35+ Sample Operating Agreements

-

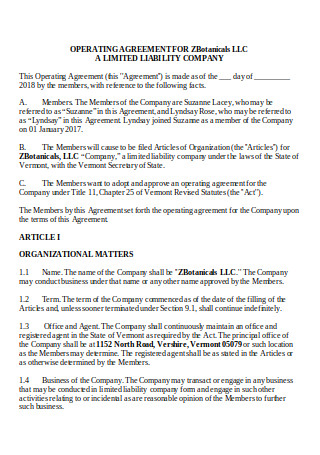

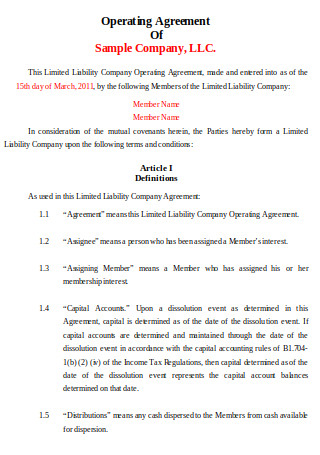

Operating Agreement for LLC

download now -

Operating Agreement for Member Managed LLC

download now -

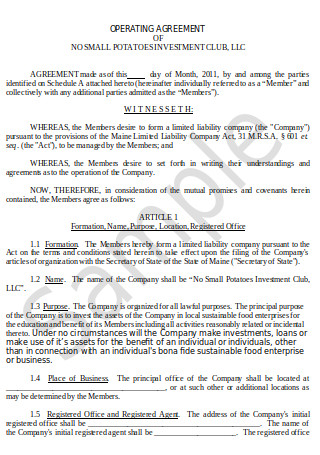

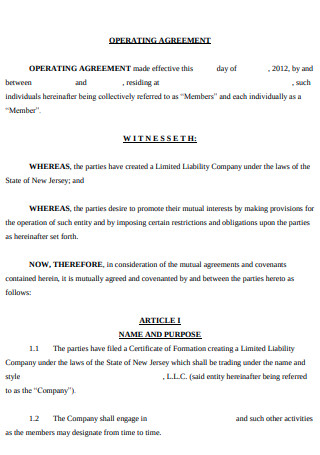

Operating Agreement

download now -

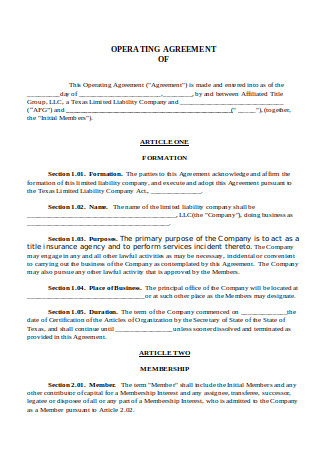

LLC Operating Agreement

download now -

Printable Operating Agreement

download now -

Simple Operating Agreement

download now -

Single Member LLC Operating Agreement

download now -

Sample Region Operating Agreement

download now -

Simple LLC Operating Agreement

download now -

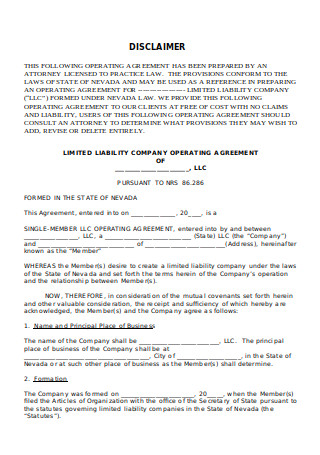

Limited Liability Company Operating Agreement

download now -

Operating Agreement in DOC

download now -

Sample Operating Agreement

download now -

Basic LLC Operating Agreement

download now -

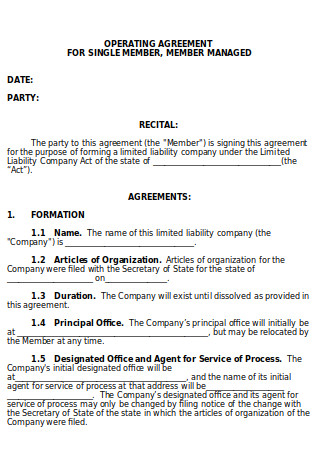

Operating Agreement Single Member

download now -

Model Joint Operating Agreement

download now -

Editable Operating Agreement

download now -

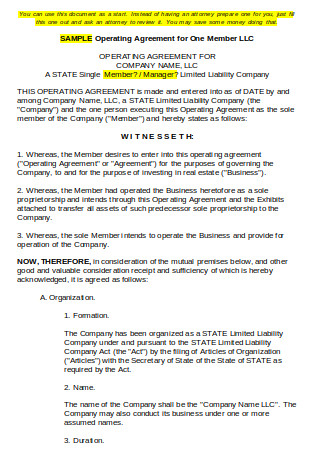

Operating Agreement for One Member LLC

download now -

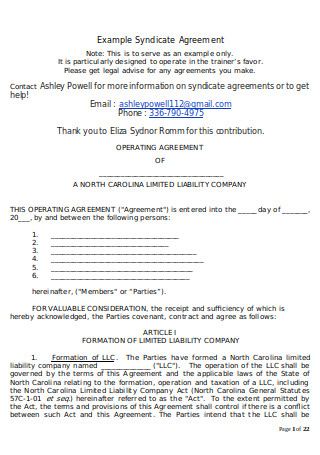

Example Syndicate Agreement

download now -

DLM Operating Agreement

download now -

Operating Agreement Sample

download now -

Basic Operating Agreement in DOC

download now -

Aircraft Operating Agreement

download now -

One Stop Operating Agreement

download now -

Team Operating Agreement

download now -

Glider Operating Agreement

download now -

Operating Level Agreement

download now -

Operating Agreement in Word

download now -

Association Operating Agreement

download now -

Operating Agreement by Members

download now -

Transparency Fund Operating Agreement

download now -

Bylaws / Operating Agreement

download now -

Rider to Borrower’s Operating Agreement

download now -

Model Form Operating Agreement

download now -

LLC Operating Agreement in PDF

download now -

Sample LLC Operating Agreement

download now -

Standard Operating Agreement

download now

FREE Operating Agreement s to Download

35+ Sample Operating Agreements

What Is an Operating Agreement?

Significant Facts about Limited Liability Companies

How to Create a Sample Template of an Operating Agreement

FAQs

What happens if you don’t have an operating agreement?

How do you get a copy of an operating agreement?

Is an operating agreement necessary for a single-member LLC?

How do you amend an operating agreement?

Can a member be involuntarily removed from an LLC?

What Is an Operating Agreement?

