19+ Sample Installment Payment Agreements

-

Sample Installment Payment Agreement

download now -

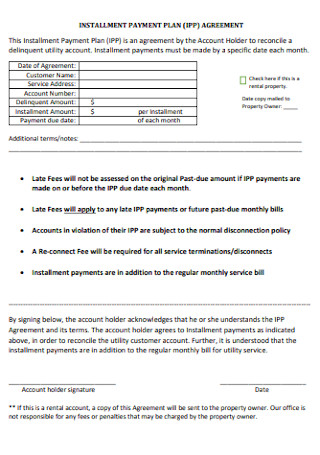

Installment Payment Plan Agreement

download now -

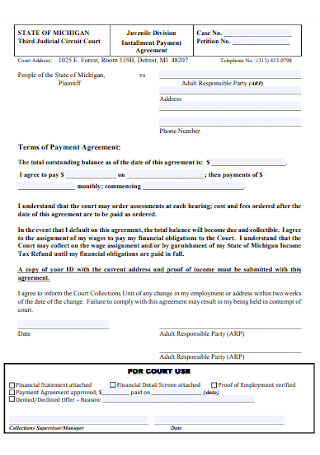

Standard Installment Payment Agreement

download now -

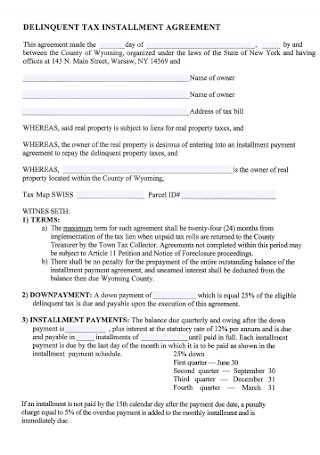

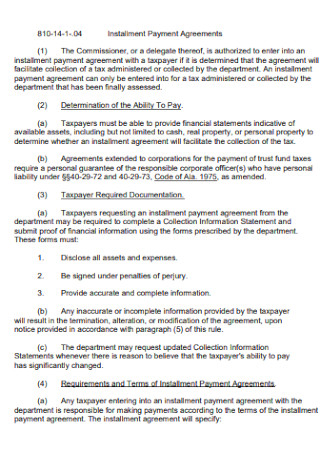

Delinquent Tax Installment Payment Agreement

download now -

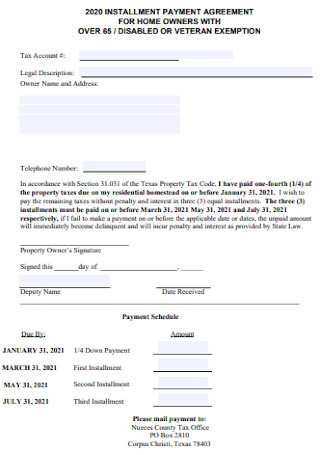

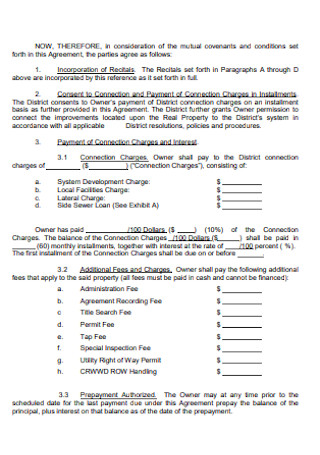

Installment Payment Agreement for Home Owners

download now -

Printable Installment Payment Agreement

download now -

Payment Installment Plan Agreement

download now -

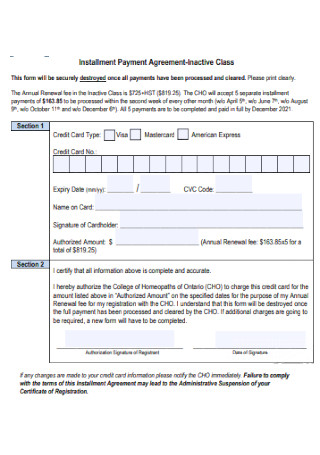

Academic Installment Payment Agreement

download now -

Simple Installment Payment Agreement

download now -

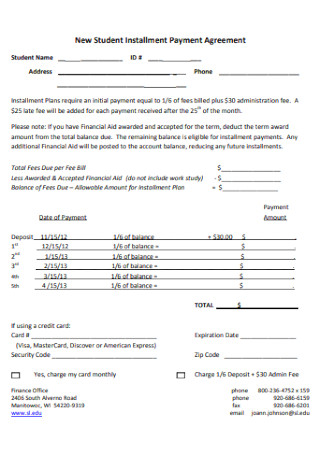

New Student Installment Payment Agreement

download now -

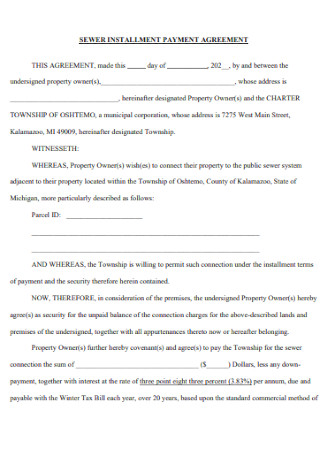

Sewer Installment Payment Agreement

download now -

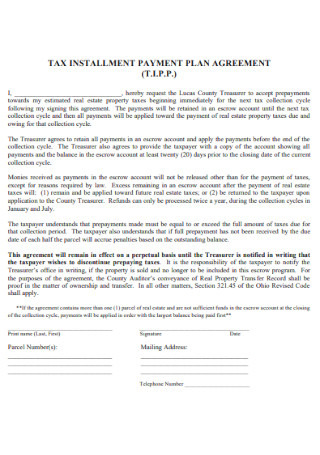

Tax Installment Payment Agreement

download now -

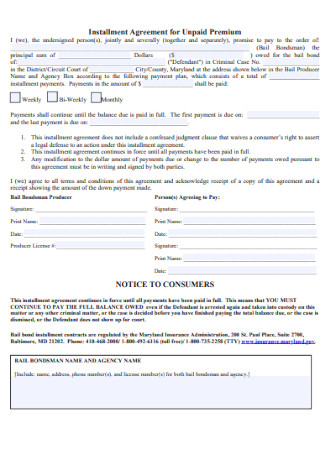

Installment Agreement for Unpaid Premium

download now -

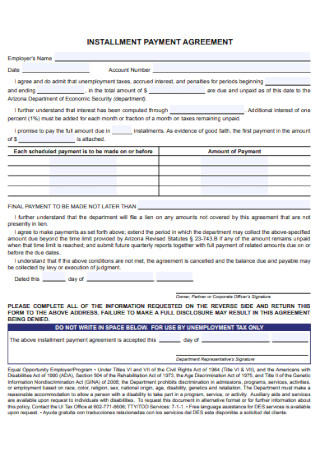

Basic Installment Payment Agreement

download now -

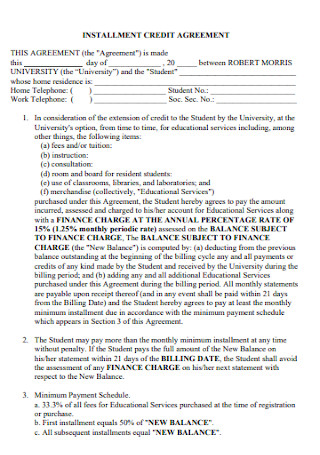

Installment Credit Payment Agreement

download now -

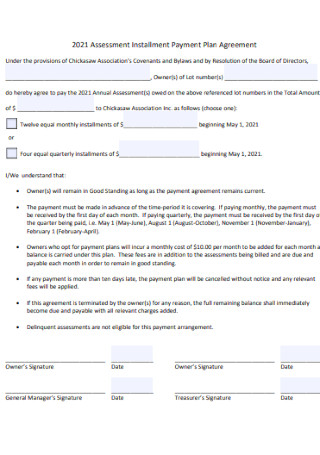

Assessment Installment Payment Plan Agreement

download now -

Installment Payment Agreement Format

download now -

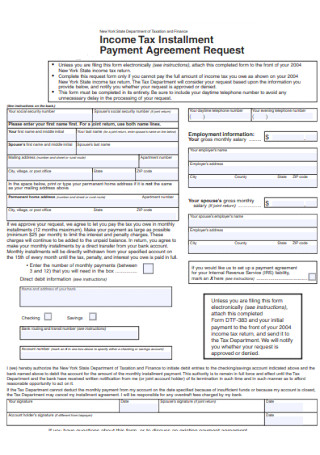

Income Tax Installment Payment Agreement

download now -

Installment Payment Plan Agreement

download now -

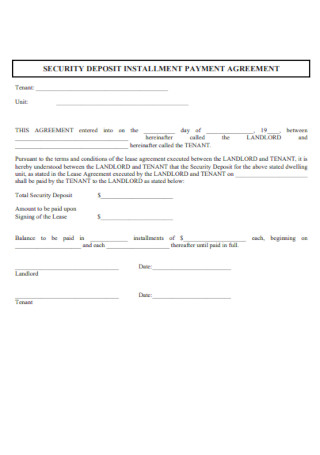

Deposit Installment Payment Agreement

download now

FREE Installment Payment Agreement s to Download

19+ Sample Installment Payment Agreements

What Is an Installment Payment?

Benefits of Installment Payment

Types of Installments

How to Get Out of Debt

FAQs

Are installment payments a good idea?

