20+ Sample Liability Agreements

FREE Liability Agreement s to Download

What is a Liability Agreement?

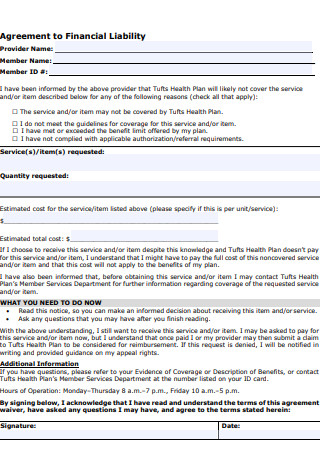

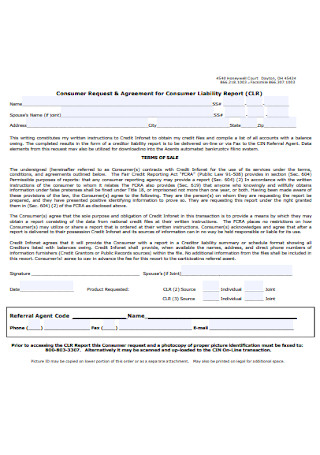

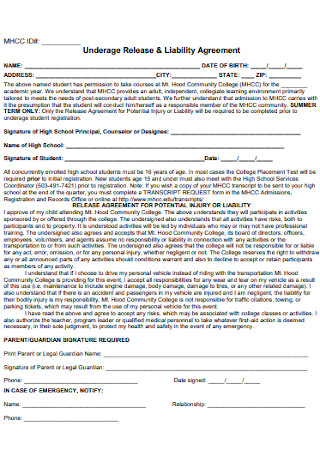

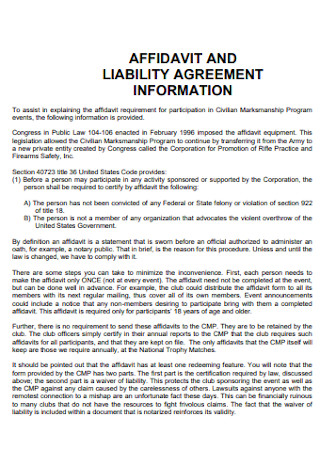

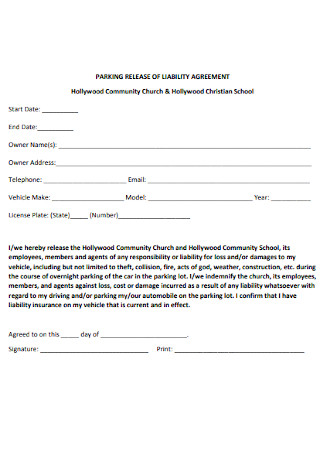

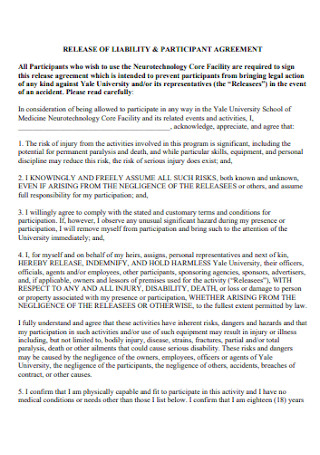

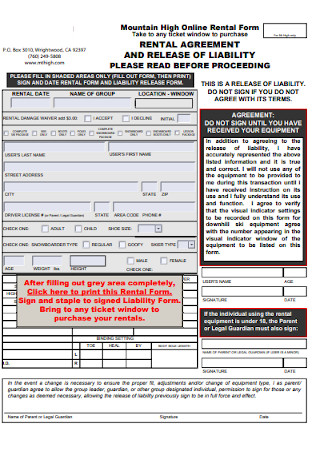

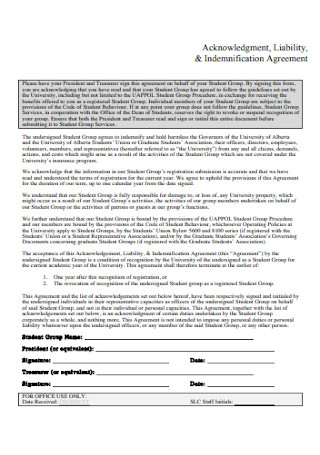

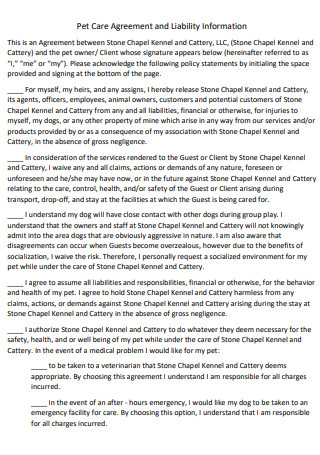

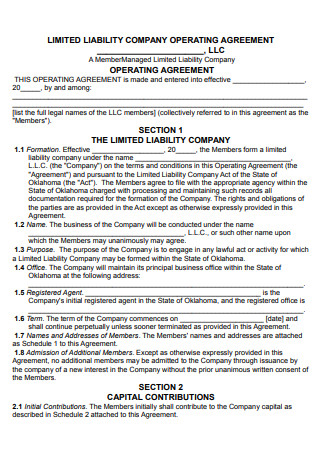

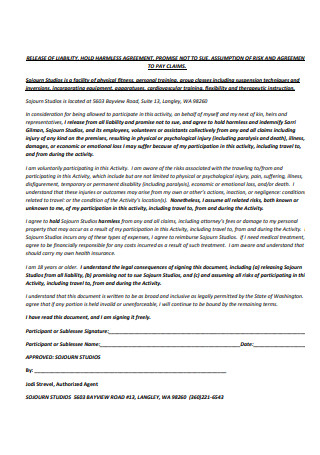

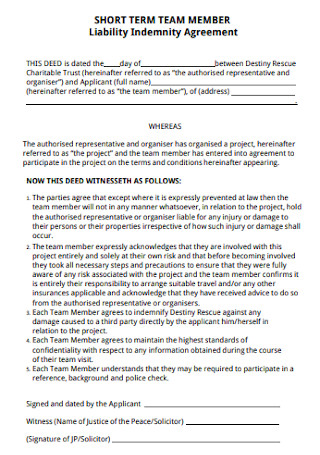

A liability agreement is a document that frees a party from any damages or injury that can happen within the agreement. This is also called the release of liability or liability waiver. A liability agreement is advisable for business contracts where you can foresee some things where you have to pay some money if ever damages can happen. This is also needed in activity engagements like horseback riding, mountain climbing, or target shooting. In things like these, you should make the releasor sign a liability agreement form or an activity waiver and release form so you can be released from any accidents that may happen. Or you can make them sign a liability agreement letter.