There are two ends where a business will meet; it will be either success or failure. Of course, every business wants to succeed, but what if it fails? Many businesses undergo trial and error before they actually accomplish something. For example, Reddit is presently one of the most famous online platforms in the world with about 169 million website visitors every month. Its first launch was in 2005. At that time, they had no visitors, not even one, but they continued to think of ways to make people notice their page. How did they do it? They made dummy accounts to make fake discussions on their platform until people came and took interest.

In the United States, there is a corporate arrangement where company owners are not liable for company liabilities in case the business fails—a limited liability company. This company structure is a combination of a corporation and partnership where it can take advantage of “pass-through taxation.” According to Cornell Law School, pass-through taxation happens when an individual pays the company’s taxes through his/her tax return. Furthermore, to take full benefit of owning an LLC, writing an operating agreement is essential. An operating agreement is a written contract that lays out the conditions of an LLC as agreed by its members. It serves as an operating and managing guide for an LLC to prosper.

Significant Facts about Limited Liability Companies

All states in the U.S. have a common understanding of what a limited liability company is. It is a company that enjoys the benefits of a corporation, partnership and sole proprietorship. Now, let us learn some other facts about LLCs.

How to Create a Sample Template of an Operating Agreement

The internal operations of an LLC mainly depend on an operating agreement. This contract is what keeps a business going. So, here are the steps in creating a sample operating agreement with its key elements:

Step 1: Input the Equity Structure

This includes the percentage interest, contributions report, and profits and losses grants of members. The percentage interest or also called a membership interest confirms a member’s ownership, which means he/she has a right to receive profit and a right to vote. Also, every member has a contribution, this contribution is the basis for an initial membership interest. A contribution can come in the form of a property, service, promissory note, or cash. In the agreement, incorporate specifications concerning initial or on-going contributions. Furthermore, profits and losses grants can change in the agreement. For example, A member that has a percentage interest of 25% may receive a 50% profit in a year.

