19+ SAMPLE Intercompany Agreement

-

Intercompany Agreement

download now -

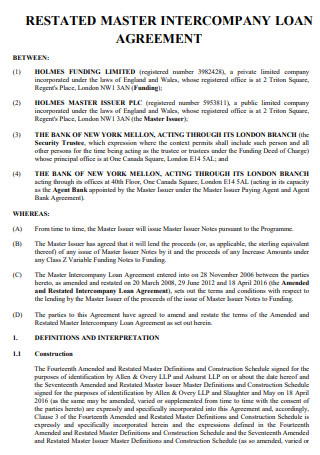

Intercompany Loan Agreement

download now -

Intercompany Confidentiality Agreement

download now -

Second Amending Intercompany Loan Agreement

download now -

Intercompany Claims Agreement

download now -

Restated Intercompany Agreement

download now -

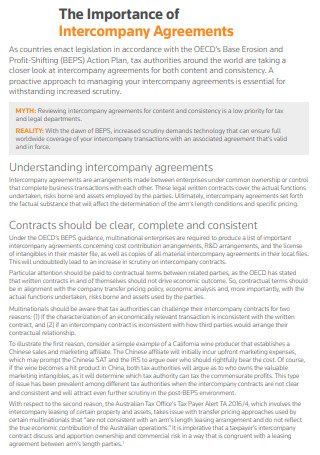

Importance of Intercompany Agreement

download now -

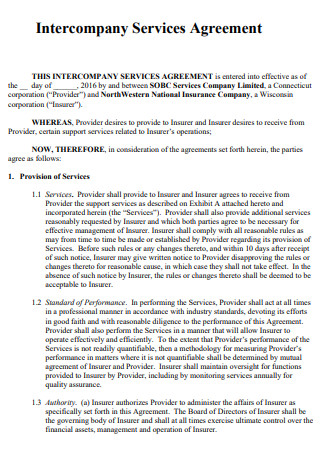

Intercompany Services Agreement

download now -

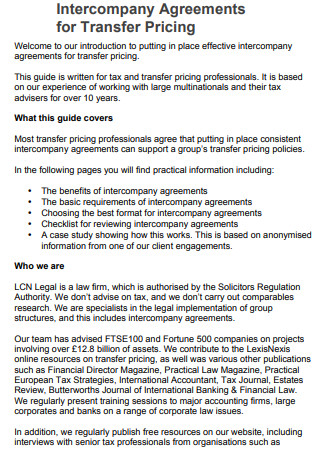

Intercompany Agreement for Transfer Pricing

download now -

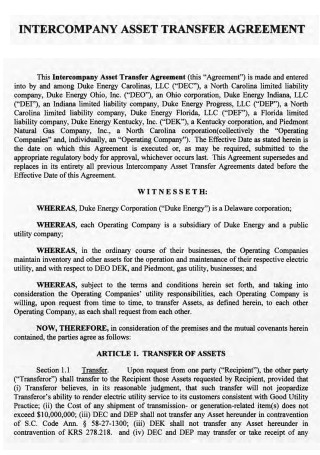

Intercompany Asset Transfer Agreement

download now -

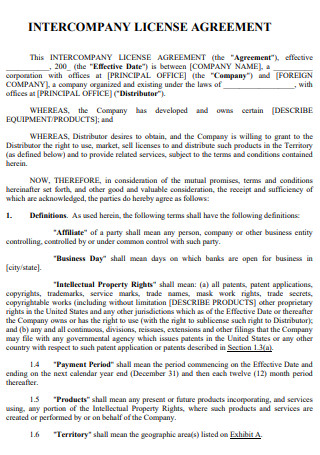

Intercompany License Agreement

download now -

Sample Intercompany Service Agreement

download now -

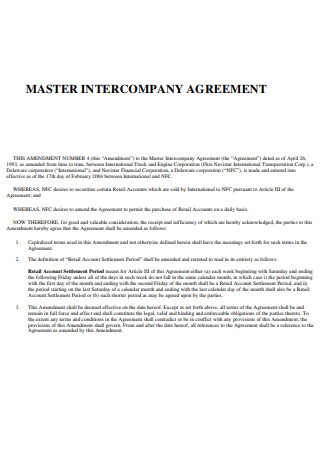

Master Intercompany Agreement

download now -

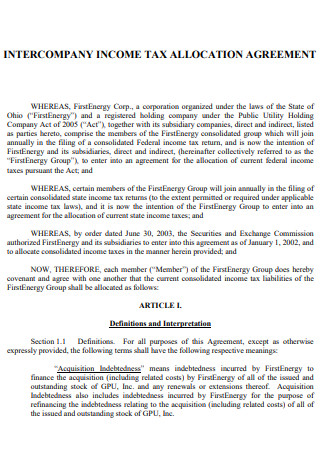

Intercompany Income Tax Allocation Agreement

download now -

Intercompany Agreement Example

download now -

Intercompany Transfer Pricing Agreement

download now -

Intercompany Transactions Advisory Agreement

download now -

First Amending Intercompany Agreement

download now -

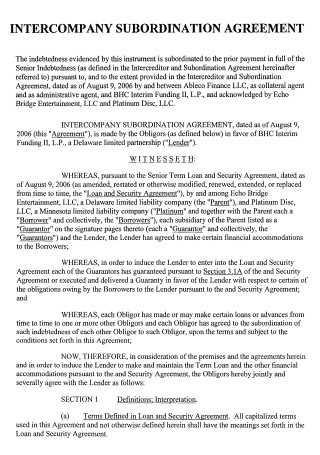

Intercompany Subordination Agreement

download now -

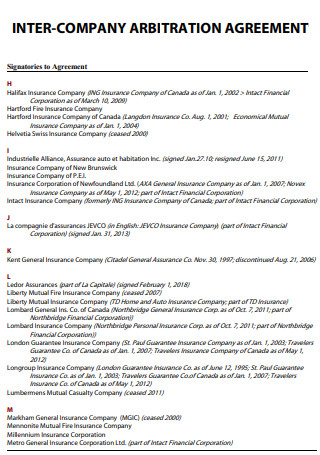

Intercompany Arbitration Agreement

download now

FREE Intercompany Agreement s to Download

19+ SAMPLE Intercompany Agreement

What Is an Intercompany Agreement?

Why Is Intercompany Agreement Important?

How Is an Intercompany Agreement Regulated?

What Are the Benefits of an Intercompany Agreement?

What Are the Ways in Mastering Intricate Intercompany Eliminations?

What Principles Should be Followed When Preparing an Intercompany Agreement?

FAQs

What Is Intercompany Transfer Pricing?

Are Intercompany Sales Taxable?

What Kind of Account is Intercompany?

How Long Should Intercompany Agreements Be?

Creating an Intercompany Agreement would mean taking forward of this huge task needs a thorough understanding of the methods involved in intercompany transaction elimination, reconciliation, and settlement as they are usually done within many multinational organizations.

What Is an Intercompany Agreement?

An Intercompany Agreement or ICA is usually a commercial agreement for services, the sale of goods, financing or intangible property made between companies related through ownership, under common control or part of the same group of companies. Companies have many reasons, including operational, strategical IP, tax and legal, to enter into ICAs.

