26+ SAMPLE Lending Agreement

-

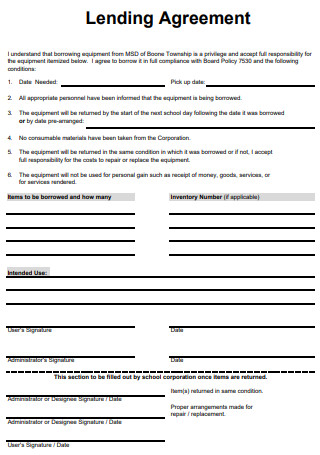

Lending Agreement

download now -

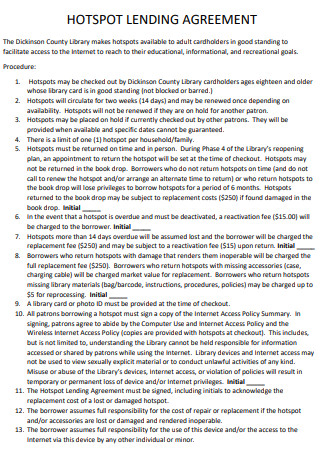

Hotspot Lending Agreement

download now -

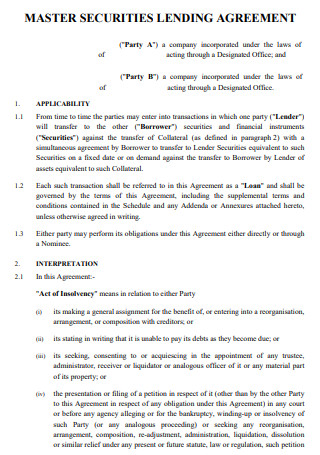

Master Securities Lending Agreement

download now -

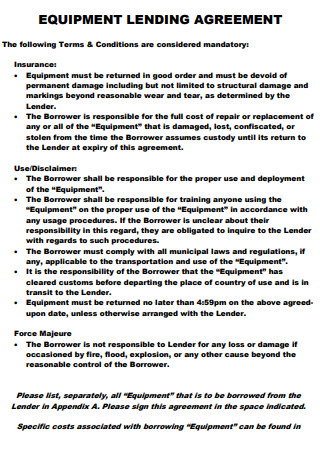

Equipment Lending Agreement

download now -

Securities Lending Agreement

download now -

Stock Lending Agreement

download now -

Cooperative Lending Agreement

download now -

Lending Program Client Agreement

download now -

Bike Lending User Agreement

download now -

Device Lending Agreement

download now -

Equipment Lending Policy and Agreement

download now -

Reciprocal Lending Agreement

download now -

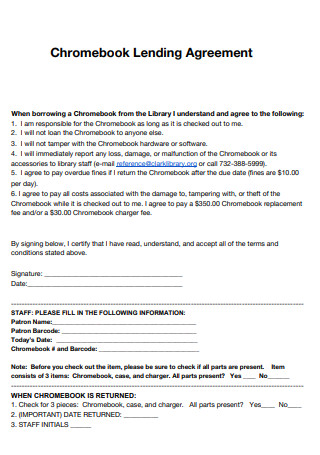

Chromebook Lending Agreement

download now -

Electronic Device Lending Agreement

download now -

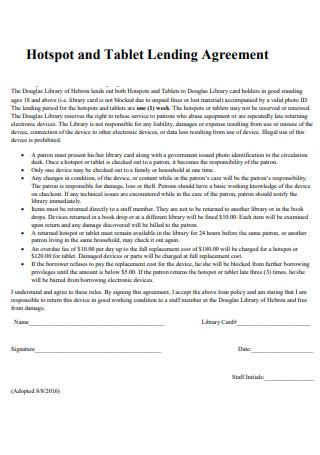

Hotspot and Tablet Lending Agreement

download now -

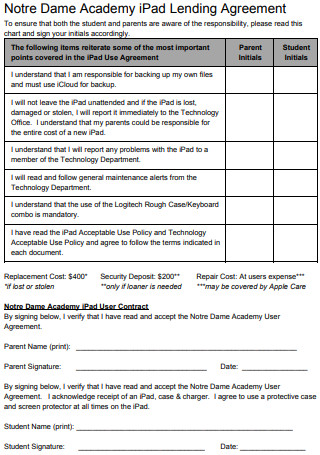

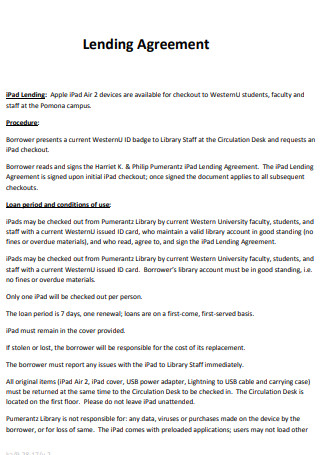

iPad Lending Agreement

download now -

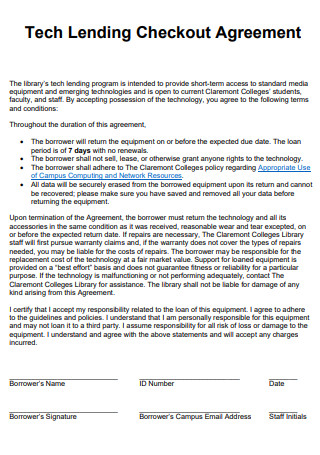

Tech Lending Checkout Agreement

download now -

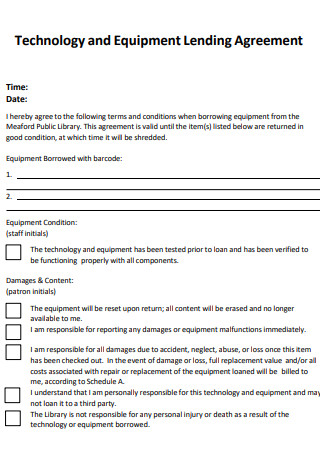

Technology and Equipment Lending Agreement

download now -

Sample Lending Agreement

download now -

Library and Lending Agreement

