10+ SAMPLE Option Agreement

-

Put Option Agreement Template

download now -

Free Land Purchase Option Agreement Template

download now -

Free Real Estate Purchase Option Agreement Template

download now -

Free Management Agreement and Option to Purchase Template

download now -

Free Stock Options Agreement HR Template

download now -

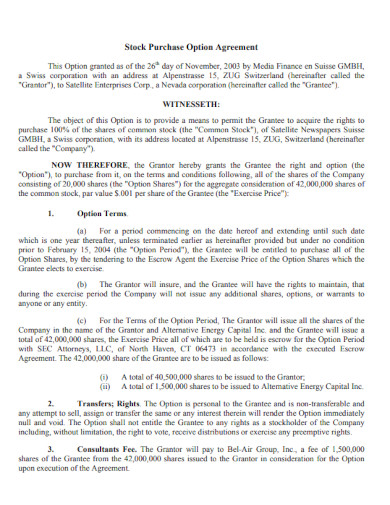

Sample Stock Purchase Option Agreement

download now -

Sample Standard Option Agreement

download now -

Proposed Option Agreement

download now -

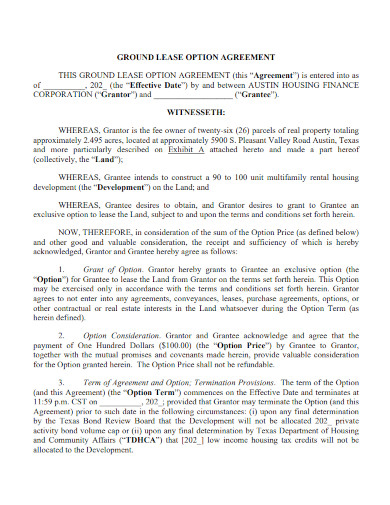

Ground Lease Option Agreement

download now -

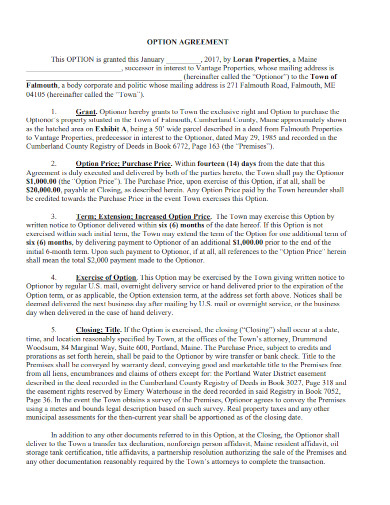

Sample Option Agreement Form

download now -

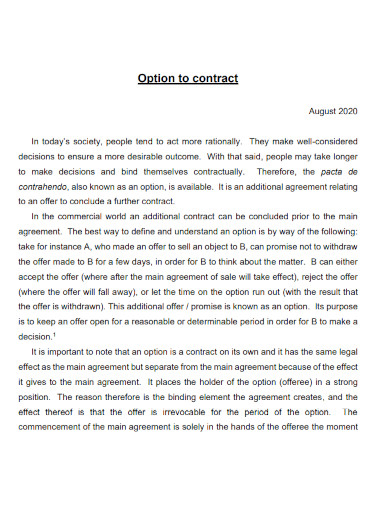

Option to contract Agreement Template

download now

FREE Option Agreement s to Download

10+ SAMPLE Option Agreement

What is Option Agreement?

What is an Option Agreement in Real Estate?

Types of Option Agreements?

Examples of Option Agreements in Action

What is a Real Estate Option Agreement

What is an Option Agreement for Shares?

What is a Call Option Agreement?

What is an Option Agreement in Real Estate?

In real estate, an option agreement is a contract that grants a potential buyer the exclusive right to purchase a property at a predetermined price within a specified timeframe. This agreement offers flexibility, allowing the buyer (option holder) to decide whether to proceed with the purchase or let the option expire. It’s a strategic tool that enables investors to secure a property at a set price while having time to conduct due diligence or secure financing. This guide explores the nuances of real estate option agreements, providing clarity and real-world examples for a comprehensive understanding.

You May Also See SAMPLE Professional Services Agreement

Types of Option Agreements?

Navigate the intricate world of option agreements with a detailed exploration of their types:

1. Call Options:

Empower yourself to buy an asset at a predetermined price, capitalizing on potential market upswings.

2. Put Options:

Safeguard your investments by securing the right to sell an asset at a predetermined price, mitigating losses in a declining market.

3. American-style Options:

Exercise your option at any time before or on the expiry date, providing flexibility in strategic decision-making.

4. European-style Options:

Limit exercise to the expiry date, streamlining the decision-making process and enhancing precision.

5. Stock Options:

Granting the right to buy or sell company stocks, these options are prevalent in Staffiing compensation plans.