For instance, a holding company may hold shares in subsidiaries but not conduct active business operations or have active employees. The holding company may therefore enter into an ICA with another company in the same group for administrative services. Moreover, Intercompany agreements describe and details the legal terminology on which financial support, products, and services are offered within a group. ICAs can blanket a wide range of situations, including back and head office services, cost and revenue sharing, intellectual property licenses, etc. It has also been recognized that intercompany agreements are a basic part of Transfer Pricing compliance and with the utilization of the OECD’s (Organization for Economic Co-operation and Development), BEPS (Base Erosion and Profit Shifting) direction by an increasing amount of countries every year. This particular significance is getting monumental only for financial institutions and multinational enterprises.

Why Is Intercompany Agreement Important?

In practice, companies often ignore intercompany contractual obligations. Even when intercompany agreements are put in place, they are often badly drafted, out-of-date, and do not reflect the economic reality of controlled transactions. The absence of the standard or quality intercompany agreements can be a risk for a lot of reasons. These are the three most important ones: Transfer pricing documentation and transfer pricing policies lay down the correct transfer pricing arrangements. Hence, these are not legally binding. Intercompany agreements are therefore needed to implement and formalize the transfer pricing arrangements in a legally enforceable contract. At the same time, it provides evidence to internal and external stakeholders that transfer pricing arrangements have indisputably been implemented. Additionally, an increasing number of countries have laws that require taxpayers to document their transfer pricing arrangements in intercompany agreements. In addition, qualifying MNEs must disclose their intercompany agreements in a Master Files and Local Files. Furthermore, tax authorities normally request copies of intercompany agreements when doing a tax investigation or audit. An inability to provide them is considered a “red flag” and possibly fuels further scrutiny of the transfer pricing position. If you can show a clear, comprehensive and up-to-date agreement in line with reality, this tremendously helps in defending your transfer pricing positions.