download now -

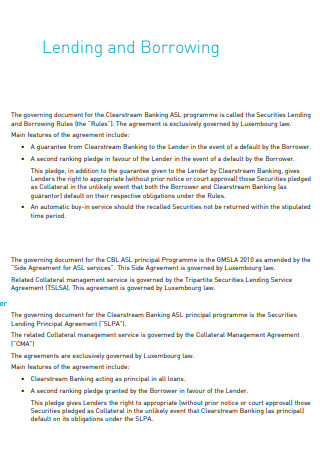

Lending and Borrowing Agreement

download now -

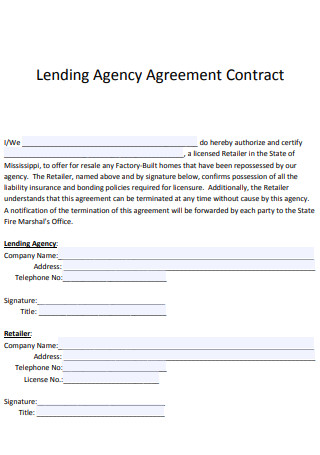

Lending Agency Agreement

download now -

Student Technology Device Lending Agreement

download now -

Securities Borrowing and Lending Agreement

download now -

Mutual Lending Agreement

download now -

Laptop Lending Agreement

download now -

Technology Lending Agreement

download now

What Is a Lending Agreement?

A lending agreement or a loan agreement has interchangeable terms, like note payable, term loans, IOUs, and promissory notes. It is a binding agreement between the lender and borrower to legalize and formalize the loaning procedure. The document also contains associated terms and conditions, along with payment schedules. Loan agreements range from simple loan letters that detail basic information regarding the longevity of the loan and interest charges to more complex documents, including mortgage agreements. The content of the loan agreement depends on the purpose of the loan and the amount of money that a business needs to borrow. Each loan agreement and the provisions and conditions of repayment are all under the governing state and federal guidelines to prevent illegal and excessive interests when it comes to repayment. It guarantees that the interest rates are under legal and reasonable terms.

