19+ Sample LLC Operating Agreement

-

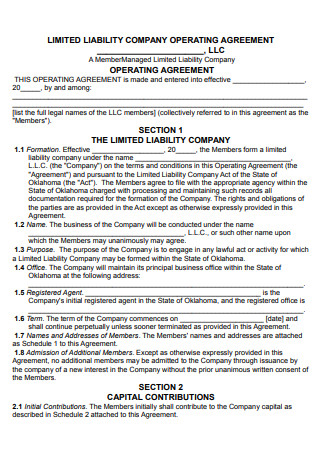

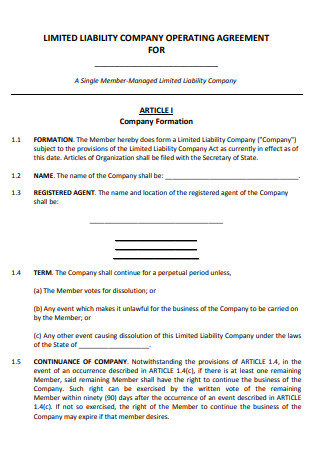

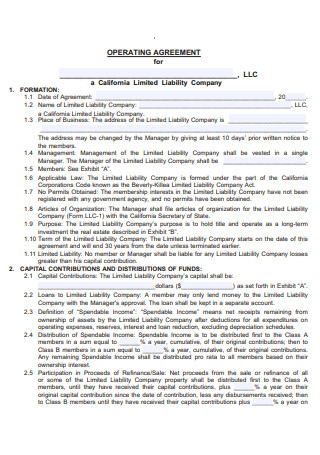

Limited Liability Company Operating Agreement Template

download now -

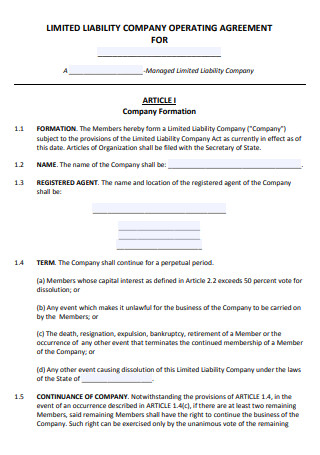

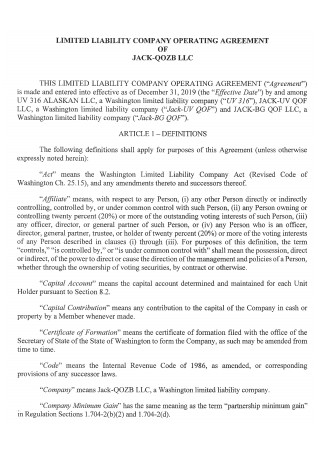

Sample Limited Liability Company Operating Agreement

download now -

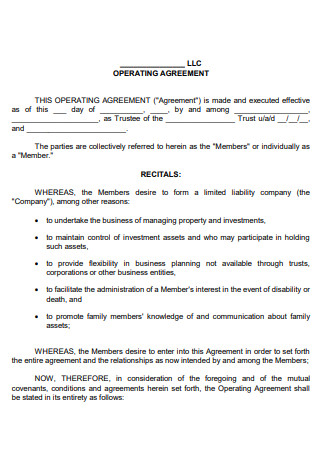

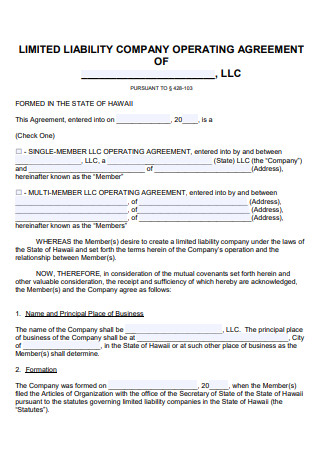

Formal LLC Operating Agreement

download now -

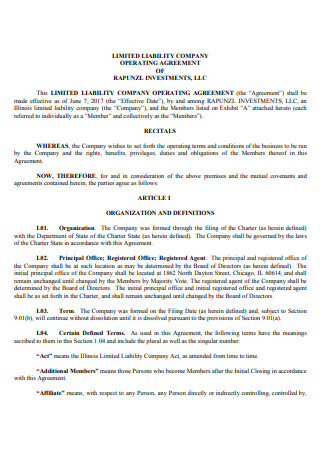

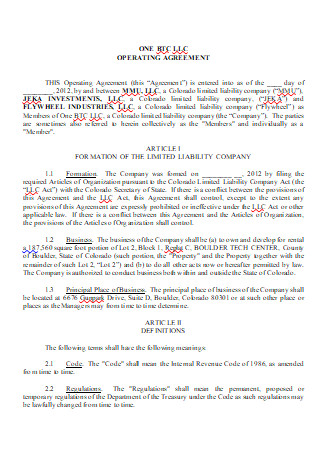

Limited Liability Company Operating Agreement of Investments

download now -

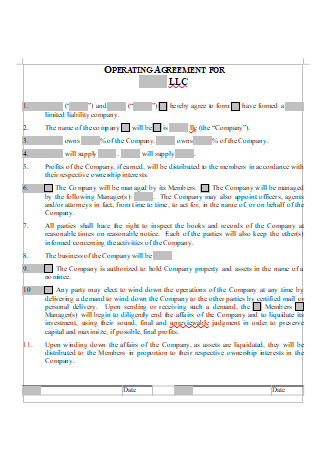

Simple LLC Operating Agreement

download now -

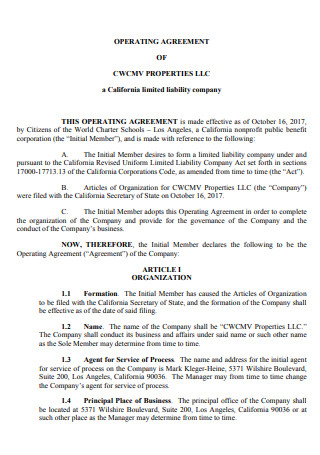

Limited Liability Company Operating Agreement for Company

download now -

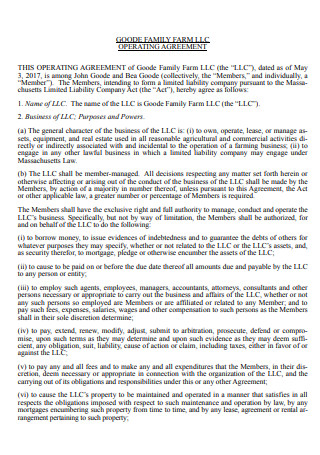

Family Farm LLC Operating Agreement

download now -

Limited Liability Company Member Operating Agreement

download now -

LLC Operating Agreement in PDF

download now -

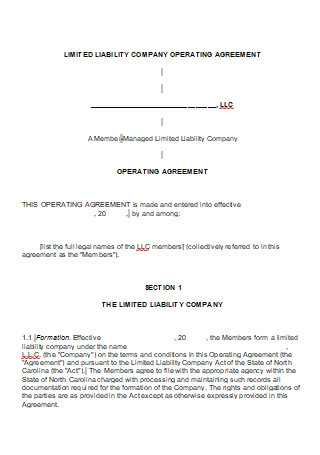

Standard Limited Liability Company Operating Agreement

download now -

Multi-Member Limited Liability Company Operating Agreement

download now -

Limited Liability Company Effective Operating Agreement

download now -

Amended and Restated Limited Liability Company Operating Agreement

download now -

LLC Operating Agreement Example

download now -

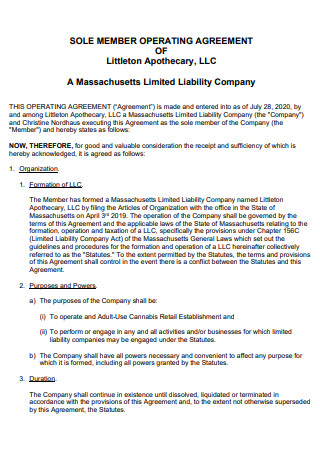

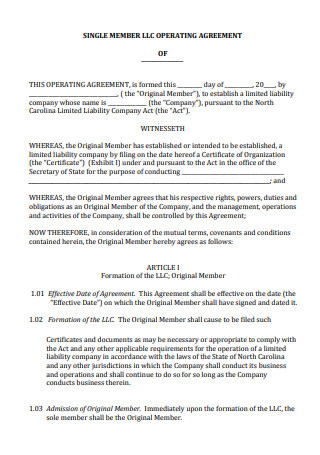

Single Member LLC Operating Agreement

download now -

Printable Limited Liability Company Operating Agreement

download now -

Limited Liability Company Operating Agreement Format

download now -

Basic Limited Liability Company Operating Agreement

download now -

Draft LLC Operating Agreement

download now -

Limited Liability Company Operating Agreement in DOC

download now

FREE LLC Operating Agreement s to Download

19+ Sample LLC Operating Agreement

What Is an LLC Operating Agreement?