Is it better to pay in installments or with a full credit card?

Is it good to have installments?

What Is an Installment Payment?

In an installment payment, customers pay for a single purchase of services in installments, as agreed upon by the vendor and buyer. This payment agreement is comparable to a reoccurring payment plan in that the buyer can pay in many installments. However, this differs from how the purchaser receives the product or service. With a recurring payment plan, the seller receives payment consistently. A monthly Netflix membership and tuition payments for college students are examples of this payment method. Also, installation payment plans allow the buyer to obtain the item immediately after signing the payment contract. Auto loans are a prime example of a payment plan with installments. This payment increases the company’s sales by allowing customers to purchase products like household appliances without exceeding their budgets. According to a PYMNTS poll, 60% of consumers across generations choose to buy now and pay later over credit cards due to the convenience of set payments.

Benefits of Installment Payment

Installment loans are adaptable and can be modified to meet the borrower’s unique needs in terms of loan amount and the repayment period. These loans enable the borrower to receive funding at a significantly cheaper interest rate than is typically available with revolving credit, such as credit cards. This allows the borrower to retain more funds in other areas rather than incurring a large cash payment. A downside of longer-term loans is that the borrower may have to make payments on a fixed-interest loan with a higher interest rate than the current market rate. The borrower may be able to refinance the loan at the reduced rate of interest currently in effect. The other major drawback of an installment loan is the borrower’s long-term financial commitment. At some point, the borrower may be unable to make the regular payments, risking default and the possible loss of any collateral used to secure the loan.

Types of Installments

