrimental effects could happen in your organization. The key is to consider a business impact analysis and SWOT analysis. They would help you identify the possible harm attributed to your business, whether it is related to construction, service, employee agreement, or even personal purposes. For example, Statista confirmed that more than half of the warranty and indemnity insurance in the UK were mostly done by tax breaches. Hence, it is smart to compensate primarily for tax breaches there.

Step 2: Use a Sample Indemnification Agreement

Have you tried using the sample indemnification agreements above already? Take time to test them out until you can pick your most preferred template to work on. With the given templates, you are free to customize, download, and print your agreement anytime. Also, the samples made promise professional standards just in case you need a guide on what an acceptable agreement looks like.

Step 3: Insert the Important Elements

You already know the parts of an indemnification agreement. So be sure to add them one by one into your document. Down from the parties involved down to the signatures, ensure you write the correct information. Also, you can add more clauses and sections to be more specific. What matters most is your message is clear so it won’t be misconstrued.

Step 4: Work on the Finishing Details

Slowly finish your work by ensuring you have no mistakes with your words, you organized the details promptly, and that you finalized the agreement’s format. More so, think about how and where to submit the agreement. Most importantly, don’t forget to inform the parties involved ahead about the indemnification so they would actually agree to the conditions. Or perhaps, they want certain changes before they actually sign the form.

FAQs

What is the difference between the indemnitee and the indemnifier?

The indemnitee refers to anyone protected from liabilities. Meanwhile, the indemnifier would be the one promising to reimburse indemnitees for particular claims.

What are other terms for indemnification agreements?

Indemnification agreements may be referred to as indemnity agreements, hold harmless agreements, no-fault agreements, waiver of liability, or release of liability.

When was indemnification invented?

Indemnification is not entirely new because it has been practiced among individuals, companies, and government entities for years. A common account is tracked back in 1825 where Haiti paid France for the independence debt. That payment was meant to manage the losses which the owners of the French plantation suffered from as they lost the property and the slaves. Albeit it is an unfair type of indemnity, it is still a known history of how indemnification began.

Bear in mind that an indemnification agreement is not simply about being greedy by excusing yourself from liabilities and ensuring you are compensated for just about anything. Many factors are to be considered as well. Hence, take time to really analyze and review your statements and details. Otherwise, you could end up making unethical and unreasonable agreements. Thankfully, you can always base the sample indemnification agreements on the correct ways of making one. Download now!