22+ SAMPLE Limited Liability Partnership Agreement

-

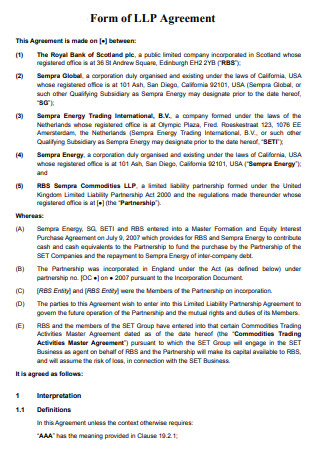

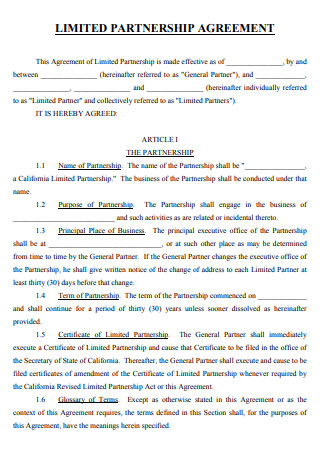

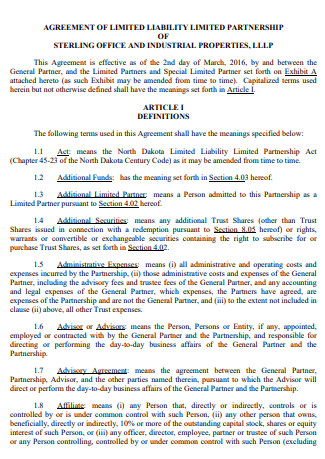

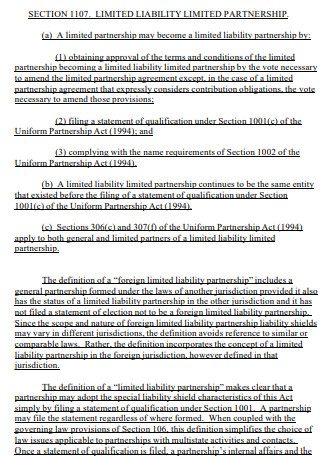

Form of Limited Liability Partnership Agreement

download now -

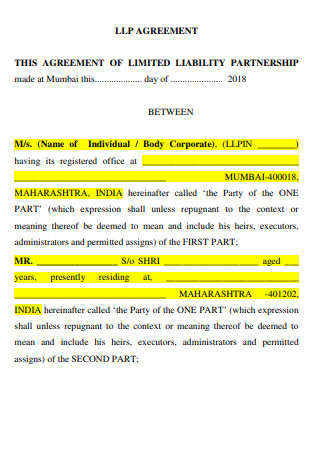

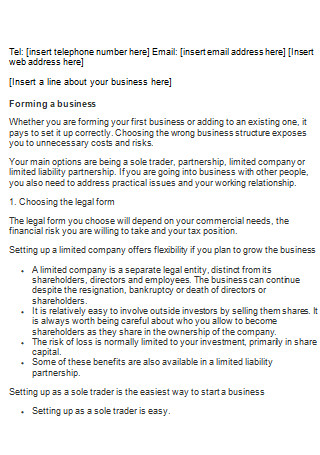

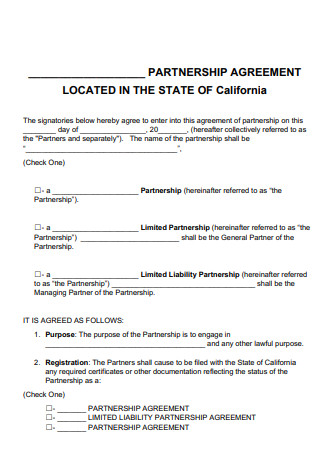

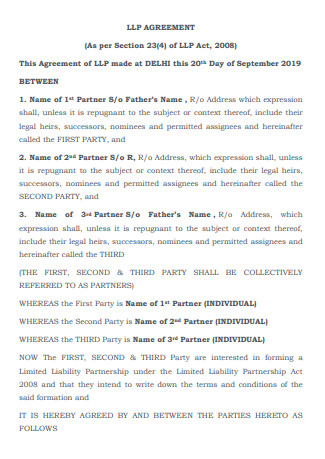

Limited Liability Partnership Agreement

download now -

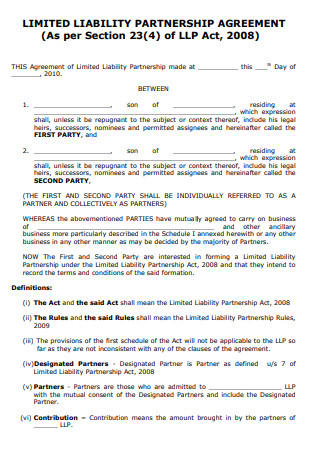

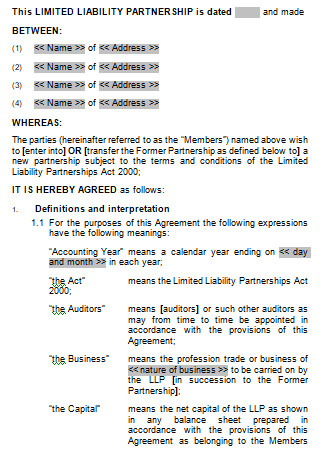

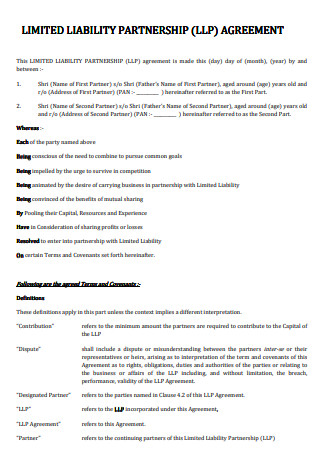

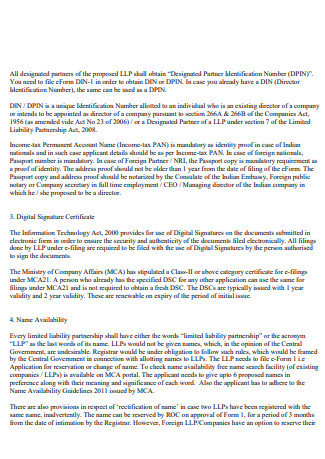

Sample Limited Liability Partnership Agreement

download now -

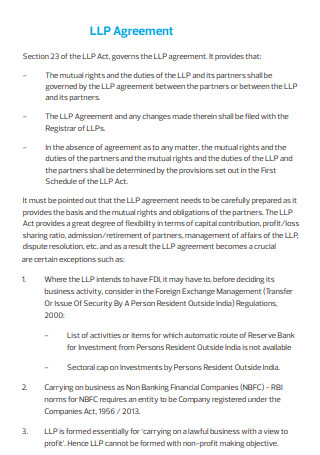

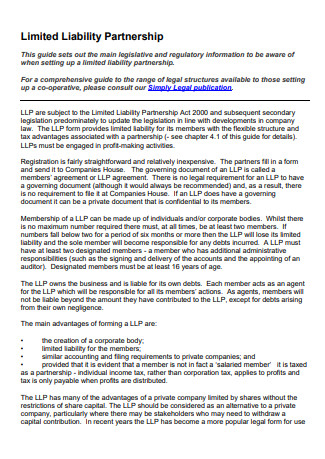

Limited Liability Partnership Agreement of Vehicle

download now -

Simple Limited Liability Partnership Agreement

download now -

Business Limited Liability Partnership Agreement

download now -

Limited Liability Partnership Agreement Template

download now -

Resource Limited Liability Partnership Agreement

download now -

Company Limited Liability Partnership Agreement

download now -

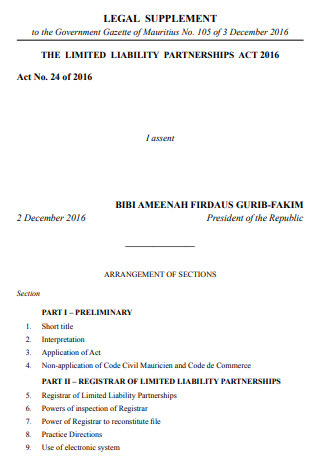

Limited Liability Partnership Act Agreement

download now -

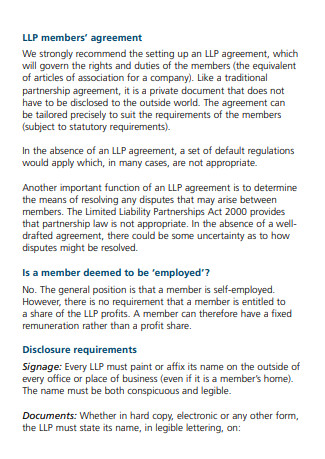

LLP Members Agreement

download now -

Private Limited Partnership Agreement

download now -

Overview of the Limited Liability Partnership Agreement

download now -

Industry Limited Liability Partnership Agreement

download now -

Basic Limited Liability Partnership Agreement

download now -

General Limited Liability Partnership Agreement

download now -

Provisions in Limited Liability Partnership Agreement

download now -

Standard Limited Liability Partnership Agreement

download now -

Limited Liability Partnership Deed Agreement

download now -

Limited Liability Partnership Annual Agreement

download now -