When you take an installment loan, you instantly receive the borrowed funds or the purchased item. In regularly scheduled installments, the debt is repaid, sometimes with interest. Typically, you owe the same amount for a predetermined number of weeks, months, or years. Once the loan has been repaid, the account is permanently closed. There are various installment loans, and both secured and unsecured options exist. This refers to whether you are required to provide an asset, or “collateral,” that could be used to repay the loan if you cannot. The interest rate, repayment duration, fees, and penalties for each loan may vary. Regardless of what you’re looking for, it is prudent to shop around. Here are some of the most prevalent installment loan types:

How to Get Out of Debt

Getting out of debt is difficult. Sometimes it takes everything you have to pay your monthly payments and save for an emergency. However, if you merely make minimal payments to your creditors, you risk becoming mired in debt, and it could take you several months or years to climb out. Fortunately, numerous debt relief options will not make you miserable. You can change your budget to free up funds to pay more than the monthly minimum on your bills or refinance your accounts with a debt joining loan or balance transfer credit card. Adopting the debt snowball method or utilizing financial windfalls can reduce debt faster. Alternatively, you can settle your debts for less than what you owe as a final resort. The optimal method for you depends on your specific circumstances and financial objectives. If you’re ready to get out of debt, follow the steps below.

1. Make payments over the minimum required

Examine your budget and determine how much additional money you can spend on your debt. More than the minimum payment will save you money on interest and expedite your debt repayment. Paying more than the minimum allows you to reduce your credit card balances more quickly. Schedule the additional payment before the current cycle’s due date. Additionally, it can be added to the minimum monthly payment.

