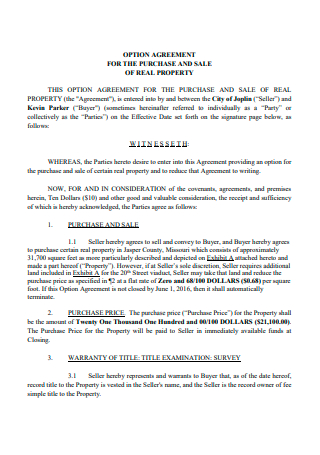

4+ Sample Option to Buy Agreement

FREE Option to Buy Agreement s to Download

4+ Sample Option to Buy Agreement

What Is an Option to Buy Agreement?

What Does it Mean to Have the Option to Buy Agreements in Real Estate?

What Are Other Uses for Option to Buy Agreement?

What Should Included in an Option to Buy Agreement?

Are Option Fees Nonrefundable?

What Are More Options to Purchase Real Estate Specs?

Can an Option to Buy Agreement Give You Control of the Property?

Elements of an Option to Buy Agreement

How to Write an Option to Buy Agreement

FAQs

What is an option to purchase an agreement?

What are the facts of an option to purchase?

When does a contract for an option to buy become binding?

What Is an Option to Buy Agreement?

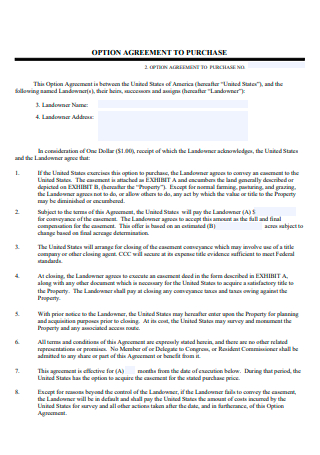

An option to buy agreement is a legal agreement between two parties under which an investor or tenant pays a fee in exchange for the opportunity to purchase real estate at a later date. A straight option to purchase a contract, which is a unilateral contract that solely binds the seller to its conditions, is one type of contract you can have. This type of contract allows a landowner or homeowner to keep the offer for sale open in exchange for a fee paid by the buyer, also known as the options, in exchange for keeping the offer for sale open.

Other templates are available on our website, and you can use them whenever you need them. They are as follows: lease-purchase agreement, employment contract, work contract, labor contract, position agreement, staffing agreement, real estate purchase agreement, work agreement, property purchase agreement, tenancy contract, land lease agreement, and other similar templates are available. This post will not only provide you with templates but will also provide you with important information that you need to know in order to complete your template.

What Does it Mean to Have the Option to Buy Agreements in Real Estate?

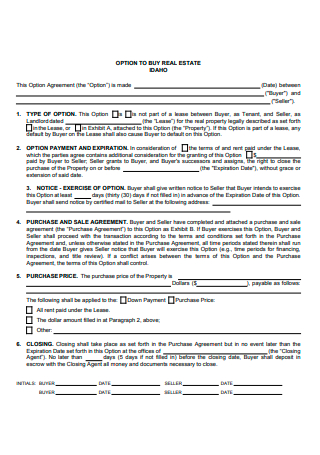

In a straight option to buy agreement, the opportunity to purchase is accessible for a specified amount of time at the price that has been agreed upon prior to the contract being executed. Using this form of arrangement in a residential contract is commonly referred to as a rent-to-own agreement or a lease option agreement in the real estate industry. When a tenant enters into a lease or rental agreement, the tenant will have the opportunity to purchase the rented property at some point in the future. It is possible to employ a lease option in conjunction with a purchase option on a home, and a percentage of the tenant’s rent is applied to the principal of the house’s purchase option. Individuals who are interested in purchasing a home or property can use option contracts to put the acquisition on hold until they are ready or have the financial resources to finalize the transaction. In its most basic form, an option contract is an offer that cannot be withdrawn from the market. It works in the same way as selling a house or piece of land, just over a longer period of time.

What Are Other Uses for Option to Buy Agreement?