How Is an Intercompany Agreement Regulated?

Related companies must follow specific rules and regulations, which will differ by jurisdiction, for their intercompany transactions. Unlike transactional agreements between unrelated parties, most countries’ taxing authorities will scrutinize Intercompany Agreements to make sure that all transaction terms under the agreement are similar to those between unrelated parties acting at arm’s length. Some form of the arm’s length standard or other transfer pricing method, is used in jurisdictions around the world with very few exceptions and will also apply to international ICAs.

Thus, Intercompany Agreements are regulated in each jurisdiction differently. In certain jurisdictions, these agreements must be in writing, lest governmental and taxing authorities will not recognize them and the companies will lose any benefits those jurisdictions provide to the related parties. In many jurisdictions, those authorities will scrutinize a related party relationship or transactions between related parties (such as, for example, in the U.S.A). ICAs are mostly regulated by a jurisdiction’s treasury or fiscal authorities but are also regulated by other agencies (consider the Federal Acquisition Regulations (“FAR”) and Defense FAR Supplement (“DFARS”) rules in the United States). Typically, if the parties’ conduct differs from the written terms of their ICA, the regulatory authorities will rely on the parties’ conduct, rather than the written document, to scrutinize the parties’ compliance with regulations or tax treatment.

What Are the Benefits of an Intercompany Agreement?

Without incurring negative tax results, corporations that have several divisions can benefit from intercompany agreements because they are able to transfer the goods and services to a place in the corporation that will benefit the most from it. Adding to this, by separating goods and service transfers brought about by intercompany agreements resulting from other transactions, they are able to help the corporation, and its businesses, more effectively interpret and analyze inventory and sales information. Furthermore, it is vital to utilize recitals to your benefit. Even though it is not part of the legal agreement, recitals are able to explain a taxpayer’s position in simple terms. For instance, if a distribution plan is known to be a limited risk, make it known in a recital. If certain aspects of history are useful for comprehending the intent of an agreement, make the history available in a recital.

Make certain that the intended subject matter of the arrangement is made clear by way of contractual language. For instance, if a taxpayer is attempting to establish a limited-risk arrangement, substantial supplies in the agreement should reduce or prevent a party’s risks, example: clarifying which merchandise poses certain risks, and which costs can be reimbursed. Just providing an adjusted, lower operating margin or utilizing a cost-plus pricing transfer method to get a limited-risk arrangement is highly unlikely, without giving more, for a benefit.

What Are the 3 Types of Intercompany Transaction?

There are three main types of intercompany transactions: downstream transactions, upstream transactions, and lateral transactions. It is essential to understand how each of these is recorded in the respective unit’s books, the impact of the transaction, and how to adjust the consolidated financials.

Generally, when determining how accountants must adjust the consolidated financial statements, it is essential to understand how intercompany transactions are recognized initially and their impact to the income statement and balance sheet. The adjustment process is extremely time-consuming and prone to human error, particularly if it involves a lot of spreadsheets.

What Are the Ways in Mastering Intricate Intercompany Eliminations?

The intercompany eliminations process entails removing any transactions between the entities within a company from the financial statements—in other words, eliminating the effects of intercompany transactions. Generally, there are three types of intercompany eliminations: elimination of intercompany revenue and expenses, elimination of intercompany stock ownership, and elimination of intercompany debt.

Intercompany revenues and expenses are transactions that involve the sale or cost of goods sold to affiliated companies as well as the interest expense to and from affiliated companies. The accounting staff eliminates these transactions because they represent the transfer of assets from one associated entity to another. The reason is clear: A company can’t recognize revenue from the sale of items to itself. Eliminating the related revenue, cost of goods sold, and profits results in no effect on the company’s consolidated net assets.

Elimination of intercompany stock ownership, on the other hand, eliminates the assets and shareholders’ equity accounts for the parent company’s ownership of the subsidiaries. For example, if a parent company has unrealized intercompany profit included in its retained earnings at a particular period end, the noncontrolling interest is misstated. The accounting staff must prepare an intercompany elimination to remove the intercompany profit that was included in retained earnings.