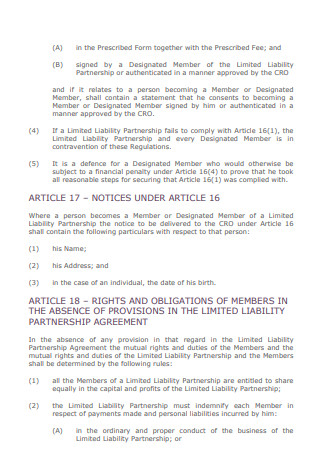

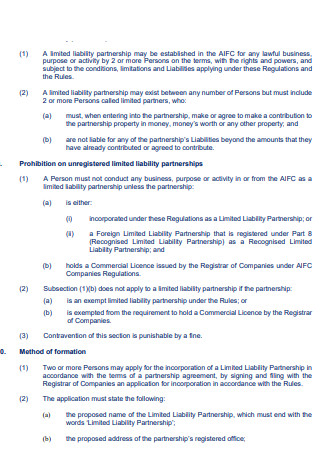

Limited Liability Partnership Regulation Agreement

download now -

Limited Liability Partnership Agreement Example

download now -

Limited Liability Partnership Development Agreement

download now

FREE Limited Liability Partnership Agreement s to Download

22+ SAMPLE Limited Liability Partnership Agreement

What Is a Limited Liability Partnership Agreement?

Elements of a Limited Liability Partnership Agreement

What are the Benefits of Entering a Limited Liability Partnership?

Risks or Drawbacks of Entering a Limited Liability Partnership

How to Form a Limited Liability Partnership

FAQs

What is the difference between a limited liability partnership and a limited liability company?

Should there be a witness when signing the limited liability partnership agreement?

What does “limited” mean in a limited liability?

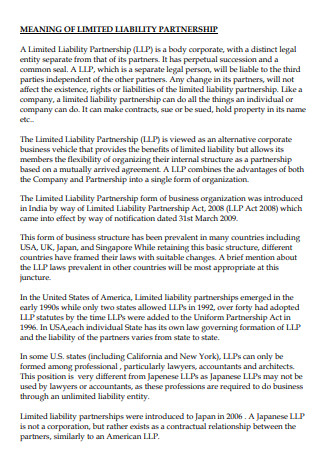

What Is a Limited Liability Partnership Agreement?

Before defining the agreement document, we need to know first what a limited liability partnership is. Putting it simply, a limited liability partnership is a type of business entity or structure in which every partner in the business is protected from the personal liability that can be incurred from the debts and obligations of the business. Why is it a limited liability? It is because the partners also don’t have any form of control over business operations. Hence, they pay fewer taxes.

A limited liability partnership agreement is a legal document that constitutes an agreement that is formed between two or more individuals or businesses who want to manage and operate a business together. This document describes the mutual rights and responsibilities of the parties involved. Furthermore, the LLP agreement also addresses profit sharing, new member admission, management and decision making, retirement and exclusion from the LLP, and outgoing members’ entitlements and obligations.