Essential Components of an LLC Operating Agreement

How to Draft an LLC Operating Agreement

FAQs

Is an LLC required to create an operating agreement?

How much does setting up an LLC cost?

Where can I find a copy of the LLC operating agreement?

What Is an LLC Operating Agreement?

A Limited Liability Company (LLC) operating agreement is a legally binding document that details the rights and obligations and outlines the ownership rights of each member of the LLC. The arrangement also outlines various functions of individual members regarding financial and functional decision-making structures within the organization. The LLC operating agreement shows similarities to articles of incorporation wherein it oversees corporate bylaws and operations. For it to be a legal document, members must sign the agreement, acting as legitimate guidelines to follow. The drafted paper allows the LLC members or owners to manage the internal affairs and operations according to personal rules and specifications. It is necessary to include that lacking the documentation for LLCs means the business operates under the default regulations of the state where the organization belongs.

According to the study of Daniel M. Häusermann entitled For a Few Dollars Less: Explaining State to State Variation in Limited Liability Company Popularity, the conclusion centers on the popularity of LLCs vary depending on the region. The research shows that monetary value is a critical factor in the formation because of fee differentials between 17 to 28 percent in terms of LLC popularity in different states.

Essential Components of an LLC Operating Agreement

An LLC operating agreement is a binding document between all LLC members, and the arrangement is a vital piece of any running LLC. Every member must have a copy of the operating agreement for references and discussions on later dates. There are essential elements that must be visible in the LLC operating agreement to guarantee the legal right protection of the members and the company itself, and they are as follows.

How to Draft an LLC Operating Agreement