Step 2: Write Management Concerns in Detail

Appointed managers or members themselves can take control over an LLC. If it is managed by a manager, the contract should detail on how to appoint managers, when to run meetings, how to conduct voting processes, what to expect from managers, and when to remove and replace managers.

Step 3: Type in Voting Rights

Normally, members have equal rights to vote in an LLC regardless of their membership interest. Depending on the members, an operating agreement may state that voting rights will depend on the contributions of each. In that case, members may still be given veto rights in case they don’t agree on some plans and decisions made by other members.

Step 4: Include Anti-Dilution Provisions

Anti-dilution clauses protect a member’s percentage interest when an LLC grants ownership to new members. These provisions may comprise of a member’s veto right concerning memberships, capital call restrictions, and pre-emptive rights. Pre-emptive rights permit a member to buy any type of percentage interest to preserve his/her ownership.

Step 5: Take Note of Confidentiality Clauses

Confidentiality provisions can be non-compete or non-solicit. A non-compete agreement prevents a former member from competing against the LLC for a specific period. On the other hand, a non-solicit provision simply restricts a member to solicit other members and draw them away from the LLC. The latter is less restrictive because it allows a member to join another company immediately after leaving.

Step 6: Don’t Neglect Incorporating General Provisions

General or Miscellaneous provisions may include dispute resolutions, amendments, and more. Bear in mind that an operating agreement can be more than 10 pages. It is a document that can be revised in case needed. A good operating agreement is one that can address many different situations regarding the operations of a limited liability company.

FAQs

What happens if you don’t have an operating agreement?

If an LLC has many members, conflicts and disagreements may arise. Without an operating agreement, it will be very difficult to deal with issues regarding percentage interest, profit allocations, operations, and more. To deal with financial and operating issues, having an operating agreement is crucial. Also, without this contract, the state laws automatically will rule your business, which can be a disadvantage. Why? State laws can change and you may not agree with the newly imposed laws. Therefore, it’s always safe and better to have an operating agreement.

How do you get a copy of an operating agreement?

You can call or visit the office of your LLC’s state. Inquire if the company has filed an operating agreement. Some states may obligate you to fill up a form and pay a fee when ordering LLC files. Another way is to call or email the company owner and ask for a copy of an operating agreement, but your request may be denied if the owner doesn’t know you. Also, you can search EDGAR on your computer, which is an information system made by the Securities and Exchange Commission of the United States. If none of the ways mentioned work, you can employ a business lawyer to assist you in obtaining a company’s operating agreement. Note that this may cost you some money.

Is an operating agreement necessary for a single-member LLC?

The answer is yes and no. Yes because it is highly suggestible and no because it is not mandatory. Remember that the main purpose of an operating agreement is to set a company’s operations and its members’ responsibilities. An operating agreement will prove that you and your company are separate entities.

How do you amend an operating agreement?

Commonly, an operating agreement is an internal file or document. When you want to change it, members must approve first. The rules written in the original agreement should be followed when making amendments. For example, a contract may require 100% of the members to effectuate changes. In a situation where there is no provision provided in the agreement, then you have to obey the state laws provided. Every state has a different rule, so you can check it on the Secretary of State Office.

Can a member be involuntarily removed from an LLC?

The articles of organization or an operating agreement of an LLC may have conditions for involuntary termination of members. Both of these documents are allowed to write clauses relating to involuntary withdrawals of members. Even if that is the case, members still have the right to receive payments which are equal to their membership interests in the institution.

An operating agreement may not be a requirement, but it is key to a thriving business. Why? This is because an operating agreement deals with a limited liability company’s financial and operational issues. Not only that, but it also protects its members from facing personal liabilities. Furthermore, it frees a business from being completely under the control of state rules, which can be very general most of the time. If an LLC is a person, then an operating agreement is the heart that keeps it alive.