9+ SAMPLE Investor Agreement

-

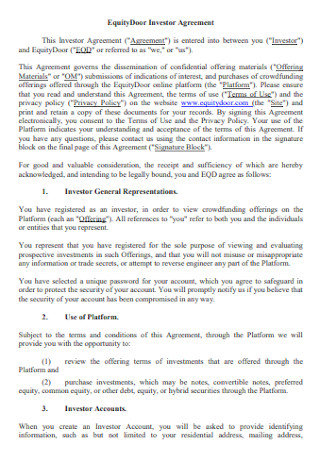

Equity Door Investor Agreement

download now -

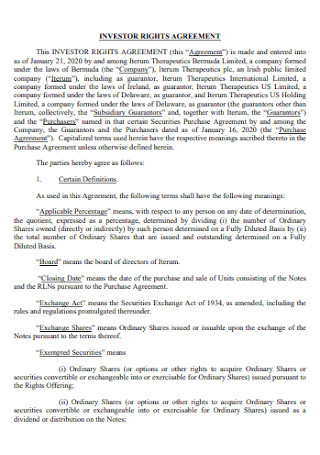

Investor Rights Agreement

download now -

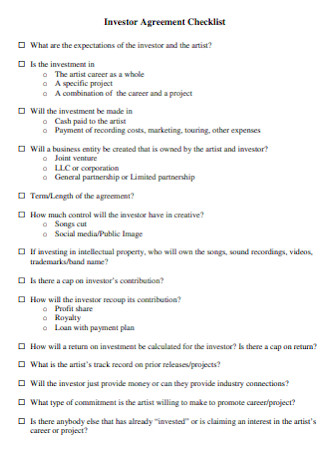

Investor Agreement Checklist

download now -

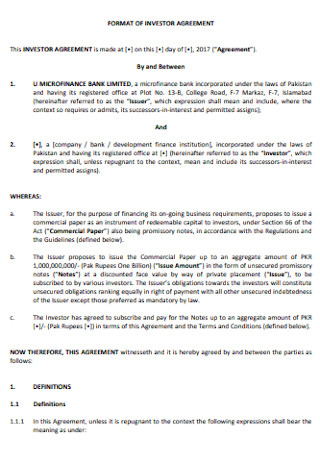

Investor Agreement Format

download now -

Investor Subscription Agreement

download now -

Investor and Rehab Agreement

download now -

Business Investor Agreement

download now -

Sample Investor Agreement

download now -

Harmony Investor Agreement

download now -

Simple Investor Agreement

download now

Investing is a practical way to put income to work to generate wealth in the future. It allows the money to outpace the possibility of inflation and increase its value. There are many reasons to consider investing money. In investing, there are higher investment returns, produce better retirement plans, better tax efficacy, beats inflation, helps in achieving the financial goals of an individual. When planning to engage in investing, it is critical to write an investor agreement. What is an investor agreement, and what is the benefit of having one? The article provides valuable information about the agreement, including its definition, components, and a step-by-step process of creating one. A section also answers frequently asked questions regarding the document.

What Is an Investor Agreement?

An investor agreement comes in many names, including investment agreements, investor contracts, or investment contracts. The document is a binding document between two parties where one party invests money intending to receive something in return. For businesses engaging in an investor agreement, it is a contract between a company along with its shareholders and an investor for an investment proposal in the company. The investor planning to invest in the company can be an existing shareholder of the company and can have an active shareholder’s agreement with the company during the pre-investment stages or an entirely new investor. An investor can also be a representative of a group of investors. The terms and conditions in the investor agreement depend on the type of allocation an organization demands from an investor. The nature of the funding arrangement also dictates the bargaining power of involved parties when negotiating the investor agreement.

According to the statistical data coming from Statista regarding the share of Americans investing money in the stock market from 1999 to 2021, about 56 percent of American adults have investments in the stock market. The numbers continue to rise at a steady pace starting from 52 percent back in 2016.

Components of an Investor Agreement

Similar to most legal documents, there is no one format for writing an investor agreement. Some terms and conditions apply to one arrangement between parties, while others have an entirely different arrangement. Nonetheless, most investor agreements have similar provisions or sections that must always be present to make it a legally binding and enforceable document. The section below covers the general provisions that an investor agreement must contain, including descriptions of each one, to create a comprehensive agreement between parties.

How To Write an Investor Agreement

When writing the investor agreement, make sure that the provisions, terms, and conditions show a clear representation of the interests of both parties. Keep in mind that the investor will want to ensure their protection, the organization wants to guarantee there is a smooth transaction when delivering funds and shares, and the founders secure their stakes in the joint venture. The section below provides a step-by-step process to create a comprehensive and enforceable agreement.

-

1. Indicate the Opening Recitals and Whereas Statements

The opening recital indicates the date of signing the agreement, including the names and addresses of the parties participating in the investment. Write the company name and business address, since the contact information will be in another section of the investor agreement. The whereas statement describes that the first party seeks to invest in the venture and that the second part provides the investment funds. The ‘therefore’ statement follows the whereas statement that says the parties agree to the provisions.

-

2. List All the Articles of the Agreement

The articles contain everything that the parties agree on and discuss that becomes part of the written investor agreement. Write the articles one at a time, with them appearing on the document in a numbered format. The sections of the agreement typically include the amount of investment, the investment plan, and the outcomes that the investor can expect in exchange for their contributions.

-

3. Incorporate the Payment Terms

Payment terms vary from one company to another, depending on the amount of investment that a company receives. In most cases, there is a lump sum payment, and the agreement must indicate the transfer amount, date received, and bank account details. If the investor chooses to make several payments, make sure to refer to attachments that contain information about the dates and other banking information.

-

4. Identify Deliverables Between the Parties

There are certain benchmarks that the parties must reach on a specific date or goods that companies must produce after performing company activities. List all the deliverables that the parties promise and their due dates.

-

5. Specify the Contract Terms and Termination Provisions

The contact term refers to the duration of the investor agreement. It details the length of time that the investor makes their contributions while receiving the return on investment or ROI. On the other hand, the termination identifies the procedures and situations for ending the contract.

-

6. Choice of Law, Contact Information, and Signatories

Since laws differ from one location to another, the investor agreement must indicate the area of jurisdiction that covers the contract. As mentioned earlier, the contact information lists the name, address, title, contact numbers, email address, and other necessary information about the parties. Finally, the signatories must sign the contract to make it legally binding. There must be a witness to notarize the signatures of the parties.

FAQs

How do investor agreements work?

Investor agreements are legal documents wherein one party invests money over a period or a full amount with the intent of receiving a return on the investment.

Can an LLC take investors?

A limited liability company or LLC can bring investors into the company or organization to raise funding.

What is a funding agreement?

A funding agreement is a business document between an investor and an issuer, wherein the investor provides a lump sum payment and the issuer guarantees there is a fixed ROI for a specific term.

When engaging in any investment activity, the investor agreement becomes a necessity. Through the document, both parties can establish a clear set of responsibilities and expectations from the joint venture. Companies need to encourage investors to partner with their companies. Investors are significant in the business sector, and companies must maintain a harmonious and transparent relationship with them. Ensure that an investor and a company have clear documentation of the arrangement through an investor agreement. Download an investor agreement for the organization by browsing through the 9+ SAMPLE Investor Agreements in PDF | MS Word only from Sample.net!