In every LLC operating agreement, it is essential to identify the members and the ownership percentage. Since the document outlines the rules and structures of the LLC, the person drafting the agreement must have sufficient knowledge in its creation. LLC members refer to this document when making critical decisions, and you must have a well-structured operating agreement. Below are helpful steps in drafting this document.

Step 1: Identify Essential Information About the Members and Company

Start by meeting up with the LLC members to have everyone involved in creating the agreement. In the first section of the document, indicate the members’ names, stating that everyone agrees to the terms and conditions of the operating agreement. It is also necessary to identify which state covers it. Afterwards, distinguish the company’s name and its principal location. State the business’ purpose and objectives, explaining the reason for creating the LLC. You must also specify the duration of the LLC, whether it operates for a limited time or indefinitely. Include the end date of the LLC if possible. Define the key terms you will use in your operating agreement to prevent ambiguity and confusion to readers.

Step 2: Define Your Members’ Rights and Powers

Explain how the ownership interest works. Identify the members’ ownership interests through estimating their principal contributions to startup the company. If your company is small and does not require various classes of membership, you can forego it. However, for larger institutions, including it is advantageous. State that members’ contribution to the capital will not receive interest. Protect your LLC by limiting the members’ ability to pull out capital investments. Indicate the process of how the company admits new members as owners and how it happens. Definite how profit and loss distribution affects the members through their percentage contribution. Identify the inclusive rights of the members and explain how each of these rights works. It is also advisable to discuss amendment processes by listing down potential events or situations that call for it.