2. Try the debt snowball

If you’re paying more than the minimum, you can reduce your debt using the debt snowball method. This strategy requires you to make minimal payments on all of your bills, except the lowest loan, for which you will pay as much as possible. By “snowballing” payments toward your lowest debt, you can swiftly eliminate it and move on to the following slightest obligation while making minimum payments on the remainder. The debt snowball strategy might encourage you to focus on one responsibility at a time rather than numerous debts, allowing you to gain momentum and stay on track. If you have a payday loan or a title loan, you should exclude the debt snowball strategy from consideration. These loans typically carry substantially higher interest rates, typically between 300 and 400 percent APR, and should be repaid as quickly as feasible.

3. Refinance debt

Refinancing your debt to a lower interest rate can keep you hundreds of dollars in interest costs and accelerate your debt repayment. You can refinance mortgages, auto loans, personal loans, and school loans. A debt consolidation loan, a personal loan with potentially lower interest rates than your previous loans, is one approach to accomplish this. If you have credit card debt, consider moving the balance to a transfer credit card. These cards provide a 0% APR for a specific time, typically between six and eighteen months. Refinancing can give you a cheaper interest rate, a predictable monthly payment, and a fixed loan term, allowing you to reach your goal more quickly. Determine the finest debt consolidation solution through research. You should obtain pre-approved for the most significant rate to consolidate your debts. If you choose a debt transfer card, make sure you can pay the bill fully before the promotional period expires.

4. Commit windfalls to debt

When you receive a tax refund or stimulus check, use the funds for your loans instead of storing them or spending them on yourself. You can invest the complete windfall or divide it 50/50 between debt and something enjoyable, such as a luxurious dinner or upcoming vacation. Other unexpected windfalls, such as inheritances, bonuses at work, and cash gifts, can also be used to pay off debts more quickly. Remember that every little dollar counts toward your debt-repayment objectives. Utilizing financial windfalls helps develop momentum for debt repayment. Determine how you will allocate the funds and instantly apply the amount to your debt levels to resist the urge to overspend.

5. Settle for less than you owe

You may also contact your creditors and negotiate a settlement of your debts, typically for a substantial discount. While it is feasible to handle this on your own, a variety of third-party firms also offer fee-based debt settlement services. Although paying less than you owe and fleeing past obligations may appear prudent, the Federal Trade Commission warns that risks are involved. Some debt settlement businesses require you to stop making payments while negotiating better conditions, which can negatively impact your credit score. You will pay a percentage of what you owe and can go on knowing you owe nothing to those creditors. If your creditors accept your settlement proposals, put the conditions in writing. Alternatively, you might employ a professional debt settlement organization to handle the legwork.

6. Re-examine your budget

Two ways to pay off debts faster: increase your income or reduce your expenses. Obtaining part-time work or side business may be challenging, but you can change your budget. Examine each line item in your budget and arrange them according to their priority level. Classify each line item as a need or a luxury, emphasizing costs that can be lowered or eliminated. Make the appropriate adjustments to your budget, and utilize the extra funds to make additional monthly payments on your debts.

FAQs

Are installment payments a good idea?

If you can afford to spend your purchase in full, financing the item and incurring interest and monthly fees is generally unnecessary. Although credit card installment plans may offer lower rates, you should still anticipate a somewhat high cost of borrowing.

Is it better to pay in installments or with a full credit card?

It would help if you planned to pay your monthly credit card bill. This means that no interest will be charged. If you do not pay off your balance in full, you will typically be charged interest on the remaining sum.

Is it good to have installments?

Installment loans may be a game-changer, particularly if you require flexible repayment terms. I enjoy installment loans because you may borrow a large sum of money and repay it in tiny amounts. In these challenging economic times, you will eventually require some cash.

Most suppliers permit interest-free installment payments. This allows you to make purchases at no additional cost without the pressure of needing the total money at once. Depending on the terms and conditions of your installment plan, you can easily divide the debt into weekly or monthly installments. Ultimately, installment purchasing might be a fantastic method of financing for meeting necessities without negatively impacting your financial standing. It enables individuals to manage their finances better and enhance their credit standing.