An elimination of intercompany debt is needed when the parent company makes a loan to a subsidiary and each party respectively possesses a note receivable and a note payable. When consolidating the two entities, the loan becomes nothing more than an exchange of cash. Consequently, staff must eliminate both the note receivable and the note payable.

What Principles Should be Followed When Preparing an Intercompany Agreement?

The following general principles should apply whenever intercompany agreements are created or updated—whether for transfer pricing, regulatory, or other commercial, or strategic purposes.

Step 1: Brevity

Every intercompany agreement should be as short as reasonably possible. Long and overly complex agreements are unlikely to be read and understood by all the relevant stakeholders. They are also less likely to match the way the group actually operates or is capable of operating in connection with intragroup supplies. This problem often occurs when groups use third-party commercial contracts as a starting point for intercompany agreements.

Step 2: Simple Language

As much as possible, intercompany agreements should be written in a simple language. This makes them easier to read, understand, and translate. Quoting statutes and regulations should be avoided if at all possible.

Step 3: Grouping Commercial Terms

The key commercial terms should be grouped in one place, rather than being allocated across definitions, schedules and appendices. Again, this allows readers to understand the effect of the agreement more quickly. Oftentimes, standard terms can be used across the full suite of a group’s ICAs – but not always.

Step 4: Consistency with Transfer Pricing Policies

This involves the pricing structure, the basis for allocating costs and risks across multiple service recipients, and (where appropriate) the exclusion of charges for shareholder services and costs, which do not directly benefit the relevant recipient entity.

Step 5: Consistency with Legal Relationships

Every intercompany agreement should be consistent with the legal relationships regarding the ownership and use of assets including intangibles—the flow of supplies and related contractual relationships with third parties, and the allocation of risk reflected in those relationships.

Step 6: Corporate Benefit

The directors of each participating group company should be able to properly approve the arrangements described. That means that they must promote the interests of that specific entity. This includes taking account of the relevant company’s financial resources and its ability to assume risk and satisfy its liabilities, including all contingent liabilities, on an ongoing basis.

Step 7: Legally Binding

Intercompany agreements should contain the elements necessary for them to be legally binding under all applicable laws. An exception is an ‘agreement’ between a parent company and its own branch or permanent establishment. As there is only one party, this will not constitute a legal agreement, but rather a memorandum of understanding of the applicable commercial terms, agreed to by the board of the parent and the managers of the branch.

Step 8: Briefing Notes for Directors

Directors of participating entities should be briefed on the reasons for putting in place the agreements and the likely implications of the proposed terms.

Step 9: Stakeholder Review

The proposed intercompany agreements should be reviewed by all relevant stakeholders. This is to ensure that the agreements reflect the needs of the group as a whole, as well as the reality of intragroup transactions and recharges.

FAQs

What Is Intercompany Transfer Pricing?

Transfer pricing refers to the pricing of transactions between enterprises under common ownership or control referred to as the related party or intercompany transactions. Intercompany transactions include tangible property, intangible property, services, and financing.

Are Intercompany Sales Taxable?

Intercompany items are taken into income to produce the same result on consolidated taxable income as if the seller and buyer were divisions of a single corporation in general.

What Kind of Account is Intercompany?

A due from account is an asset account in the general ledger used to track money owed to a company that is currently being held at another firm. It is typically used in conjunction with a due to account and is sometimes referred to as intercompany receivables.

How Long Should Intercompany Agreements Be?

This would depend on the type of transaction involved, the complexity of the arrangements, the applicable pricing methods, and the payment mechanics. Normally, intercompany agreements should be no more than 5-10 pages in length. Longer agreements may look impressive, but they are usually less robust, because they are less likely to be read and understood by key stakeholders, less likely to reflect the operations of the group and the relevant parties, and therefore less likely to be fit for purpose. The aim is always to document the key terms as simply as possible.

Companies customarily spend a lot of time and money on the analysis and documentation of their transfer pricing arrangements. But, the implementation of those arrangements is equally essential. Intercompany agreements are an integral part of that process. One advantage of intercompany agreements is that it helps keep the several financial statements and information of the two businesses separate. All transactions have individual services outlined so they do not clash with each other. In addition, these agreements are useful when there is more than one division in the parent company. Other details in the agreement include the date, the names of the entities, and what goods and services are being transferred. An intercompany agreement is also very useful for ending a contract that was formed between two businesses under the parent company.