Step 3: Identify Who Manages the Company

Begin with identifying the initial manager through voting and state the duration of service. Along the line, when the company is ready to elect more managers, explain the election process. Since the manager is responsible for ensuring that the company runs smoothly with its daily activities, it is helpful to list down their powers and make sure it has the necessary details. As you have included the election process, you must indicate the removal or resignation process. It must also describe the method of calling meetings and the liabilities of managers. You can explain this separately in an employment contract and include it in the operating agreement as a clause.

Step 4: Explain the Resignation and Dissolution Process

Indicate the limitation of members to sell their interests, including detailed selling procedures. In terms of resignation, indicate the member must submit a resignation letter or a written notice and that the submission is subject to a 30 to 60-day notice in advance. In the operating agreement, define the situations and conditions the LLC can undergo dissolution. It can include events like unanimous voting coming from members, court trials, or under law. It is also necessary to discuss matters of distributing assets in the event of a dissolution. Explain that the company must pay its debts and liabilities first and the liquidation of the company. Afterward, the distribution of remaining assets to the members comes from the ownership interests.

Step 5: Indicate Standardized Provisions

Identify the governing law in the operating agreement, and it is advisable to use the state laws where the LLC currently resides. A severability clause is critical in an operating agreement as it prevents the court from abolishing the document when it finds an illegal or invalid provision, statement, or clause. An integration clause dismisses any verbal or written agreements before the operating agreement’s creation.

Step 6: Finalize the LLC Operating Agreement

Start to distribute the drafted document to the members of the LLC and make sure you receive feedback and give them a deadline for the changes and revisions they wish to see on the agreement. Afterward, you can incorporate them into the document. Upon the revision, present a copy to a legal attorney for review and give significant recommendations. You can also discuss tax-related situations with a certified public accountant and get information on the distribution of profits and losses for enormous tax consequences. With everything settled, get the members to sign the draft document that they agree and certify the adoption of the operating agreement.

FAQs

Is an LLC required to create an operating agreement?

An operating agreement lays out vital information and rules of operation. Unlike articles of organization for Limited Liability Organizations, the operating agreement is not a requirement for forming an LLC, especially a Single-Member LLC (SMLLC), nor is it filed with state agencies. Despite it not being a necessity, it is helpful in daily operations. You can have the document within the company and keep it on file.

How much does setting up an LLC cost?

The costs for setting up an LLC depend on whether you do it yourself, hire a legal attorney, utilize an online incorporation website, or through online courses. When it comes to filing an LLC by yourself, you pay state filing fees, ranging from $40 to $500, depending on the location you are in. If you are hiring an attorney, it will cost roughly $1000 to $1500. In terms of an online incorporation website, it costs around $99 to $900. Regardless of the option you choose, remember that you still have to pay for state filing fees.

Where can I find a copy of the LLC operating agreement?

If you lost or misplaced your copy of the LLC operating agreement, there are places you can find yourself another. You can start by checking company records, whether in the rack and file cabinets or through computer files or email communication. Aside from that, you can ask your co-owners for a copy of the operating agreement. You can also try checking for copies with your company agent. In the worst-case scenario, you can choose to file a lawsuit if the LLC members refuse to provide copies. If a similar event occurs, an unassailable record of made requests is critical.

Major business magnates all started from small companies. In starting a company, you must be aware of various conditions, including personal liabilities, ownership issues, management considerations, registration and filing fees, even taxation. It is critical to know when you have to form an LLC and an operating agreement. If you are planning on one, make sure to weigh out the advantages and disadvantages of creating one. Take the time to conduct proper research and study, taking advice from attorneys and accountants as well. If you finalize on considering an LLC, start by drafting an LLC operating agreement with your members. Check out the LLC operating agreement samples available above for use and download to start your business venture.