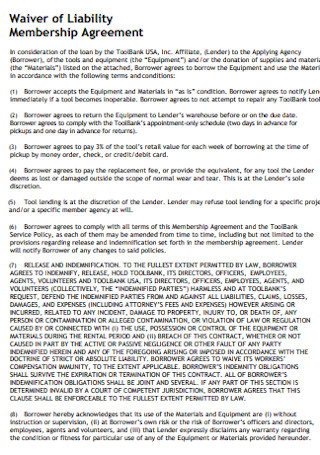

Any liability agreement sample can prove to be helpful for the releasee. There is nothing to worry about regarding the costs of damages that can be possible for anything that can be unforeseen. Some examples of liability agreement are a liability limitation agreement, a liability release agreement, a liability assumption agreement, a liability waiver agreement, and a liability hold harmless agreement. In making a liability agreement contract, you can use a liability agreement template so you can construct a better agreement. Whether it will be a PDF document or a Word Document, it will be better if you can use a pattern to ensure that you can make the right agreement.

What is Included in a Liability Agreement?

A liability agreement is something where both parties will have clear terms about rights and obligations. For you to have the best liability agreement, you must first know the necessary elements that can make the agreement good. Some things are needed to be understood first so you can include the right clauses in your agreement. If you want to know the things that are included in a liability agreement, you can read the following:

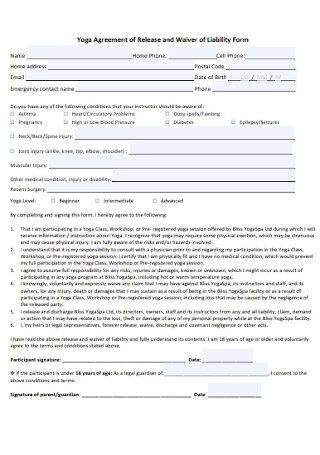

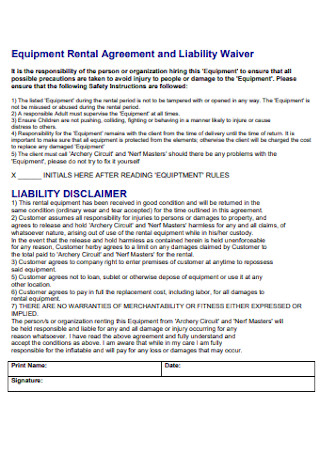

Information of Parties: The first thing that you should look at in a liability agreement is the names of the parties involved. The names of both parties should be clearly written in the agreement. For example, if you want to be clear from liabilities in a business partnership agreement, you must write the names of the business partners. If you want to be held harmless in a target shooting activity, you must write the name of the client and the name of the business owner. Every party that is involved in the agreement should have their name on the agreement.Acknowledgment of Risk: There should be an assumption of risk in the agreement. You must recognize that you know all the risks that can happen. Even if you must not make a risk assessment, there are some risks that are known in a certain engagement. Both parties know that these risks can happen in the future. There should be an acknowledgment that you are aware of all these risks and you are willing to hold harmless the releasee of any of those risks that can happen in the future. Some agreements may be clear about the risks that can happen within the agreement. But some may put a simple clause that you accept that you will free the other party from any risks that can occur. But it will be better to understand first to know any risks in any business engagements. If you are not aware of all the risks of something, you must research to understand everything. This way, you can protect yourself and your business from all possible liabilities.Indemnification: This is a specialized clause where you will have to declare that you will hold the releasee harmless from any event of damages or injuries. It means that you will never take legal action if ever anything will happen. Of course, there may be limitations in indemnification. You have to specify the situations where the releasee can be held harmless. The releasor also has the right to defend some claims when it is obvious that the releasee should pay for damages. If you want to be perfectly free on anything, you must make it clear in the indemnification clause. The releasor should perfectly agree on it and that is the only way that you will be free from all obligation. But there can be some laws that may permit some things and will prohibit some things. So, you have to conform the indemnification clause to all the applicable laws.No Duress: This is the section in the liability agreement where you should express that you are going to sign the agreement of your own free will. You can give a voluntary statement where you should state that you are not forced to sign the agreement. With no duress, you will acknowledge that no force is done or whatever that is used to make you sign the agreement. So, you are perfectly aware of everything that the written agreement signifies. If ever something will happen in the future, you cannot contest that you are being deprived of your rights. You voluntarily signed the agreement and you cannot argue about anything in court.Liability Release Clause: This is the clause where you accept the release of liability. With this clause, you perfectly release the releasee from any liabilities. This is the most important clause in a liability agreement. Whether it is a corporate agreement or a research agreement, you are going to release the releasee from any obligations that may happen in the future. You will have no right to pursue anything in court if anything may occur after the agreement. The whole essence of the agreement is written in this clause which states that you hold harmless the releasee on any claims. It is important that you carefully read this clause before signing the agreement.Consideration: In the liability agreement, there should be a clause about considerations. This is usually about the participation of the other party. If you do not want to sign the release, you may not participate in a certain activity where damage is most likely to happen. This is because the other parties may have obligations that they are avoiding and you do not want to cooperate. So, both parties can choose the activities where they can both engage. This way, you know how to act when liabilities happen.Acknowledgment of Qualifications: Some qualifications should be settled first before having the liability agreement. For example, if you have a sales agreement for a car, you have to ensure that the buyer of the car will be qualified to drive so you can sign a liability agreement that can make the buyer harmless from any damage that can happen in the car. There are certain qualifications that you need to know first before jumping in any liability agreement. This way, you can have the right protection in anything.Release of Specific Rights: In every situation, we cannot hold the releasee harmless at all times. For example, a model should be definite about the rights of the photographer who will publish his or her pictures. There are some things that you can agree that you can let the releasee be held harmless but there are some things that you cannot permit. So, you have to be clear about the release of rights. For example, if you make equipment rentals, you should be clear on the things that you can hold harmless the releasee. If you are going to damage the equipment, of course, you should pay for damages unless the owner freed you from it. In your equipment checklist, you must be familiar with the equipment so you will know when it will just be right for you to pay for damages. After that, you can talk with the owner about the specific rights where you can be released.Effective Dates: The effective dates for the liability agreement are important. You must clearly write the dates when you should implement the agreement. Before the date, if everything happens, you can take legal action to make the other party pay for damages. But beginning on the date when the liability agreement is signed, the releasor will have no right to fight for claims.Emergency Contact Information: Even if you sign a liability agreement, there can be some obligations that you still have to fulfill because of the law. So, if ever there will be claims that will be according to the law, you must leave your contact information in the agreement for any time of emergency. You have to show that you have no intention of running away from any obligations. So, if you truly have to pay for any damage, you should do it if this is according to the law.Choice of Law: In the agreement, be sure to include the governing laws that you are going to follow. This makes the agreement more binding because you can show that you are complying with the law of your state. Make clear specifications about the choice of law.

How to Write a Liability Agreement

Of course, you want to be held harmless from anything that may cost you a lot. To have a solution to this, you need to be familiar with liability agreements. But first, know how to write a liability agreement through this article.

1. Identify All Risks

First, to save yourself from any cost in the future, you have to know all the risks of your engagement. By knowing all the risks, you will know how you can protect yourself from liabilities. Have a risk assessment plan so you will know how to identify all the risks in your endeavor.

2. Study Governing Laws

To know how you can hold yourself harmless, you must study the law of your state. Know the governing laws that you have to comply with. By studying the law, you can have the right liability agreement that will be just for both parties.

3. Schedule a Lawyer Consultation

Your knowledge of the law after your research may not be enough. You need a lawyer to help and guide you. So, check your daily schedule and schedule a consultation with a reputable lawyer. Make your draft approved by the lawyer.

4. Have a Copy of the Agreement

After the lawyer finalized your agreement, you can go to the other party to sign the agreement. Both parties should sign the liability agreement. After that, secure a copy so you will have proof of your agreement.

FAQs

What are the benefits of a liability agreement?

The benefits of a liability agreement are being free from the price of legal disputes, having protection for your business, and having risk management.

What is the risk of not using a liability agreement?

If you will not have a liability agreement, you will pay for damages that can happen in the future. This may not be fair to you in some cases. You can also get into disputes that can even be brought to court.

As much as possible, we should save ourselves from any cost that may be due to damages. This can only be possible if we have a liability agreement that can protect our rights. Study the laws governing liabilities and you can save yourself from unnecessary obligations. This can be good in any personal or business engagement.