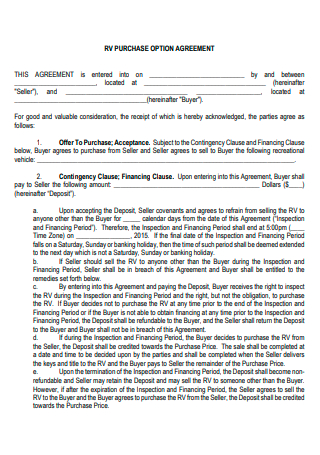

While the option to buy agreements are most commonly associated with real estate, they can also be used to give a buyer the option to acquire a variety of other items. When a contract is signed, it becomes legally binding – the seller is obligated to sell and the buyer is obligated to purchase according to the terms and price that have been agreed upon. Once a contract for an option to purchase a property has been established, it cannot be sold to anybody else at any time. When drafting a contract, it is common for the buyer to pay a fee in order to have this choice. They will come to an agreement on the price as well as the time period for which the pricing will be valid. Typically, terms are valid for six months to a year after they are signed. What is special about these types of contracts is that they bind the seller to sell the property in accordance with the provisions of the contract, but they do not obligate the buyer to acquire the property at the end of the transaction. If the buyer decides not to complete the purchase within the agreed-upon timeframe, the seller is allowed to keep the money that was paid to have the option to purchase included in the contract, as long as the buyer does not violate the terms of the contract.

The option to purchase agreement is frequently used by builders and developers who are wanting to build huge subdivisions or high-end residential properties. The builder may opt for this option in order to be able to test the site and verify that the zoning process will be completed correctly and efficiently. If the builder did not have the option to acquire the property, he or she would be forced to invest a large amount of time and money in inspecting the property with no assurance that they would be able to purchase it if it was determined to be suitable. Real estate investors, who may desire to hold onto the property that they believe will rise in value in the future, are another group that frequently uses options to purchase contracts. They are able to lock in the lower present price while also taking benefit of the better value in the future if the property’s worth increases in the future as a result of this strategy.

What Should Included in an Option to Buy Agreement?

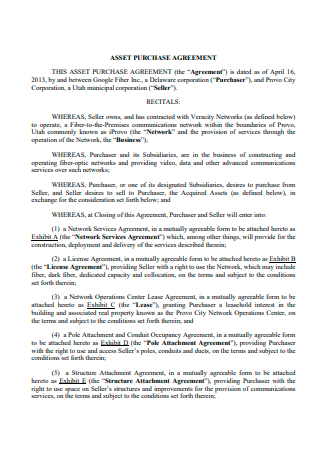

It is necessary to include several elements and follow specific procedures in order for your option to purchase to be regarded as a valid and legally binding agreement. Your purchase selection should include the following:

- It must be in writing, as a handshake or verbal agreement is not regarded acceptable.

- Include the signatures of all parties, as well as the date, on the agreement form.

- Check to see if one of the signing parties is the legal owner of the property.

- Include the property’s address in the description.

- Specify the parcel identifying number if applicable.

Are Option Fees Nonrefundable?

Option costs are normally nonrefundable, and the duration of the option period must be clearly stated in the agreement. In other words, if you decide not to exercise your option to purchase the house within the agreed-upon time limit, you will forfeit the money you paid to obtain the option. The duration of the option period must be explicitly stated in the option to purchase agreement. No specific or preferred unit of time exists, and choice durations can range from a few weeks up to several years. Option periods in the residential environment, on the other hand, are typically between 30 and 90 days in length. If the contract specifies a time frame for the buyer to exercise the option to purchase the house, the buyer may do so at any point during that period or at a specific date indicated in the option-to-purchase agreement. If the buyer does not exercise the option within the specified time period, the option expires and becomes null and invalid. In that case, the tenant forfeits his or her right to the option fee.

What Are More Options to Purchase Real Estate Specs?