6. Index Options:

Diversify your portfolio by trading options based on market indices, offering exposure to broader market movements.

7. Binary Options:

Simplify your approach with a straightforward “yes” or “no” prediction on price movements within a set timeframe.

8. Real Estate Options:

Exclusive rights to purchase a property at a predetermined price, providing flexibility for due diligence and financing agreement.

9. Exotic Options:

Explore customized options with unique features, catering to specific risk appetites and market conditions.

1. Granting Options:

The right to grant options to individuals or entities, allowing them the opportunity to purchase or sell company shares under the terms specified in the agreement.

2. Setting Terms and Conditions:

The right to establish the terms and conditions of the option agreement, including the exercise price, vesting period, exercise period, and other relevant provisions.

3. Control over Exercise of Options:

The right to control when and how options can be exercised. This may involve setting specific conditions or restrictions, such as vesting requirements or performance milestones.

4. Determination of Exercise Price:

The right to determine the exercise price at which the option holder can buy or sell the shares. This is often set at a price determined at the time of the option grant.

5. Vesting Conditions:

The right to set vesting conditions that the option holder must meet before being entitled to exercise the option. Vesting conditions may be based on time or performance criteria.

6. Payment Terms:

The right to establish the payment terms for the shares when the option is exercised. This could include specifying the form of payment (cash, stock, etc.).

7. Termination Provisions:

The right to include provisions outlining circumstances under which the option agreement can be terminated, such as expiration of the option period or a breach of terms.

8. Conditions Precedent:

The right to include conditions that must be fulfilled before the option can be exercised. This might include regulatory approvals or the achievement of specific milestones.

9. Right of First Refusal:

The right to include a right of first refusal, giving the company the option to purchase the shares before the option holder sells them to a third party.

10. Restrictions on Transfer:

The right to include provisions restricting the transfer of options or shares without the company’s consent.

11. Compliance with Laws:

The right to ensure that the option agreement complies with applicable laws and regulations.

The right to specify the jurisdiction whose laws will govern the agreement.

You May Also See SAMPLE Put Option Agreement

Explore the dynamic world of option agreements through real-world examples that showcase their versatility and strategic impact:

1. Call Option Profits:

Imagine purchasing a call option for Company X at $50 when the stock is trading at $45. If the stock price rises to $60 before the option expires, you can exercise your right to buy at $50, earning a profit on the price difference.

2. Protective Put Strategy:

An investor owns shares of Company Y at $70 per share. Concerned about a potential downturn, they buy a put option at a strike price of $65. If the stock drops, the put option acts as insurance, allowing the investor to sell at a higher price.

3. Employee Stock Options:

Company grants its employees the option to purchase company shares at a predetermined price. As the company grows, employees exercise their options, benefiting from the increased stock value.

4. Real Estate Option Agreement:

A property developer secures an option to buy a piece of land within the next year at a fixed price. This allows time for feasibility studies and obtaining necessary approvals before committing to the purchase.

5. Index Option Hedging:

An investor holds a diversified portfolio mirroring a market index. To hedge against potential market declines, they purchase put options on the index, providing a safeguard for their overall investment.

6. Binary Options Profit:

In a binary option trade, an investor predicts that a stock will close above $100 by the end of the day. If the prediction is correct, a fixed profit is earned; otherwise, the initial investment is lost.

You May Also See SAMPLE Rent To Own Agreements

What is a Real Estate Option Agreement

In real estate, an option agreement allows a potential buyer to secure the exclusive right to purchase a property at a predetermined price within a specified timeframe.

What is an Option Agreement for Shares?

An option agreement for shares is a legal document that grants an individual or entity the right, but not the obligation, to buy or sell a specified number of shares at a predetermined price within a defined time frame

What is a Call Option Agreement?

1. Strike Price:

The strike price is the price at which the underlying asset can be purchased if the option is exercised.

2. Expiration Date:

Call options have an expiration date, after which they are no longer valid.

3. Rights of the Holder:

The call option holder has the right to exercise the option (buy the underlying asset) or let it expire, depending on market conditions and their investment strategy.

4. Profit Potential:

The potential profit for the call option holder arises if the market price of the underlying asset is higher than the strike price at the time of exercise.

5. Risk for the Holder:

The holder’s risk is limited to the premium paid for the call option. If the market price does not rise above the strike price by the expiration date, the holder may choose not to exercise the option.

Mastering option agreements is pivotal for strategic agreement of investing . This guide unravels the complexities, offering practical tips on crafting effective agreements. From understanding call and put options to navigating expiration dates, empower your investment journey. Write with clarity, use real-world examples, and employ our expert tips to create impactful content that resonates with your audience and demystifies the art of option agreements.