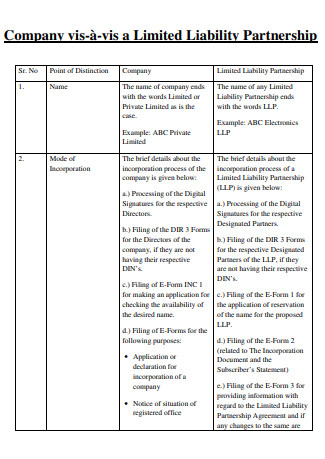

Elements of a Limited Liability Partnership Agreement

Here are the following elements that are discussed when forming a limited liability partnership agreement:

- Legal Name of the Limited Liability Partnership – the first important element of this document would be the legal name of the LLP. This name should always be used whenever the limited liability partnership does business.

- The objective of the Limited Liability Partnership – this part of the document states the main purpose of the limited liability partnership and also states a brief description of the business that the partnership will be conducting.

- Partner information – this part clearly states the legal information such as the names, addresses, and all the contact information (such as e-mail address or a phone number) of all the partners that are involved in the limited liability partnership.

- Designated Partner information – similar to the previous part, it states all the information of the designated partners, most importantly their legal names, of the LLP. Also stated here are the corresponding powers that they can exercise throughout the agreement.

- Capital Contributions – this part provides a clear description of the cash, the various assets, services, and any other resources that each business partner has originally contributed to the limited liability partnership. This doesn’t increase the profit of the business but only the equity capital.

- Ownership Interest – the ownership interest provides a clear description of the percentage of the limited liability partnership that is currently owned by each of the business partners. In other words, it refers to any stake a party owns in the company.

- Profit/Loss distribution – this section describes how the LLP’s profits and losses will be distributed among the collaborators and the distribution is often based on the capital contributions and/or ownership stake, and how frequently distribution will occur.