The option to purchase consideration is similar to an earnest money deposit in that it can be inexpensive and it grants you an equitable interest in the property. Consider option consideration to be a little sum of money paid by you to the seller in exchange for the seller agreeing to a ratified contract. The fact that there is no specific floor or ceiling for this consideration is vital to remember because it is entirely up to negotiation between the seller and buyer. The option fee can range from a few dollars to several thousand dollars, depending on a variety of factors such as the price and demand for the property.

Can an Option to Buy Agreement Give You Control of the Property?

In addition to having an equitable interest in the property, you are also protected since you received an option consideration, which is what grants you the interest in the property. A contract for option exercise that does not result in the exchange of money is null and void and would not hold up in a court of law. Make sure you are familiar with the regulations of your state so that you can be confident that the option to purchase the form you are using complies with the requirements of your state. The option to purchase an agreement should be straightforward and simple to comprehend, and you should study it well so that you can explain it to all eager sellers. If you want to invest in a way that is completely risk-free, then the option to buy or option to purchase approach is the way to go. If you do not sell or decide not to purchase the property before the option period expires, you will only have lost time and the dollars used to purchase the option consideration. This method is quite beneficial, especially if you are new to the real estate investment world, because it will allow you to gain a thorough understanding of your market very quickly, and the best part is that you will not have to pay a high price for that knowledge.

Elements of an Option to Buy Agreement

An option to buy a contract takes the danger out of the game and is a terrific approach for all investors to consider, but especially for those who are just getting started in real estate investing because it is a low-risk, high-profit method for purchasing real estate.

How to Write an Option to Buy Agreement

Writing an option to buy might be a challenging form to complete well. You can, however, draft a legal option to acquire a business form if you follow a few simple instructions. Instead of reading the tutorial, it is recommended that you look at the resource box for an example of a complete Option purchase form. If you are a person or a small firm, the information in this article can assist you in lowering contract administration fees. It is recommended that you have your copy checked by an attorney to avoid any legal complications in the future.

Step 1: State the Seller and the Option Holder

Clearly define who is referred to as the seller and who is referred to as the option holder. This is critical because it makes it clearly, unequivocally clear which party is in charge of the situation. “In this arrangement, name1 is referred to as the selling party, and name2 is referred to as the option holder,” as an example might be.

Step 2: State the Cost

Clearly state how much money the option will cost and that it will be paid by the option holder in the description. Remember to provide your business address (or individual address), trademark information, and bank account number as well as how the money is to be paid (periodically via PayPal or wire transfer, for example).

Step 3: Describe the Circumstances

Describe the circumstances under which the contract was established (without a broker, legal entities, or agents).

Step 4: Take Note of External Factors

Specify when the contract is valid. Take into consideration external factors such as fire as well.

Step 5: Products and Services

List the products and services that the option holder is eligible to purchase, as well as the agreements that govern those products and services. Because of the need for accountability, it is critical to document this.

Step 6: Option Holder’s Signature

Ensure that the date is listed and that room has been left open for both the selling party and the option holder’s signatures

Business companies will check to see that you are not a fraud and that you will be able to pay back your loan or debt for the items you have purchased on time. In spite of the seriousness and difficult environment that comes with doing adult things, the contentment and happiness that comes with achieving things on your own are unrivaled. As long as you have the patience to figure out how things function, you will be fine in this world. You might also be interested in sample business agreements.

FAQs

What is an option to purchase an agreement?

Options contracts can be utilized for real estate, money, and equities. It allows the holder to buy something at a set price.

What are the facts of an option to purchase?

It allows the holder to buy something at a set price. If the holder so desires, he may purchase the object.

When does a contract for an option to buy become binding?

A contract is binding when it is signed – the seller must sell and the buyer must buy.

An option to purchase agreement is a critical document to have on hand when doing business with other people or businesses. It contributes to ensuring that the business transaction proceeds smoothly and without difficulty. As a result, whether you get into a purchase or selling transaction, be certain that you sign a purchase agreement with which you are completely satisfied. We hope that this article has answered some of your queries concerning purchase agreements and other related topics.