According to the statistical data from Statista regarding the approval of small business loans in the United States in the second quarter of 2021, alternative lenders have the highest approval share from small business loan applications as of June 2021, with a rating of 24.8 percent. Institutional lenders follow at a 23.8 percent acceptance rating, followed by credit unions at 20.5 percent. Small and big banks also lend to small businesses at 18.9 and 13.6 percent, respectively.

Components of a Lending Agreement

Since lending agreements are legally binding documents between lenders and borrowers, constructing a well-written and detailed agreement is necessary to communicate key provisions and statements. Different lending agreements follow standards from their organizations and sometimes can vary from one lending institution to another. However, there are fundamental elements that every lending agreement must contain to relay the terms and conditions of the arrangement. Below are the components essential to lending agreements with their respective descriptions.

Types of Lending Agreement

Different lending agreements serve various purposes. Lending industries and individuals classify these documents according to their repayment terms. The section below details the three types of lending agreements and their descriptions to help individuals understand their significance and purpose.

How To Write a Lending Agreement

Since there are various types of lending agreements, writing each one is unique, with lengths varying depending on its content. There are promissory notes that are only a page long, while there are full-length lending agreements with more than five pages in length. Despite having different types of this document, the guide below helps you construct a comprehensive and well-written lending agreement for your lending needs.

-

1. Create an Introduction for the Lending Agreement

To start the introduction of the lending agreement, ensure that you indicate the date on the top page or front page of the document. Aside from the date, include the title and the type of loan agreed upon by the borrower and lender on the very first page. If you are creating an informal personal payment agreement before receiving a loan, date the document when you first receive the money.

-

2. Elaborate on the Terms and Conditions of the Loan

The loan agreement must incorporate the terms and conditions of the lending agreement between the two parties. It must include the purpose of the lending agreement, terms of repayment of the loan, and the interest rates agreed upon by the parties.

-

3. Don’t Forget To Date the Document

It may sound like common sense, but more often than not, individuals forget to indicate the date of the document. This is a critical aspect of the agreement since repayment plans are highly dependent on the date of the loan. Select the start and end dates for the repayment term and write them on the agreement.

-

4. Indicate the Statement of the Agreement

One of the most critical elements of the lending agreement is the statement of the agreement. The agreement statement can follow something along the lines of the lender and borrower agreeing to the terms and conditions identified in the loan agreement. Writing the statement ensures that both parties agree and acknowledge the content of the agreement.

-

5. Implement the Signing of the Agreement

Without attaching signatures to the agreement, the document is unenforceable. Indicate the names of the borrower and lender below the agreement statement, with sufficient space for them to incorporate their respective signatures.

-

6. Don’t Forget To Record the Lending Agreement

Right after both parties shake hands and sign the agreement, the next step is to proceed to the state or county recorder office and record the agreement. This enables the loan to be protected from the parties to lose paperwork and have the assurance that the agreement is real and binding.

FAQs

What is a borrowing agreement?

A borrowing agreement is another term for loan agreement together with lending agreements, term loans, IOUs, and promissory notes.

Is a loan agreement legally binding?

Yes, loan agreements and lending agreements are legally binding documents, regardless of whether the lender is a lending institution or an individual. Once both parties sign the document and are in agreement with the terms and conditions, it becomes binding under a court of law.

How can I legally lend money?

When legally lending money to friends or family members, the first step is to tell friends or relatives that you will think about lending money. Next is to look at possible finances before making the loan. Make sure to get everything in writing. It is also essential to consider debt payment plans and understand all the legal and tax consequences associated with loans. Consider the inclusion of interest rates as well.

Having a positive credit score affects an individual’s activity to request a loan in the future. Whether you are a lending individual or part of a lending institution, it is critical for there to be a clear agreement on the terms and conditions of the loan, including the involved parties, repayment terms, interest rates, and other essential provisions. Establishing the lending agreement is a must for the lender and borrower to agree on the terms. It serves as a legally binding agreement to which both parties, especially the borrower, must adhere to and fulfill. Create your lending agreement and start with the 26+ SAMPLE Lending Agreement in PDF available from the article above.