- Requirements for management and voting – this element of the agreement describes the methods on how the limited liability partnership will be handled, how the voting weight will be decided, and whether important decisions about the LLP’s finances and operations will require unanimous or majority votes.

- Terms for partner addition and withdrawal – this last part of the agreement contains the guidelines or terms that will govern or dictate how the LLP will handle new partner additions, voluntary partner withdrawals, and involuntary partner withdrawals.

What are the Benefits of Entering a Limited Liability Partnership?

Why would you set up your business as this entity? Well, here are the following reasons why entering a limited liability partnership can be beneficial to your business:

Risks or Drawbacks of Entering a Limited Liability Partnership

When deciding to enter a limited liability partnership for your first business, it is important to remember that there are also risks or drawbacks that you need to be aware of. Here are some of those:

How to Form a Limited Liability Partnership

Now that the basics of a Limited Liability Partnership have been discussed, along with its advantages and disadvantages, it’s time to discuss the steps on how to form one:

-

1. Verify if You’re Eligible or Not

Before going to the know-hows of forming this partnership, it is important to see if you’re eligible or not. Different places have different laws concerning the formation of an LLP. If your profession is an architect, a lawyer, or a doctor, then there is a great chance that you may be eligible to form a limited liability partnership with others. Some places have really tight restrictions regarding the formation of LLPs, so it’s best to actually know if you’re qualified to form one or not before applying, as it can be a time-waster if you’ve applied only to find out that you’re not eligible.

-

2. Give Your LLP a Name

Once you find out that you’re eligible in forming a limited liability partnership, then it is time to pick a legal name for your LLP. Your company’s name should be unique from the identities of other businesses in your vicinity. You’ll also need to add the phrase”Limited Liability Partnership” or the acronym”LLP” to the end of your name to signify that you’re operating as a limited liability partnership.

-

3. Designate an Agent and Apply for the Necessary Papers

Once you’ve given your LLP a name, then it is important to now pick a registered agent. This is important because a registered agent is someone or a corporation who agrees to accept legal documentation and other paperwork on your firm’s behalf. It should also be noted that you should pick this individual carefully since they are responsible for informing you of any pending lawsuits concerning your company.

After that, depending on your sort of business and the state in which you operate, apply for the essential business licenses and permissions and make sure you’re up to date on that paperwork.

-

4. File an LLP Certificate

After applying for all the necessary papers, the next step is to file a certificate. All LLPs that are formed are required to file a certificate of limited liability partnership. Having a certificate is very important since it legalizes the operation of your LLP. When you apply for one, you are often required to submit your company’s name, address, the names and contact information for the partners, the contact information for the registered agent, and other administrative information.

-

5. Get Your Business Known

Once you’ve done all the necessary legal steps, then the limited liability partnership is now ready to operate. The only remaining thing is for it to be known or to get the LLP recognized in your vicinity. One way you could do this (and it may even be required in some areas) is by publishing a statement in the classified advertisement section of your local papers or getting it announced in your local radio stations.

FAQs

What is the difference between a limited liability partnership and a limited liability company?

The most significant distinction between an LLP and a limited liability corporation (LLC) is that the LLP relies on partners for effective ownership. While partners in an LLP are not normally accountable for the debts or irresponsible acts of other associates, the liability protection for shareholders of an LLC extends to the debts incurred by the business as a whole or any legal actions brought against it in court.

Should there be a witness when signing the limited liability partnership agreement?

Yes, there should be a witness. When the LLP Agreement is finished, all of the partners should sign and write the date on it. Each partner’s signature shall be witnessed by an independent adult, defined as someone over the age of 18 who is not affiliated with the LLP. This practically implies that the LLP’s partners cannot testify against one another. After signing the agreement, copies of the agreement should be kept by each of the partners who are involved in it. Should they wish to amend any of the terms, they can do so but it is important that they should be sure to do so in writing.

What does “limited” mean in a limited liability?

The specifics of an LLP vary depending on where you form it. However, the personal assets as a partner are often safeguarded from legal action. Essentially speaking, liability is restricted in the sense that you can lose assets within the partnership but not assets outside of it (your personal assets). Any lawsuit will initially go after the partnership, yet a particular partner may be held accountable if they individually did anything illegal.

Ultimately, the type of business entity that you decide to stick with will set a precedent on how the general public will see your business. Entering a limited liability partnership enables its constituents to combine the flexibility of their business with multiple owners and it is also advantageous because it comes with the legal protection for each of their personal assets. The limited liability partnership agreement is also a valuable tool since it provides a clear definition of the partner’s assets and liability limitations. In this article, you can acquire different examples of such agreements so that you have a reference when you need to draft one.